We tend to find information that confirms our existing beliefs.

We’re seeing it more than ever, if we pay attention and recognize it.

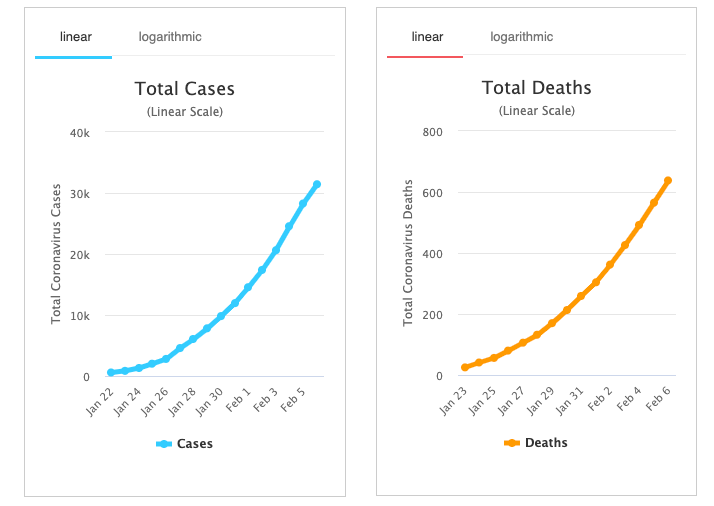

If you feel we should stay on lock down and maintain the quarantine, you find news and opinions that support yours.

If you feel it’s all just a hoax and the quarantine has been a disaster, you find news and opinions that support yours.

If you feel the lock down has been necessary, but now the curve has flattened, so it’s time to open the United States for business, you find news and opinions that support yours.

Yes, I said “we”, because I do it, too, but the difference may be; I know it do, so I’m aware of it.

Awareness allows us to recognize it, then we get to decide if we want to do it, or not.

In other words, we decide if we want it, or not.

Confirmation bias is the tendency to search for, interpret, favor, and recall information in a way that confirms or strengthens one’s prior personal beliefs or hypotheses. It is a type of cognitive bias.

One says about cognitive bias:

A cognitive bias is a systematic error in thinking that affects the decisions and judgments that people make. Some of these biases are related to memory. The way you remember an event may be biased for a number of reasons and that in turn can lead to biased thinking and decision-making.

Another defines it as:

A cognitive bias is a systematic pattern of deviation from norm or rationality in judgment. Individuals create their own “subjective reality” from their perception of the input. An individual’s construction of reality, not the objective input, may dictate their behavior in the world.

I like the “subjective reality” part.

We aren’t objective, unless we want to be.

Wikipedia says;

Objectivity is a philosophical concept of being true independently from individual subjectivity caused by perception, emotions, or imagination. A proposition is considered to have objective truth when its truth conditions are met without bias caused by a sentient subject.

Simply put, objectivity is when our judgment isn’t influenced by personal feelings or opinions in considering and representing facts.

Yeah, tell me how often you are objective about things, leaving out your feelings and opinions, or considering the facts as you see them.

So, to be objective is not being influenced by personal feelings, interpretations, or prejudice; based on facts; and unbiased.

An objective opinion is an intention of dealing with things without taking into considering our own beliefs, thoughts, opinions, and feelings.

Who does that?

I think we’re going to feel our feelings, experience them, one way or another.

I also think it’s hard to ignore our own judgement and perceptions.

And then there’s feelings. If the topic drives our emotions, it makes us scared, mad, or happy, then it’s hard to get past it, unless we really want to.

We sometimes get lazy, and we just don’t want to pay attention anymore, so we just take those mental shortcuts. The easy way it is so, easy.

When it comes to the lockdown, Physicians who are concerned about their hospitals being overwhelmed may prefer it this way, so they’ll find information that supports their own individual motivations.

Other Physicians may earn their living doing surgeries that aren’t labeled a necessity, so their motivation is to get back to work. They may be more biased toward finding information that supports opening for business.

What is wrong with having your own opinion or personal motivations?

Nothing.

It’s useful to pay attention and know we have it.

It’s an example of how we find ways to get what we want.

We decide what we get.

Our cognitive biases influence how we think and act, so it’s useful to be aware of what it is we want, because we’re going to find information that supports what we want.

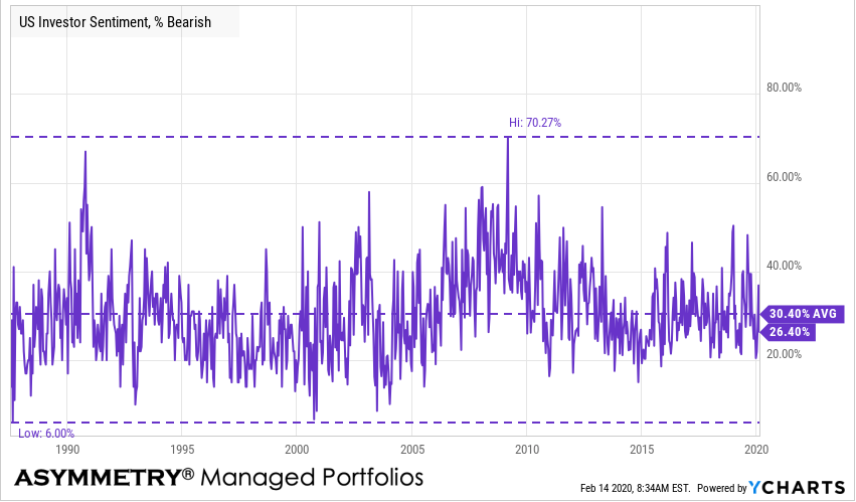

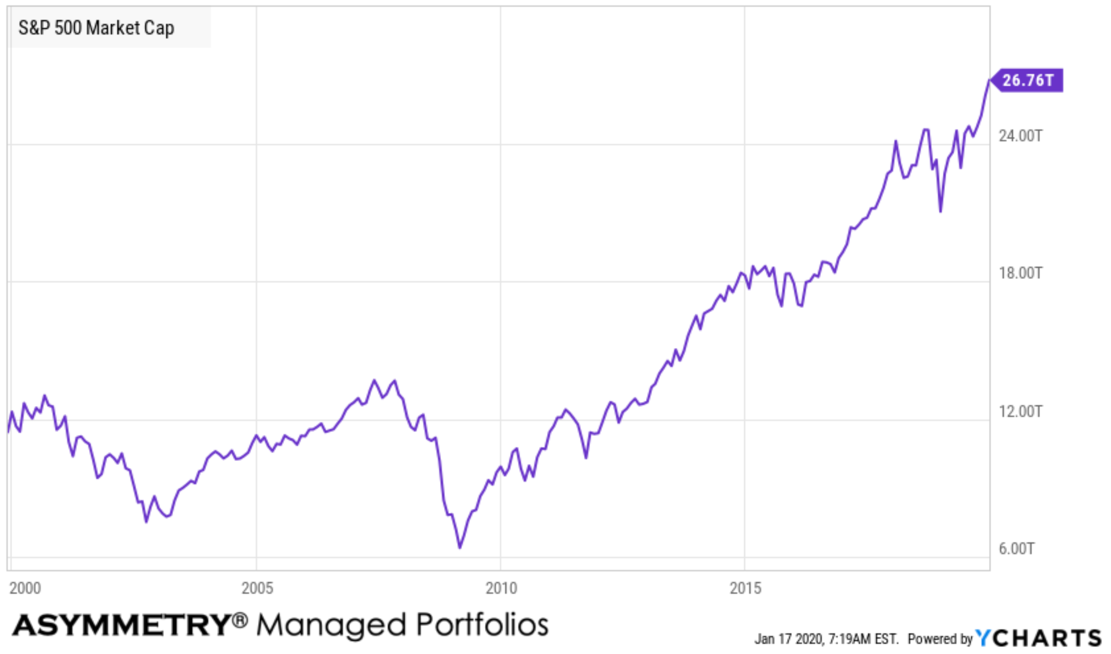

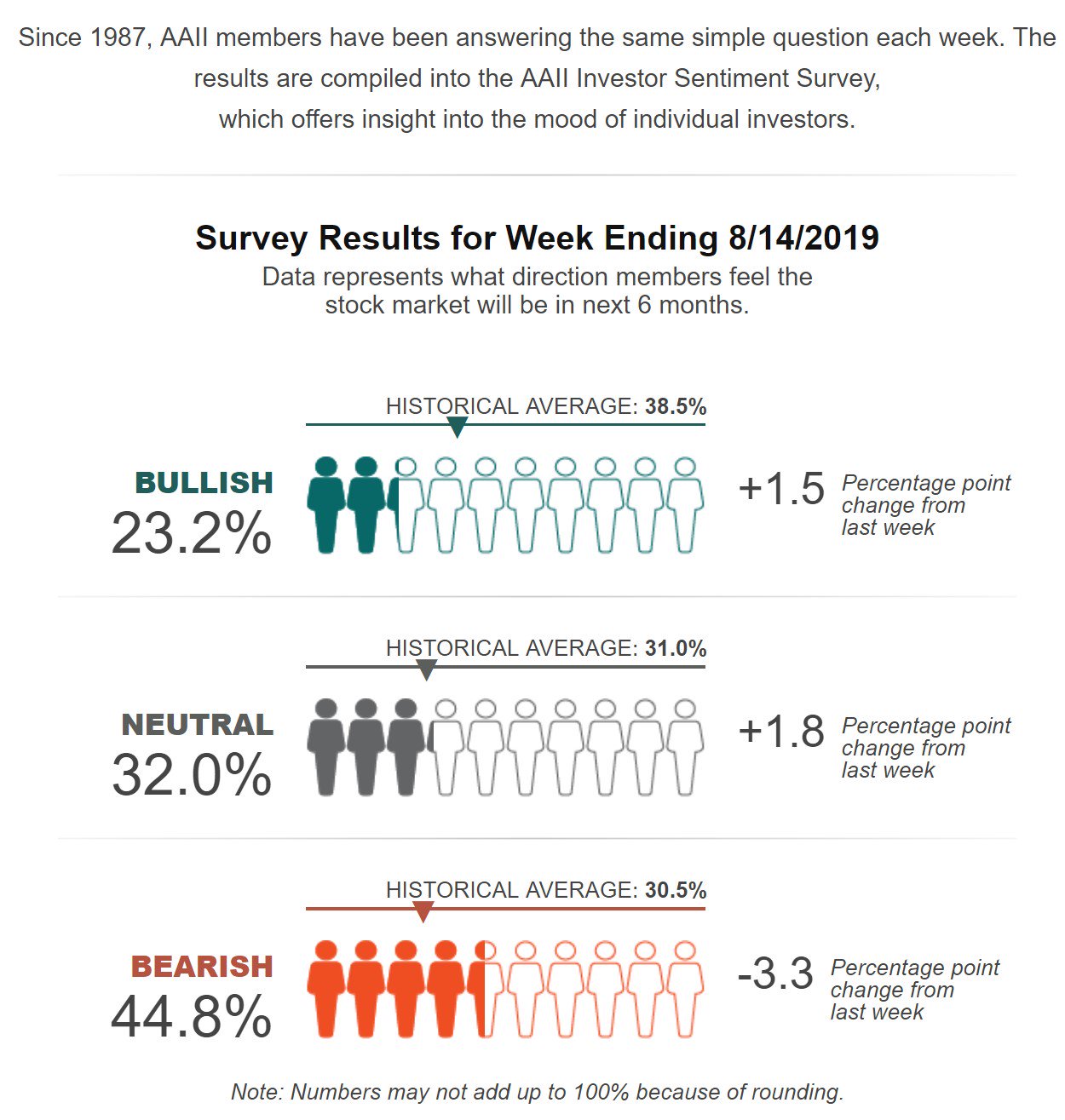

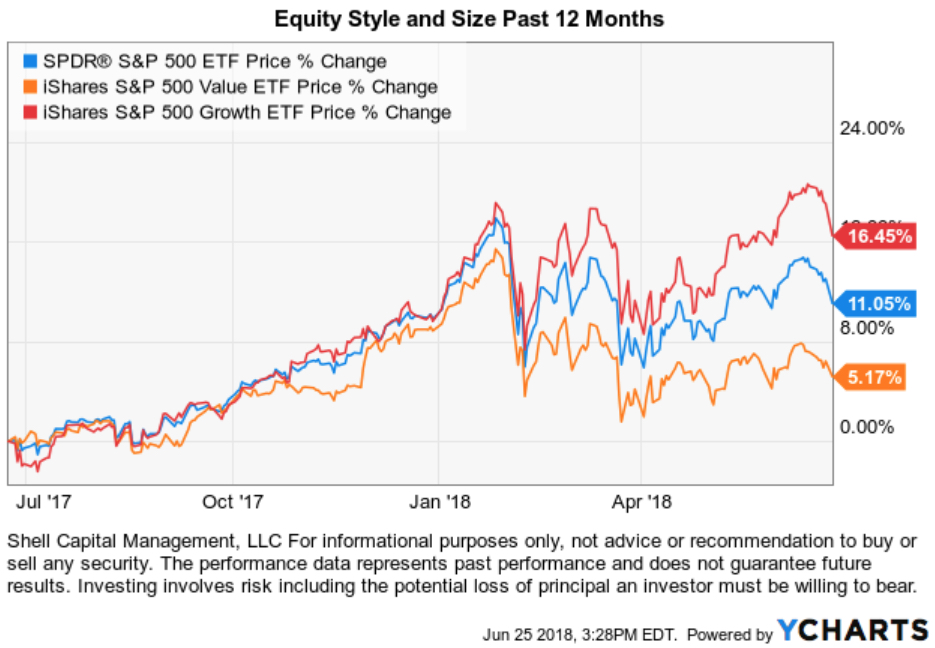

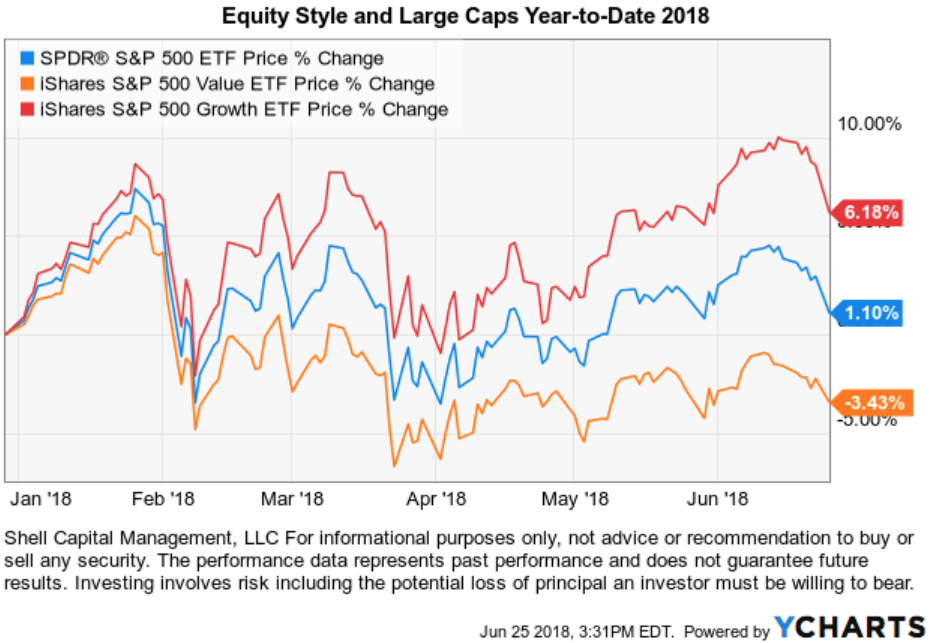

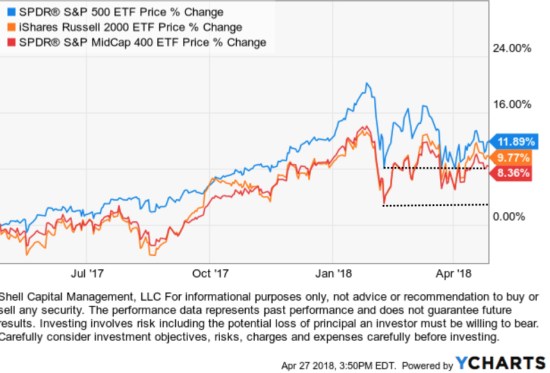

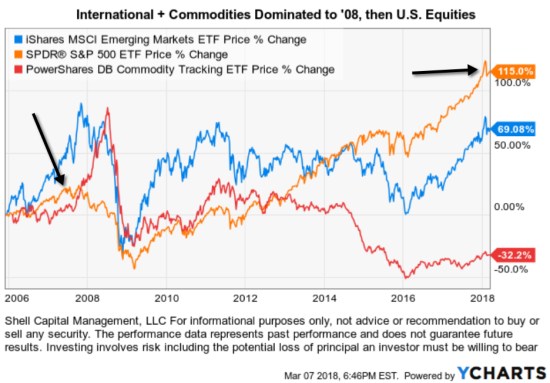

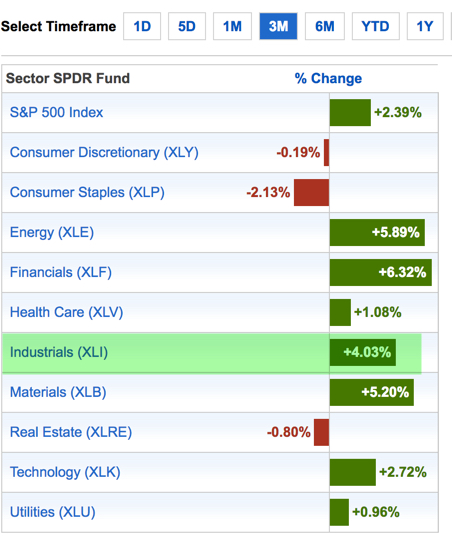

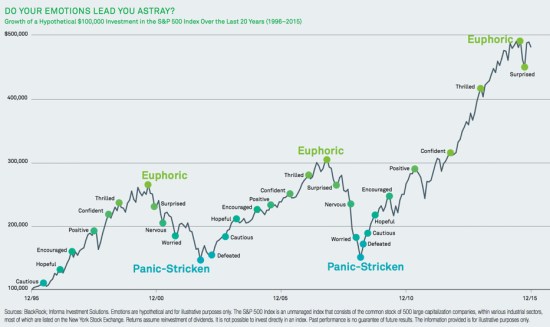

Sometimes we just don’t have time to think for ourselves, so we just find information from trusted people and go with it. My observations here is an example, especially when it comes to market trends and such.

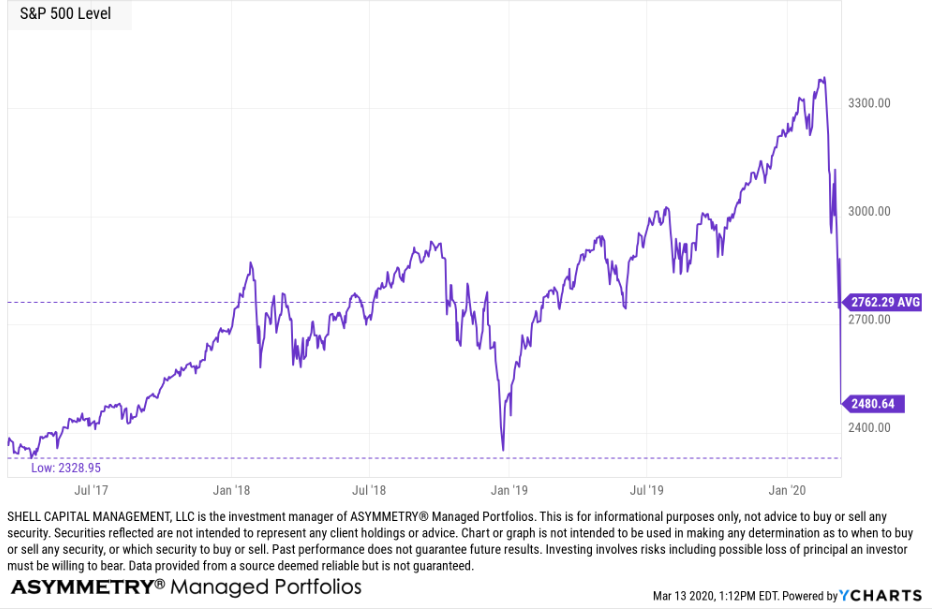

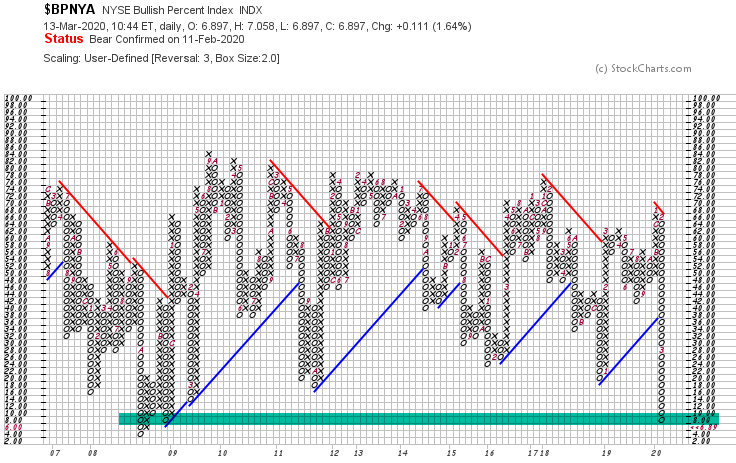

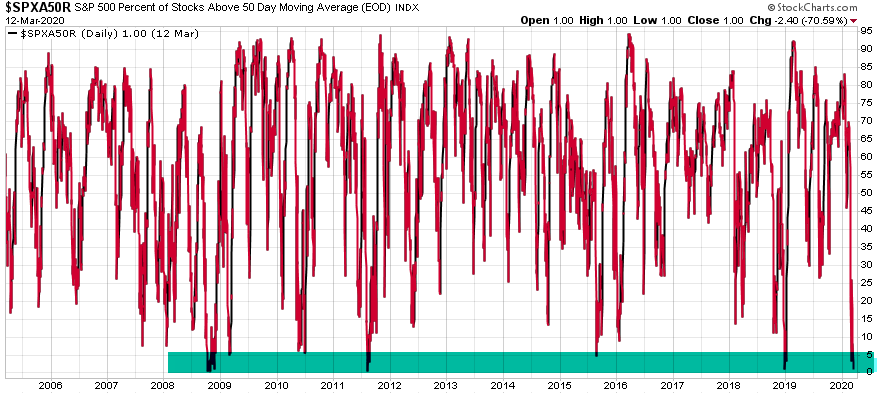

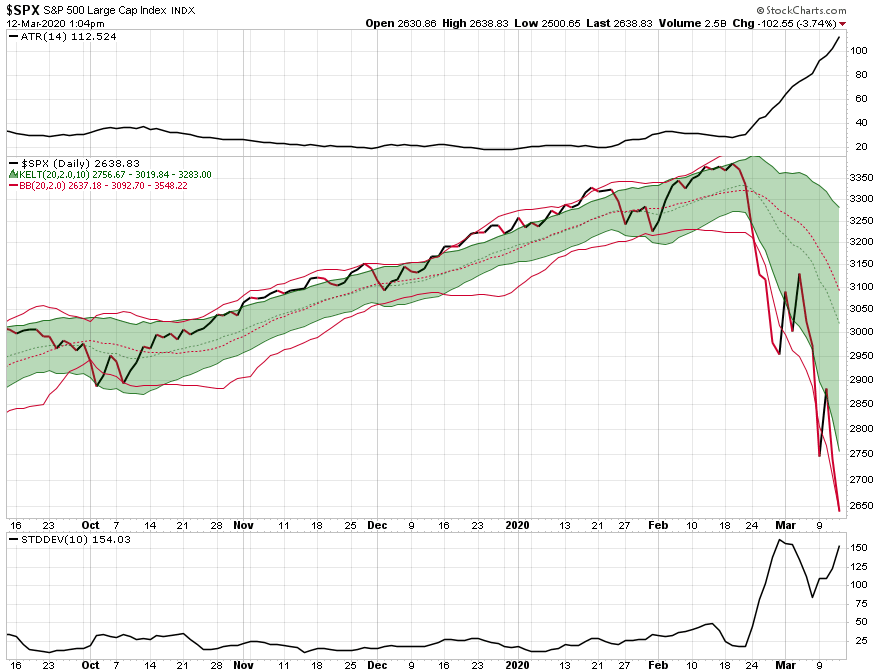

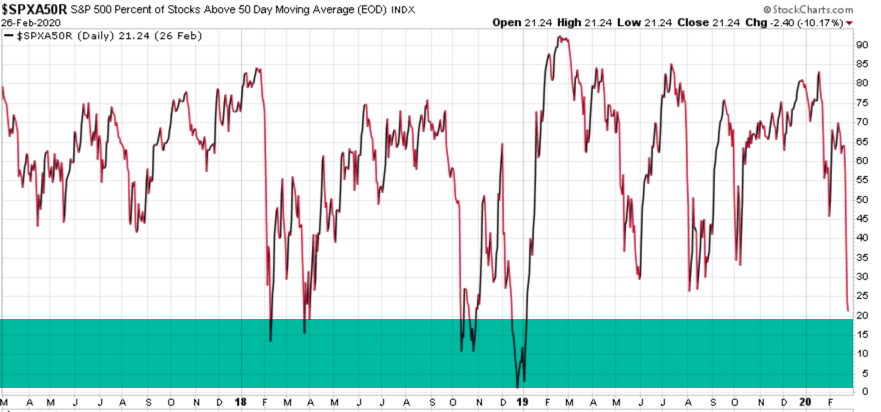

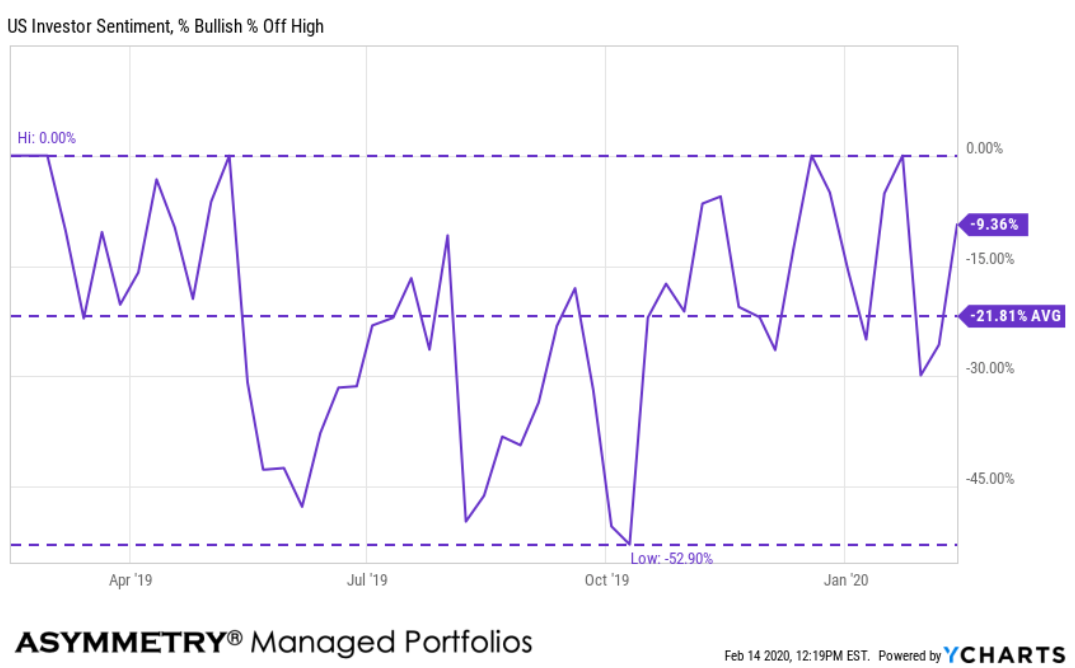

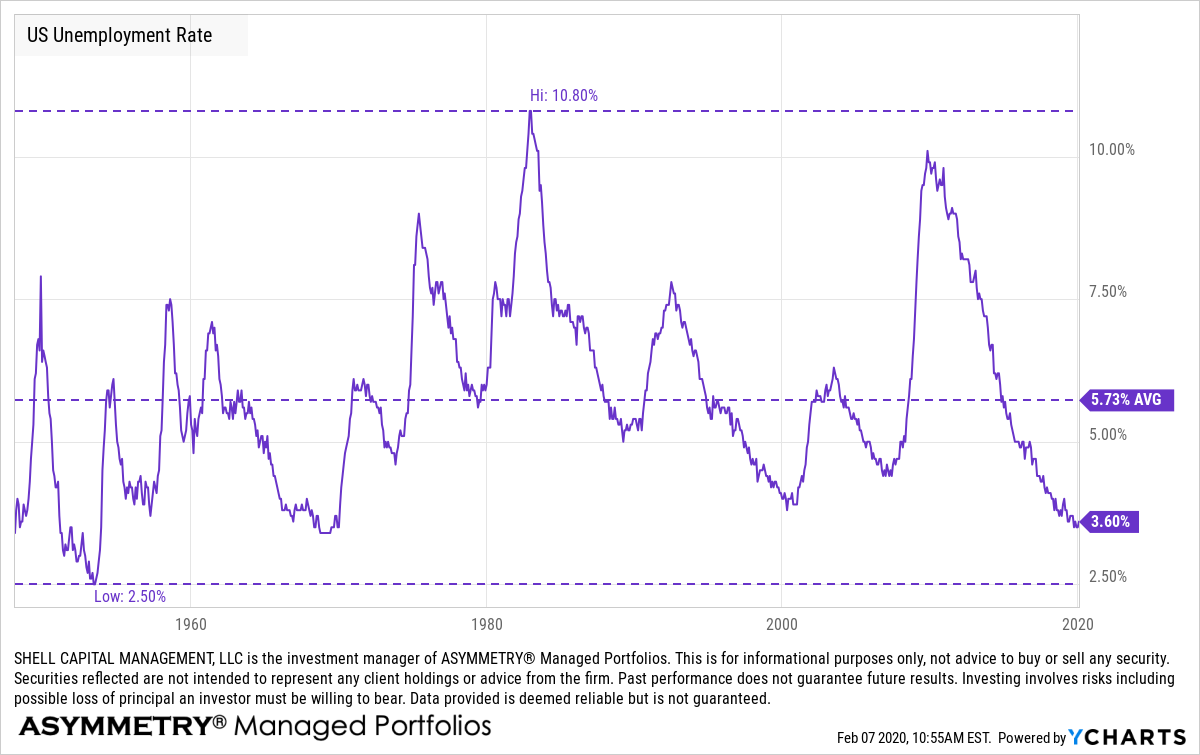

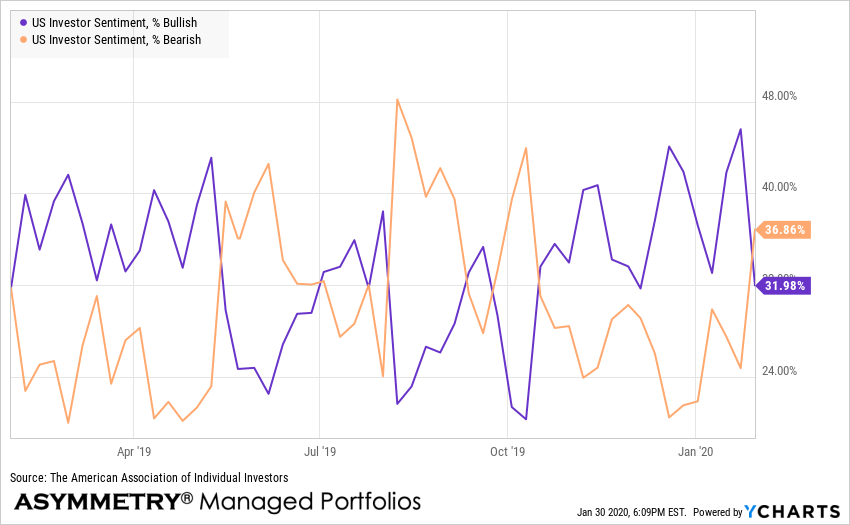

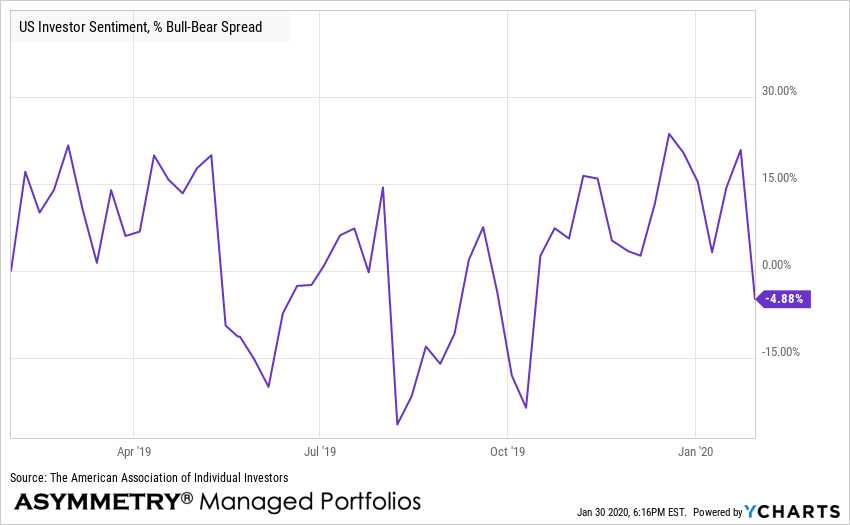

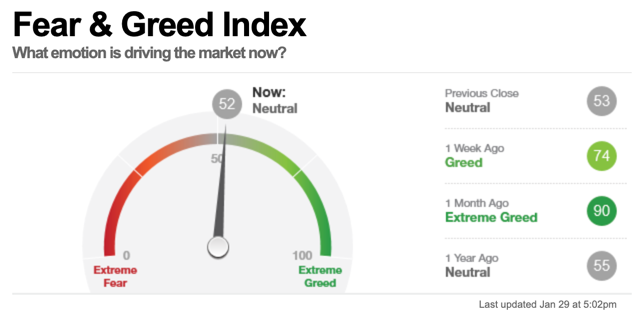

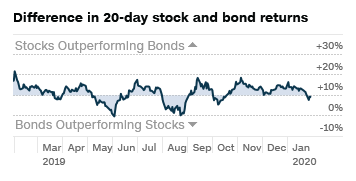

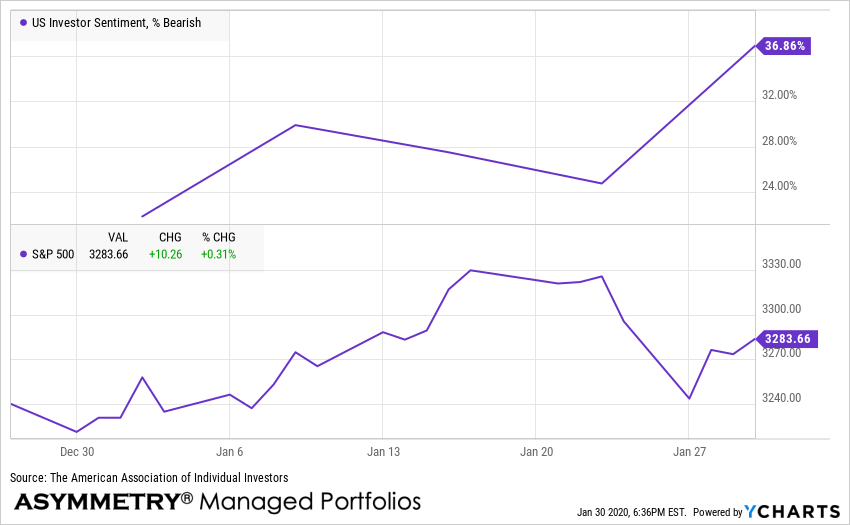

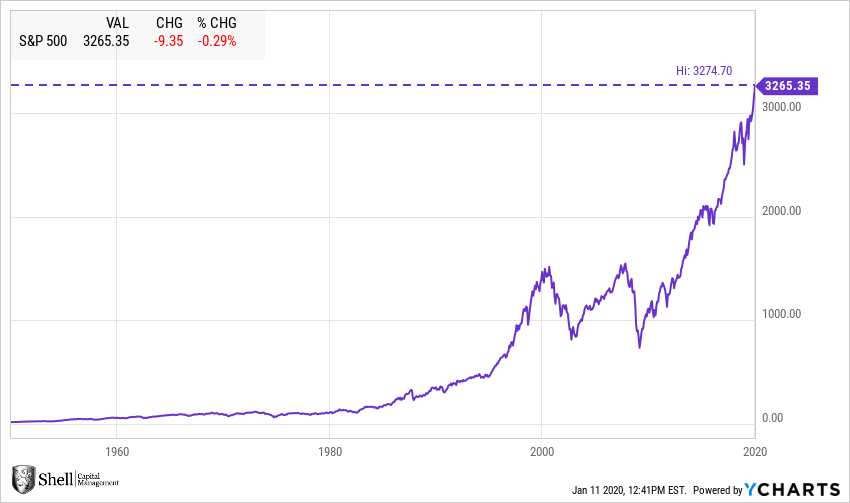

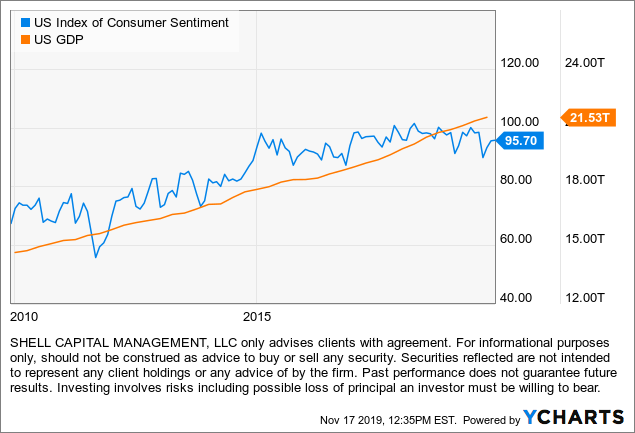

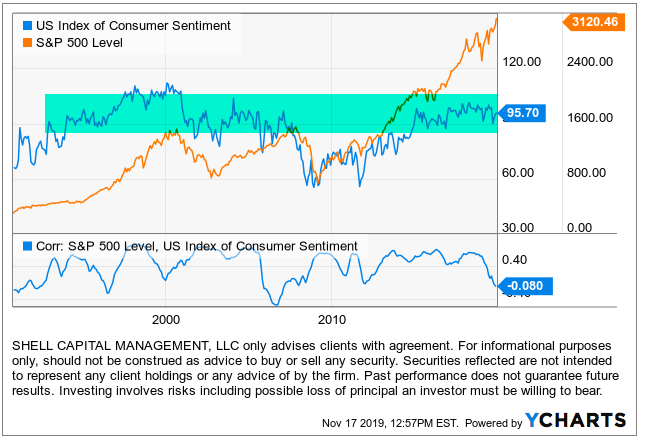

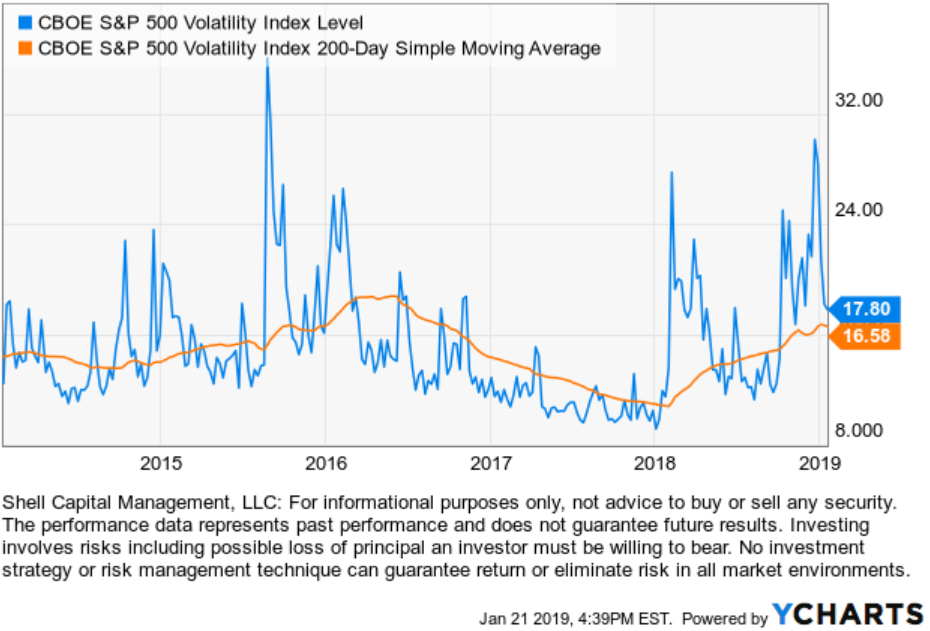

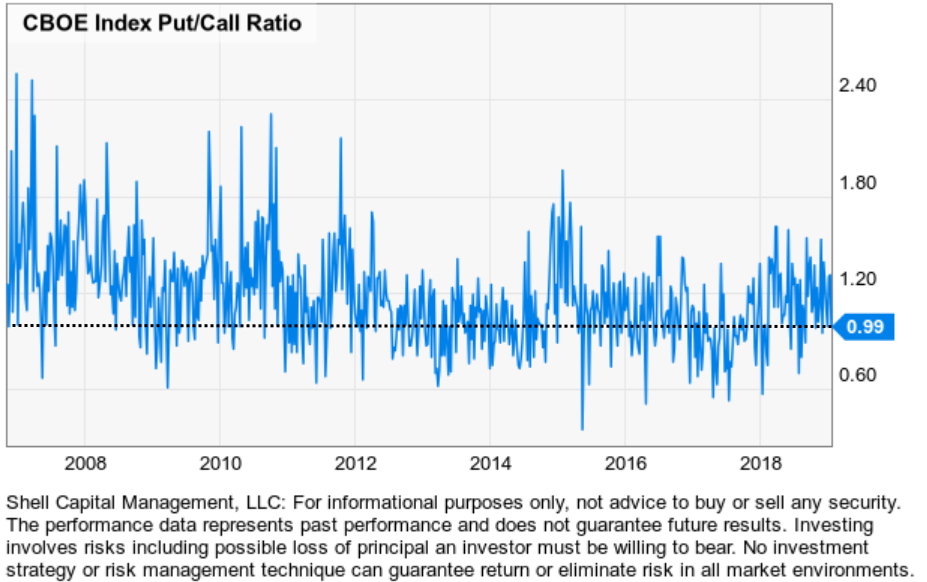

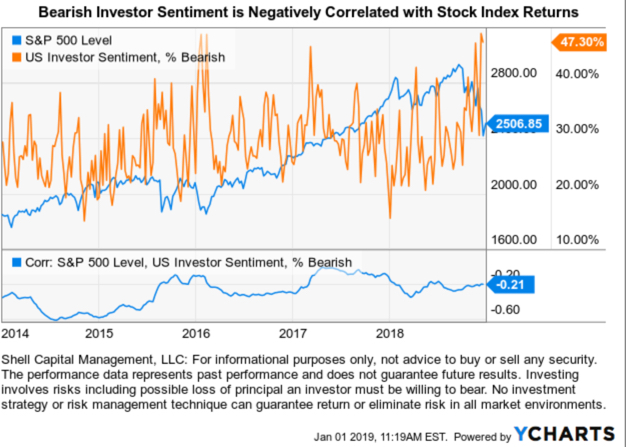

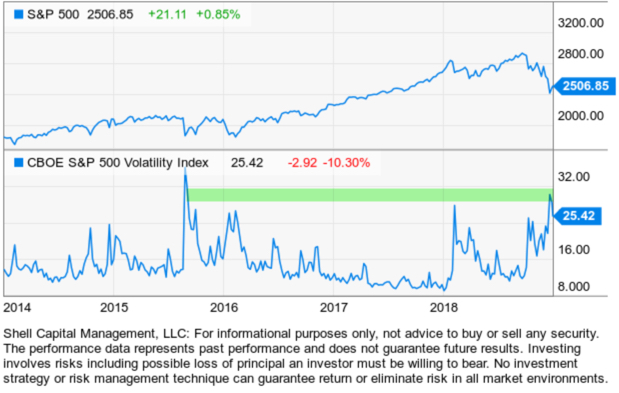

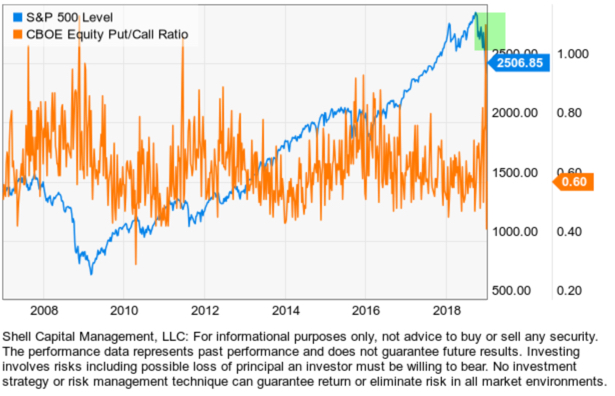

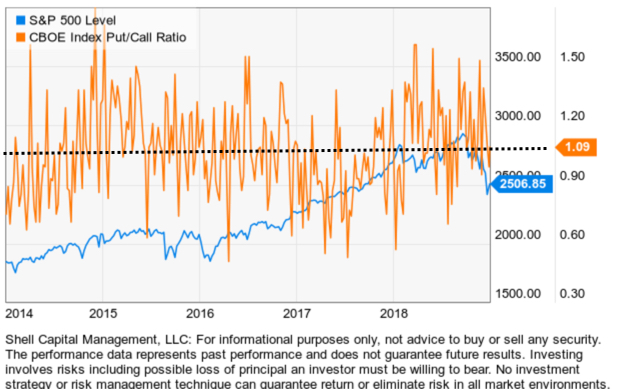

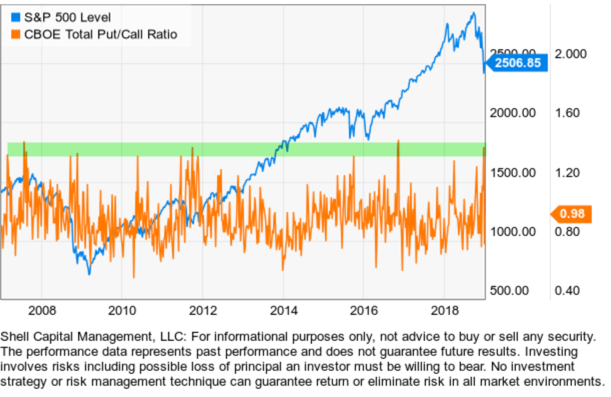

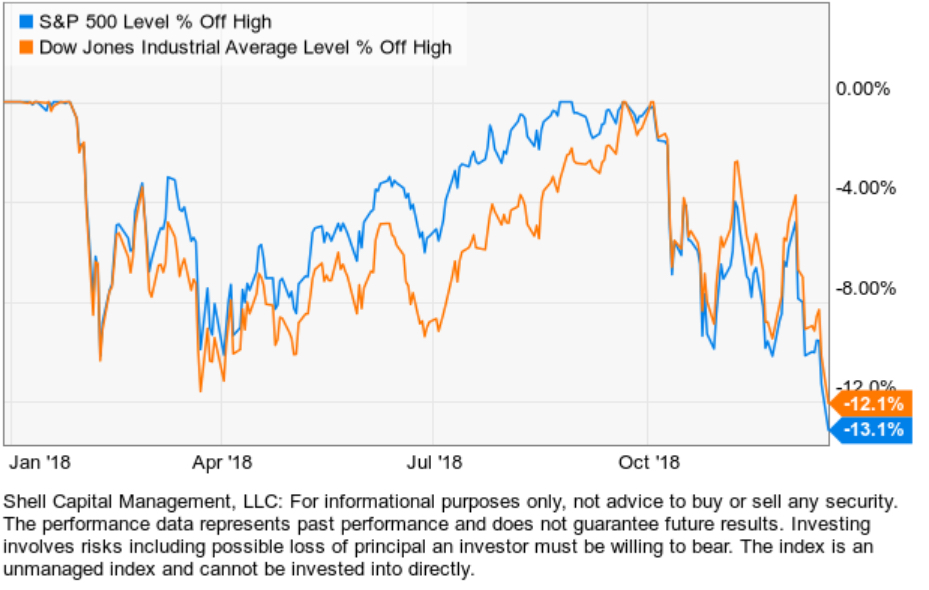

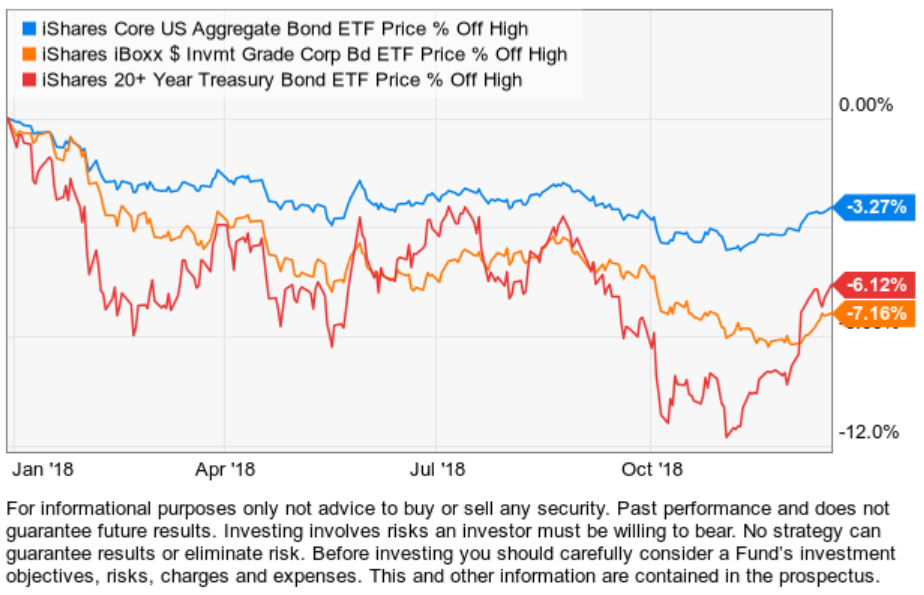

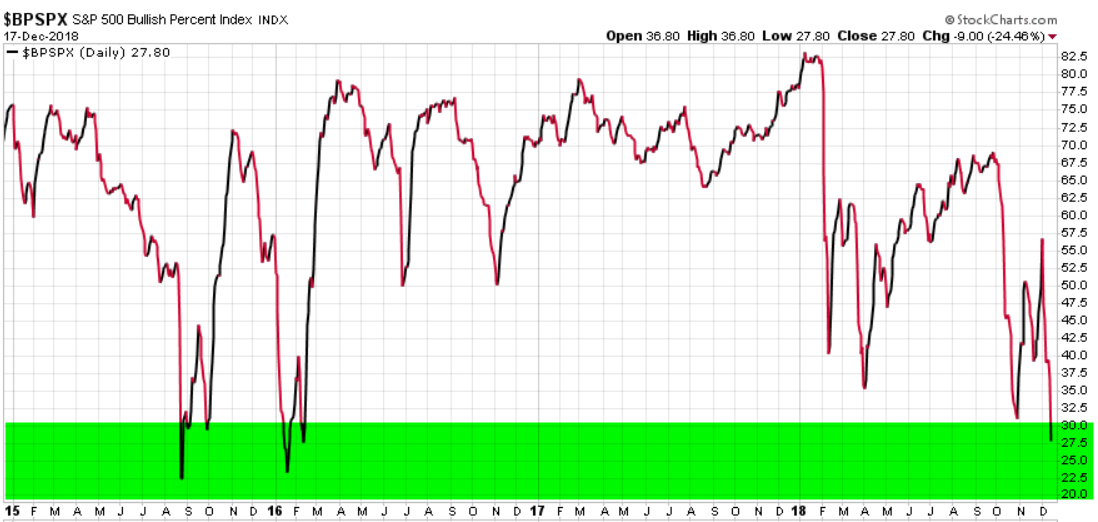

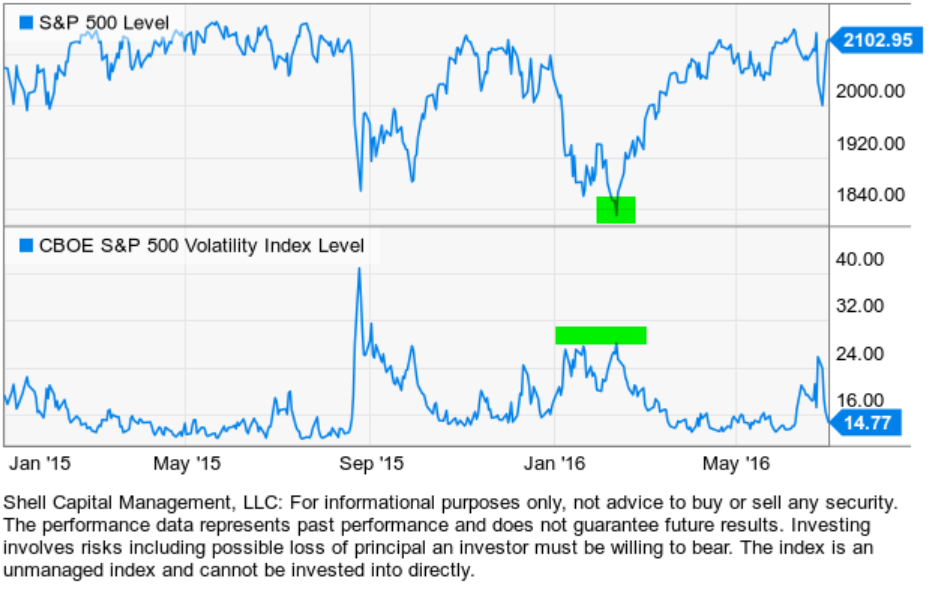

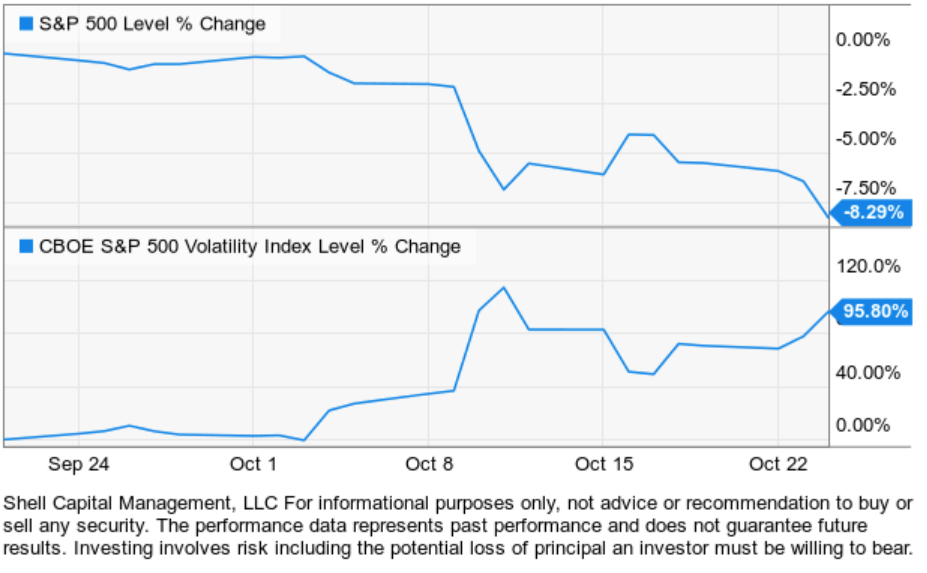

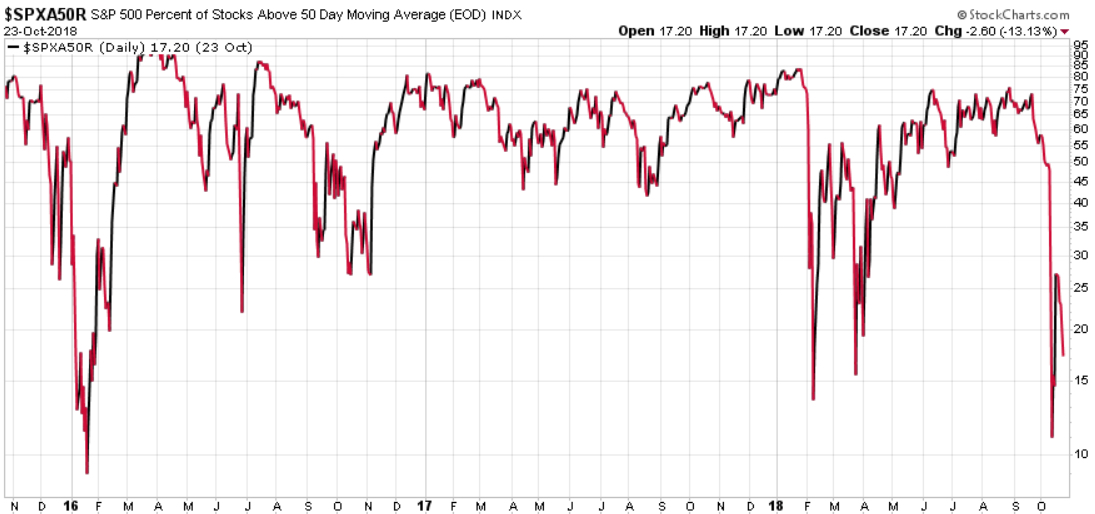

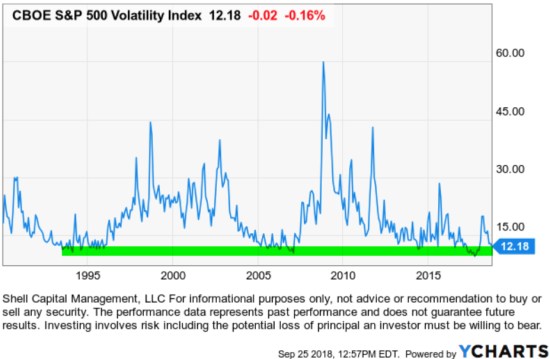

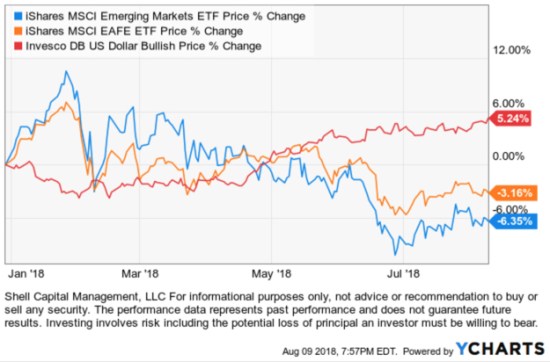

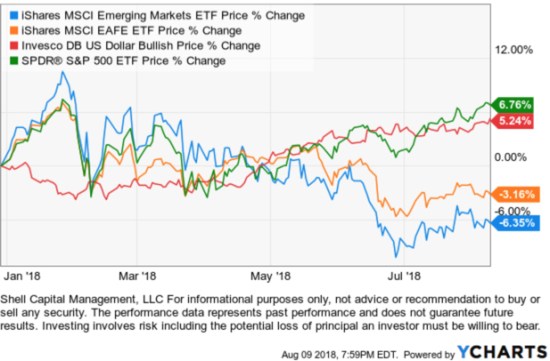

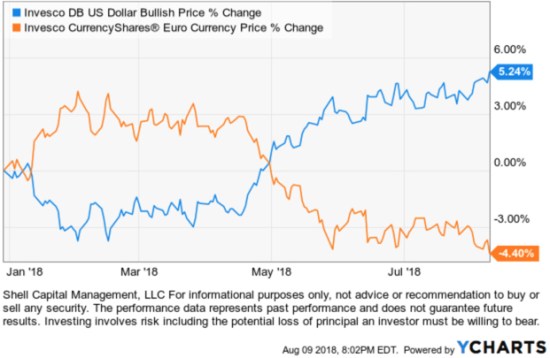

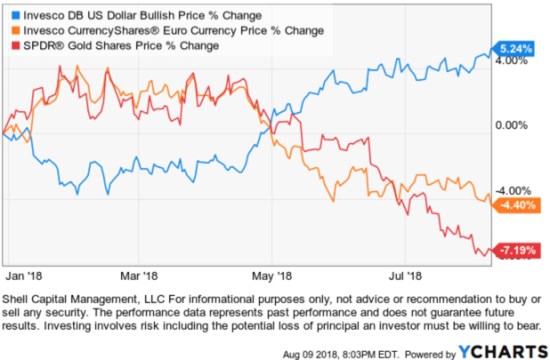

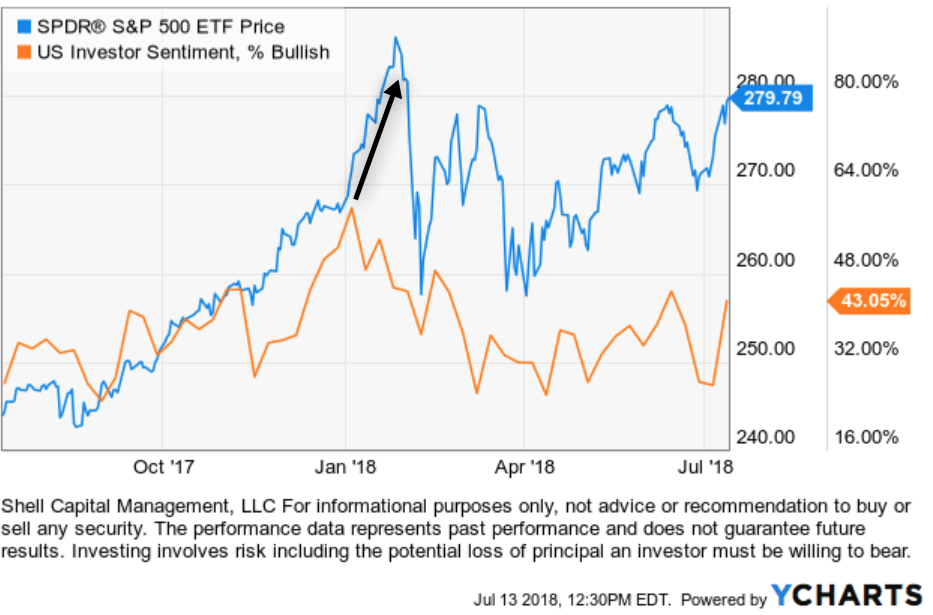

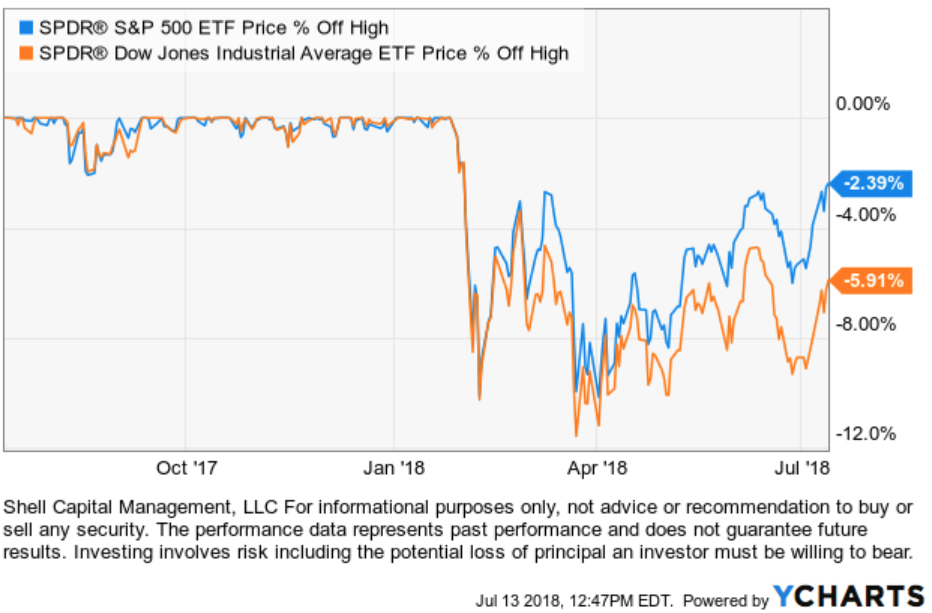

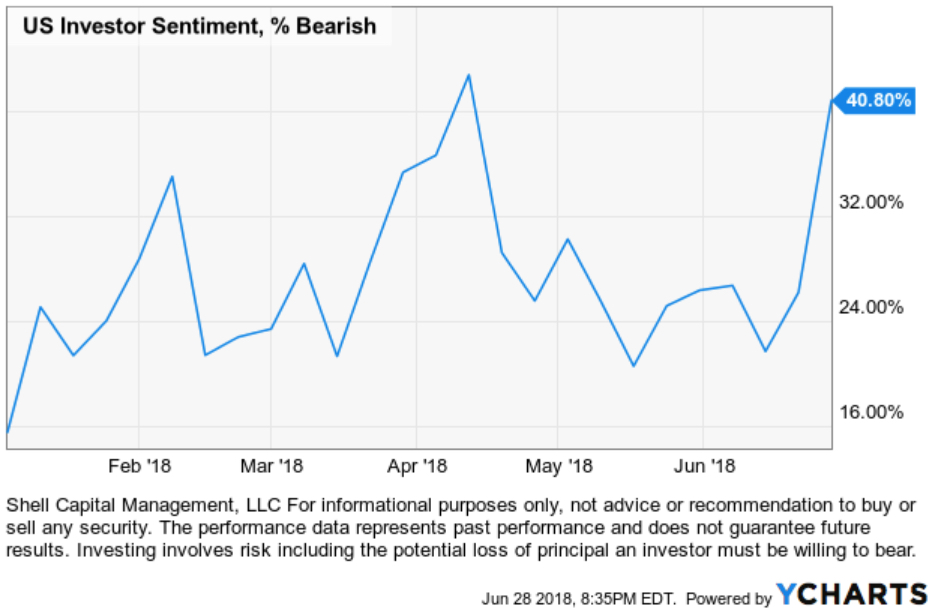

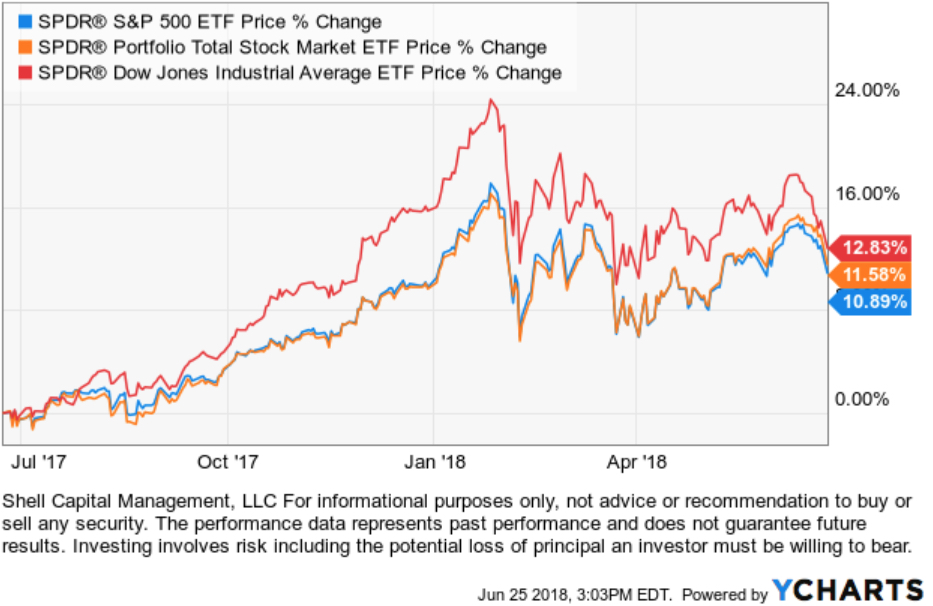

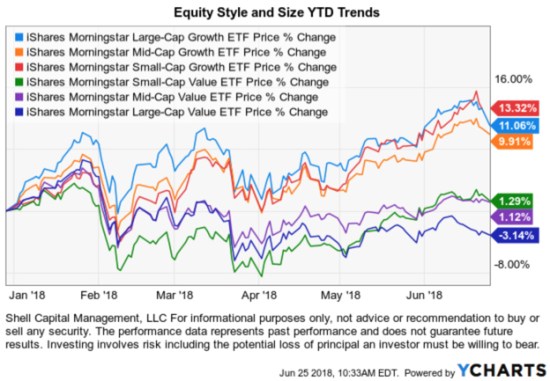

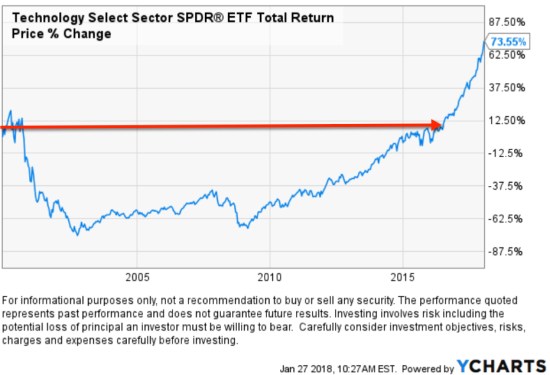

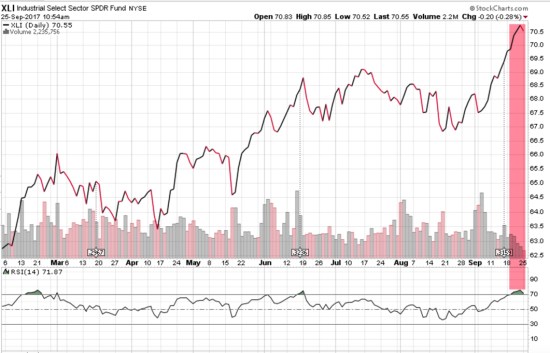

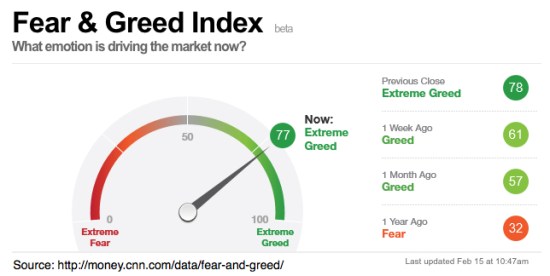

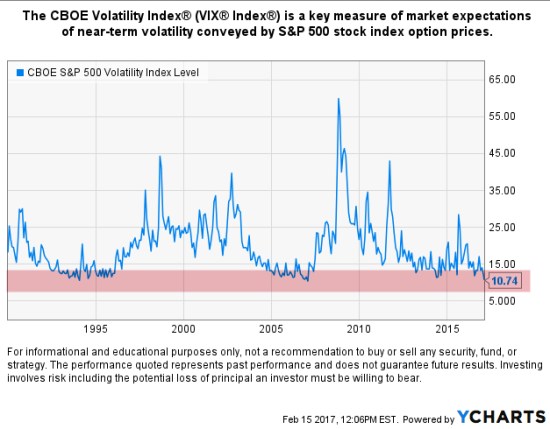

We have to be selective in how we pay attention to what’s going on the world around us because we simply don’t have time to observe it all. I realized this two decades ago, so I developed systems for monitoring what has changed, systematically. I don’t have to sit around and look for it manually, I get alerts. When something has changed enough to send me a signal, then I look to see if I believe it matters.

Should you listen to others?

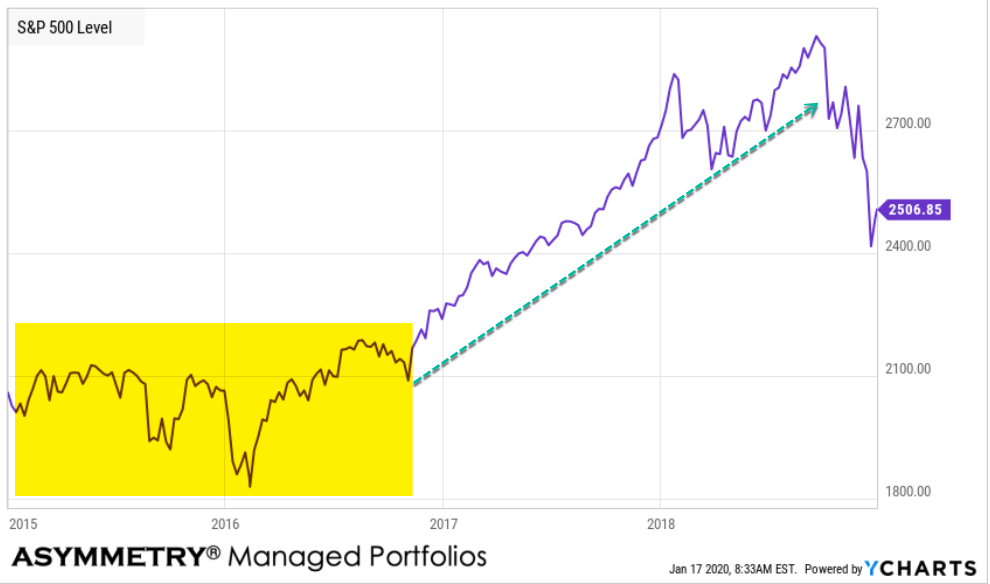

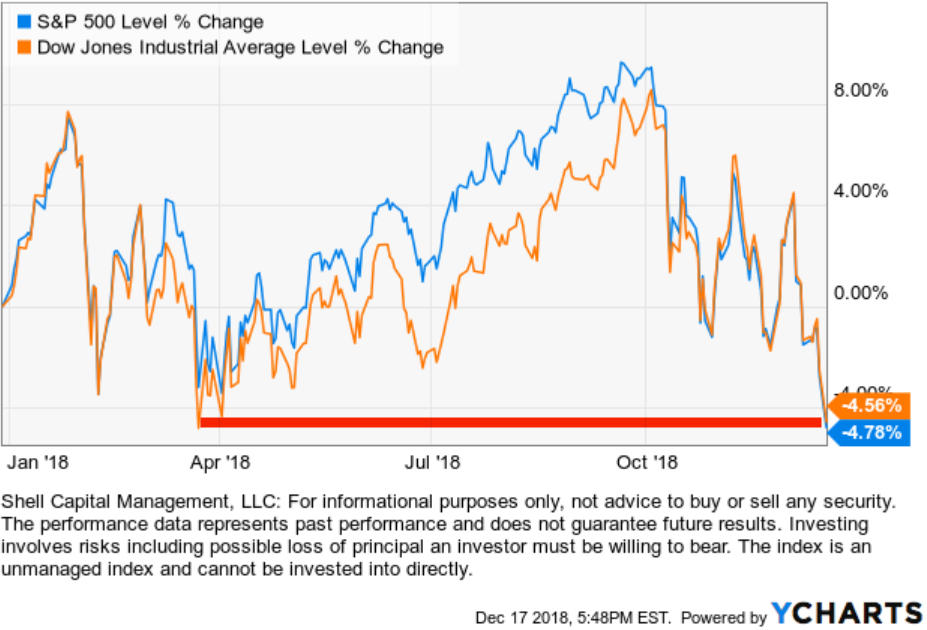

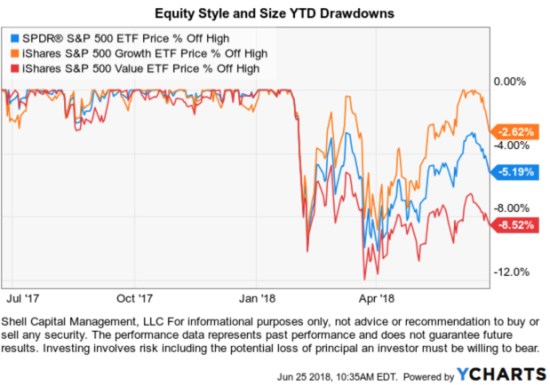

Only if they’re better at it than you are, and have more focus. Concentration is key, to me. My track record speaks for itself, especially during bear markets and volatility expansions. I’ve now operated through three major bear markets and a hundred volatility expansion. This isn’t new for me.

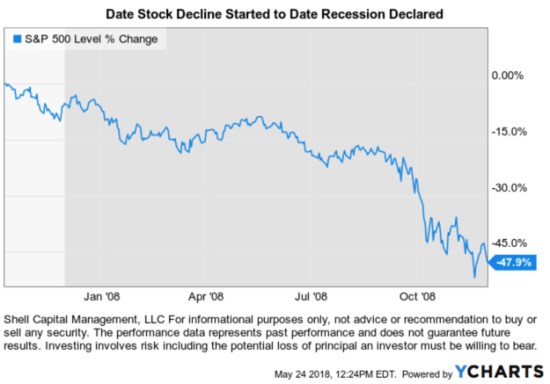

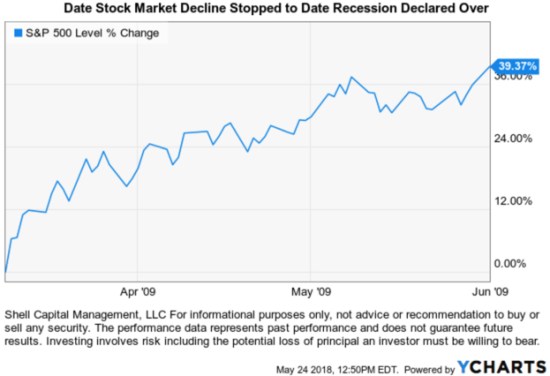

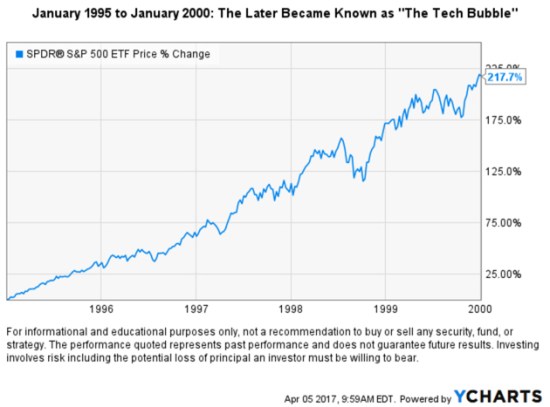

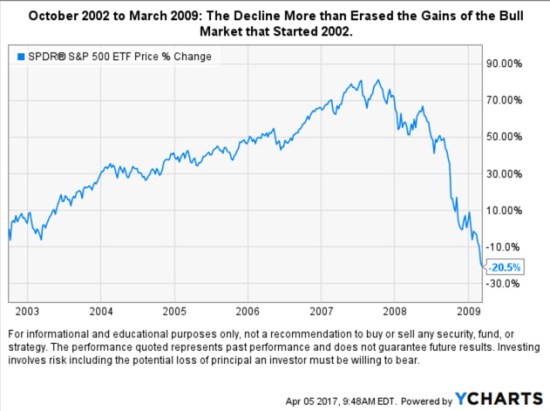

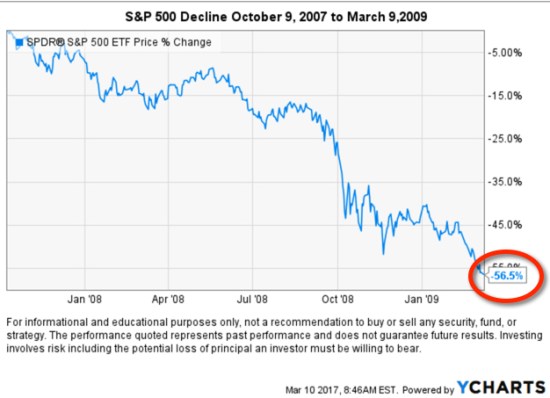

More importantly, I didn’t just “hunker down” and buy and hold through market crashes like 2000-03 or 2007-09. I tactically traded through them, successfully, and managed my drawdowns within a tolerable level. Past performance is never a guarantee of future results, but I’d rather drive my own boat through this storm than ride with anyone else. I’ve learned many lessons that should add to my skill and experience, so I’m likely to get what I want, but likely isn’t a sure thing.

What we believe about the virus and the lockdown depends on our personal beliefs, and we probably find things that support what we already believe. Nothing I write is guaranteed change your mind. You’ll instead compare it to the observations and opinions of others, but most importantly, you own.

That is, unless you intentionally look at the data with determination to be objective.

I know, it’s hard. Who does that?

A simple equation: Intentions = results.

In Market Wizards: Interviews with Top Traders, Ed Seykota, one of the famous traders interviewed, said:

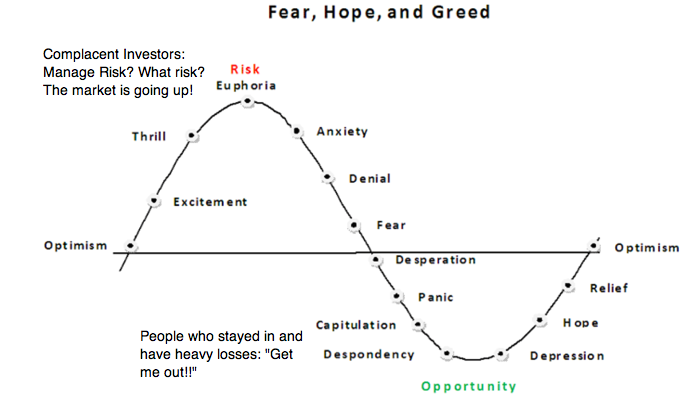

“Win or lose, everyone gets what they want from the market.”

It means our intentions equals our results. Our intentions create our results.

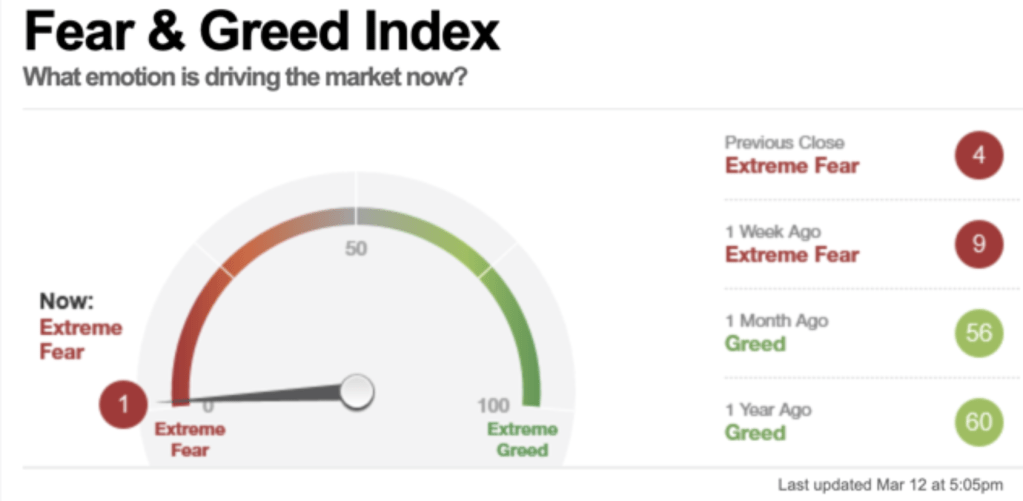

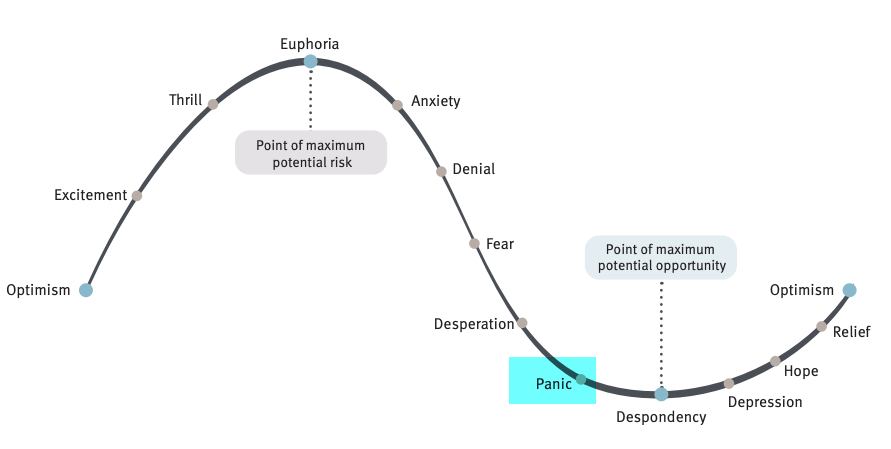

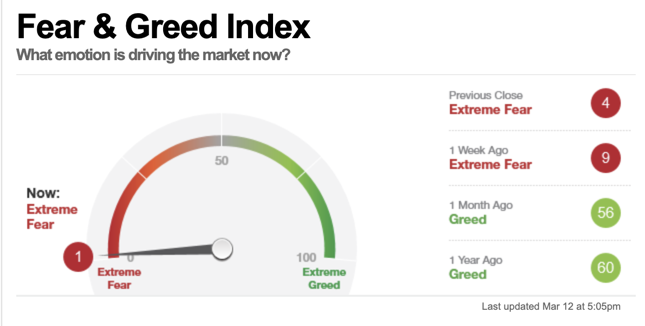

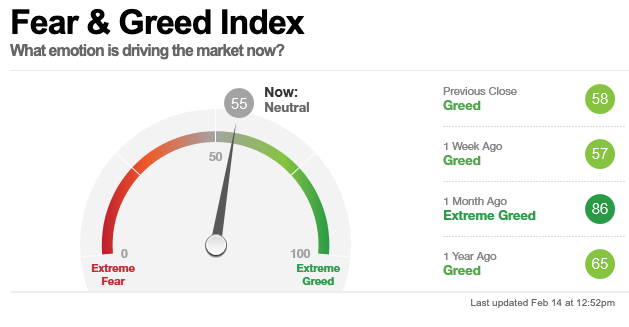

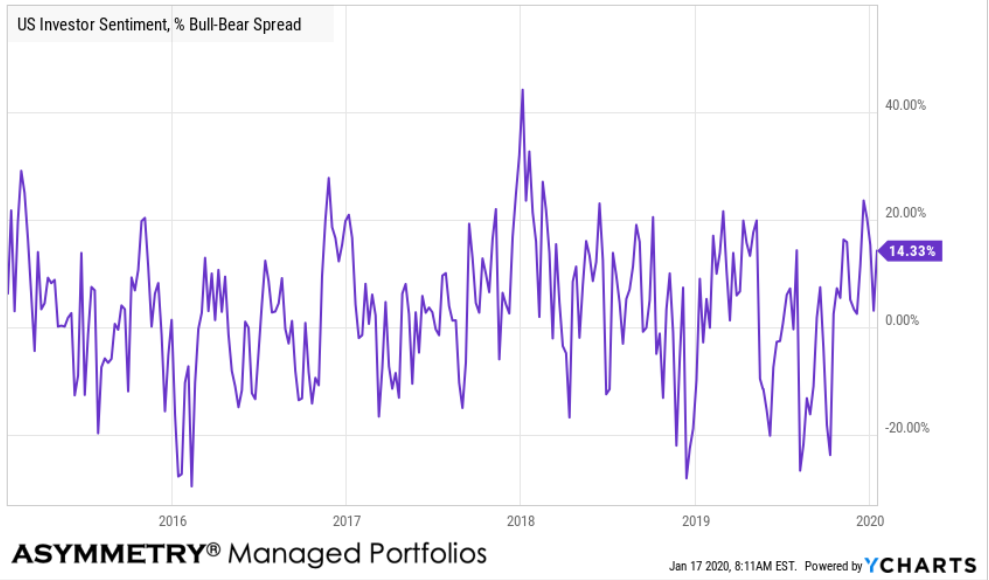

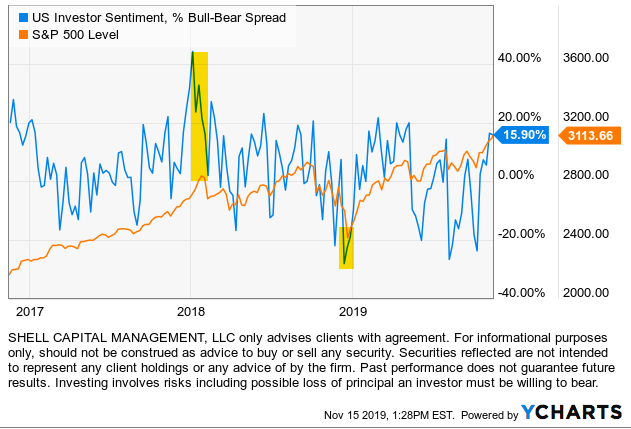

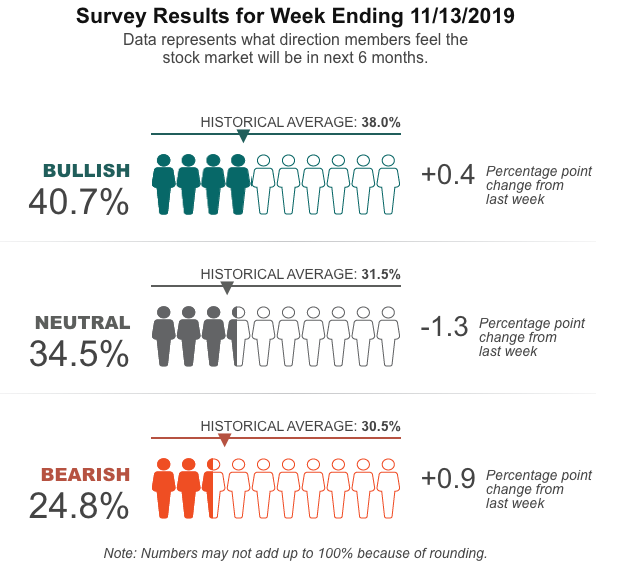

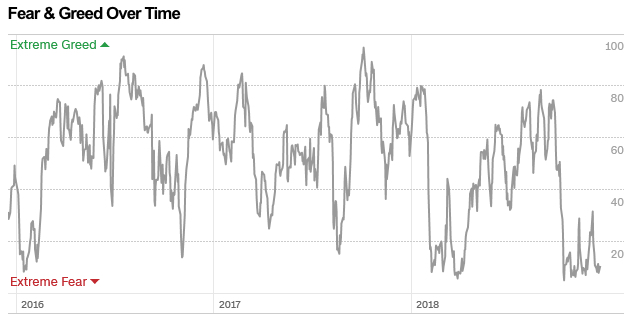

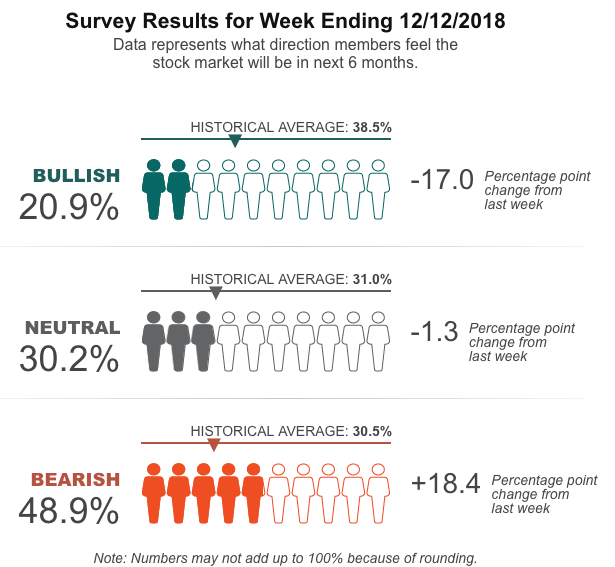

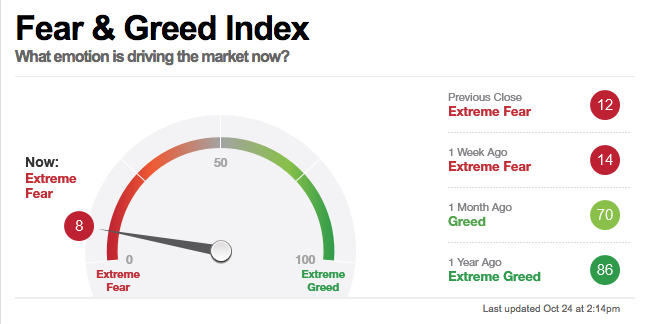

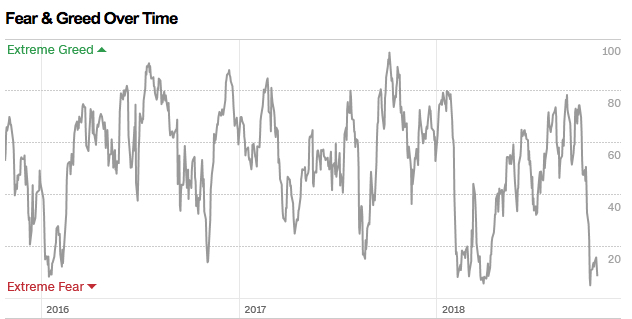

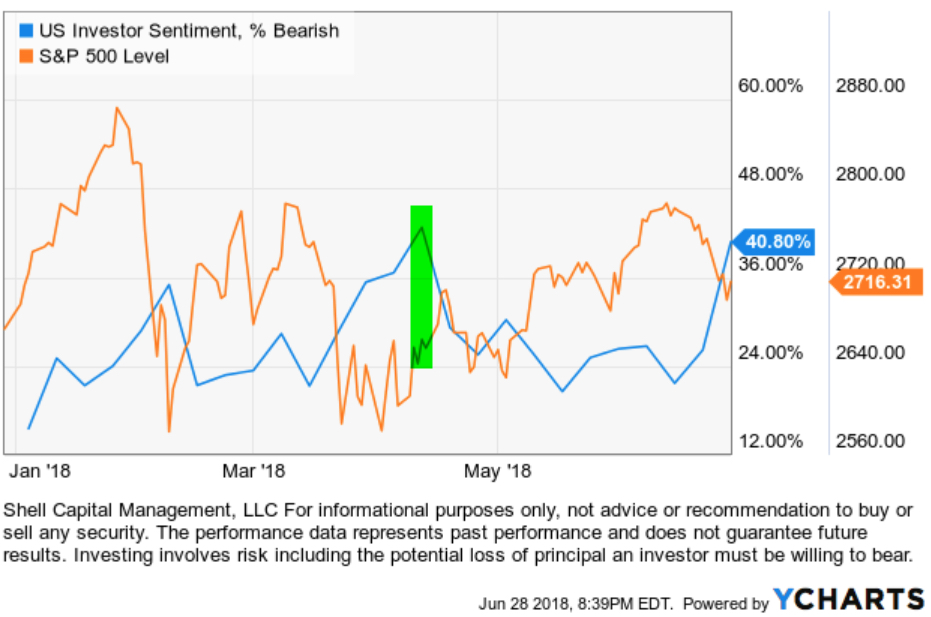

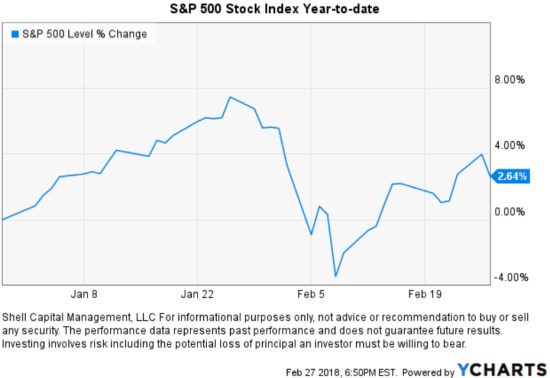

For example, you have an opinion about the stock market right now. You have a feeling about it. You have beliefs. You may draw from the beliefs and opinions of others. You’re certainly focused on finding what confirms what you already believe, if you recognize it.

If you believe the stock market can’t possibly trend higher, you look for confirming information and opinions. If the market trends down and you avoided the loss, you got what you wanted. If the market trends up and you missed out, you got what you wanted. You wanted to avoid the downtrend you believe should happen. It doesn’t matter if it does, or not.

If you believe the stock market will go to the moon again because the Fed is intent on it, you’ll expose your portfolio to your belief. If the market trends up and you participate in its profits, you got what you wanted. If the market instead trends up and you participate in its losses, you got what you wanted. You believed it should trend up and you wanted exposure to what you believe should happen. It doesn’t matter if it does, or not.

What you believe is true, for you.

It’s how we get what we want.

We decide what we get. So, if we want to be empowered, create our own outcomes, we must necessarily take responsibility for them. When we take responsibility for our outcomes, we get the results we want.

Knowing what I know, having operate through times like this before, you’re going to need it. That is, unless you choose to be a victim. But I just made you aware that’s a choice, too.

I want to use my skills and experience to make the best of what is going to happen next.

Join 39.5K other subscribers

Mike Shell is the Founder and Chief Investment Officer of Shell Capital Management, LLC, and the portfolio manager of ASYMMETRY® Global Tactical. Mike Shell and Shell Capital Management, LLC is a registered investment advisor focused on asymmetric risk-reward and absolute return strategies and provides investment advice and portfolio management only to clients with a signed and executed investment management agreement. The observations shared on this website are for general information only and should not be construed as advice to buy or sell any security. Securities reflected are not intended to represent any client holdings or any recommendations made by the firm. Any opinions expressed may change as subsequent conditions change. Do not make any investment decisions based on such information as it is subject to change. Investing involves risk, including the potential loss of principal an investor must be willing to bear. Past performance is no guarantee of future results. All information and data are deemed reliable but is not guaranteed and should be independently verified. The presence of this website on the Internet shall in no direct or indirect way raise an implication that Shell Capital Management, LLC is offering to sell or soliciting to sell advisory services to residents of any state in which the firm is not registered as an investment advisor. The views and opinions expressed in ASYMMETRY® Observations are those of the authors and do not necessarily reflect a position of Shell Capital Management, LLC. The use of this website is subject to its terms and conditions.

:max_bytes(150000):strip_icc():format(webp)/what-is-a-cognitive-bias-2794963_V1-a96938160eea438cb3b5e2ed9f20cee0.png)

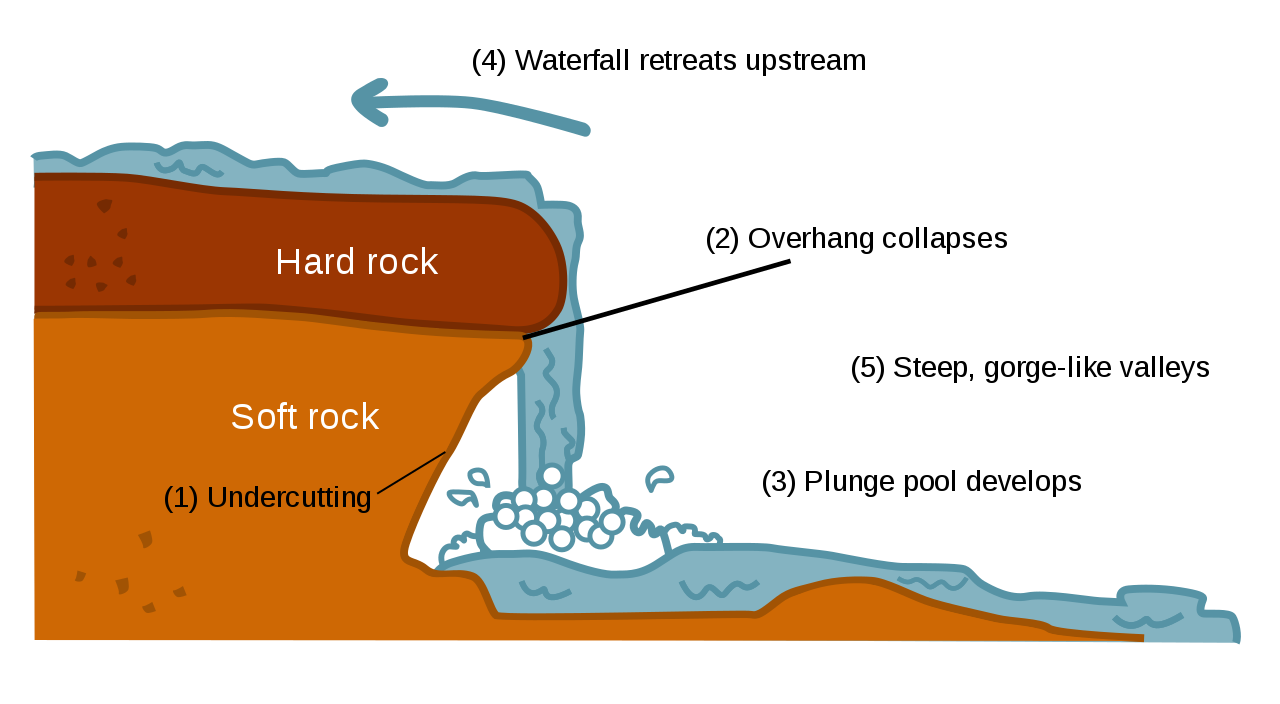

An overhang in a waterfall can sometimes protrude out enough to form a base, or even drive the water to flow upward for a while, but the waterfall isn’t over until the plunge pool develops.

An overhang in a waterfall can sometimes protrude out enough to form a base, or even drive the water to flow upward for a while, but the waterfall isn’t over until the plunge pool develops.

You must be logged in to post a comment.