See the note:

Category Archives: Global Macro

Inflation is Declining According to this Trend Analysis of Commodities

In economics, inflation is an increase in the prices of goods and services in an economy.

When the general price level rises, each unit of currency buys fewer goods and services; consequently, inflation corresponds to a reduction in the purchasing power of money.

You may not see the value of your money change online like you do with your investment fund values changing daily, but it’s changing.

Inflation is a real risk for everyone, but it’s worse for people who have their money earning a low rate of interest at a bank or another low-yield fixed asset.

If someone believes they are being a “conservative investor” by investing money in an interest-bearing bank account, it’s only because the bank statement doesn’t show the real value of money after inflation.

The latest inflation report shows U.S. Inflation is 9%, three times higher than the long-term average of 3.25%, so if someone is only earning 3% on a CD, the value of their money is 6% less than it was.

That is, they “lost” 6% of buying power.

But that’s not the main point of this observation, it’s just one of many reasons the trend in prices is important.

The US Inflation Rate is the percentage a chosen basket of goods and services purchased in the US increases in price over a year. Inflation is one of the metrics used by the US Federal Reserve to gauge the health of the economy. Since 2012, the Federal Reserve has targeted a 2% inflation rate for the US economy and may make changes to monetary policy if inflation is not within that range. A notable time for inflation was the early 1980’s during the recession. Inflation rates went as high as 14.93%, causing the Federal Reserve led by Paul Volcker to take dramatic actions.

As an investment manager applying trend systems to global markets, I see it much more granular. I’m applying computerized trend systems to a wide range of global currencies, commodities, stocks, and bond markets, so I see the directional trend changes and shifts in momentum. Although I’ve automated the process of monitoring all these global markets, I still like to review the pictures as charts to see what is going on.

I ranked the S&P GSCI Indices by short-term momentum to see which are trending up the most, so we’ll start there.

I think it’s well known that many commodities markets had been trending up this year, but as we’ll see, many of these markets are now in downtrends.

I’ll share these trends in a way that makes it obvious that commodities aren’t just tradable markets, but they impact all of us, and commodities are interconnected. For example, the price of soybeans impacts livestock.

The S&P GSCI Feeder Cattle Index provides investors with a reliable and publicly available benchmark for investment performance in the feeder cattle market. S&P GSCI Feeder Cattle Index is in an uptrend as defined by above the 50 and 200-day moving averages. In fact, in the lower two frames, I include the percent above or below the 50 and 200-day average, and Feeder Cattle is about 5% above its 50-day average and 8% above its 200-day average price.

Feeder Cattle is the strongest uptrend over the past three months. It only gets worse from here.

S&P GSCI All Cattle Index is a broader basket of cattle, and it too is in an uptrend after breaking out of a multi-month base.

Live Cattle represented by S&P GSCI Live Cattle Index looks very similar, and is an uptrend, but not an all-time new high as it’s still below the February high.

Here’s where the weakness in these commodities trends begins. The S&P GSCI Gas Oil Index is in an intermediate-term uptrend; It’s 20% above the 200-day average. But the recent decline pushed it 6% below the 50-day average. The Gas & Oil index is in a primary uptrend, but short-term pullback. Longer-term trends begin with a shorter-term trend, so we’ll see how it trends from here.

Heating oil is represented by the S&P GSCI Heating Oil Index. Like gas and oil, it’s in a primary uptrend, but a short-term downtrend.

Now we’re getting into commodities with a negative price momentum over the past 3 months.

S&P GSCI Sugar Index is in a non-trending, volatile period over the past year, and it’s right at the 50 and 200-day average.

The S&P GSCI Livestock Index, a sub-index of the S&P GSCI, provides investors with a reliable and publicly available benchmark for investment performance in the livestock commodity market. Livestock is another market that’s lost its upward momentum over the past three months, and one to watch for a breakout.

S&P GSCI Natural Gas Index is in a primary uptrend, but recent downtrend in the short term. It tapped its 200-day average and is trending back up, but nearly 7% below where it was three months ago.

I ranked these trends by three-month momentum, so all of the commodities up to this point were outperforming the broad commodity index we know as S&P GSCI Total Return Index. My three-month momentum ranking is completely arbitrary, but it signaled many of these trends had changed recently.

The S&P GSCI Total Return Index is in a primary uptrend as defined by a level above its 200-day average, but it’s in a downtrend since it peaked in June.

S&P GSCI Total Return Index is what many global macro asset managers managing global macro hedge funds use as a benchmark for commodities, so the rest of these trends are more granular looking inside this broader index made up of these other indices.

S&P GSCI Energy Index is in a primary uptrend but has declined materially over the past month.

S&P GSCI Unleaded Gasoline Index is a big one that impacts Americans and our personal economy. S&P GSCI Unleaded Gasoline Index is in a primary uptrend but has corrected a lot these past five weeks. Once again, we see a commodity trend tapping the 200-day moving average, so a breakout below it will signal a changing primary trend.

Coffee is in a downtrend. S&P GSCI Coffee Index is below the 50 and 200 average, signaling it’s in both a short-term and intermediate-term downtrend. This may help explain why Latin American countries like Brazil’s stock index is down, too. Latin America makes a lot of the world’s coffee.

Unless you’re a long/short commodity trader like a CTA trend follower who aims to capitalize on these downtrends as much as the uptrends, this is one of the rare times downtrends are something to cheer on.

S&P GSCI Crude Oil Index is in a short-term downtrend, but a primary uptrend.

Meanwhile, S&P GSCI Cocoa Index is in a downtrend across both time frames.

Hey Crude, as in Brent Crude. We have a downtrend in S&P GSCI Brent Crude Index over the short run after a volatile non-trending period.

An interesting Intermarket analysis this year has been the trend in Gold. Gold is seen by many market participants as a store of value and a safe haven, but S&P GSCI Gold Index is in a downtrend after a sharp uptrend around March. You can probably see how applying multiple time frames can be useful in observing these trends.

By and large, the metals like precision metals are in downtrends.

S&P GSCI Platinum Index is in a downtrend.

Soft commodities, or softs, are commodities such as coffee, cocoa, sugar, corn, wheat, soybean, fruit and livestock. The term generally refers to commodities that are grown, rather than mined. You can see how some of the commodity markets tracked by indices are very granular focused on one single market trend, and others are a basket of commodities within a sector.

S&P GSCI Softs Index has shifted from a quiet uptrend to a volatile downtrend.

A biofuel is any fuel that is derived from biomass, that is, plant or algae material or animal waste.

After an uptrend breakout around March, S&P GSCI Biofuel Index has trended back to the same level it started.

Some of the most common products produced with soybeans are tofu, soy milk, soy sauce, and soy flour. Approximately 85% of soybeans grown around the world are used to make vegetable oils that are either sold to consumers or used commercially according to The Spruce Eats. The USDA says “Just over 70 percent of the soybeans grown in the United States are used for animal feed, with poultry being the number one livestock sector consuming soybeans, followed by hogs, dairy, beef and aquaculture.”

You can probably see how interconnected all this stuff is.

S&P GSCI Soybeans Index is in a downtrend after an uptrend started at the beginning of this year. Hopefully, this lower animal feed cost will help lower the prices of the livestock that are in uptrends.

Lead is still widely used for car batteries, pigments, ammunition, cable sheathing, weights for lifting, weight belts for diving, lead crystal glass, radiation protection and in some solders, according to RSC.org.

S&P GSCI Lead Index is in a downtrend, so I guess we’ll eventually see the price of ammo and car batteries decline, too. Overall, lead has been a non-trending volatile market the past year, but it’s now more decisively in a dowtrend.

Lean Hog is a type of hog (pork) futures contract that can be used to hedge and to speculate on pork prices.

S&P GSCI Lean Hogs Index has trended into a downtrend, so your bacon price may improve.

Palladium is one of a number of metals starting to be used in the fuel cells to power things like cars and buses as well as in jewelry and in dental fillings and crowns.

S&P GSCI Palladium Index is in a downtrend.

Grains are used around the world and are also called cereals, and are the most important staple food. According to NatGeo, humans get an average of 48 percent of their calories, or food energy, from grains. Grains are also used to feed livestock and to manufacture some cooking oils, fuels, cosmetics, and alcohols.

S&P GSCI Grains Index is in a downtrend after it broke up with momentum going into this year. If you like to eat and drink alcohol, this is great news as it seems the prices should drift back to where they were.

Wheat is used for white bread, pastries, pasta, and pizza, so this downtrend in S&P GSCI Wheat Index is a welcome change.

Dr. Copper is market lingo for the base metal that is reputed to have a “Ph. D. in economics” because of its ability to predict turning points in the global economy.

S&P GSCI Copper Index is in a strong downtrend, so if its reputation holds true, the Ph. D. in economics suggests a global economic slowdown is ahead.

The Royal Society of Chemistry says aluminum is used in a huge variety of products including cans, foils, kitchen utensils, window frames, beer kegs and airplane parts.

If the trend in S&P GSCI Aluminum Index is a guide, the price of your next beer keg or airplane should drift lower. Aluminum is in a downtrend.

Industrial Metal alloys are known for their strength, durability, and corrosion resistance, so engineers, architects, and others in the industrial field use these alloys to construct buildings, wires, pipes, bridges, machines, and much more according to Wieland.

S&P GSCI Industrial Metals Index shows industrial metals are in a downtrend with great momentum.

Industrial metals are down so much I’ll show a two-year chart to see the price is back to 2020 levels.

Last but not least is cotton. I think we all know what cotton is used for. The price of clothes should see some decline with S&P GSCI Cotton Index in such a downtrend.

What we’ve observed is many commodity markets were in uptrends, but have more recently trended down. Not all of these necessarily impact the Consumer Price Index, but we certainly use most if not all of them one way or another.

Commodities are real “stuff”, and the prices of much of this stuff are no longer as elevated as it was. If this flows into lowering prices of the stuff we buy, then we’ll see inflation fall from here.

If inflation trends down from here, it’ll be positive for stocks and bonds and may result in the Federal Reserve pausing its aggressive interest rate hikes.

Now you know why we aren’t long commodities at this point.

Investor sentiment (about stocks) is so negative right now, that any slight improvement in inflation may spark an uptrend, then the extremely bearish positioning may drive short covering to keep the trend going a while.

Let’s see how it all unfolds.

Mike Shell is the Founder and Chief Investment Officer of Shell Capital Management, LLC, and the portfolio manager of ASYMMETRY® Managed Portfolios. Mike Shell and Shell Capital Management, LLC is a registered investment advisor focused on asymmetric risk-reward and absolute return strategies and provides investment advice and portfolio management only to clients with a signed and executed investment management agreement. The observations shared on this website are for general information only and should not be construed as investment advice to buy or sell any security. This information does not suggest in any way that any graph, chart, or formula offered can solely guide an investor as to which securities to buy or sell, or when to buy or sell them. Securities reflected are not intended to represent any client holdings or recommendations made by the firm. In the event any past specific recommendations are referred to inadvertently, a list of all recommendations made by the company within at least the prior one-year period may be furnished upon request. It should not be assumed that recommendations made in the future will be profitable or will equal the performance of the securities on the list. Any opinions expressed may change as subsequent conditions change. Please do not make any investment decisions based on such information, as it is not advice and is subject to change without notice. Investing involves risk, including the potential loss of principal an investor must be willing to bear. Past performance is no guarantee of future results. All information and data are deemed reliable but are not guaranteed and should be independently verified. The presence of this website on the Internet shall in no direct or indirect way raise an implication that Shell Capital Management, LLC is offering to sell or soliciting to sell advisory services to residents of any state in which the firm is not registered as an investment advisor. The views and opinions expressed in ASYMMETRY® Observations are those of the authors and do not necessarily reflect the position of Shell Capital Management, LLC. The use of this website is subject to its terms and conditions.

Bear Markets with an Economic Recession Last Longer and are More Severe

Bear markets that occur in economic recessions last longer and are more severe than bear markets without an economic recession.

The non-recession bears are clustered in the upper left quadrant (lower decline, recovered sooner) and the big bear markets with recession are red dots.

Source: NDR

Mike Shell is the Founder and Chief Investment Officer of Shell Capital Management, LLC, and the portfolio manager of ASYMMETRY® Managed Portfolios. Mike Shell and Shell Capital Management, LLC is a registered investment advisor focused on asymmetric risk-reward and absolute return strategies and provides investment advice and portfolio management only to clients with a signed and executed investment management agreement. The observations shared on this website are for general information only and should not be construed as investment advice to buy or sell any security. This information does not suggest in any way that any graph, chart, or formula offered can solely guide an investor as to which securities to buy or sell, or when to buy or sell them. Securities reflected are not intended to represent any client holdings or recommendations made by the firm. In the event any past specific recommendations are referred to inadvertently, a list of all recommendations made by the company within at least the prior one-year period may be furnished upon request. It should not be assumed that recommendations made in the future will be profitable or will equal the performance of the securities on the list. Any opinions expressed may change as subsequent conditions change. Please do not make any investment decisions based on such information, as it is not advice and is subject to change without notice. Investing involves risk, including the potential loss of principal an investor must be willing to bear. Past performance is no guarantee of future results. All information and data are deemed reliable but are not guaranteed and should be independently verified. The presence of this website on the Internet shall in no direct or indirect way raise an implication that Shell Capital Management, LLC is offering to sell or soliciting to sell advisory services to residents of any state in which the firm is not registered as an investment advisor. The views and opinions expressed in ASYMMETRY® Observations are those of the authors and do not necessarily reflect the position of Shell Capital Management, LLC. The use of this website is subject to its terms and conditions.

Fundamental Valuation: Is the Stock Market Cheap or Expensive?

For me, and everyone else even if they don’t realize it, the price trend is the final arbiter.

For more than two decades, I’ve focused my efforts on developing systems to identify trends early in their stage to capitalize on trends as they continue and exit a trend if it reverses.

It all started in business school, where I earned a Bachelor of Applied Science degree in advanced accounting. It was “advanced” because I took the extra advanced classes above a typical accounting major required to sit for the CPA exam in Tennessee. It basically results in a master’s in accounting, but not really, but it’s just the same 150 credit hours.

I rarely speak of my formal college simply because I haven’t considered it a source of edge for investment management.

But maybe it has.

In some conversations recently, people have asked about my background and how I got started as an investment manager and founder of an investment firm. After further review, I’ve come to realize the knowledge I have of financial statements, and the vast details and fundamental information that make them up, is what drove me to observe very little of it really drives the market price in an auction market.

That’s something I’ve always believed, but it occurred to me during business school.

To be succinct; I very quickly discovered undervalued stocks are trading at a cheap multiple of earnings for a reason, and that’s more likely to continue than to reverse.

I didn’t have a lot of capital to play with, and it was hard earned capital. I worked as a Sheriffs’ Officer full time through college fully time, so it took me a few extra years to complete. I wasn’t about to lose too much of what I had in the stock market, so I aimed to cut my losses short early on.

I’ve focused on cutting my losses short ever since, so now I have about 25 years experience as a tactical trader with an emphasis on the one thing I believe I can best limit or control; the downside of my losers.

When I focus on limiting the downside of loss, I am left to enjoy the upside of gains.

But we can’t do that with fundamentals and valuation. Risk can only be directed, limited, managed, and controlled, by focusing on the price trend.

The price trend is more likely to continue than to reverse, as evidenced even by vast academic studies of momentum.

Because a price trend is more likely to continue than to reverse, it’s essential to realize if you attempt to buy stocks that are in downtrends, you’ll likely experience more downtrend.

So, buying what you perceive are “undervalued” stocks is like catching a falling knife they say.

I’d rather wait for the knife to fall, stab the ground or someone’s foot, then pick it up safely.

Knives a dangerous, and up close, even more dangerous than a gun, so govern yourself accordingly.

Nevertheless, the valuation of stocks and overall valuation of the market by and large can be useful to observe at the extremes in valuation.

The chart below tells the story based on Morningstar’s fair value estimates for individual stocks.

The chart shows the ratio price to fair value for the median stock in Morningstar’s selected coverage universe over time.

- A ratio above 1.00 indicates that the stock’s price is higher than Morningstar’s estimate of its fair value.

- The further the price/fair value ratio rises above 1.00, the more the median stock is overvalued.

- A ratio below 1.00 indicates that the stock’s price is lower than our estimate of its fair value.

- The further it moves below 1.00, the more the median stock is undervalued.

It shows stocks are as undervalued as they were at the low in 2011, nearly as undervalued stocks were March 2020, but not as undervalued as stocks reached in the 2008 stock market crash when the S&P 500 lost -56% from October 2007 to March 2009.

If I were to overall a drawdown chart of the stock index it would mirror the undervalued readings in the chart.

As prices fall, stocks become more undervalued by this measure.

My observation is by and large stocks are relatively undervalued, but they can get much more undervalued if they haven’t yet reached a low enough point to attract institutional buying demand.

To be sure, in 2011 when stocks were as undervalued as Morningstar suggests they are now, the stock index had declined about -19%, similar to the current drawdown of -23%.

The waterfall decline in stock prices March 2020 was -34%, although it recovered quickly in a v-shaped reversal, so it didn’t get as much attention as the current bear market which is down 10% less, but has lasted for seven months without a quick recovery.

Time allows the losses to sink in for those who are holding their stocks.

This time the average stock is down much more than the stock indexes, too, so if you’re holding the weakest stocks your drawdown is worse than the index.

In that case, you’re probably wondering how low it can go.

If stock prices haven’t yet be driven down to a low enough level to attract big institutional capital to buy these lower prices, stocks can certainly trend down a lot lower from here.

For example, in the 2007 – 2009 bear market known as the 2008 Financial Crisis, one I successfully operated through as a tactical trader and risk manager, the stock index dropped -56% over 16 grueling months.

The infamous 2008 crash included many swings up and down on its way to printing a -56% decline from its high in October 2007.

That’s how bad it could get.

It’s also largely the cause of the situation the U.S. finds itself in today.

Since the 2008 Global Financial Crisis, the U.S. Treasury and Federal Reserve Open Market Committee have provided unprecedented support for the equity market and the bond market.

Passive investors and asset allocators have been provided a windfall from the Fed and Treasury, but it’s time to pay the debt.

For passive investors, they’ve been hammered with large losses this year and risk losing more if stock and bond prices keep trending down.

Stocks are already undervalued, but they can get much more undervalued.

Even worse, as my experience tactically operating through many declines like this since the 1990s reflects, are the paranna bites along with the shark bites.

The shark bite is from a passive asset allocator holding on through a prolonged deep bear market in stock prices as they fall -20%, -30%, -40%, -50% or more.

Because losses are so asymemtric and geometically compound aginast you, these capital losses become harder and harder to recover from.

If you lose -50%, it takes a 100% gain to get it back.

Stock market trends are asymmetric; they trend up much lower than they crash down, so that larger gain needed often takes longer, too.

So your emotional capital is at risk.

When you’re down a lot, you’re thinking and decision-making becomes cloudy and stressed because you[‘re under pressure like a pressure cooker.

You don’t know how low it can go.

If you are a buy and hold asset allocator, your loss is unlimited, as there is not point in which you would exit but zero.

Zero may be unlikely, but -50% or more isn’t, as evidenced by history.

And you’ve not been here before.

You’ve not seen this before.

The Fed has never stretched its open market operations this far before.

We just don’t know what’s going to happen next.

But, I’m prepared to tactically execute through whatever unfolds.

I’m having a great year relatively speaking. I’ve been positive most of the year and haven’t ventured far below our all-time new high.

Times like these are when my skillset is designed to show an edge.

Like many tactical investment managers like trend followers, hedge funds, global macro, I too had a period of relative underperformance of the long-only stock indexes. I held my ground but learned some new tricks during the many swings the past decade, and sharpened my countertrend axe to chip away some of the bad parts we don’t want.

But relative outperformance has never been my objective, especially not against a stock index for stock fund that’s fully invested in stocks all the time.

My objective has always been absolute return, not relative return.

My absolute return objective is what drives me to actively manage risk for drawdown control.

Like a good doctor, I aim to first do no harm… as best I can as a risk taker.

Looking at the Shiller PE ratio for the S&P 500, a long-term observation, the U.S. stock market is still grossly overvalued.

The S&P 500 was the second-highest most expensive valuation in 140 years, and even after the decline this year, the stock index is still twice the valuation of Black Monday in October 1987 and

only down to its extremely overvalued level it was on Black Monday Oct. 19, 1987, when the Dow Jones Industrial Average fell -22% in a single day and just now down to the valuation level the stock index was on Black Tuesday in the 1929 crash.

If you believe in fundamental valuation as a gauge and a guide, anything can happen, so please govern yourself accordingly.

If you need help or have questions, contact us here.

Mike Shell is the Founder and Chief Investment Officer of Shell Capital Management, LLC, and the portfolio manager of ASYMMETRY® Managed Portfolios. Mike Shell and Shell Capital Management, LLC is a registered investment advisor focused on asymmetric risk-reward and absolute return strategies and provides investment advice and portfolio management only to clients with a signed and executed investment management agreement. The observations shared on this website are for general information only and should not be construed as investment advice to buy or sell any security. This information does not suggest in any way that any graph, chart, or formula offered can solely guide an investor as to which securities to buy or sell, or when to buy or sell them. Securities reflected are not intended to represent any client holdings or recommendations made by the firm. In the event any past specific recommendations are referred to inadvertently, a list of all recommendations made by the company within at least the prior one-year period may be furnished upon request. It should not be assumed that recommendations made in the future will be profitable or will equal the performance of the securities on the list. Any opinions expressed may change as subsequent conditions change. Please do not make any investment decisions based on such information, as it is not advice and is subject to change without notice. Investing involves risk, including the potential loss of principal an investor must be willing to bear. Past performance is no guarantee of future results. All information and data are deemed reliable but are not guaranteed and should be independently verified. The presence of this website on the Internet shall in no direct or indirect way raise an implication that Shell Capital Management, LLC is offering to sell or soliciting to sell advisory services to residents of any state in which the firm is not registered as an investment advisor. The views and opinions expressed in ASYMMETRY® Observations are those of the authors and do not necessarily reflect the position of Shell Capital Management, LLC. The use of this website is subject to its terms and conditions.

The 10-2 Year Treasury Yield Spread Continues to Indicate a Warning of a Possible Recession

In Following the Trend of Inflation and Risk of Bonds I mentioned we are closely monitoring the 10-2 Year Treasury Yield Spread because an inverted yield curve has a track record of predicting future recessions 6 – 24 months in advance.

The 10-2 Year Treasury Yield Spread is declining fast and has now trended to 0.24%, meaning the 2 Year U.S. Treasury Yield is nearly the same yield as the Year 10 U.S. Treasury Yield.

For more context, read: How We’ll Know if a Recession is Imminent.

For information about our proactive investment management, active risk management, hedging your risks, and ASYMMETRY® Managed Portfolios, contact us.

Mike Shell is the Founder and Chief Investment Officer of Shell Capital Management, LLC, and the portfolio manager of ASYMMETRY® Managed Portfolios. Mike Shell and Shell Capital Management, LLC is a registered investment advisor focused on asymmetric risk-reward and absolute return strategies and provides investment advice and portfolio management only to clients with a signed and executed investment management agreement. The observations shared on this website are for general information only and should not be construed as advice to buy or sell any security. Securities reflected are not intended to represent any client holdings or any recommendations made by the firm. Any opinions expressed may change as subsequent conditions change. Please do not make any investment decisions based on such information, as it is subject to change. Investing involves risk, including the potential loss of principal an investor must be willing to bear. Past performance is no guarantee of future results. All information and data are deemed reliable but are not guaranteed and should be independently verified. The presence of this website on the Internet shall in no direct or indirect way raise an implication that Shell Capital Management, LLC is offering to sell or soliciting to sell advisory services to residents of any state in which the firm is not registered as an investment advisor. The views and opinions expressed in ASYMMETRY® Observations are those of the authors and do not necessarily reflect a position of Shell Capital Management, LLC. The use of this website is subject to its terms and conditions.

Observations of the Unemployment Trend

The US Unemployment Rate measures the percentage of total employees in the United States that are a part of the labor force, but are without a job. It’s one of the most widely followed indicators of the health of the US labor market and the US economy as a whole.

Historically, the US Unemployment Rate reached as high as 10.80% in 1982 and 9.9% in November of 2009, which were recessionary periods.

The US Unemployment Rate is at 8.40%, compared to 10.20% last month and 3.70% this time last year.

US Unemployment Rate remains significantly higher than the long term average of 5.76%.

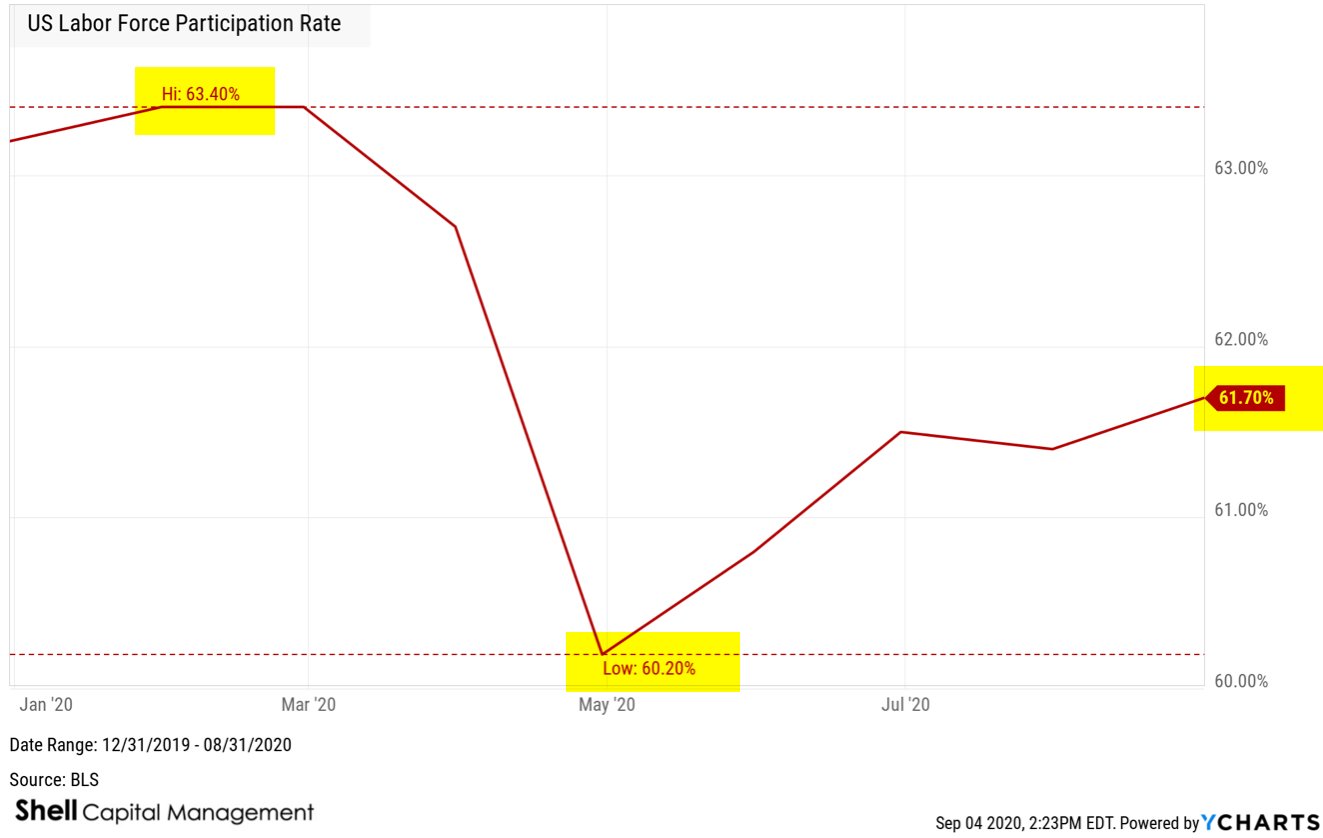

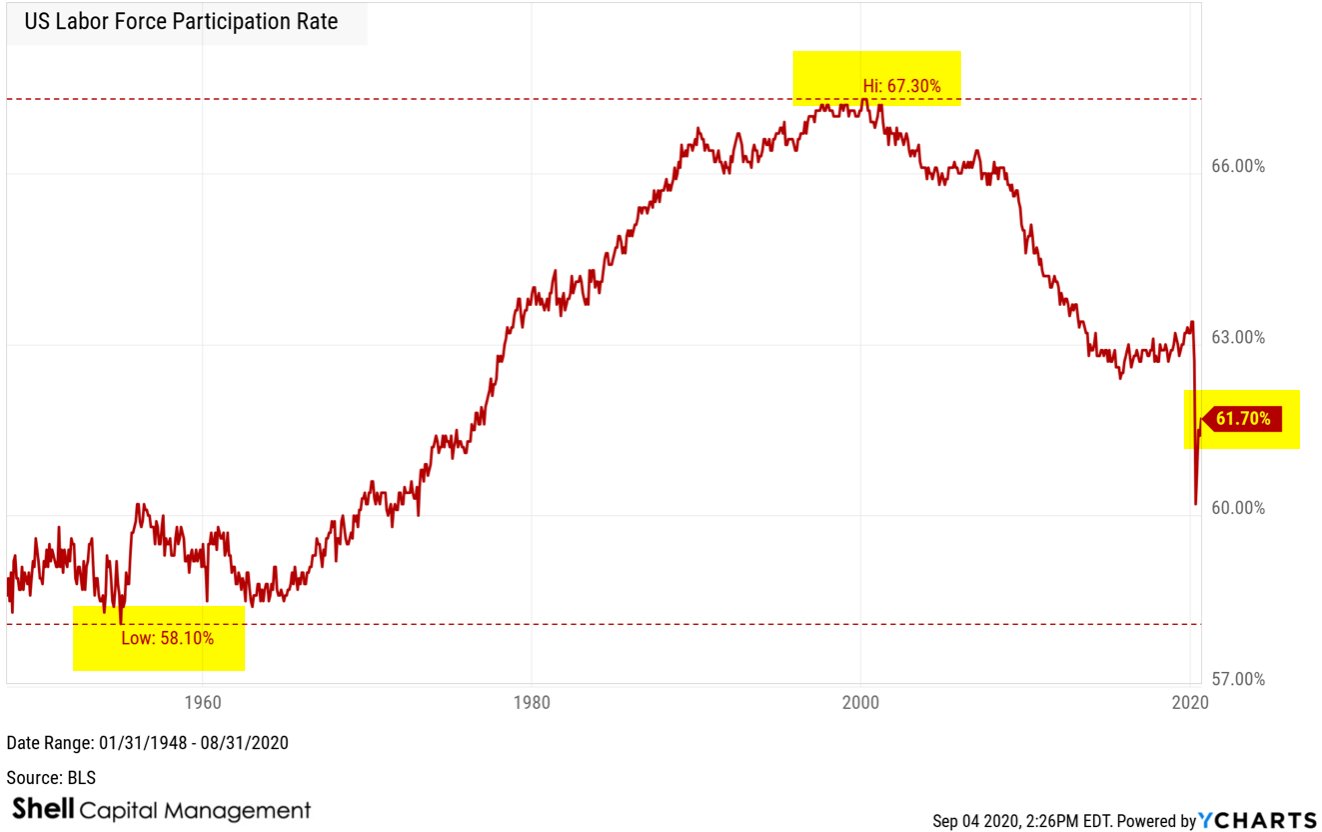

The US Labor Force Participation Rate from the Bureau of Labor Statistics is the sum of total number of employed persons and unemployed persons looking for work in the United States as a percentage of the working age population.

US Labor Force Participation Rate is at 61.70%, compared to 61.40% last month and 63.20% this time last year.

Looking at the bigger picture over a longer time frame, there has been a negative trend from the 2000s of 67.10% participation to the 2010s 62.50% participation as the boomer generation has begun shifting out of the working age population.

In bad economic conditions, the labor force participation rate may actually fall as people eventually give up looking for a job.

So, the employment situation seems to be improving, but we’re likely to see some of these job losses become permanent.

Mike Shell is the Founder and Chief Investment Officer of Shell Capital Management, LLC, and the portfolio manager of ASYMMETRY® Global Tactical. Mike Shell and Shell Capital Management, LLC is a registered investment advisor focused on asymmetric risk-reward and absolute return strategies and provides investment advice and portfolio management only to clients with a signed and executed investment management agreement. The observations shared on this website are for general information only and should not be construed as advice to buy or sell any security. Securities reflected are not intended to represent any client holdings or any recommendations made by the firm. Any opinions expressed may change as subsequent conditions change. Do not make any investment decisions based on such information as it is subject to change. Investing involves risk, including the potential loss of principal an investor must be willing to bear. Past performance is no guarantee of future results. All information and data are deemed reliable but is not guaranteed and should be independently verified. The presence of this website on the Internet shall in no direct or indirect way raise an implication that Shell Capital Management, LLC is offering to sell or soliciting to sell advisory services to residents of any state in which the firm is not registered as an investment advisor. The views and opinions expressed in ASYMMETRY® Observations are those of the authors and do not necessarily reflect a position of Shell Capital Management, LLC. The use of this website is subject to its terms and conditions.

Has the economy lost momentum?

I pay more attention to macroeconomic trends when we are in a recession.

Though my tactical investment decisions are driven by the direction of price trends, momentum, sentiment, and volatility, it’s useful to take a moment to see what in the world is going on.

Clearly, employment and payrolls seem to be one of the main macroeconomic risks right now.

The July ADP employment report showed private employment increased by 167,000, far less than the expectations of the street of 1.2 million. It’s a big disappointment.

Today, we see the US Continuing Claims for Unemployment Insurance is at a current level of 16.11 million, down from 16.95 million last week, which is a change of -4.98% from last week and -35% from the peak in May.

For a long term perspective, here is US Continuing Claims for Unemployment Insurance going back to 1967, the past 53 years. It averaged 2.8 million over the period, reached 10 times higher than average, and is still 5 times higher than the long term average.

Of course, the average over 53 years doesn’t mean much when such an outlier is present, but maybe it helps put the trend into perspective.

Prior to now, the highest continuing claims for unemployment insurance from the Department of Labor was 6.6 million. That’s 10 million less than now. So, for perspective, todays level is nearly three times what it was at the peak in 2009. Said another way, the worst claims for unemployment insurance in 2009 was only 1/3 of today.

But hey, today’s 16.1 million is better than the peak at 25 million just a few months ago.

By the way, that 25 million was more than four times the highest level it reached in 2009.

So yeah, employment is an issue that certainly has my attention as a macroeconomic trend guy.

Next up is US Initial Claims for Unemployment Insurance. US Initial Jobless Claims, as tracked and reported by the US Department of Labor, provides data on how many new people have filed for unemployment benefits in the previous week. It allows us to gauge economic conditions in regard to employment.

As more new people file for unemployment benefits, fewer people in the economy have jobs. Of course, initial jobless claims tended to peak at the end of recessionary periods such as the last cycle peak on March 21, 2009 when it reached 661,000 new filings.

US Initial Claims for Unemployment Insurance is at a current level of 1.186 million, which is nearly double the 2009 peak, but it’s -83% below the stunning March 2020 high of 6.8 million.

I know I just shared some of these numbers a few days ago, but these are updated data this morning.

The next big issue I think we’ll see comes tomorrow.

If tomorrows payroll numbers are similar to these ADP numbers, the job growth will be way below Wall Street expectations of 1.5 million.

We’ll see how it unfolds in the morning.

In the meantime, the resiliency of US stock market has been remarkable. Though anyone paying attention knows the driver is the US government intervention, the S&P 500 has now recovered from its -34% loss in March.

The Dow Jones Industrial Average remains about -5% from the February peak.

The equal weight S&P 500, which gives far more weighting to the smaller and mid size stocks, is about -6.4% from its prior high.

To the layman, it would seem the stock market has all but recovered.

If we didn’t know better, the bear market is over.

Do we know better? or is it over?

Will 2020 go down as the sharpest decline in modern history and the fastest recovery?

We’ll see.

But, over the long run, the stock market is driven by fundamentals. The challenge with fundaments like earnings growth, dividend yield, and the price-to-earnings multiple (optimism) they trade at.

Here is a chart of the rate of change of the S&P 500 price trend normalized with the Shiller S&P 500 CAPE Ratio, which is a measure of valuation. I’ve pointed out many times the valuation level was extremely high, though it has been since 2013. Look when it peaked in the relative chart compared to the SPX at the start of 2018.

What’s happened since then?

Swings.

Massive swings.

And sharp sudden drawdowns.

While the S&P 500 Shiller CAPE Ratio is now down to about 30, which is -10% below where it was at the start of 2018, the valuation level is still as high as it was before the Great Depression.

The markets are going to swing up and down and motivate a lot of mistakes along the way, but if history is a guide, we may be in for a much longer bear market and recession than is currently reflected.

You can probably see why my investment strategy is unconstrained, so I can go anywhere, including cash and treasuries, and apply different tactics for tactical decisions in pursuit of asymmetric risk/reward.

It’s never perfect, but I just keep doing what I do.

In hindsight, I’ve been underinvested in stocks the past few weeks, but we’ll see how it plays out from here.

Mike Shell is the Founder and Chief Investment Officer of Shell Capital Management, LLC, and the portfolio manager of ASYMMETRY® Global Tactical. Mike Shell and Shell Capital Management, LLC is a registered investment advisor focused on asymmetric risk-reward and absolute return strategies and provides investment advice and portfolio management only to clients with a signed and executed investment management agreement. The observations shared on this website are for general information only and should not be construed as advice to buy or sell any security. Securities reflected are not intended to represent any client holdings or any recommendations made by the firm. Any opinions expressed may change as subsequent conditions change. Do not make any investment decisions based on such information as it is subject to change. Investing involves risk, including the potential loss of principal an investor must be willing to bear. Past performance is no guarantee of future results. All information and data are deemed reliable but is not guaranteed and should be independently verified. The presence of this website on the Internet shall in no direct or indirect way raise an implication that Shell Capital Management, LLC is offering to sell or soliciting to sell advisory services to residents of any state in which the firm is not registered as an investment advisor. The views and opinions expressed in ASYMMETRY® Observations are those of the authors and do not necessarily reflect a position of Shell Capital Management, LLC. The use of this website is subject to its terms and conditions.

The US Unemployment Situation is Stunning

US Initial Jobless Claims, provided by the US Department of Labor, provides underlying data on how many new people have filed for unemployment benefits in the previous week.

We can gauge economic conditions with respect to employment.

As more new individuals file for unemployment benefits, fewer individuals in the economy have jobs.

For example, initial jobless claims have tended to reach a cycle peak at the end of recessionary periods. For example, near the end of the last recession, on March 21, 2009 there were 661,000 new filings.

US Initial Claims for Unemployment Insurance is at a current level of US Initial Claims for Unemployment Insurance is at a current level of 1.434 million, which is an increase 592.8% from one year ago.

But, if it makes you feel any better, US Initial Claims for Unemployment Insurance are down -79% from its March 2020 high.

So, US Initial Claims for Unemployment Insurance is up 576% from the beginning of 2020, though it was up over 3,000% in March.

The US Unemployment Rate measures the percentage of total employees in the United States that are a part of the labor force, but are without a job.

The US Unemployment Rate is one of the most widely followed indicators of the health of the US labor market and the US economy as a whole.

Historically, the US Unemployment Rate has reached as high as 10.80% in 1982 and 9.9% in November of 2009.

Both periods were significant recessionary periods.

US Unemployment Rate is at 11.10%, compared to 13.30% last month and 3.70% last year. It is much higher than the long term average of 5.75%.

The US Unemployment Rate at 14.7% was by far the highest it has been in 72 years according the the Bureau of Labor Statistics.

At 11.10% the US Unemployment Rate is still higher than the prior peak in 1982.

I know most people were shocked by this spike in unemployment, and of course, much of it was driven by the Coronavirus pandemic, but it’s also just the market, doing what it does.

For example, I shared in an observation here on December 29, 2019 in “Asymmetry in yield spreads, inverted yield curve warning shot, and unemployment” when I shared the following in regard to what was then an extremely low unemployment rate.

“The yield curve inversion doesn’t automatically mean a recession is in the near future.

Employment is essential, too. The U.S. Unemployment Rate is about as low as it’s ever been.”

“As with all cycles, it isn’t the extremely low level of the cycle we should focus on, but what’s more likely to happen next. It should be no surprise that low unemployment precedes recessions.”

But, I’ll close this observation with the same one I did this one last December.

For me, the directional trend of the stock market will be my primary guide for the economy but I monitor many trends for situational awareness of what is going on.

I hope all is well with all of you and you are avoiding COVID-19 like the plague.

Mike Shell is the Founder and Chief Investment Officer of Shell Capital Management, LLC, and the portfolio manager of ASYMMETRY® Global Tactical. Mike Shell and Shell Capital Management, LLC is a registered investment advisor focused on asymmetric risk-reward and absolute return strategies and provides investment advice and portfolio management only to clients with a signed and executed investment management agreement. The observations shared on this website are for general information only and should not be construed as advice to buy or sell any security. Securities reflected are not intended to represent any client holdings or any recommendations made by the firm. Any opinions expressed may change as subsequent conditions change. Do not make any investment decisions based on such information as it is subject to change. Investing involves risk, including the potential loss of principal an investor must be willing to bear. Past performance is no guarantee of future results. All information and data are deemed reliable but is not guaranteed and should be independently verified. The presence of this website on the Internet shall in no direct or indirect way raise an implication that Shell Capital Management, LLC is offering to sell or soliciting to sell advisory services to residents of any state in which the firm is not registered as an investment advisor. The views and opinions expressed in ASYMMETRY® Observations are those of the authors and do not necessarily reflect a position of Shell Capital Management, LLC. The use of this website is subject to its terms and conditions.

Global Macro Trends: Eurozone Economic Sentiment, US Home Sales, Texas Manufacturing Business Activity, and Retail Gas Price

Eurozone Economic Sentiment Indicator is reversing back up off its lowest level ever at a current level of 75.70, up 12.15% from last month and -26.43% from one year ago. It’s way below average, but at least a countertrend from the extreme low reached this year.

Eurozone Consumer Confidence Indicator is at a current level of -14.70, up from -18.80 last month as it has almost reverted back to its long term average.

US Pending Home Sales Month over Month is at -21.77%, compared to -20.83% last month and -1.14% last year, which is lower than the long term average of -0.03%. Pending home sales mounted a record comeback in May, seeing encouraging contract activity after two previous months of declines brought on by the coronavirus pandemic, according to the National Association of Realtors®. Every major region recorded an increase in month-over-month pending home sales transactions, while the South also experienced a year-over-year increase in pending transactions.

The Pending Home Sales Index (PHS), a leading indicator of housing activity, measures housing contract activity, and is based on signed real estate contracts for existing single-family homes, condos, and co-ops. Because a home goes under contract a month or two before it is sold, the Pending Home Sales Index generally leads Existing-Home Sales by a month or two.

Here is the Year over year relative to Month over Month.

Meanwhile, in Texas… the outlook has recovered after an epic decline.

The Dallas Fed conducts the Texas Manufacturing Outlook Survey monthly to obtain a timely assessment of the state’s factory activity. Firms are asked whether output, employment, orders, prices and other indicators increased, decreased or remained unchanged over the previous month. Responses are aggregated into balance indexes where positive values generally indicate growth while negative values generally indicate contraction.

Texas Manufacturing Business Activity Index is at a current level of -6.10, UP from -49.20 last month and even UP from -12.60 one year ago.

We’ll see if Texas can keep up the recovery with an uptrend in new COVID-19 cases, especially in Houston. The number currently hospitalized is at an all time high.

And the new uptrend in cases doesn’t seem to be driven by more testing in Texas. Although testing has trended up, it was above average about five weeks before cases were, and about eight weeks before the escalating uptrend.

To be sure, we can apply the same relative ratio we would to a stock vs. its index. For example, Apple, Inc. (AAPL) is a top technology stock, so if we want to determine when it’s outperforming the tech sector, we compare it to the sector index. Here we see the relative momentum between them as a ratio. When the line is trending up, Apple has relative strength over the tech sector.

Below I did the same with Texas cases relative to tests administered, which shows cases have momentum over tests. Up until now, the percent of positive cases was trending down.

The US Retail Gas Price is the average price that retail consumers pay per gallon. Retail gas prices is good to observe to see how the energy industry is performing. Retail gas prices can give a good observation of how much discretionary income consumers might have to spend.

US Retail Gas Price is at a current level of 2.216, up 1.42% from last week and down -19.68% from one year ago. Gas reached a peak in July 2008 and then trended back up to the $4 range the summer of 2011 to the summer of 2014 before trending down again.

Gas has now reverted to its long term average price, which has remained elevated since 2005.

If you wondered why electric cars are still popular, it’s because the average price of gas is elevated to a new higher level. Over the past decade, gas had oscillated between $4 and $2, for an average price around $3 a gallon.

Don’t miss out! Sign up for an email of new ASYMMETRY® Observations, including some that may not be posted here.

Mike Shell is the Founder and Chief Investment Officer of Shell Capital Management, LLC, and the portfolio manager of ASYMMETRY® Global Tactical. Mike Shell and Shell Capital Management, LLC is a registered investment advisor focused on asymmetric risk-reward and absolute return strategies and provides investment advice and portfolio management only to clients with a signed and executed investment management agreement. The observations shared on this website are for general information only and should not be construed as advice to buy or sell any security. Securities reflected are not intended to represent any client holdings or any recommendations made by the firm. Any opinions expressed may change as subsequent conditions change. Do not make any investment decisions based on such information as it is subject to change. Investing involves risk, including the potential loss of principal an investor must be willing to bear. Past performance is no guarantee of future results. All information and data are deemed reliable but is not guaranteed and should be independently verified. The presence of this website on the Internet shall in no direct or indirect way raise an implication that Shell Capital Management, LLC is offering to sell or soliciting to sell advisory services to residents of any state in which the firm is not registered as an investment advisor. The views and opinions expressed in ASYMMETRY® Observations are those of the authors and do not necessarily reflect a position of Shell Capital Management, LLC. The use of this website is subject to its terms and conditions.

Global Macro: Signs of bullish sentiment across the globe

In some cases, the recovery of economic and market trends are as impressive as the rate in which they fell.

The so-called “panic button” indicator, TED Spread, is back down to low levels. The chart tracks the daily TED Spread (3 Month LIBOR relative to the 3 Month Treasury Bill) as a measure of the perceived credit risk in the U.S. economy. It tends to widen during times of economic uncertainty. The TED Spread spiked up briefly in March, but has since settled back down.

The TED Spread spiked up briefly in March, but has since settled back down.

German economic sentiment snapped back fast.

The ZEW Indicator of Economic Sentiment is a leading indicator for the German economy. It reflects the expectations in six months of 300 financial experts on inflation rates, interest rates, stock markets, exchange rates, and oil prices for leading global economies. A value greater than 0 reflects more optimism than pessimism and a value less than 0 reflects more pessimism than optimism with respect to economic sentiment.

ZEW Indicator of Economic Sentiment for Germany is at a current level of 63.40, which is right at the high it reached in 2014.

ZEW Indicator of Economic Sentiment for Germany and the Eurozone updates will be released tomorrow, so we’ll see how they have trended through June.

US Consumer Sentiment has trended up off its low. We’ll see if it can continue this uptrend with the COVID cases trending up again.

The Sabrient Insider Sentiment Index is designed to identify companies with potentially superior risk-return profiles that also are;

(1) reflecting favorable corporate insider buying trends (determined via the public filings of such corporate insiders) and/or

(2) have recent earnings estimate increases published by Wall Street analysts.

The Sabrient Insider Sentiment Index declined with the stock indexes in March and has recovered in similar fashion. As with investor sentiment measures, it seems to follow price. Nothing drives sentiment like the price trend.

Speaking of sentiment, the Citigroup Panic/Euphoria model is a gauge of investor sentiment. It identifies “Panic” and “Euphoria” levels which are statistically driven buy and sell signals for the broader market. Historically, a reading below panic supports a better than 95% likelihood that stock prices will be higher one year later, while euphoria levels generate a better than 80% probability of stock prices being lower one year later.

The current reading of the Citigroup Panic/Euphoria model at 0.41 indicates euphoria and anything at or below -0.17 indicates panic.

The S&P 500 EQUAL WEIGHT is probably the best measure of the U.S. stock market. Here, I charted both the standard capitalization weighted index along with its Equal Weight counterpart. The cap-weighted S&P 500 is heavily driven by its top holdings, whereas the equal-weighted index holds about .20% in the 500 or so stocks in the index.

The S&P 500 Equal Weight Index declined -40% in March, which is more than the -34% of the S&P 500 weighted based on company size. The equal-weighted index also remains in a -17% drawdown off its highs, which is more than the standard SPX index, which is more weighted to the largest stocks.

For example, below are the top 25 stocks in the cap weighted S&P 500 everyone follows. As these top stocks have as much weighting in the index as 5%, the equal weight only holds about 0.20% in these same stocks.

| Symbol | Name | % Weight |

| MSFT | Microsoft Corp | 5.94% |

| AAPL | Apple Inc | 5.81% |

| AMZN | Amazon.com Inc | 4.51% |

| FB | Facebook Inc A | 2.22% |

| GOOGL | Alphabet Inc A | 1.69% |

| GOOG | Alphabet Inc Class C | 1.65% |

| JNJ | Johnson & Johnson | 1.44% |

| BRK.B | Berkshire Hathaway Inc Class B | 1.36% |

| V | Visa Inc Class A | 1.28% |

| JPM | JPMorgan Chase & Co | 1.17% |

| PG | Procter & Gamble Co | 1.14% |

| UNH | UnitedHealth Group Inc | 1.10% |

| HD | The Home Depot Inc | 1.03% |

| MA | Mastercard Inc A | 1.03% |

| INTC | Intel Corp | 0.97% |

| NVDA | NVIDIA Corp | 0.91% |

| VZ | Verizon Communications Inc | 0.88% |

| T | AT&T Inc | 0.83% |

| ADBE | Adobe Inc | 0.82% |

| NFLX | Netflix Inc | 0.80% |

| PYPL | PayPal Holdings Inc | 0.79% |

| DIS | The Walt Disney Co | 0.79% |

| MRK | Merck & Co Inc | 0.76% |

| BAC | Bank of America Corp | 0.75% |

| CSCO | Cisco Systems Inc | 0.75% |

The price trend for Emerging Markets stocks has been dismal since the 2007 peak, which has had some negative impact on global macro. That is, considering the killer trend from 2003 to 2007 has a strong return driver for us, it hasn’t been the case since then. So, we’ve not had much exposure to EM, even though it’s now considered undervalued relative to the rest of the world, for me, it has to be trending up with some momentum. This tend is non-trending and volatile.

Zooming in to the year to date, at least the MSCI Emerging Markets Index only declined about the same as US stocks.

Looking inside the EM Index we see the top country exposures are China, Taiwan, South Korea, India, and Brazil, all of which we can gain portfolio exposure via ETFs.

Looking at these individual emerging countries, Brazil has been hammered the most, Taiwan, Korea, and China have been relatively resilient.

In fact, the trend in China is probably surprising to investors, especially considering it’s where the COVID-19 Coronavirus started. China only had a -18.4% drawdown priced in US Dollars.

Brazil has some of the worse COVID trends in the world right now, which isn’t helping their stock market trend either.

Here’s a view of the global stock market trends. Though they are down from their February 2020 highs, they are well above their March 2020 lows.

Gold has had one of the most asymmetric risk/reward profiles YTD. In 2020, Gold has only only down about -3% and a drawdown from its peak of -11%, but it has gained 16%. That’s relatively strong asymmetry.

Gold is no contest against the long term US Treasury Index in 2020. Long Term US Treasuries have the strongest momentum and asymmetric risk/reward year to date, which is why I have exposure. Gold has still been a good asymmetric risk/reward, though.

We remain on defense and invested in bonds for now as they seem to exhibit the most asymmetric risk reward.

Mike Shell is the Founder and Chief Investment Officer of Shell Capital Management, LLC, and the portfolio manager of ASYMMETRY® Global Tactical. Mike Shell and Shell Capital Management, LLC is a registered investment advisor focused on asymmetric risk-reward and absolute return strategies and provides investment advice and portfolio management only to clients with a signed and executed investment management agreement. The observations shared on this website are for general information only and should not be construed as advice to buy or sell any security. Securities reflected are not intended to represent any client holdings or any recommendations made by the firm. Any opinions expressed may change as subsequent conditions change. Do not make any investment decisions based on such information as it is subject to change. Investing involves risk, including the potential loss of principal an investor must be willing to bear. Past performance is no guarantee of future results. All information and data are deemed reliable but is not guaranteed and should be independently verified. The presence of this website on the Internet shall in no direct or indirect way raise an implication that Shell Capital Management, LLC is offering to sell or soliciting to sell advisory services to residents of any state in which the firm is not registered as an investment advisor. The views and opinions expressed in ASYMMETRY® Observations are those of the authors and do not necessarily reflect a position of Shell Capital Management, LLC. The use of this website is subject to its terms and conditions.

Global Macro Trends: Extreme asymmetric observations and changes

Macroeconomics is a branch of economics dealing with the performance, structure, behavior, and decision-making of an economy as a whole.

Macroeconomics is the part of economics focused on the big picture: analyzing economic phenomena such as interest rates, growth, unemployment, and inflation. Macro is in contrast with microeconomics, the study of the behavior of individual markets, workers, households, and firms. Macroeconomic phenomena are the product of all the microeconomic activity in an economy.

Global is related to, or involving, the whole world, not just one country or state.

Global Macroeconomics, or Global Macro, then, is looking at the whole world for trends and behavior of big picture trends.

US Total Vehicle Sales measures the total number of auto, light truck, and heavy truck sales in the US and helps gauge how consumers are spending their discretionary income. In the chart, we can visually see the trends in car and truck sales going back 43 years.

US Total Vehicle Sales bottomed at prior lows, and is now trending back up.

US Light Truck Sales is part of total sales and at a current level of 9.6 million, it’s up from 6.7 million last month and down from 12.57 million one year ago.

US Light Truck Sales has been in an overall uptrend the past four decades, and it reverted to the long term average, but is recovering. US Light Truck Sales is up 41.68% from last month, and -23.96% from one year ago.

Personal Consumption Expenditures Price Index (PCE) is a measure of the prices that people living in the United States, or those buying on their behalf, pay for goods and services. The PCE price index is known for capturing inflation (or deflation) across a wide range of consumer expenses and reflecting changes in consumer behavior. The PCE price index, released each month in the Personal Income and Outlays report, reflects changes in the prices of goods and services purchased by consumers in the United States. Quarterly and annual data are included in the GDP release.

Personal Consumption Expenditures Price Index (PCE) Year over Year is is at 0.55%, compared to and 1.38% last year (a decline of 60%) and is materially lower than the long term average of 3.25%.

US Personal Spending Month over Month is at 8.17%, compared to -12.62% last month and 0.44% last year. US Personal Spending is now higher than the long term average of 0.52%. The chart shows this data was historically more stable, but we’ve observe some extreme outlier trends this year never seen in the last 60 years.

The US Inflation Rate is the percentage in which a chosen basket of goods and services purchased in the US increases in price over a year. Inflation is one of the metrics used by the US Federal Reserve to gauge the health of the economy. Since 2012, the Federal Reserve has targeted a 2% inflation rate for the US economy and may make changes to monetary policy if inflation is not within that range. A notable time for inflation was the early 1980’s during the recession. Inflation rates went as high as 14.93%, causing the Federal Reserve led by Paul Volcker to take dramatic actions.

US Inflation Rate is at 0.12%, compared to 0.33% last month and 1.79% last year. This is disinflation, which is a decrease in the rate of inflation. Disinflation is a slowdown in the rate of increase of the general price level of goods and services in a nation’s gross domestic product over time. Inflation has mostly trended below the long term average of 3.23% for years, but is extremely low at 0.12%. We could be a risk of deflation, which occurs when the inflation rate falls below 0%.

Inflation reduces the value of a currency over time, but sudden deflation increases it. As inflation is declining, the US Dollar is trending up.

When we think of macroeconomics trends like inflation and the US Dollar, we also think of gold. Here is Gold, priced in US Dollars. The Gold Price in US Dollars measures the cost in US Dollars for a Troy Ounce of gold. Gold can be seen as a “safe haven” investment since it is a tangible investment. Gold is also believed to be a hedge against inflation, which is why it reached as high as $1,895 per troy ounce in 2011 when inflation trended higher.

Gold is in an uptrend.

Inflation and interest rates are the primary return driver of stocks and bonds as well as some commodities and currencies.

The 10 Year Treasury Rate is the yield earned by investing in a US government issued treasury security that has a maturity of 10 years. The 10 year treasury yield is the longer end of the yield curve. Many analysts use the 10 year yield as the “risk free” rate when valuing the markets or an individual security. Historically, the 10 Year treasury rate reached as high as 15.84% in 1981 as the Fed raised benchmark rates in an effort to contain inflation.

10 Year Treasury Rate is the lowest it has been the past 30 years, currently at 0.64%, compared to 2.01% last year, and is significantly lower than the long term average of 4.45%.

We all know that past performance is no guarantee of future results, and the bond market expected return is a fine example. One thing that is essential for investors to understand is the long term bond returns will not repeat their past performance over the long term.

The directional trend of interest rates like the 10 Year Treasury Rate are a driver of other rates, such as mortgage rates.

The 30 Year Mortgage Rate is the fixed interest rate that US home-buyers would pay for a 30 year mortgage. Historically, the 30-year mortgage rate has trended as high as 18.6% in 1981, and up until now has trended down as low as 3.3% in 2012.

The 30 Year Mortgage Rate is at 3.13%, the lowest in 48 years, compared to 3.82% last year, and less than half of its 7.97% long term average.

The 15 Year Mortgage Rate is trending down low enough to double tap its all time low at 2.59% reached in May 2013, which is significantly lower than the long term average of 5.36%.

That’s all for now.

Don’t miss out! Stay informed and sign up for an email of new ASYMMETRY® Observations, including some that may not be posted here.

Mike Shell is the Founder and Chief Investment Officer of Shell Capital Management, LLC, and the portfolio manager of ASYMMETRY® Global Tactical. Mike Shell and Shell Capital Management, LLC is a registered investment advisor focused on asymmetric risk-reward and absolute return strategies and provides investment advice and portfolio management only to clients with a signed and executed investment management agreement. The observations shared on this website are for general information only and should not be construed as advice to buy or sell any security. Securities reflected are not intended to represent any client holdings or any recommendations made by the firm. Any opinions expressed may change as subsequent conditions change. Do not make any investment decisions based on such information as it is subject to change. Investing involves risk, including the potential loss of principal an investor must be willing to bear. Past performance is no guarantee of future results. All information and data are deemed reliable but is not guaranteed and should be independently verified. The presence of this website on the Internet shall in no direct or indirect way raise an implication that Shell Capital Management, LLC is offering to sell or soliciting to sell advisory services to residents of any state in which the firm is not registered as an investment advisor. The views and opinions expressed in ASYMMETRY® Observations are those of the authors and do not necessarily reflect a position of Shell Capital Management, LLC. The use of this website is subject to its terms and conditions.

Global Macro trends are all over the place

Macroeconomics is a branch of economics dealing with the performance, structure, behavior, and decision-making of an economy as a whole. Macroeconomics is the part of economics focused on the big picture: analyzing economic phenomena such as interest rates, growth, unemployment, and inflation. Macro is in contrast with microeconomics, the study of the behavior of individual markets, workers, households, and firms. Macroeconomic phenomena are the product of all the microeconomic activity in an economy.

Global is relating to, or involving, the whole world, not just one country or state.

Global Macroeconomics, or Global Macro, then, is looking at the whole world for trends and behavior of big picture trends.

US Existing Home Sales reflects the total unit sales of US homes that are already built. It is a lagging indicator tracking the US housing market, which is impacted by changes in mortgage rates. Historically, US Existing Home Sales declined to a trough of 3.77 million units sold in November 2008 as foreclosures increased and home values fell during the US Housing Crisis.

US Existing Home Sales is at a current level of 3.91M, down from 4.33M last month and down from 5.33M one year ago. This is a change of -9.70% from last month and -26.64% from one year ago.

The US Retail Gas Price is the average price that retail consumers pay per gallon, for all grades of gasoline. Retail gas prices are important to view in regards to how the energy industry is performing. Additionally, retail gas prices can give a good overview of how much discretionary income consumers might have to spend.

US Retail Gas Price is at a current level of 2.185, up from 2.123 last week and down from 2.821 one year ago. This is a change of 2.92% from last week and -22.55% from one year ago. US Retail Gas Price is trending up from its recent low, which was around the same level of support gas had at prior lows of the past decade.

China Imports YoY is down -16.69%, compared to -14.19% last month and -8.22% last year. This is lower than the long term average of -3.83%.

China Trade Balance is at a high of 62.93B, up from 45.33B last month and up from 41.20B one year ago. This is a change of 38.82% from last month and 52.73% from one year ago.

US Continuing Claims for Unemployment Insurance is at a current level of 20.54M, down from 20.61M last week and up from 1.70M one year ago. This is a change of -0.30% from last week and 1.11K% from one year ago.

US Initial Jobless Claims, provided by the US Department of Labor, provides underlying data on how many new people have filed for unemployment benefits in the previous week. We can gauge market conditions in the US economy with respect to employment; as more new individuals file for unemployment benefits, fewer individuals in the economy have jobs. Historically, initial jobless claims tended to reach peaks towards the end of recessionary periods such as on March 21, 2009 with a value of 661,000 new filings.

US Initial Claims for Unemployment Insurance is at a current level of 1.508M, down from 1.566M last week and up from 222,000 one year ago. This is a change of -3.70% from last week and still up 579.3% from one year ago.

Equity option demand continues to be focused on call buying relative to put options.

The CBOE Equity Put/Call Ratio had reached a very low level, indicating options traders were mostly operating in speculative call options over put options for hedging.

I pointed out in “Volatility contractions are eventually followed by volatility expansions” on May 27th:

“CBOE Equity Put/Call Ratio is trending toward the low level was saw before the waterfall decline in March. A falling put-call ratio, or a ratio less than 1, means that traders are buying fewer puts than calls. It suggests that bullish sentiment is building in the market.”

Shortly after, we saw a -7% decline in the stock indexes.

However, I’m seeing evidence of hedging now. The CBOE Index Put/Call Ratio shows a relatively high degree of hedging with put options.

Implied volatility as measured by the CBOE Volatility Index (VIX) remains very elevated, even though it declined nearly 10% today. In fact, it has mean reversed, as it does. The VIX is at its one year average.

Global Macro trends are all over the place.

Mike Shell is the Founder and Chief Investment Officer of Shell Capital Management, LLC, and the portfolio manager of ASYMMETRY® Global Tactical. Mike Shell and Shell Capital Management, LLC is a registered investment advisor focused on asymmetric risk-reward and absolute return strategies and provides investment advice and portfolio management only to clients with a signed and executed investment management agreement. The observations shared on this website are for general information only and should not be construed as advice to buy or sell any security. Securities reflected are not intended to represent any client holdings or any recommendations made by the firm. Any opinions expressed may change as subsequent conditions change. Do not make any investment decisions based on such information as it is subject to change. Investing involves risk, including the potential loss of principal an investor must be willing to bear. Past performance is no guarantee of future results. All information and data are deemed reliable but is not guaranteed and should be independently verified. The presence of this website on the Internet shall in no direct or indirect way raise an implication that Shell Capital Management, LLC is offering to sell or soliciting to sell advisory services to residents of any state in which the firm is not registered as an investment advisor. The views and opinions expressed in ASYMMETRY® Observations are those of the authors and do not necessarily reflect a position of Shell Capital Management, LLC. The use of this website is subject to its terms and conditions.

Global Macro: Unemployment and jobless claims make 2008 look good

US Initial Jobless Claims, provided by the US Department of Labor, provides data on how many new people have filed for unemployment benefits in the previous week.

We can use initial jobless claims to gauge the economy with respect to employment. As more new people file for unemployment benefits, fewer individuals in the economy have jobs.

Historically, initial jobless claims tended to reach peaks towards the end of recessionary periods such as on March 21, 2009 with a value of 661,000 new filings.

The initial jobless claims at the end of the “global financial crisis” is nothing compared to what we are seeing today.

US Initial Jobless Claims is at a current level of 3.839 million, down from 4.442 million last week and up from 230,000.0 one year ago. Over 30 million Americans have no filed for unemployment.

Continued jobless claims is about 18 million.

It’s in uncharted territory. We’ve never seen job losses to this magnitude.

Mike Shell is the Founder and Chief Investment Officer of Shell Capital Management, LLC, and the portfolio manager of ASYMMETRY® Global Tactical. Mike Shell and Shell Capital Management, LLC is a registered investment advisor focused on asymmetric risk-reward and absolute return strategies and provides investment advice and portfolio management only to clients with a signed and executed investment management agreement. The observations shared on this website are for general information only and should not be construed as advice to buy or sell any security. Securities reflected are not intended to represent any client holdings or any recommendations made by the firm. Any opinions expressed may change as subsequent conditions change. Do not make any investment decisions based on such information as it is subject to change. Investing involves risk, including the potential loss of principal an investor must be willing to bear. Past performance is no guarantee of future results. All information and data are deemed reliable but is not guaranteed and should be independently verified. The presence of this website on the Internet shall in no direct or indirect way raise an implication that Shell Capital Management, LLC is offering to sell or soliciting to sell advisory services to residents of any state in which the firm is not registered as an investment advisor. The views and opinions expressed in ASYMMETRY® Observations are those of the authors and do not necessarily reflect a position of Shell Capital Management, LLC. The use of this website is subject to its terms and conditions.

The longest economic expansion in U.S. history is over, but…

As the US and and global economies are entering a recession, this is when I start actively monitoring global macro-economic trends.

My investment and tactical trading decisions are informed by directional price trends, momentum, volatility, and investor sentiment. So, this quantitative data is my primary focus as a global macro/tactical investment manager.

That is, until economic trends shift outside their range and reach extremes.

Then I start observing these global macro trends to observe what has changed. We monitor thousands and data streams and time series, daily, with quantitative alerts that signal when these trends change, or when their rate of change shifts. For example, we monitor 4,136 global Gross Domestic Product (GDP) indicators alone.

US GDP Growth released today indicates the longest U.S. economic expansion in history is over.

The Bureau of Economic Analysis releases quarterly figures for US Gross Domestic Product. In addition to the Real GDP, the report also includes data for income, sales, inventories, and corporate profits. It is one of the most important parts of the National Income and Product Accounts.

US Real GDP Growth is measured as the year over year change in the Gross Domestic Product in the US as adjusted for inflation. Gross Domestic Product is the total value of goods produced and services provided in a the US. Real GDP Growth is a vital indicator to analyze the health of the economy. Two quarters of consecutive negative real GDP growth officially signifies a recession. Additionally, GDP is used by the Fed (FOMC) as a gauge to make their interest rate decisions. In the post World War II boom years, US Real GDP grew as high as 12.8% in a year, but in the late 20th century 0-5% growth was more the norm.

US Real GDP Growth is now at -4.80%, compared to 2.10% last quarter and 3.10% last year, which is materially below the long term average of 3.18%. This GDP is sharpest drop since 2008 as governments and consumers responded to the new coronavirus.

I expect the second quarter will be worse.

I’ve been pointing out a few years now that this is the longest economic expansion in U.S. history as well as the longest bull market for stocks that was very aged.

But, after a -37% decline in the popular market proxy, the Dow Jones Industrial Average, the stock market is climbing a wall of worry.

Despite the negative GDP, the Dow Jones is up 2.7% today.

And the Dow Jones is now just -13.28% year to date, after starting 2020 up 3.55% and then crashing down -35% just a few weeks ago.

I have tactically operated through bear markets, so investors should be prepared for many significant swings along the way, but for now, it seems on March 24th stock prices reached a low enough point to attract buying enthusiasm that exceeds the desire to sell.

Of course, the buying enthusiasm may be mostly the Federal Reserve, but notwithstanding who is driving up prices, the trend is up for now.

The stock market is forward-looking, so what is, is.

Giddy up.