Based on my velocity measuring algorithms, the stock indexes are now starting to get oversold. That is, the stock indexes are reaching a point we could see at least a short term countertrend back up, on a short term basis. These measures are based on short term market overreactions, such as when price decline sharply beyond a point we expect mathematically over a period. It certainly doesn’t mean the price trend can’t fall farther as they often do but instead signals a potential countertrend that could drive prices to retrace some of their loss. However, if the downtrend price trend becomes a prolonged and deeper downtrend, these countertrend measures fail to perfectly time the low. Investment management is probabilistic, never a sure thing, so I never expect anything more.

What matters most is if I wanted to take some risk right now on a short term oversold market, I would predefine my exit to cut my loss short if it doesn’t work out and let it rip. We never know for sure in advance when prices will reverse, I can only determine when it is more likely.

The challenge right now, in addition to some other observations I’ve shared recently about valuation, etc. is stock market breadth is far from oversold. So, my breadth measures do not yet suggest any significant selling pressure has been exhausted. I believe when investors sell stocks with great enthusiasm, it shows up in the percent of stocks above and below the trend lines. After prices have plummeted and most of the stocks have fallen into downtrends I start to wonder if the desire to sell is losing steam. At this point, these indicators don’t yet signal a significant panic level selling, so that’s the risk from this point.

I’ll share some of the price trends and indicators I look at when stock prices are falling.

First up is the percent of S&P 500 stocks above their 50-day moving averages. As the chart shows, last month about 82% of the stocks were above their shorter-term trend line. I consider levels above 80% to be a higher risk zone. As we see below, the percent of S&P 500 stocks above their 50-day moving averages made a lower high since January and now is falling at 38%.

While we don’t use it as a market timing indicator, it instead provides some situational awareness of the risk of decline. After most stock prices have already risen, where does more demand come from? At higher levels, I consider the enthusiasm to buy may be becoming exhausted. It once again seems to be what has happened here as investors were enthusiastic about stocks until recently.

Another warning shot across the bow was when this breadth measure failed to confirm an all-time new high in the stock market. Below is the same indicator as above, but I overlayed it with the price trend of the S&P 500. As the SPX trended up to an all-time new high, the percent of S&P 500 stocks above their 50-day moving averages showed a material divergence, indicating fewer stocks were participating in the uptrend. I’ve been monitoring these indicators for two decades now and from my experience, a divergence like this that indicates less participation and “breadth” of the trend is a warning sign. In a healthy uptrend, most stocks are trending higher, so the percent of S&P 500 stocks above their 50-day moving averages is increasing, not decreasing.

For a longer-term context, below is the percent of S&P 500 stocks above their 200 day moving averages. I consider below 20 or 30% to be an overreaction to the downside, but currently, 66% of stocks are above this longer-term trend line. On the one hand, higher participation is positive, but it’s declining from a relatively high level, which makes it more negative. It also provides us with the awareness that stocks could certainly fall a lot more. The times when less than 20% of these stocks were above their 200-day moving average was periods of notable stock market drawdowns.

So, these are some examples of why I started reducing our exposure to zero a month ago and only recently have been increasing exposure by rotating back out of US Treasuries into high dividend yield positions. The nice thing about high dividend yield positions is as the price falls, the dividend yield increases. It’s one time when I buy after prices fall, so we earn the dividend yield from that point forward. My timing is rarely perfect and it doesn’t have to be.

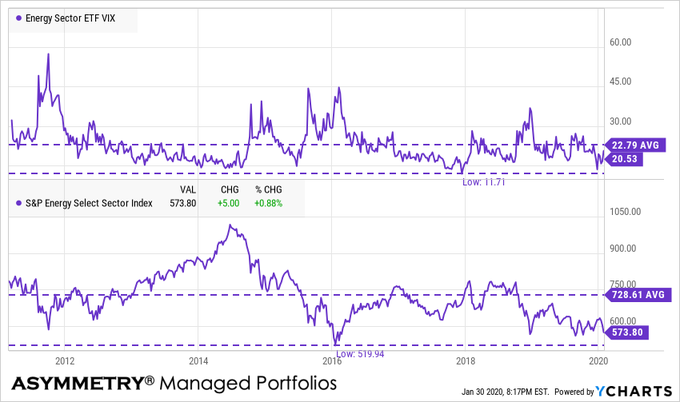

By way of example only, below is a chart of the Alerian MLP Index price and dividend yield. MLP’s are Master Limited Partnerships and in this case, they are publically traded. The Alerian MLP Index is the leading gauge of energy infrastructure Master Limited Partnerships (MLPs). The capped, float-adjusted, capitalization-weighted index, whose constituents earn the majority of their cash flow from midstream activities involving energy commodities, is disseminated in real-time. I’m using this index for illustration to show how (1) the price trend of the MLP index has fallen with energy prices and (2) since its holdings pay high dividend yield, as the price falls, the yield trends up as seen in the chart.

The purple line shows the dividend yield is 9.41% based on the current price and the price is making a new low. This is one of the most extreme examples right now to make the point. It not only makes the point that buying lower prices in high yield securities can potentially capture asymmetric risk-reward, but also these high yielding securities are not without risks that need to be managed. The risk is made obvious by the price trend chart, which is down -27% over the past year.

As with most things in life, timing is everything. If we had entered a position with the risk/reward profile that existed a year ago, it was more risk than reward, as the high yield income from dividends wouldn’t have been enough to offset the loss from the price decline. But, in the case of exposures that provide higher potential income streams from dividend yield at lower prices, you can probably see how to offset the potential from asymmetric returns from an asymmetric risk-reward payoff. But again, it isn’t so simple and requires risk management, because there is no guarantee stocks, bonds, or MLPs will always keep paying their yields.

In summary, my short term velocity algorithms suggest the popular stock indexes are nearing a short term level we could see a countertrend, but the bigger picture isn’t so positive as there remains plenty enthusiasm to be exhausted. In other words, in late December 2018, my indicators suggested an extreme level of panic selling has happened and it was likely becoming exhausting. It turned out to be exactly what happened. The current measures are nowhere near that level of oversold, but if sellers aren’t panicking to sell it will not get there, either.

At this point, the stock index is only -6% off its high, which is just short of the decline last summer and well within a normal decline. We typically see 2-3 price declines of -5% annually.

To put it into context, the current stock market decline is less than 1/3rd of the waterfall decline over a year ago.

Only time will tell if the desire to sell is being exhausted. Fortunately, we had already de-risked our portfolio before this started and are now looking to take on new asymmetric risk-reward positions as they present themselves. My risk management and drawdown control systems handle the rest.

Mike Shell is the Founder and Chief Investment Officer of Shell Capital Management, LLC, and the portfolio manager of ASYMMETRY® Global Tactical. Mike Shell and Shell Capital Management, LLC is a registered investment advisor in Florida, Tennessee, and Texas focused on asymmetric risk-reward and absolute return strategies and provides investment advice and portfolio management only to clients with a signed and executed investment management agreement. The observations shared on this website are for general information only and should not be construed as advice to buy or sell any security. Securities reflected are not intended to represent any client holdings or any recommendations made by the firm. Any opinions expressed may change as subsequent conditions change. Do not make any investment decisions based on such information as it is subject to change. Investing involves risk, including the potential loss of principal an investor must be willing to bear. Past performance is no guarantee of future results. All information and data are deemed reliable but is not guaranteed and should be independently verified. The presence of this website on the Internet shall in no direct or indirect way raise an implication that Shell Capital Management, LLC is offering to sell or soliciting to sell advisory services to residents of any state in which the firm is not registered as an investment advisor. The views and opinions expressed in ASYMMETRY® Observations are those of the authors and do not necessarily reflect a position of Shell Capital Management, LLC. The use of this website is subject to its terms and conditions.

You must be logged in to post a comment.