Following up on Why Bitcoin Itself Lacks Asymmetric Risk/Reward, we go into more detail with an example in Engineering Bitcoin into an Asymmetric Risk/Reward Investment and Managing Cryptocurrency Risk

Why Bitcoin Itself Lacks Asymmetric Risk/Reward

Does the cryptocurrency Bitcoin offer an asymmetric risk/reward payoff? Find out: Why Bitcoin Itself Lacks Asymmetric Risk/Reward

Are We Entering a Civil War?

That question isn’t being asked because of headlines or rhetoric. It’s being asked because something more structural is changing beneath the surface.

History shows that societies don’t move directly from polarization to violence. They move through a late-cycle phase where internal conflict escalates, trust erodes, and institutions lose their ability to absorb disagreement without breaking something important.

That phase doesn’t guarantee collapse.

But it does change the geometry of risk.

When internal conflict rises, outcomes stop being symmetrical. Stability becomes conditional. Small shocks produce outsized reactions. And assumptions built during long periods of calm begin to fail.

The real risk isn’t predicting the worst-case scenario.

It’s remaining structurally exposed as the distribution of outcomes widens.

Read it here: Are We Entering a Civil War? Or Entering the Phase That Precedes It?

When “Tax-Free” Isn’t Free—and When It Is

When do tax-exempt money market funds actually deliver an edge? This Asymmetry Observation breaks down the after-tax math behind taxable vs. tax-exempt cash yields, explains why “tax-free” often isn’t free, and shows how marginal tax rates and state taxes determine when the geometry finally flips. Read it here: Asymmetry Observation: When “Tax-Free” Isn’t Free — and When It Is

Investors vs. Traders

In asymmetric investing, the difference between an investor and a trader is misunderstood. Read about it in Investors Own Capital. We Actively Manage Exposure

People Earn Money in One Business — Then Lose It in Another

Why many professionals and business owners earn wealth in one business—then lose it in another. An ASYMMETRY® Observation on exit risk, capital redeployment, and asymmetric risk management. Read it: People Often Earn Money in One Business — Then Lose It in Another

The Art of Asymmetric Investing: When Imbalance Beats Balance

The Art of Asymmetric Investing: When Imbalance Beats Balance. Most investors think the goal is balance. Balanced portfolios. Balanced risk. Balanced returns. What business owner wants to balance their profit and loss? What investor wants to balance their risk and reward? Read it here: The Art of Asymmetric Investing Isn’t Balance — It’s Survival

Connecting the Dots Means Understanding How Markets Interact With Each Other

Markets don’t move in isolation. They interact. Equities, rates, volatility, options, and liquidity form a system where pressure in one area transmits into others. Understanding those interactions—who is forced to act, when risk accelerates, and where fragility builds—matters far more than predicting the next market move. Connecting the dots isn’t about forecasting outcomes. It’s about understanding how risk flows through the system—and structuring portfolios so downside is defined while upside remains open. Read it here: Connecting the Dots Means Understanding How Markets Interact

True Asymmetry vs. False Asymmetry in Investment Management

Many strategies look asymmetric—until volatility exposes what was hidden. True asymmetry starts with defined risk and leaves upside open. The difference is geometry, not storytelling. Read: True Asymmetry vs. False Asymmetry in Investment Management

Captain Condor Blowup and the Illusion of Asymmetry

Having traded options for thirty years, I’ve seen the same pattern repeat across decades and market regimes: what looks like consistency is often just risk being deferred. A strategy can look disciplined, consistent, and “low risk” right up until the moment it isn’t. The Captain Condor $50 million collapse wasn’t caused by a market crash or bad luck — it was caused by a hidden asymmetry in the risk itself. This observation explains how smooth returns, high win rates, and “defined risk” trades can still produce catastrophic outcomes when portfolio risk is left undefined — and why true asymmetry always starts with survival, not consistency. Read the observation: Captain Condor Blowup and the Illusion of Asymmetry

The Asymmetry of Alpha vs. Survival

Nassim Nicholas Taleb argues that most so-called “alpha” isn’t real because it ignores the most important variable in investing: survival through time. Strategies that look impressive based on historical averages often conceal a small probability of catastrophic loss. For investors compounding wealth over decades—especially after a liquidity event like selling a business or retirement—those rare losses matter far more than smooth long-term averages. True alpha must endure volatility, uncertainty, and adverse regimes without risking permanent capital impairment.

Read the full article on the Shell Capital blog:

Why Nassim Nicholas Taleb Says Most “Alpha” Isn’t Real

https://shell-capital.com/asymmetry-observations/why-nassim-nicholas-taleb-says-most-alpha-isnt-real

Markets aren’t driven by averages

This observation was originally published at Shell Capital’s ASYMMETRY® Observations.

Markets aren’t driven by averages

Most investment frameworks still assume markets are driven by rational actors optimizing long-term averages.

They aren’t.

Markets are driven by how humans perceive gains, losses, and risk in real time—and that perception is systematically distorted under pressure.

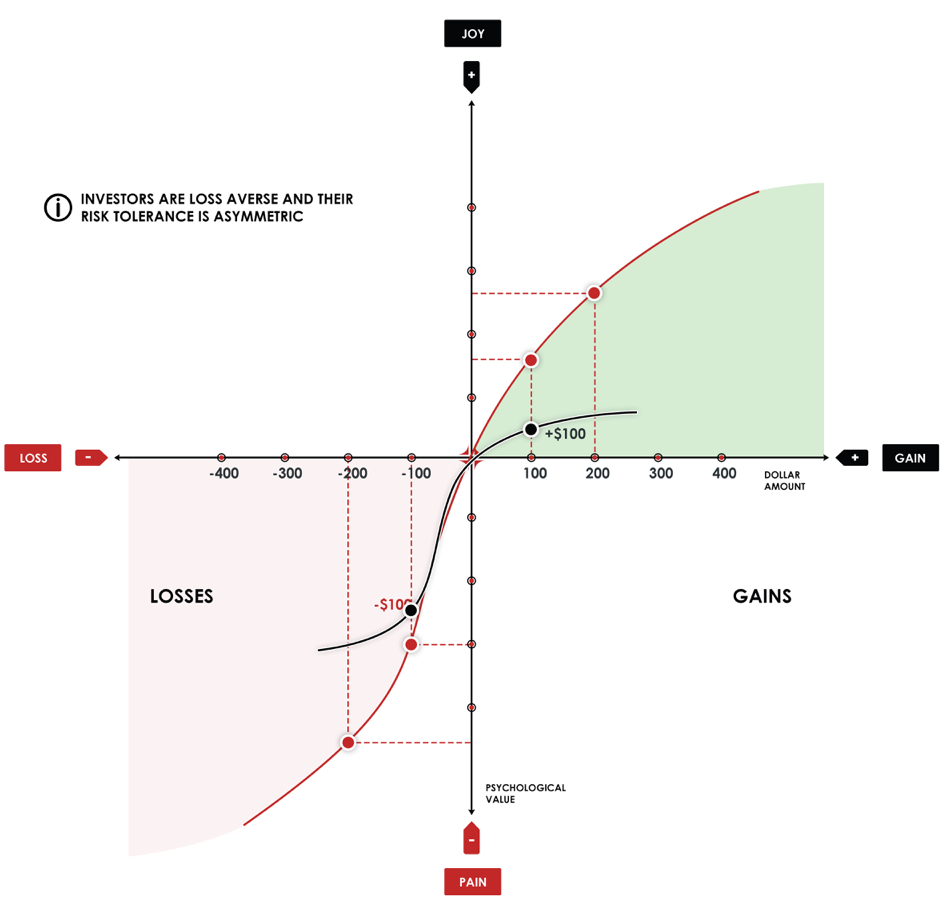

This isn’t speculation. It’s formalized in Prospect Theory, the Nobel Prize-winning framework developed by Daniel Kahneman and Amos Tversky that explains how people actually behave when real money is on the line.

The asymmetry is structural

Prospect Theory demonstrates investors are:

- Risk-averse when they’re winning

- Risk-seeking when they’re losing

- Far more sensitive to losses than to equivalent gains

This creates a non-linear value function centered around a reference point—usually “break-even.”

In markets, that behavioral asymmetry shows up as:

- Upside trends that persist longer than expected

- Downside moves that accelerate faster than models assume

- Volatility that clusters rather than distributes smoothly

Averages don’t explain that. Behavior does.

Where wealth gets destroyed

Here’s the problem most investors don’t see coming:

The gap between how portfolios are constructed and how humans actually behave under pressure is where wealth gets destroyed.

Not by market risk. By behavioral risk.

Modern Portfolio Theory assumes you’ll hold through any drawdown. Prospect Theory explains why you won’t—and why trying to force yourself to will likely make things worse.

Loss aversion intensifies as drawdowns deepen. Investors lock in gains too early when winning and hold losses too long trying to “get back to even.” The discipline you think you have evaporates precisely when you need it most.

That’s not a character flaw. It’s human wiring.

From behavior to process

Prospect Theory doesn’t predict what markets will do next. It explains how people react once markets move.

That distinction is critical.

At Shell Capital, we design systems around that reality:

- Downside risk is defined in advance, before loss aversion takes over

- Exits to limit losses are systematic, not emotional

- Upside is allowed to compound when trends persist

- Position sizing reflects asymmetry, not averages

We don’t optimize for theoretical means. We manage the path—how returns are experienced over time.

Because the path is what determines whether you stay invested or tap out.

The practical reality

You can’t behavior-modify your way out of loss aversion. You can only design around it.

Markets aren’t driven by averages—they’re driven by how humans perceive gains, losses, and risk under pressure.

Our systems are built to harness that asymmetry while protecting against the behavioral traps that destroy even well-intended investment plans.

That’s where disciplined risk management begins.

Does your portfolio account for behavioral risk?

At best, portfolios may be stress-tested for market scenarios—2008, COVID, rate shocks.

Almost none are stress-tested for the investor.

One of the many parts of ASYMMETRY® is a behavioral risk diagnostic that maps allocations against asymmetries that emerge under pressure:

- Where loss aversion is likely to override discipline

- Which positions create unintended behavioral exposure

- How your exit strategy (or lack of one) amplifies downside risk

- Whether your position sizing reflects asymmetry or just diversification

If you want to see how your portfolio holds up under behavioral stress, contact us and we’ll send you the framework and walk you through how we apply it to your current holdings.

—Mike Shell President & Chief Investment Officer Shell Capital Management, LLC

S&P 500 Dividend Yield Hits Multi-Decade Low: What It Means for Asymmetric Investors

This observation was originally published at Shell Capital’s ASYMMETRY® Observations.

The S&P 500 dividend yield has dropped to 1.25%, one of the lowest readings in more than two decades. That’s 31% below its long-term average of 1.81% and just a hair above its historical low of 1.12%. Read it here: The S&P 500 Dividend Yield Has Collapsed—Here’s Why It Matters for Asymmetric Risk/Reward and Asymmetric Returns

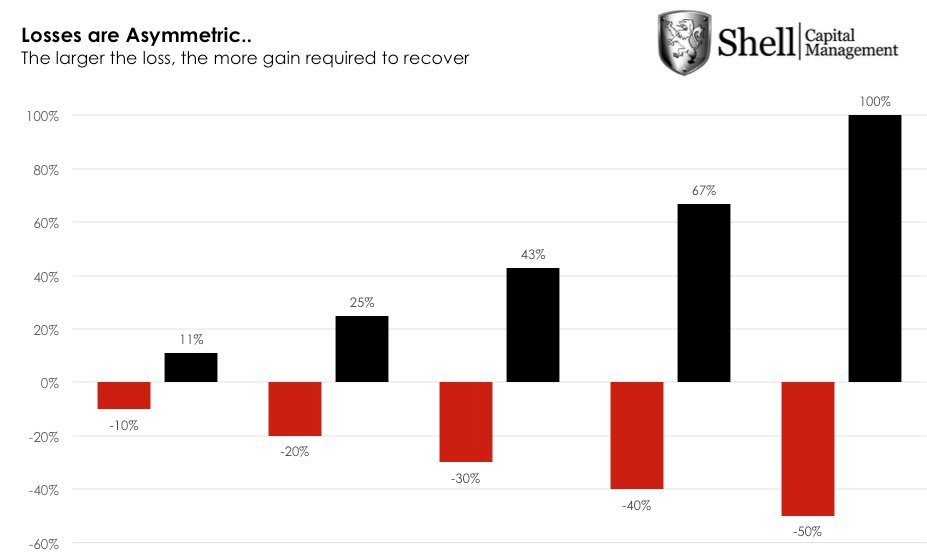

Drawdown Control is Essential for Compounding Efficiency

We pursue what we refer to as “drawdown control” through individual position risk management, portfolio heat limits, and portfolio hedging for risk mitigation.

Compounding efficiency isn’t about how much we make—it’s about how much we keep compounding.

Read about it: Drawdown Control is Essential for Compounding Efficiency

Investment Portfolio Drawdowns from Market Losses Work Geometrically Against You

Investment drawdowns from market losses work geometrically against you.

Losses don’t scale linearly—they scale exponentially in how they hurt compounding.

Read it here: Drawdowns from Market Losses Work Geometrically Against You

VIX Futures Still in Backwardation: What It Tells Us Now

VIX Futures Still in Backwardation: What This Shift Tells Us Now

The VIX futures curve continues to send a clear message: volatility remains elevated, and the market still expects it to fade—but not just yet.

Read it here: VIX Futures Still in Backwardation: What This Shift Tells Us Now

If the link doesn’t open from the email, click the title.

The Case for Limiting Drawdowns Through Active Risk Management and Hedging: The Math Behind Efficient Compounding

To compound capital efficiently over time, downside risk must be actively mitigated. The key to long-term wealth creation isn’t just capturing upside—it’s protecting capital through asymmetric risk/reward positioning and strict portfolio risk exposure limits.

Read it here: The Case for Limiting Drawdowns Through Active Risk Management and Hedging: The Math Behind Efficient Compounding

Market Breadth Collapse Intensifies: Monitoring for Countertrend Setups with Asymmetric Risk/Reward

The latest internal market data shows a broad collapse in demand and increase in selling pressure across all major S&P 500 sectors.

The percentage of stocks trading above key moving averages—from 5-day to 200-day—has declined sharply. While short-term trend damage is now widespread, we’re beginning to see conditions where countertrend setups with convexity potential may form.

It’s a signal to prepare for an eventual countertrend.

Read it here: Market Breadth Collapse Intensifies: Monitoring for Countertrend Setups with Asymmetric Risk/Reward

Asymmetry in Sector Dispersion: Q1 2025 U.S. Sector Dashboard Insights

Sector dispersion is a gift to the asymmetric investor. When sectors diverge this sharply in trend, volatility, and valuation, the environment rewards those who are willing to rotate tactically and structure trades to capture exponential upside while controlling downside risk. We may use this data to identify setups with capped downside and high upside optionality—hallmarks of true asymmetry.

Read about it here: Asymmetry in Sector Dispersion: Q1 2025 U.S. Sector Dashboard Insights

The Illusion of Asymmetry in Options-Based Buffered, Overlay, and Defined Outcome ETFs

Asymmetry in Action: Sector Dispersion Widens in March 2025 Industry Dashboard

When industry performance disperses this widely, the opportunity for asymmetric positioning multiplies. Whether through long/short pairs, structured options, or sector rotation with predefined exits, we may use this dashboard data to seek positive asymmetry—capping downside while preserving exponential upside. At Shell Capital, this is the edge we pursue in dynamic markets.

Read it here: Asymmetry in Action: Sector Dispersion Widens in March 2025 Industry Dashboard

Asymmetric Insights from the March 2025 Dispersion, Volatility, and Correlation Report

How Flow and Positioning Data Can Reveal Asymmetric Opportunities

Asymmetry in Equal Weight Sectors

The Volatility Mullet!

You wouldn’t know it from watching the VIX index alone, but something interesting is happening beneath the surface. The VIX futures curve — the structure that really drives volatility-linked products like VXX, VIXY, and UVXY — is showing signs of indecision. Here’s what it means for asymmetric hedging.

Read it here: The Volatility Mullet: What the VIX Curve Is Quietly Telling Us Today

The Stock Market Risk/Reward Asymmetry Has Shifted

The stock market is a constant battle between buying pressure and selling pressure, and recently, that battle has shifted in a meaningful way. After a strong rally earlier in the year, we’ve now seen a notable change in the risk/reward asymmetry. Markets don’t move in a straight line, and shifts in trend strength often signal the potential for new opportunities—or new risks. Read more: The Stock Market Risk/Reward Asymmetry Has Shifted

Ray Dalio and Elon Musk Are Right About U.S. Debt—And Here’s Why

Ray Dalio and Elon Musk see the U.S. debt problem for what it is: an unsustainable ticking time bomb.They aren’t just speculating—they’re using decades of experience in finance, economics, and business to sound the alarm.And when two of the sharpest minds in their fields are saying the same thing, it’s time to connect the dots.

Read it here: Ray Dalio and Elon Musk Are Right—And Here’s Why

On Bubble Watch: A Critical Look at Market Cycles for Asymmetric Investing and Trading

Howard Marks has a unique ability to distill complex market dynamics into clear, actionable insights, and his latest memo, “On Bubble Watch,” is no exception. It’s a powerful reminder of the importance of recognizing the telltale signs of a market bubble, the psychology driving it, and the necessary caution that comes with it.

Read it: On Bubble Watch: A Critical Look at Market Cycles for Asymmetric Investing and Trading

Are Credit Spreads Signaling Asymmetric Risk?

The ICE BofA US High Yield Index Option-Adjusted Spread (OAS) is a key measure of risk sentiment in the credit markets. Historically, extreme levels in credit spreads have preceded major shifts in market conditions, often serving as a leading indicator for broader financial stress or recovery.

Today, as we find ourselves in one of the tightest credit spread environments in decades, it’s worth asking: Are investors underpricing risk, and does it present an asymmetric opportunity?

Find out here: Are Credit Spreads Signaling Asymmetric Risk?

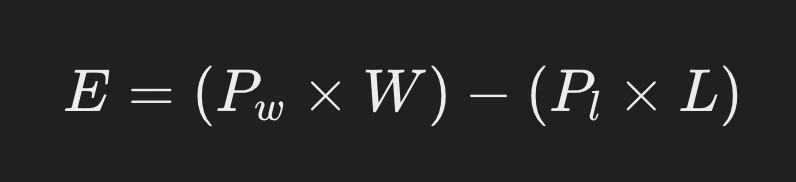

How Do You Know a Investing and Trading Strategy is Asymmetric and Robust Long Term?

For more than two decades, I’ve required a mathematical basis to maintain confidence in my decisions, especially during challenging periods inherent in every investment or trading strategy.

Read it at A Mathematical Basis for Believing in Asymmetric Trading Systems

The Stock Market is at an Inflection Point

See the observation here: The Trend Remains Up for the Stock Market, But Risk is Increasing as the Trend is Weakening

Asymmetric Risk/Reward is More Than Just Buying Undervalued Stocks

Many investors believe they are pursuing asymmetric opportunities when they buy stocks they think are undervalued or have more upside than downside.

But true asymmetry isn’t just about perceived valuation gaps—it’s about structuring risk in a way that limits the downside while allowing for uncapped or asymmetric upside.

The reality is, just buying a stock you think is undervalued doesn’t create asymmetry.

It may offer potential upside, but if there’s no predefined risk management, the downside remains open-ended.

Asymmetry isn’t about hoping you’re right—it’s about ensuring that even if you’re wrong, the damage is controlled, and if you’re right, the reward is exponentially greater.

The Flawed Assumption of “Undervalued” Stocks

Many investors assume they have an asymmetric opportunity when they buy a stock trading below what they believe to be its intrinsic value.

The thinking goes:

- The downside is “limited” because the stock is already cheap.

- The upside is large because the market will eventually recognize its value.

The problem?

Cheap stocks can get cheaper, and markets don’t always correct “mispricings” in a timely manner—if ever.

Many deep-value stocks stay undervalued for years, and some go to zero.

Buying something just because it “should” go up does nothing to limit risk.

True Asymmetry Requires Predefined Risk Management

A true asymmetric investment isn’t just about identifying opportunities with more upside than downside—it’s about structuring the position to ensure a capped downside and disproportionate upside.

There are several ways we do this:

- Options Strategies: Buying call options allows for defined risk (the premium paid) with unlimited upside potential. Likewise, strategies like risk reversals or spreads can enhance asymmetry.

- Stop-Losses & Exit Strategies: Setting a predefined exit point ensures the downside is controlled rather than open-ended.

- Hedging & Position Sizing: Using hedges or maintaining proper position sizing ensures that no single position can derail a portfolio.

The Key Difference: Hope vs. Structure

The key distinction is that just buying something undervalued is based on hope, while structuring asymmetric trades is about controlling risk.

Hope is not a strategy—a predefined downside is.

If you enter a trade where:

1. Downside is capped (through predefined exits or contractual limits like options).

2. Upside is uncapped or exponentially larger (through compounding, leverage, or event-driven catalysts).

3. The approach is repeatable (not relying on luck but a systematic framework).

Then you are truly executing an asymmetric strategy.

But the process of creating asymmetric investment returns doesn’t stop there; it continues at the portfolio level.

Conclusion: Asymmetry Is Intentional, Not Accidental

Simply believing a stock has more upside than downside does not create asymmetric risk/reward—it’s just a market opinion. Asymmetry must be structured in advance, not assumed after the fact.

For investors who seek true asymmetric payoffs, the focus shouldn’t just be on finding “cheap” stocks but on structuring trades where the worst-case scenario is predefined and limited while the best-case scenario remains disproportionately large.

That’s the difference between hoping for a high return and engineering an asymmetric edge like we do.

The Technology Sector Gets More Oversold

Click to read: The Technology Sector Gets More Oversold

Stock Market Sentiment Has Reached an Extreme

Mike Shell shares his latest: Stock Market Sentiment Has Reached an Extreme

Shell Capital Management, LLC, is Celebrating its Twentieth Anniversary as a Registered Investment adviser!

Click here to read this post.

When Volatility Gets Asymmetric

Realized volatility has reached an extreme low.

See the implications at Volatility Expansions Eventually Follow Periods of Low Volatility.

From an investor sentiment perspective, is this what 2017 felt like? (before the crash in 2018)

Someone asked, “From a sentiment perspective, is this what 2017 felt like?”

My observation:

VIX as a Companion for Hedge Fund Portfolios

Volatility in general, and VIX in particular, is widely thought to influence hedge fund returns. This article shows that not only is VIX negatively correlated to hedge fund returns, the correlation profile is asymmetric with the correlation being more negative in negative months for hedge funds. When hedge funds are delivering the worst quartile returns, the diversification benefit is best. Equally interestingly, when the diversification or protection is least needed, i.e. in highest quartile months, the correlation is positive. It is explored whether a small allocation to VIX can be constructively used for risk reduction or downside protection in broad based hedge fund portfolios. Standard mean variance measures suggest a static allocation of 0% to 10%, which is consistent with the common sense approach of allocation only a very small portion of the portfolio to volatility. This range, together with the mean reverting property of VIX, and the asymmetric correlation of VIX and hedge fund returns is used to explore a tactical allocation strategy that outperforms a simple static allocation of VIX or a portfolio with no VIX allocation on a risk adjusted basis, while reducing downside risks.

Read: VIX as a Companion for Hedge Fund Portfolios

Here’s What the Federal Reserve is Most Likely to do at Future FOMC Meetings

Asymmetry isn’t just about asymmetric risk/reward for asymmetric investment returns, it’s also the probability of one outcome over another when it’s skewed.

I share my latest observation of the Federal Reserve FOMC decision yesterday in the FOMC Meeting Review: Likely the Last Interest Rate Hike.

US Dollar and Gold Trend

See this observation here: US Dollar is in a Downtrend but Statistically Oversold Short-Term as Gold Turns Up

Lower Odds of a US Recession

See the note:

Using Volatility for Asymmetric Risk Reward

Volatility trading may be used for asymmetric risk/reward when the odds are in our favor.

That’s the proposition of:

When Trend Analysis and Options Positioning Collide

This observation was originally published at This is Where Trend Analysis and Options Positioning Gets Interesting

Up until now, the trend S&P 500 index has failed to break above the 4200 level.

I highlighted 4200 in yellow on the chart to point out the SPX has trended around 4200 several times over the last two years, but until this week, these higher levels were met with selling pressure. The selling pressure was enough to provide overhead resistance, selling pressure not allowing the index to move to a higher high.

Such resistance is caused by investors and traders who may have been trapped at lower prices after adding exposure around this level.

Once the index gets back to the level it tapped multiple times, those who wished they’d sold sooner (before the down-trends below 4200) sell to break even.

But that’s just one example of the thinking behind the concept of resistance from selling pressure preventing a new high breakout.

Another resistance has been a large wall of call options.

A Call Wall is the strike with the largest net call option gamma. Market maker (dealer) positioning can create some of the biggest resistance levels and holds a lot of the time when a Call Wall defines the upper boundary of the probable range.

Below is a recent example. The grey bars are a lot of call options on the SPX.

We expect the price to slow down as it reaches the Call Wall level, but it sometimes trends above it, then drifts back below within a few days. So, it takes more than a few days to confirm the wall of calls has increased to a higher level.

No market analysis is ever perfect.

It’s always probabilistic, never a sure thing.

Call Walls can have a sticky gamma effect, making it difficult for the price to break out. When market makers are long gamma, it accelerates their directional exposure favorably as the size of their positions dynamically increases when they are positioned in the right direction creating an open profit. When these designated market makers have a large profit from being positioned on the correct side of the trend, they can sell some of the underlying positions (like SPX) to get their directional exposure closer to neutral and realize a profit. That’s why market makers trade in the opposite direction of the underlying (like SPX) when they are positive gamma, and this suppresses volatility and creates a pin.

So, up until now, the large Call Wall at 4200 was hard to break out of because there are so many calls the dealers were hedging and/or taking profits as the level was reached.

This form of derivatives resistance matched up with the aforementioned technical trend resistance can create a formidable overhead supply of sellers.

The selling pressure has been enough to mute the SPX, for now.

But, looking at the SPX today, up 1.5% to 4286 as of the time of this writing, the index is pushing up and may be enough to clear out all this overhang.

What could go wrong?

There is no shortage of negative macro risks, but that’s beyond the scope of this technical observation.

Next week, the SPX will see another big test with a large number of calls set to expire.

Interestingly, today I noticed a very bullish flow into VIX options betting on a volatility expansion with VIX down to 14.80 for the first time since 2021.

Meanwhile, the VIX term structure is 11% contango between July and June, so ETFs like VXX are rolling from 16.8 to 18.7 (aka selling low, buying high) which is a headwind even if VIX spikes.

So, the stock market index is trending up and trying to print higher highs and higher lows, and implied (expected) volatility is contracting.

Can the S&P 500 gain enough momentum to keep trending up?

One way to view the directional trend is the price channel the stock index is creating. with higher lows and higher highs.

I see this and wonder if the SPX will reach the 4400 level it’s trending toward.

To see if it has enough momentum left to move up that far, I look at recent velocity.

Its relative strength suggests it could move up enough to tap the 4300 level before it starts to get overbought, but then it will be overbought.

So, 4400 may be a resistance without a flat base or ~5% correction.

Only time will tell if the Call Wall, expirations, and long-vol positioning today has more impact or if there’s enough momentum to drive it higher, but we’ll be watching to see how it all unfolds.

Mike Shell is the founder and Chief Investment Officer of Shell Capital Management, LLC, and the portfolio manager of ASYMMETRY® Managed Portfolios. Mike Shell and Shell Capital Management, LLC is a registered investment advisor focused on asymmetric risk-reward and absolute return strategies and provides investment advice and portfolio management only to clients with a signed and executed investment management agreement. The observations shared on this website are for general information only and should not be construed as investment advice to buy or sell any security. This information does not suggest in any way that any graph, chart, or formula offered can solely guide an investor as to which securities to buy or sell, or when to buy or sell them. Securities reflected are not intended to represent any client holdings or recommendations made by the firm. In the event any past specific recommendations are referred to inadvertently, a list of all recommendations made by the company within at least the prior one-year period may be furnished upon request. It should not be assumed that recommendations made in the future will be profitable or will equal the performance of the securities on the list. Any opinions expressed may change as subsequent conditions change. Please do not make any investment decisions based on such information, as it is not advice and is subject to change without notice. Investing involves risk, including the potential loss of principal an investor must be willing to bear. Past performance is no guarantee of future results. All information and data are deemed reliable but are not guaranteed and should be independently verified. The presence of this website on the Internet shall in no direct or indirect way raise an implication that Shell Capital Management, LLC is offering to sell or soliciting to sell advisory services to residents of any state in which the firm is not registered as an investment advisor. The views and opinions expressed in ASYMMETRY® Observations and Asymmetric Investment Returns are those of the authors and do not necessarily reflect the position of Shell Capital Management, LLC. The use of this website is subject to its terms and conditions.

Bridgewater Co-CIO: The Market is Very Asymmetric Right Now

Bridgewater Associates, Inc.Co-CIO Karen Karniol-Tambour joins Positive Sum CEO Patrick O’Shaughnessy at the 2023 Sohn Investment Conference. Below is the interview she says the market is very asymmetric right now because of the asymmetry between the upside vs. the downside, and I agree.

I’ll summarize:

If the economy enters a recession, it’s very bad for stocks, and this time the Fed is unlikely to immediately respond by lowering rates since inflation is a problem. So, the downside risk is large. It’s already priced-in to the stock market, so it won’t be a big surprise. Not a lot of upside potential.

If the economy doesn’t enter a recession, the Fed will be in a tough decision point, because inflation is unlikely to come down without a recession. If the Fed doesn’t ease like it’s already price-in, the market is going to be disappointed.

It’s asymmetric because the downside potential is greater than the upside.

The interview:

Patrick O’Shaughnessy:

What do you think that prevailing valuations, let’s say, just on like the big asset classes tell us about what the market thinks is going on? Like, what does it seem like is in prices right now, if you will, as you look at S&P 500 you know, multiples or something very basic like that?

Bridgewater Co-CIO Karen Karniol-Tambour:

WellI think the stock market is telling you that there’s going to be a modest economic slowdown, a pretty contained economic slowdown, nothing like you know a significant recession or anything like that, With that slowdown alone, the Federal Reserve is going to find that sufficient to go ease from you know, 5% to 3% extremely quickly, and that its going to do that despite where inflation is today because inflation is going to go back to totally reasonable levels that they want very very quickly. You see that kind of across stock and bond pricing you know bond pricing is telling you in places to be fine we’re not there’s no inflation from anything like resembling long term and the Fed’s about to ease pretty significantly without a significant slowdown.

Where that sort of leaves you is if the market I believe is asymmetric it’s very asymmetric because it you actually get an economic slowdown; that’s obviously very bad for stocks. I don’t have to tell you that that would be you know pretty bad for stocks. But there’s really not much of a recession priced into them it would be pretty bad. Usually the way you get out of that (as I was saying) is that every time there’s a slowdown the Central Bank just comes and eases right away. Now, not only will it be much harder for them to ease because inflation’s been more a problem. Tension is there, but that easing is already priced in and so even if they do kind of bite the bullet and say “I’m not going to worry about inflation” and ease, it’s already in the market prices it’s not going to surprise the market so much.

Then, on the other hand, if the market doesn’t slow, if the economy doesn’t slow so much, if we don’t get that kind of recession if the equity prices are right that you’re not going to get a big recession and the fed’s going to be a tough spot because I don’t really see why inflation’s going to come down with no recession. You have a very very strong labor market if nothing slows and so if they don’t ease like it’s already price they’re going to be disappointing. So, every day once we hit summer the Federal Reserve doesn’t pivot and ease that’s effectively a tightening relative to what’s priced in that’s also disappointing.

That’s a lot of room for disappointment that can happen whether the economy is strong or weak.

Patrick O’Shaughnessy:

That’s all sort of like what I’ll call you know relatively near to intermediate term future how do you think about portfolio positioning in light of that general view when you know like you for a long time it’s paid to just be long risk and have a very simple portfolio because of everything you’ve discussed. How’s that different today like how would you how do you think about positioning against this asymmetric setup that you described

Karen Karniol-Tambour:

I think it’s one of the toughest times to be an investor in many years because you know as you’re saying risk assets has been so good and I think risk assets are about as unattractive as we’ve seen a very long time and they’ve and that’s we’re seeing that come to fruition they don’t just bounce back you don’t just get kind of automatic rallies no matter what so it’s a hard time to be an investor I think as an investor you have to think about diversification in a different way diversification just wasn’t that important because the one asset people hold “equities” was just the strongest outperformer and the different places investors can kind of look they can look at geographically so they can look at geographies that have less of this tension places like Japan or China where you’re in a different situation you’re not about to hit a big Central Bank tension Japanese Central Bankers are pretty excited about getting higher inflation they’ve won for a long time and it’s far from, you know, out of control.

She basically suggests U.S. stocks are overrated and Japan stocks, Emerging Markets stocks, and Gold, are underrated.

Is the Market Telling Us How to Invest Our Money for Asymmetric Investment Returns?

My latest observation:

The Market Telling Us How to Invest Our Money for Asymmetric Investment Returns

A Market Wizard on Waiting for Asymmetric Risk/Reward

“Although the cheetah is the fastest animal in the world and can catch any animal on the plains, it will wait until it is absolutely sure it can catch its prey. It may hide in the bush for a week, waiting for just the right moment.

It will wait for a baby antelope, and not just any baby antelope, but preferably one that is also sick or lame; only then, when there is no chance it can lose its prey, does it attack.

That, to me, is the epitome of professional trading.

When I trade at home, I often watch the sparrows in my garden.

When I feed them bread, they take just a little piece at a time and fly away. They keep on flying back and forth, taking small bits of bread. They may have to make a hundred stabs at a piece of bread to get what a pigeon gets at one time, but that is why a pigeon is a pigeon.

You will never be able to shoot a sparrow, it is just too fast.

That is the way I day trade.

For example, there are times during the day when I am sure that the S&P is going up, but I don’t try to pick the bottom, and I am out before it tops. I just take the mid-range where the momentum is greatest.

That, to me, is trading like a sparrow eats.

– Mark Weinstein in Schwager, Jack D.. Market Wizards, Updated: Interviews With Top Traders (p. 329). Wiley.

The market climbs a wall of worry

I Know You Want a Good Story, But Here’s the Deal on the Stock Market

That was my first idea, and “Whipsaws are Common in Bear Markets” was my third pick for the title of my latest observation, published on our main website, which you can read here: When the trends change direction, I change my direction; what do you do?

I may be indecisive about semantics, but I’m always clear about the numbers.

The U.S. Stock Market Resumes its Trend

Linear Regression Suggests Interest Rates Have Entered a New Higher Regime

In statistics, linear regression is a linear approach for modeling the relationship between variables.

Linear regression analyzes two separate variables in order to define a single relationship.

When we apply linear regression to capital market trends we are looking at price and time.

You must be logged in to post a comment.