S&P Target Risk Index Global Asset Allocation

S&P Dow Jones Indices’ Target Risk series comprises multi asset class indices that correspond to a particular risk level. Each index is fully investable, with varying levels of exposure to equities and fixed income and are intended to represent stock and bond allocations across a risk spectrum from conservative to aggressive.

S&P Target Risk Index Objective The S&P Target Risk Index Series is comprised of four indices, each one measuring the performance of specific allocations to equities and fixed income.

Each index is composed of exchange traded funds (ETFs). The indices represent stock-bond allocations across a risk spectrum from conservative to aggressive. The assigned risk level of the index (conservative, moderate, growth, and aggressive) depends on the allocation to fixed income.

S&P Target Risk Conservative Index. The index seeks to emphasize exposure to fixed income, in order to produce a current income stream and avoid excessive volatility of returns. Equities are included to protect long-term purchasing power.

S&P Target Risk Moderate Index. The index seeks to provide significant exposure to fixed income, while also providing increased opportunity for capital growth through equities.

S&P Target Risk Growth Index. The index seeks to provide increased exposure to equities, while also using some fixed income exposure to dampen risk.

S&P Target Risk Aggressive Index. The index seeks to emphasize exposure to equities, maximizing opportunities for long-term capital accumulation. Please refer to Index Construction for details on each index’s allocation to equity and fixed income.

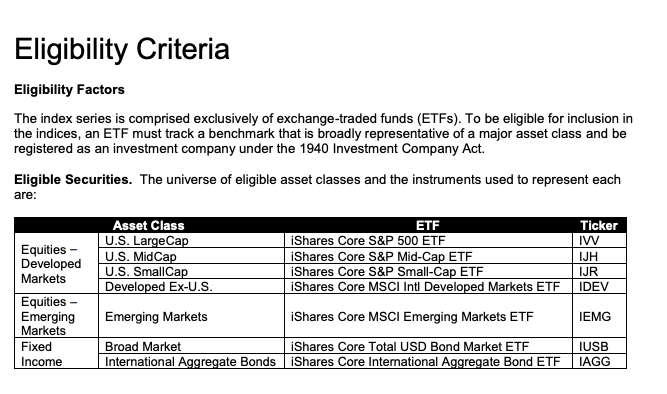

Eligibility criteria of the S&P Target Risk Index

S&P Target Risk Index Index Construction

For more details, visit S&P Target Risk Index Series the source of all of the data on this page.

Please note, the history prior to the index launch date of Launch Date: Sep 25, 2008, is backtested. S&P provides the following disclosure:

All information for an index prior to its Launch Date is back-tested, based on the methodology that was in effect on the Launch Date. Back-tested performance, which is hypothetical and not actual performance, is subject to inherent limitations because it reflects application of an Index methodology and selection of index constituents in hindsight. No theoretical approach can take into account all of the factors in the markets in general and the impact of decisions that might have been made during the actual operation of an index. Actual returns may differ from, and be lower than, back-tested returns.

You must be logged in to post a comment.