Retail risk appetite has reached the 95th percentile, according to Citadel Securities’ order flow data. Extremes in positioning don’t predict timing, but they do change the distribution of potential outcomes — and the structure of asymmetric risk/reward. Read More

The Market Can’t Hide Its Nervous System

Price can trend higher while fear remains embedded beneath the surface. When volatility refuses to confirm a rally, the divergence between price and positioning becomes the real signal — and the real source of asymmetric risk and opportunity. Read More

Getting Off The Treadmill Isn’t About Income. It’s About Control.

Financial freedom isn’t about income levels—it’s about control. This ASYMMETRY® Observation reframes the classic four-quadrant model as levels of dependency, resilience, and optionality, showing why getting off the treadmill is a risk-management decision, not a lifestyle one. Read More

Quantitative Rules-Based Trading Systems Don’t Remove the Emotion

Why claims of “emotionless investing” misunderstand risk, behavior, and asymmetry—and why real edge comes from structure, not psychology. Investment systems don’t remove emotion. They expose it. The real edge isn’t feeling less—it’s designing a structure where emotion can’t quietly distort risk, sizing, or exits when it matters most. Read More

Valuation Extremes and the Compression of Asymmetry

Valuation is not a timing signal. It is a distribution signal. When starting points are stretched, expected forward returns compress and downside asymmetry expands. The discipline is structural, not predictive. Read More

ASYMMETRY® Observations from Last Week

The original ASYMMETRY® Observations are now published at ASYMMETRY® Observations on the Shell Capital Management, LLC website. Here are last week’s:

Asymmetry vs. Velocity in Gold and Silver

January 27, 2026

Gold and silver are expressing very different forms of asymmetry. Gold reflects slow-moving structural convexity tied to policy risk, while silver’s explosive moves are driven by liquidity squeezes and regulatory uncertainty. The opportunity isn’t prediction — it’s understanding the risk geometry.

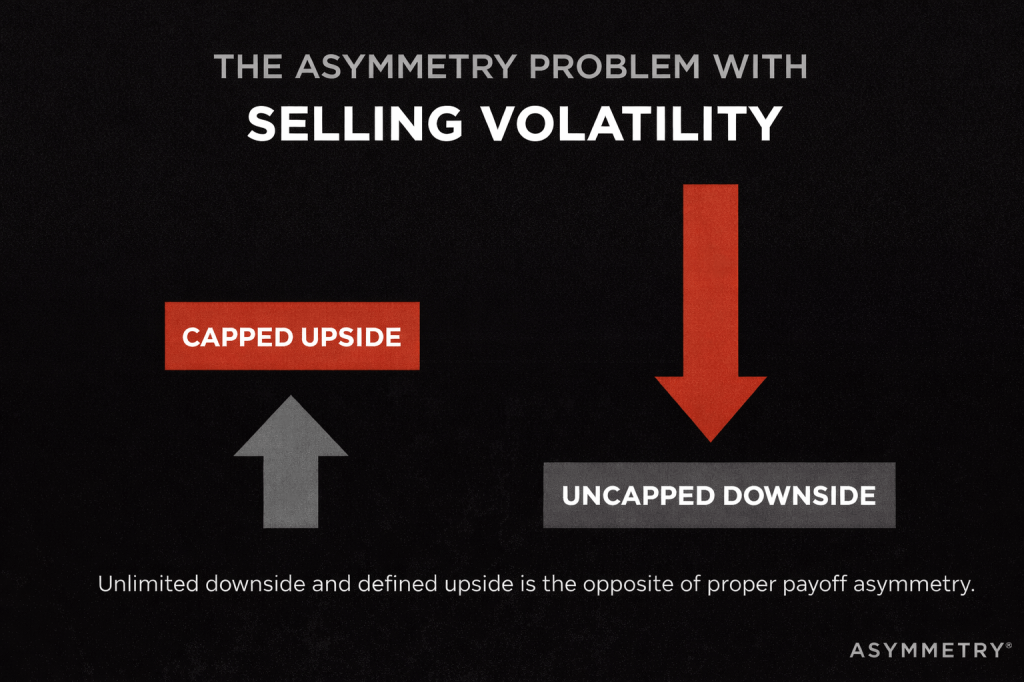

The Asymmetry Problem With Selling Volatility

January 29, 2026

Selling volatility still works—until it doesn’t. The real issue isn’t whether the volatility risk premium exists, but where it’s been competed away, how capital concentration changes the payoff geometry, and why most investors are selling convexity without being paid for it.

When ETF Arbitrage Fails: What SLV’s Record Discount Reveals About Market Structure

January 30, 2026

SLV’s apparent record discount wasn’t about silver being mispriced. It was about arbitrage stepping aside under extreme velocity. When liquidity providers stop enforcing convergence, risk migrates from price into market structure—and that’s where asymmetry flips.

When Arbitrage Opts Out: More on What Happened to the Silver ETF SLV

February 2, 2026

SLV’s record discount wasn’t a mispricing—it was a signal. Volatility surged. Liquidity vanished. Arbitrage stepped aside. ETF structure didn’t break. It reverted to its true condition: conditional.

When Return Drivers Concentrate: The Hidden Risk Inside “Diversified” Trend Portfolios

February 2, 2026

It doesn’t matter how high the return is if the drawdown is so severe you tap out before it’s achieved. The same logic applies to broad diversification—even inside trend-following systems. When return drivers concentrate, portfolios that appear diversified can still experience sharp, asymmetric drawdowns.

Relative Strength is a Measure of Asymmetry

February 2, 2026

RSI isn’t a timing oscillator — it’s an asymmetry measure. Built on average gains divided by average losses, RSI reveals which side of the market is dominant and why upside or downside can persist far longer than intuition expects.

Asymmetry vs. Velocity in Gold and Silver

Gold and silver are expressing very different forms of asymmetry. Gold reflects slow-moving structural convexity tied to policy risk, while silver’s explosive moves are driven by liquidity squeezes and regulatory uncertainty. The opportunity isn’t prediction — it’s understanding the risk geometry. Read it here: Asymmetry vs. Velocity in Gold and Silver

Asymmetry Is Defined by Downside, Not Upside

Asymmetry in investing is often misunderstood as large upside potential. In reality, true asymmetric risk/reward is defined by controlled downside, not imagined gains. Without a clearly defined loss, upside narratives are irrelevant because unbounded risk dominates long-term outcomes. Asymmetry begins with survival. Read here: Asymmetry Is Defined by Downside, Not Upside

Engineering Bitcoin into an Asymmetric Risk/Reward Investment and Managing Cryptocurrency Risk

Following up on Why Bitcoin Itself Lacks Asymmetric Risk/Reward, we go into more detail with an example in Engineering Bitcoin into an Asymmetric Risk/Reward Investment and Managing Cryptocurrency Risk

Why Bitcoin Itself Lacks Asymmetric Risk/Reward

Does the cryptocurrency Bitcoin offer an asymmetric risk/reward payoff? Find out: Why Bitcoin Itself Lacks Asymmetric Risk/Reward

Are We Entering a Civil War?

That question isn’t being asked because of headlines or rhetoric. It’s being asked because something more structural is changing beneath the surface.

History shows that societies don’t move directly from polarization to violence. They move through a late-cycle phase where internal conflict escalates, trust erodes, and institutions lose their ability to absorb disagreement without breaking something important.

That phase doesn’t guarantee collapse.

But it does change the geometry of risk.

When internal conflict rises, outcomes stop being symmetrical. Stability becomes conditional. Small shocks produce outsized reactions. And assumptions built during long periods of calm begin to fail.

The real risk isn’t predicting the worst-case scenario.

It’s remaining structurally exposed as the distribution of outcomes widens.

Read it here: Are We Entering a Civil War? Or Entering the Phase That Precedes It?

When “Tax-Free” Isn’t Free—and When It Is

When do tax-exempt money market funds actually deliver an edge? This Asymmetry Observation breaks down the after-tax math behind taxable vs. tax-exempt cash yields, explains why “tax-free” often isn’t free, and shows how marginal tax rates and state taxes determine when the geometry finally flips. Read it here: Asymmetry Observation: When “Tax-Free” Isn’t Free — and When It Is

Investors vs. Traders

In asymmetric investing, the difference between an investor and a trader is misunderstood. Read about it in Investors Own Capital. We Actively Manage Exposure

People Earn Money in One Business — Then Lose It in Another

Why many professionals and business owners earn wealth in one business—then lose it in another. An ASYMMETRY® Observation on exit risk, capital redeployment, and asymmetric risk management. Read it: People Often Earn Money in One Business — Then Lose It in Another

The Art of Asymmetric Investing: When Imbalance Beats Balance

The Art of Asymmetric Investing: When Imbalance Beats Balance. Most investors think the goal is balance. Balanced portfolios. Balanced risk. Balanced returns. What business owner wants to balance their profit and loss? What investor wants to balance their risk and reward? Read it here: The Art of Asymmetric Investing Isn’t Balance — It’s Survival

Connecting the Dots Means Understanding How Markets Interact With Each Other

Markets don’t move in isolation. They interact. Equities, rates, volatility, options, and liquidity form a system where pressure in one area transmits into others. Understanding those interactions—who is forced to act, when risk accelerates, and where fragility builds—matters far more than predicting the next market move. Connecting the dots isn’t about forecasting outcomes. It’s about understanding how risk flows through the system—and structuring portfolios so downside is defined while upside remains open. Read it here: Connecting the Dots Means Understanding How Markets Interact

True Asymmetry vs. False Asymmetry in Investment Management

Many strategies look asymmetric—until volatility exposes what was hidden. True asymmetry starts with defined risk and leaves upside open. The difference is geometry, not storytelling. Read: True Asymmetry vs. False Asymmetry in Investment Management

Captain Condor Blowup and the Illusion of Asymmetry

Having traded options for thirty years, I’ve seen the same pattern repeat across decades and market regimes: what looks like consistency is often just risk being deferred. A strategy can look disciplined, consistent, and “low risk” right up until the moment it isn’t. The Captain Condor $50 million collapse wasn’t caused by a market crash or bad luck — it was caused by a hidden asymmetry in the risk itself. This observation explains how smooth returns, high win rates, and “defined risk” trades can still produce catastrophic outcomes when portfolio risk is left undefined — and why true asymmetry always starts with survival, not consistency. Read the observation: Captain Condor Blowup and the Illusion of Asymmetry

The Asymmetry of Alpha vs. Survival

Nassim Nicholas Taleb argues that most so-called “alpha” isn’t real because it ignores the most important variable in investing: survival through time. Strategies that look impressive based on historical averages often conceal a small probability of catastrophic loss. For investors compounding wealth over decades—especially after a liquidity event like selling a business or retirement—those rare losses matter far more than smooth long-term averages. True alpha must endure volatility, uncertainty, and adverse regimes without risking permanent capital impairment.

Read the full article on the Shell Capital blog:

Why Nassim Nicholas Taleb Says Most “Alpha” Isn’t Real

https://shell-capital.com/asymmetry-observations/why-nassim-nicholas-taleb-says-most-alpha-isnt-real

Markets aren’t driven by averages

This observation was originally published at Shell Capital’s ASYMMETRY® Observations.

Markets aren’t driven by averages

Most investment frameworks still assume markets are driven by rational actors optimizing long-term averages.

They aren’t.

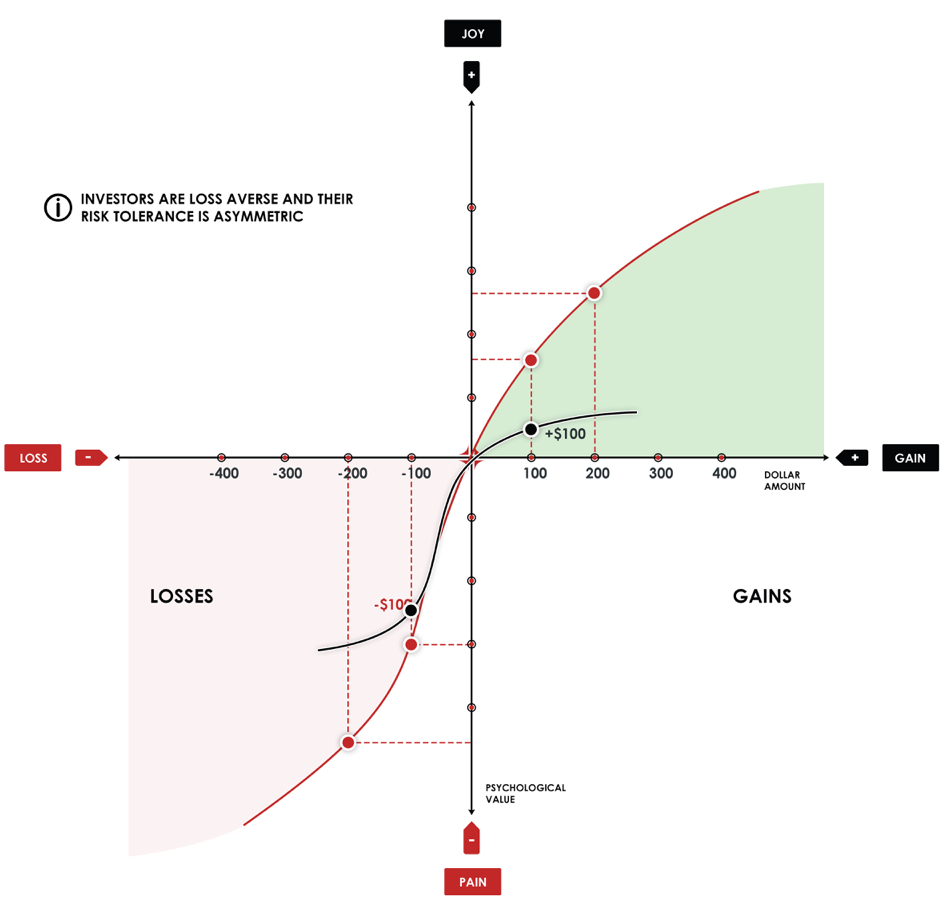

Markets are driven by how humans perceive gains, losses, and risk in real time—and that perception is systematically distorted under pressure.

This isn’t speculation. It’s formalized in Prospect Theory, the Nobel Prize-winning framework developed by Daniel Kahneman and Amos Tversky that explains how people actually behave when real money is on the line.

The asymmetry is structural

Prospect Theory demonstrates investors are:

- Risk-averse when they’re winning

- Risk-seeking when they’re losing

- Far more sensitive to losses than to equivalent gains

This creates a non-linear value function centered around a reference point—usually “break-even.”

In markets, that behavioral asymmetry shows up as:

- Upside trends that persist longer than expected

- Downside moves that accelerate faster than models assume

- Volatility that clusters rather than distributes smoothly

Averages don’t explain that. Behavior does.

Where wealth gets destroyed

Here’s the problem most investors don’t see coming:

The gap between how portfolios are constructed and how humans actually behave under pressure is where wealth gets destroyed.

Not by market risk. By behavioral risk.

Modern Portfolio Theory assumes you’ll hold through any drawdown. Prospect Theory explains why you won’t—and why trying to force yourself to will likely make things worse.

Loss aversion intensifies as drawdowns deepen. Investors lock in gains too early when winning and hold losses too long trying to “get back to even.” The discipline you think you have evaporates precisely when you need it most.

That’s not a character flaw. It’s human wiring.

From behavior to process

Prospect Theory doesn’t predict what markets will do next. It explains how people react once markets move.

That distinction is critical.

At Shell Capital, we design systems around that reality:

- Downside risk is defined in advance, before loss aversion takes over

- Exits to limit losses are systematic, not emotional

- Upside is allowed to compound when trends persist

- Position sizing reflects asymmetry, not averages

We don’t optimize for theoretical means. We manage the path—how returns are experienced over time.

Because the path is what determines whether you stay invested or tap out.

The practical reality

You can’t behavior-modify your way out of loss aversion. You can only design around it.

Markets aren’t driven by averages—they’re driven by how humans perceive gains, losses, and risk under pressure.

Our systems are built to harness that asymmetry while protecting against the behavioral traps that destroy even well-intended investment plans.

That’s where disciplined risk management begins.

Does your portfolio account for behavioral risk?

At best, portfolios may be stress-tested for market scenarios—2008, COVID, rate shocks.

Almost none are stress-tested for the investor.

One of the many parts of ASYMMETRY® is a behavioral risk diagnostic that maps allocations against asymmetries that emerge under pressure:

- Where loss aversion is likely to override discipline

- Which positions create unintended behavioral exposure

- How your exit strategy (or lack of one) amplifies downside risk

- Whether your position sizing reflects asymmetry or just diversification

If you want to see how your portfolio holds up under behavioral stress, contact us and we’ll send you the framework and walk you through how we apply it to your current holdings.

—Mike Shell President & Chief Investment Officer Shell Capital Management, LLC

S&P 500 Dividend Yield Hits Multi-Decade Low: What It Means for Asymmetric Investors

This observation was originally published at Shell Capital’s ASYMMETRY® Observations.

The S&P 500 dividend yield has dropped to 1.25%, one of the lowest readings in more than two decades. That’s 31% below its long-term average of 1.81% and just a hair above its historical low of 1.12%. Read it here: The S&P 500 Dividend Yield Has Collapsed—Here’s Why It Matters for Asymmetric Risk/Reward and Asymmetric Returns

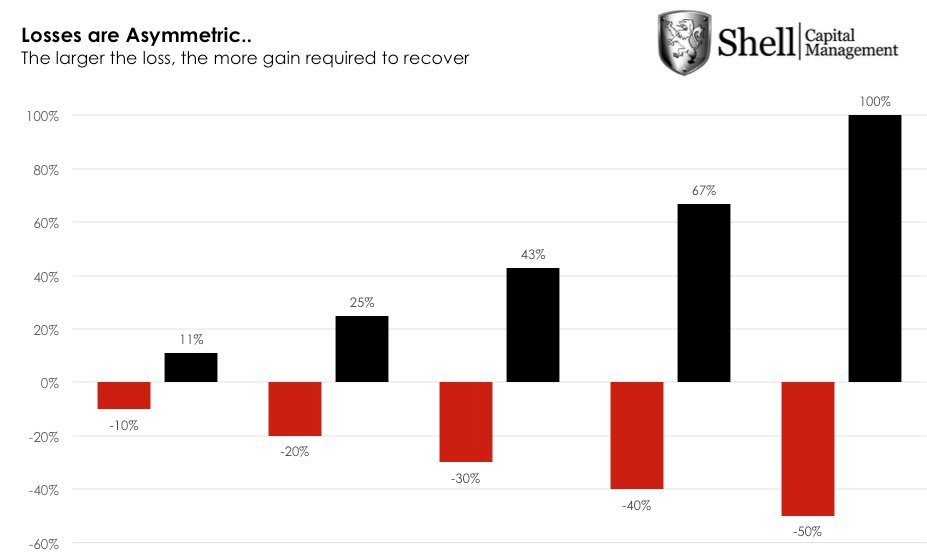

Drawdown Control is Essential for Compounding Efficiency

We pursue what we refer to as “drawdown control” through individual position risk management, portfolio heat limits, and portfolio hedging for risk mitigation.

Compounding efficiency isn’t about how much we make—it’s about how much we keep compounding.

Read about it: Drawdown Control is Essential for Compounding Efficiency

Investment Portfolio Drawdowns from Market Losses Work Geometrically Against You

Investment drawdowns from market losses work geometrically against you.

Losses don’t scale linearly—they scale exponentially in how they hurt compounding.

Read it here: Drawdowns from Market Losses Work Geometrically Against You

VIX Futures Still in Backwardation: What It Tells Us Now

VIX Futures Still in Backwardation: What This Shift Tells Us Now

The VIX futures curve continues to send a clear message: volatility remains elevated, and the market still expects it to fade—but not just yet.

Read it here: VIX Futures Still in Backwardation: What This Shift Tells Us Now

If the link doesn’t open from the email, click the title.

The Case for Limiting Drawdowns Through Active Risk Management and Hedging: The Math Behind Efficient Compounding

To compound capital efficiently over time, downside risk must be actively mitigated. The key to long-term wealth creation isn’t just capturing upside—it’s protecting capital through asymmetric risk/reward positioning and strict portfolio risk exposure limits.

Read it here: The Case for Limiting Drawdowns Through Active Risk Management and Hedging: The Math Behind Efficient Compounding

Market Breadth Collapse Intensifies: Monitoring for Countertrend Setups with Asymmetric Risk/Reward

The latest internal market data shows a broad collapse in demand and increase in selling pressure across all major S&P 500 sectors.

The percentage of stocks trading above key moving averages—from 5-day to 200-day—has declined sharply. While short-term trend damage is now widespread, we’re beginning to see conditions where countertrend setups with convexity potential may form.

It’s a signal to prepare for an eventual countertrend.

Read it here: Market Breadth Collapse Intensifies: Monitoring for Countertrend Setups with Asymmetric Risk/Reward

Asymmetry in Sector Dispersion: Q1 2025 U.S. Sector Dashboard Insights

Sector dispersion is a gift to the asymmetric investor. When sectors diverge this sharply in trend, volatility, and valuation, the environment rewards those who are willing to rotate tactically and structure trades to capture exponential upside while controlling downside risk. We may use this data to identify setups with capped downside and high upside optionality—hallmarks of true asymmetry.

Read about it here: Asymmetry in Sector Dispersion: Q1 2025 U.S. Sector Dashboard Insights

The Illusion of Asymmetry in Options-Based Buffered, Overlay, and Defined Outcome ETFs

Asymmetry in Action: Sector Dispersion Widens in March 2025 Industry Dashboard

When industry performance disperses this widely, the opportunity for asymmetric positioning multiplies. Whether through long/short pairs, structured options, or sector rotation with predefined exits, we may use this dashboard data to seek positive asymmetry—capping downside while preserving exponential upside. At Shell Capital, this is the edge we pursue in dynamic markets.

Read it here: Asymmetry in Action: Sector Dispersion Widens in March 2025 Industry Dashboard

Asymmetric Insights from the March 2025 Dispersion, Volatility, and Correlation Report

How Flow and Positioning Data Can Reveal Asymmetric Opportunities

Asymmetry in Equal Weight Sectors

The Volatility Mullet!

You wouldn’t know it from watching the VIX index alone, but something interesting is happening beneath the surface. The VIX futures curve — the structure that really drives volatility-linked products like VXX, VIXY, and UVXY — is showing signs of indecision. Here’s what it means for asymmetric hedging.

Read it here: The Volatility Mullet: What the VIX Curve Is Quietly Telling Us Today

The Stock Market Risk/Reward Asymmetry Has Shifted

The stock market is a constant battle between buying pressure and selling pressure, and recently, that battle has shifted in a meaningful way. After a strong rally earlier in the year, we’ve now seen a notable change in the risk/reward asymmetry. Markets don’t move in a straight line, and shifts in trend strength often signal the potential for new opportunities—or new risks. Read more: The Stock Market Risk/Reward Asymmetry Has Shifted

Ray Dalio and Elon Musk Are Right About U.S. Debt—And Here’s Why

Ray Dalio and Elon Musk see the U.S. debt problem for what it is: an unsustainable ticking time bomb.They aren’t just speculating—they’re using decades of experience in finance, economics, and business to sound the alarm.And when two of the sharpest minds in their fields are saying the same thing, it’s time to connect the dots.

Read it here: Ray Dalio and Elon Musk Are Right—And Here’s Why

On Bubble Watch: A Critical Look at Market Cycles for Asymmetric Investing and Trading

Howard Marks has a unique ability to distill complex market dynamics into clear, actionable insights, and his latest memo, “On Bubble Watch,” is no exception. It’s a powerful reminder of the importance of recognizing the telltale signs of a market bubble, the psychology driving it, and the necessary caution that comes with it.

Read it: On Bubble Watch: A Critical Look at Market Cycles for Asymmetric Investing and Trading

Are Credit Spreads Signaling Asymmetric Risk?

The ICE BofA US High Yield Index Option-Adjusted Spread (OAS) is a key measure of risk sentiment in the credit markets. Historically, extreme levels in credit spreads have preceded major shifts in market conditions, often serving as a leading indicator for broader financial stress or recovery.

Today, as we find ourselves in one of the tightest credit spread environments in decades, it’s worth asking: Are investors underpricing risk, and does it present an asymmetric opportunity?

Find out here: Are Credit Spreads Signaling Asymmetric Risk?

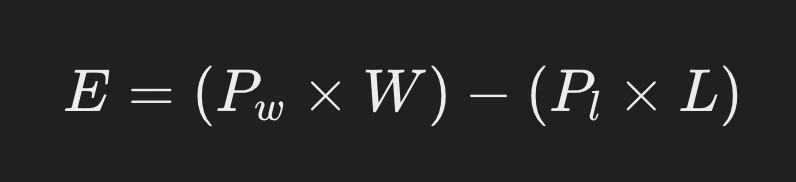

How Do You Know a Investing and Trading Strategy is Asymmetric and Robust Long Term?

For more than two decades, I’ve required a mathematical basis to maintain confidence in my decisions, especially during challenging periods inherent in every investment or trading strategy.

Read it at A Mathematical Basis for Believing in Asymmetric Trading Systems

The Stock Market is at an Inflection Point

See the observation here: The Trend Remains Up for the Stock Market, But Risk is Increasing as the Trend is Weakening

Asymmetric Risk/Reward is More Than Just Buying Undervalued Stocks

Many investors believe they are pursuing asymmetric opportunities when they buy stocks they think are undervalued or have more upside than downside.

But true asymmetry isn’t just about perceived valuation gaps—it’s about structuring risk in a way that limits the downside while allowing for uncapped or asymmetric upside.

The reality is, just buying a stock you think is undervalued doesn’t create asymmetry.

It may offer potential upside, but if there’s no predefined risk management, the downside remains open-ended.

Asymmetry isn’t about hoping you’re right—it’s about ensuring that even if you’re wrong, the damage is controlled, and if you’re right, the reward is exponentially greater.

The Flawed Assumption of “Undervalued” Stocks

Many investors assume they have an asymmetric opportunity when they buy a stock trading below what they believe to be its intrinsic value.

The thinking goes:

- The downside is “limited” because the stock is already cheap.

- The upside is large because the market will eventually recognize its value.

The problem?

Cheap stocks can get cheaper, and markets don’t always correct “mispricings” in a timely manner—if ever.

Many deep-value stocks stay undervalued for years, and some go to zero.

Buying something just because it “should” go up does nothing to limit risk.

True Asymmetry Requires Predefined Risk Management

A true asymmetric investment isn’t just about identifying opportunities with more upside than downside—it’s about structuring the position to ensure a capped downside and disproportionate upside.

There are several ways we do this:

- Options Strategies: Buying call options allows for defined risk (the premium paid) with unlimited upside potential. Likewise, strategies like risk reversals or spreads can enhance asymmetry.

- Stop-Losses & Exit Strategies: Setting a predefined exit point ensures the downside is controlled rather than open-ended.

- Hedging & Position Sizing: Using hedges or maintaining proper position sizing ensures that no single position can derail a portfolio.

The Key Difference: Hope vs. Structure

The key distinction is that just buying something undervalued is based on hope, while structuring asymmetric trades is about controlling risk.

Hope is not a strategy—a predefined downside is.

If you enter a trade where:

1. Downside is capped (through predefined exits or contractual limits like options).

2. Upside is uncapped or exponentially larger (through compounding, leverage, or event-driven catalysts).

3. The approach is repeatable (not relying on luck but a systematic framework).

Then you are truly executing an asymmetric strategy.

But the process of creating asymmetric investment returns doesn’t stop there; it continues at the portfolio level.

Conclusion: Asymmetry Is Intentional, Not Accidental

Simply believing a stock has more upside than downside does not create asymmetric risk/reward—it’s just a market opinion. Asymmetry must be structured in advance, not assumed after the fact.

For investors who seek true asymmetric payoffs, the focus shouldn’t just be on finding “cheap” stocks but on structuring trades where the worst-case scenario is predefined and limited while the best-case scenario remains disproportionately large.

That’s the difference between hoping for a high return and engineering an asymmetric edge like we do.

The Technology Sector Gets More Oversold

Click to read: The Technology Sector Gets More Oversold

Stock Market Sentiment Has Reached an Extreme

Mike Shell shares his latest: Stock Market Sentiment Has Reached an Extreme

Shell Capital Management, LLC, is Celebrating its Twentieth Anniversary as a Registered Investment adviser!

Click here to read this post.

When Volatility Gets Asymmetric

Realized volatility has reached an extreme low.

See the implications at Volatility Expansions Eventually Follow Periods of Low Volatility.

From an investor sentiment perspective, is this what 2017 felt like? (before the crash in 2018)

Someone asked, “From a sentiment perspective, is this what 2017 felt like?”

My observation:

VIX as a Companion for Hedge Fund Portfolios

Volatility in general, and VIX in particular, is widely thought to influence hedge fund returns. This article shows that not only is VIX negatively correlated to hedge fund returns, the correlation profile is asymmetric with the correlation being more negative in negative months for hedge funds. When hedge funds are delivering the worst quartile returns, the diversification benefit is best. Equally interestingly, when the diversification or protection is least needed, i.e. in highest quartile months, the correlation is positive. It is explored whether a small allocation to VIX can be constructively used for risk reduction or downside protection in broad based hedge fund portfolios. Standard mean variance measures suggest a static allocation of 0% to 10%, which is consistent with the common sense approach of allocation only a very small portion of the portfolio to volatility. This range, together with the mean reverting property of VIX, and the asymmetric correlation of VIX and hedge fund returns is used to explore a tactical allocation strategy that outperforms a simple static allocation of VIX or a portfolio with no VIX allocation on a risk adjusted basis, while reducing downside risks.

Read: VIX as a Companion for Hedge Fund Portfolios

Here’s What the Federal Reserve is Most Likely to do at Future FOMC Meetings

Asymmetry isn’t just about asymmetric risk/reward for asymmetric investment returns, it’s also the probability of one outcome over another when it’s skewed.

I share my latest observation of the Federal Reserve FOMC decision yesterday in the FOMC Meeting Review: Likely the Last Interest Rate Hike.

US Dollar and Gold Trend

See this observation here: US Dollar is in a Downtrend but Statistically Oversold Short-Term as Gold Turns Up

Lower Odds of a US Recession

See the note:

Using Volatility for Asymmetric Risk Reward

Volatility trading may be used for asymmetric risk/reward when the odds are in our favor.

That’s the proposition of:

You must be logged in to post a comment.