See this observation here: US Dollar is in a Downtrend but Statistically Oversold Short-Term as Gold Turns Up

Category Archives: Trend Following

When Trend Analysis and Options Positioning Collide

This observation was originally published at This is Where Trend Analysis and Options Positioning Gets Interesting

Up until now, the trend S&P 500 index has failed to break above the 4200 level.

I highlighted 4200 in yellow on the chart to point out the SPX has trended around 4200 several times over the last two years, but until this week, these higher levels were met with selling pressure. The selling pressure was enough to provide overhead resistance, selling pressure not allowing the index to move to a higher high.

Such resistance is caused by investors and traders who may have been trapped at lower prices after adding exposure around this level.

Once the index gets back to the level it tapped multiple times, those who wished they’d sold sooner (before the down-trends below 4200) sell to break even.

But that’s just one example of the thinking behind the concept of resistance from selling pressure preventing a new high breakout.

Another resistance has been a large wall of call options.

A Call Wall is the strike with the largest net call option gamma. Market maker (dealer) positioning can create some of the biggest resistance levels and holds a lot of the time when a Call Wall defines the upper boundary of the probable range.

Below is a recent example. The grey bars are a lot of call options on the SPX.

We expect the price to slow down as it reaches the Call Wall level, but it sometimes trends above it, then drifts back below within a few days. So, it takes more than a few days to confirm the wall of calls has increased to a higher level.

No market analysis is ever perfect.

It’s always probabilistic, never a sure thing.

Call Walls can have a sticky gamma effect, making it difficult for the price to break out. When market makers are long gamma, it accelerates their directional exposure favorably as the size of their positions dynamically increases when they are positioned in the right direction creating an open profit. When these designated market makers have a large profit from being positioned on the correct side of the trend, they can sell some of the underlying positions (like SPX) to get their directional exposure closer to neutral and realize a profit. That’s why market makers trade in the opposite direction of the underlying (like SPX) when they are positive gamma, and this suppresses volatility and creates a pin.

So, up until now, the large Call Wall at 4200 was hard to break out of because there are so many calls the dealers were hedging and/or taking profits as the level was reached.

This form of derivatives resistance matched up with the aforementioned technical trend resistance can create a formidable overhead supply of sellers.

The selling pressure has been enough to mute the SPX, for now.

But, looking at the SPX today, up 1.5% to 4286 as of the time of this writing, the index is pushing up and may be enough to clear out all this overhang.

What could go wrong?

There is no shortage of negative macro risks, but that’s beyond the scope of this technical observation.

Next week, the SPX will see another big test with a large number of calls set to expire.

Interestingly, today I noticed a very bullish flow into VIX options betting on a volatility expansion with VIX down to 14.80 for the first time since 2021.

Meanwhile, the VIX term structure is 11% contango between July and June, so ETFs like VXX are rolling from 16.8 to 18.7 (aka selling low, buying high) which is a headwind even if VIX spikes.

So, the stock market index is trending up and trying to print higher highs and higher lows, and implied (expected) volatility is contracting.

Can the S&P 500 gain enough momentum to keep trending up?

One way to view the directional trend is the price channel the stock index is creating. with higher lows and higher highs.

I see this and wonder if the SPX will reach the 4400 level it’s trending toward.

To see if it has enough momentum left to move up that far, I look at recent velocity.

Its relative strength suggests it could move up enough to tap the 4300 level before it starts to get overbought, but then it will be overbought.

So, 4400 may be a resistance without a flat base or ~5% correction.

Only time will tell if the Call Wall, expirations, and long-vol positioning today has more impact or if there’s enough momentum to drive it higher, but we’ll be watching to see how it all unfolds.

Mike Shell is the founder and Chief Investment Officer of Shell Capital Management, LLC, and the portfolio manager of ASYMMETRY® Managed Portfolios. Mike Shell and Shell Capital Management, LLC is a registered investment advisor focused on asymmetric risk-reward and absolute return strategies and provides investment advice and portfolio management only to clients with a signed and executed investment management agreement. The observations shared on this website are for general information only and should not be construed as investment advice to buy or sell any security. This information does not suggest in any way that any graph, chart, or formula offered can solely guide an investor as to which securities to buy or sell, or when to buy or sell them. Securities reflected are not intended to represent any client holdings or recommendations made by the firm. In the event any past specific recommendations are referred to inadvertently, a list of all recommendations made by the company within at least the prior one-year period may be furnished upon request. It should not be assumed that recommendations made in the future will be profitable or will equal the performance of the securities on the list. Any opinions expressed may change as subsequent conditions change. Please do not make any investment decisions based on such information, as it is not advice and is subject to change without notice. Investing involves risk, including the potential loss of principal an investor must be willing to bear. Past performance is no guarantee of future results. All information and data are deemed reliable but are not guaranteed and should be independently verified. The presence of this website on the Internet shall in no direct or indirect way raise an implication that Shell Capital Management, LLC is offering to sell or soliciting to sell advisory services to residents of any state in which the firm is not registered as an investment advisor. The views and opinions expressed in ASYMMETRY® Observations and Asymmetric Investment Returns are those of the authors and do not necessarily reflect the position of Shell Capital Management, LLC. The use of this website is subject to its terms and conditions.

Renaissance Technologies, Considered the “Best Money Manager on Earth”, Uses Technical Indicators to Drive its Automated Trading Systems

Technical indicators get a bad rap among some groups in the quantitative trading profession, but many of the most famous profitable investment managers apply technical indicators to global markets.

Trend Following U.S. Sectors February 2023

U.S. Stock Market Trend Following Update

I just shared my latest observations of the U.S. stock market trend in U.S. Stock Market Trend Following as of February 18, 2023.

Click here to read it.

Trend Following Natural Gas and Heating Oil

Nat gas, short street name for Natural Gas, has crashed since December.

I discuss it in: Trend Following Natural Gas and Heating Oil

Oops a whipsaw

I tend to focus on risk management in these occasional observations I share.

My focus is on risk management because that’s my edge.

If I can direct and control my possibility of loss through tactical trading decisions, then I’m left to focus on the upside of profits.

I pinned that on my wall twenty years ago when I was testing asymmetric trading systems for asymmetric risk/reward and asymmetric investment returns.

As I intensely studied the mathematical expectation of trading systems, I concluded the downside drawdown is the part I have the potential to control.

If a position is trending down, I can exit, and reduce my exposure to zero.

I could also use exchange-traded options for defined risk. ie. if I buy a call option for $5 that’s all I can lose if the position doesn’t become profitable.

I could instead place a stop loss exit $5 below the entry price for a similar effect, but the position could gap down $10, and the loss would be larger than the limited call option would have been.

These are the kind of portfolio management decisions we get to choose from as investment portfolio managers.

I discuss this more in How is trend following with a stop loss optionality similar to a call option?

Our issue at hand today is the trendline whipsaw of the stock market index.

In Stock Market Resumes Downtrend I shared the observation the U.S. stock market as measured by the S&P 500 stock index, has trended down from a lower high.

Here’s the chart:

I went on to point out the stock index wasn’t yet oversold, and the number of stocks in the 500 in an uptrend was trending down.

Trend lines aren’t magic; they’re just a general trend guide.

I wasn’t seeing heavy selling pressure, so I thought “we’ll see.”

Here’s an update. See below for the context of the numbers.

- The downtrend line for the S&P 500 is now negated as the stock market has reversed back up and the index easily trended above the trendline and broke out to the upside. This will likely drive some to call the bear market over and suggest a new bull market has begun.

- Momentum, as measured by 14-day relative strength, indicates the SPX isn’t yet overbought at 62, and I’d only consider it so above 80. Read: there’s still room to run if it wants. There will be little resistance from velocity moving too far too fast.

- The percent of SPX 500 stocks trending above their 200-day moving averages is at 67%, so 33% of the stocks could still trend up, and 67% isn’t a level I consider resistance. That is, if it were at 80% it would indicate most stocks have already trended up, so the desire to buy may be getting exhausted.

- The average true range of the past 15 days shows a visual representation that realized volatility is declining. In fact, realized vol has declined to the August 2022 level.

I’ll stop there to keep this succinct.

The bottom line is the stock market was trending down, and it’s now reversed back up into a notable uptrend.

I started with observations of risk management because no indicator is ever perfect, they’ll all imperfect.

When every new moment is unique, and we’ve never been “here” before, anything can happen.

The best we can do is define the direction of the trend and follow it, until it reaches an extreme, or reverses down.

Ironically, as the realized volatility is now as low as it was in August 2022, that’s also when I shared Whipsaw and warned I have a hunch we’re going to hear the word “whipsaw” a lot in the coming months.

For the past year, we’ve survived and thrived through a prolonged bear market that may be much longer and deeper if the U.S. economy enters a recession.

Only time will tell if the U.S. is in a recession, or if we’ll instead see the soft landing our friends at Goldman Sachs expect.

But for now, the U.S. equities trend is back up again, and the Fed’s interest rate decision next week will likely be the driver of what happens next.

I expect 2023 to be a very challenging year for macro economics, and it’ll be fun to watch.

At Shell Capital, we just want to repeat another profitable year like last year, or better.

Mike Shell is the founder and Chief Investment Officer of Shell Capital Management, LLC, and the portfolio manager of ASYMMETRY® Managed Portfolios. Mike Shell and Shell Capital Management, LLC is a registered investment advisor focused on asymmetric risk-reward and absolute return strategies and provides investment advice and portfolio management only to clients with a signed and executed investment management agreement. The observations shared on this website are for general information only and should not be construed as investment advice to buy or sell any security. This information does not suggest in any way that any graph, chart, or formula offered can solely guide an investor as to which securities to buy or sell, or when to buy or sell them. Securities reflected are not intended to represent any client holdings or recommendations made by the firm. In the event any past specific recommendations are referred to inadvertently, a list of all recommendations made by the company within at least the prior one-year period may be furnished upon request. It should not be assumed that recommendations made in the future will be profitable or will equal the performance of the securities on the list. Any opinions expressed may change as subsequent conditions change. Please do not make any investment decisions based on such information, as it is not advice and is subject to change without notice. Investing involves risk, including the potential loss of principal an investor must be willing to bear. Past performance is no guarantee of future results. All information and data are deemed reliable but are not guaranteed and should be independently verified. The presence of this website on the Internet shall in no direct or indirect way raise an implication that Shell Capital Management, LLC is offering to sell or soliciting to sell advisory services to residents of any state in which the firm is not registered as an investment advisor. The views and opinions expressed in ASYMMETRY® Observations are those of the authors and do not necessarily reflect the position of Shell Capital Management, LLC. The use of this website is subject to its terms and conditions.

Stock Market Resumes Downtrend

The U.S. stock market as measured by the S&P 500 stock index, has trended down from a lower high.

The S&P is not yet oversold, and implied volatility is around 20%, which is the prior lows over the past year.

At the recent high, 60% of the stocks in the index were trending above their 200-day average and about 80% of the stocks were trending above their 50-day average, both of which have now turned down as an increasing number of stocks are trending down.

Trend lines aren’t magic; they’re just a general trend guide.

I’m not seeing heavy selling pressure, so we’ll see.

Mike Shell is the founder and Chief Investment Officer of Shell Capital Management, LLC, and the portfolio manager of ASYMMETRY® Managed Portfolios. Mike Shell and Shell Capital Management, LLC is a registered investment advisor focused on asymmetric risk-reward and absolute return strategies and provides investment advice and portfolio management only to clients with a signed and executed investment management agreement. The observations shared on this website are for general information only and should not be construed as investment advice to buy or sell any security. This information does not suggest in any way that any graph, chart, or formula offered can solely guide an investor as to which securities to buy or sell, or when to buy or sell them. Securities reflected are not intended to represent any client holdings or recommendations made by the firm. In the event any past specific recommendations are referred to inadvertently, a list of all recommendations made by the company within at least the prior one-year period may be furnished upon request. It should not be assumed that recommendations made in the future will be profitable or will equal the performance of the securities on the list. Any opinions expressed may change as subsequent conditions change. Please do not make any investment decisions based on such information, as it is not advice and is subject to change without notice. Investing involves risk, including the potential loss of principal an investor must be willing to bear. Past performance is no guarantee of future results. All information and data are deemed reliable but are not guaranteed and should be independently verified. The presence of this website on the Internet shall in no direct or indirect way raise an implication that Shell Capital Management, LLC is offering to sell or soliciting to sell advisory services to residents of any state in which the firm is not registered as an investment advisor. The views and opinions expressed in ASYMMETRY® Observations are those of the authors and do not necessarily reflect the position of Shell Capital Management, LLC. The use of this website is subject to its terms and conditions.

U.S. Sector Trend, Momentum, and Breadth Through October 2022

Our objective is asymmetric risk/reward for asymmetric investment returns; we are unconstrained as to strategy or market.

A skillful trend follower wants to catch a trend early in its stage and capitalize on it until it ends, so if we want to identify them early, we must necessarily focus on short-term trends to see if they can become longer-term trends and asymmetric profits.

With that said, in the month of October 2022, eight of the eleven sectors tracked by S&P sector indices are in the green, and three are in the red.

To read the complete observation, see U.S. Sector Trend, Momentum, and Breadth Through October 2022

The stock market trend is being tested

The stock market is now reaching its first short-term higher probability of a countertrend pullback.

The S&P 500 stock index tapped its 200-day average and reached a short-term overbought level based on relative strength and volatility and is now stalling.

The S&P 500 Equal Weight, which gives an equal weighting to all 500 stocks instead of more exposure to the largest companies based on capitalization, crossed above its 200-day average but was reaching an overbought level at the same time.

So, it’s not surprising to see these market proxies roll over at this level.

Two weeks ago I pointed out in The stock market is at an inflection point the S&P 500 was stalling as if there is resistance at this price level, and there’s a lot of potential supply for those in a loss trap, and it was getting overbought as measured by the relative strength index. The index trended up a few more percent before pulling back today.

I don’t normally trade the S&P 500 index, I just use it as a proxy for the overall stock market.

For portfolio management, I get more granular into the sectors inside, and the stocks.

I also include global markets like commodities, bonds, and other alternatives, to provide a global unconstrained opportunity set to find potentially profitable trends.

Trend systems just want to be fed some trends, so the system can extract the parts it wants from the parts it doesn’t want. It’s best to provide a wide range of uncorrelated price trends for trend systems to create a unique return stream from them.

From the broad index like the S&P 500 it’s useful to look inside to see the percentage of stocks that are trending above their 50-day and 200-day averages to gauge the strength of participation in the uptrend.

The percent of S&P 500 stocks trending above the 50-day average has quickly trended up to the red zone.

The breadth thrusts we’ve seen are typical of a new uptrend — unless* it’s a prolonged bear market. *IF this is the early stage of a prolonged bear market that is likely accompanied by a recession, then we’ll see many swings like this as it unfolds along the way.

However, once most stocks are already in uptrends, the enthusiasm to buy may have run out, so I consider the level above 80% to be a higher risk zone. If we are looking for a lower risk entry, it’s below 30%. A strong breadth thrust like this is bullish when it starts and is typical off the lows after stocks have already trended down as much as they have.

At this point, despite the S&P 500 being down 1.5% today, it appears to be a normal pullback from overbought levels. Our relative strength index signals the index was moving up with such velocity it was a little too far, too fast, which is good in the longer term but increased the odds of a retrench in the short term.

I reduced exposure earlier this week, and the price action next week will determine if we reduce further or buy the dip at lower prices.

In the big picture, we’re strolling into the seasonally weakest month for the stock market after a big rally and no shortage of risks to the short-term uptrend, so it’s essential to determine an exit, hedge, or reduce exposure.

On the positive side, the recent decline in volatility and new uptrends suggest systematic trend-following investment programs could provide inflows of several billion dollars a day in stocks for the next few months if it continues.

While everyone else is trying to figure out what’s going to happen next with inflation, rates, and other global macro issues, we focus on keeping our hard-earned capital invested in the direction of the trend.

If the trends change, so will we.

Mike Shell is the Founder and Chief Investment Officer of Shell Capital Management, LLC, and the portfolio manager of ASYMMETRY® Managed Portfolios. Mike Shell and Shell Capital Management, LLC is a registered investment advisor focused on asymmetric risk-reward and absolute return strategies and provides investment advice and portfolio management only to clients with a signed and executed investment management agreement. The observations shared on this website are for general information only and should not be construed as investment advice to buy or sell any security. This information does not suggest in any way that any graph, chart, or formula offered can solely guide an investor as to which securities to buy or sell, or when to buy or sell them. Securities reflected are not intended to represent any client holdings or recommendations made by the firm. In the event any past specific recommendations are referred to inadvertently, a list of all recommendations made by the company within at least the prior one-year period may be furnished upon request. It should not be assumed that recommendations made in the future will be profitable or will equal the performance of the securities on the list. Any opinions expressed may change as subsequent conditions change. Please do not make any investment decisions based on such information, as it is not advice and is subject to change without notice. Investing involves risk, including the potential loss of principal an investor must be willing to bear. Past performance is no guarantee of future results. All information and data are deemed reliable but are not guaranteed and should be independently verified. The presence of this website on the Internet shall in no direct or indirect way raise an implication that Shell Capital Management, LLC is offering to sell or soliciting to sell advisory services to residents of any state in which the firm is not registered as an investment advisor. The views and opinions expressed in ASYMMETRY® Observations are those of the authors and do not necessarily reflect the position of Shell Capital Management, LLC. The use of this website is subject to its terms and conditions.

The stock market is at an inflection point

The S&P 500 is stalling as if there is resistance at this price level, and there’s a lot of potential supply for those in a loss trap.

It’s also getting overbought as measured by the relative strength index.

The yellow horizontal highlight denotes the price range with the most volume, which you can see in the Volume by Price bars on the right which show the volume at each price level that could be support or resistence.

At the current price level, you can see the yellow highlighted area is the price range of the highest volume of the past three months.

In February, the SPY declined and found support, or buying demand, at this level. Afterward, it trended up before trending down to this level again and once again was met with enough buying enthusiasm to hold it for several days, then the support failed and the S&P 500 Index ETF declined.

At that point, those who bought earlier at higher prices around the price level or higher carried a loss.

In May the stock market trended up against but selling pressure dominated and the index once again trended sideways for several days of indecision before finally breaking down in a waterfall decline for several days.

The stock market finally got oversold again and investor sentiment was extremely bearish, and it’s since climbed a wall or worry.

Now the price has trended up to this price level again that has been both support and resistance in the past three months and it seems to be stalling.

Today started off strong, up 1% or more, only to fade by the end of the day.

The stock market is at an inflection point.

If the stock market gets enough buying demand to keep prices trending up this bear market could be over sooner than later. However, with the Federal Reserve increasing interest rates because the annual inflation rate in the US has accelerated to 9.1% and economic growth is slowing, if the US is in a recession, as noted in “Bear Markets with an Economic Recession Last Longer and are More Severe” bear markets typically last much longer and trend down more.

Investors should be cautious this may not be over yet, and far from it.

We’ll see, and probably sooner than later.

The inflation report this week may be a market mover.

Mike Shell is the Founder and Chief Investment Officer of Shell Capital Management, LLC, and the portfolio manager of ASYMMETRY® Managed Portfolios. Mike Shell and Shell Capital Management, LLC is a registered investment advisor focused on asymmetric risk-reward and absolute return strategies and provides investment advice and portfolio management only to clients with a signed and executed investment management agreement. The observations shared on this website are for general information only and should not be construed as investment advice to buy or sell any security. This information does not suggest in any way that any graph, chart, or formula offered can solely guide an investor as to which securities to buy or sell, or when to buy or sell them. Securities reflected are not intended to represent any client holdings or recommendations made by the firm. In the event any past specific recommendations are referred to inadvertently, a list of all recommendations made by the company within at least the prior one-year period may be furnished upon request. It should not be assumed that recommendations made in the future will be profitable or will equal the performance of the securities on the list. Any opinions expressed may change as subsequent conditions change. Please do not make any investment decisions based on such information, as it is not advice and is subject to change without notice. Investing involves risk, including the potential loss of principal an investor must be willing to bear. Past performance is no guarantee of future results. All information and data are deemed reliable but are not guaranteed and should be independently verified. The presence of this website on the Internet shall in no direct or indirect way raise an implication that Shell Capital Management, LLC is offering to sell or soliciting to sell advisory services to residents of any state in which the firm is not registered as an investment advisor. The views and opinions expressed in ASYMMETRY® Observations are those of the authors and do not necessarily reflect the position of Shell Capital Management, LLC. The use of this website is subject to its terms and conditions.

Every new price trend begins with a countertrend

Every new price trend begins with a countertrend, and that’s true for uptrends that roll over into downtrends and downtrends that reverse into uptrends, so trend following starts with a countertrend.

Technology-weighted Nasdaq 100 changed the short-term trend, breaking out above its 50-day average, now in a short-term uptrend.

Past performance is never a guarantee of future performance, but if the Nasdaq uptrend follows through, it’ll need to trend up more than 12% to trade above the longer-term 200-day average.

Nasdaq meets first overhead supply as potential resistant around 13,000.

All the areas above current prices are the hurdle of a trend trying to recover from losses.

Why?

Because many investors and traders may be trapped in losses around those prior lows and highs, the price levels attracted much historical trading.

Many tactical traders mistakenly claim resistance “is” at these levels, but we don’t know if there is resistance to further prices trending up until the price range is reached.

If a price trend reaches a level and reverses back, then we know there was “resistance” to that price level, which means there was selling pressure once the price got to that higher level.

Only time will tell if that is the case here, but we’ll be watching to see if new uptrends are met with selling prior price levels of interest, then we’ll know how much trouble these trends will have trending up into areas investors may have wished they had sold before taking on heavy losses.

To see what I mean, the Nasdaq 100 index was down -33% year to date a few weeks ago, and after a series of higher lows and higher highs (an uptrend) it’s still down -25%.

If you were invested in the Nasdaq type investment this year, or a portfolio of similar stocks, you’ve been in a loss trap.

As prices trend back up, trapped holders may start to tap out, although others may hold on until they get back to breakeven.

This is the kind of price action we’ll observe unfold from here to see which market dynamics are more dominant.

Overhead supply of shares wanting to be sold becoming at least some pressure as resistance is why price trends look so rough and volatile after a downtrend.

At every level the trend reaches, other investors and traders are deciding to buy, hold, or sell.

It’s what makes a market.

For now, we have an uptrend in enough of the high-growth stocks as measured by the Nasdaq 100 index to clear the 50-day average, so no resistance there.

Every new price trends begin with a countertrend and a follow-through.

Let’s see how it goes from here.

Giddy up!

Mike Shell is the Founder and Chief Investment Officer of Shell Capital Management, LLC, and the portfolio manager of ASYMMETRY® Managed Portfolios. Mike Shell and Shell Capital Management, LLC is a registered investment advisor focused on asymmetric risk-reward and absolute return strategies and provides investment advice and portfolio management only to clients with a signed and executed investment management agreement. The observations shared on this website are for general information only and should not be construed as investment advice to buy or sell any security. This information does not suggest in any way that any graph, chart, or formula offered can solely guide an investor as to which securities to buy or sell, or when to buy or sell them. Securities reflected are not intended to represent any client holdings or recommendations made by the firm. In the event any past specific recommendations are referred to inadvertently, a list of all recommendations made by the company within at least the prior one-year period may be furnished upon request. It should not be assumed that recommendations made in the future will be profitable or will equal the performance of the securities on the list. Any opinions expressed may change as subsequent conditions change. Please do not make any investment decisions based on such information, as it is not advice and is subject to change without notice. Investing involves risk, including the potential loss of principal an investor must be willing to bear. Past performance is no guarantee of future results. All information and data are deemed reliable but are not guaranteed and should be independently verified. The presence of this website on the Internet shall in no direct or indirect way raise an implication that Shell Capital Management, LLC is offering to sell or soliciting to sell advisory services to residents of any state in which the firm is not registered as an investment advisor. The views and opinions expressed in ASYMMETRY® Observations are those of the authors and do not necessarily reflect the position of Shell Capital Management, LLC. The use of this website is subject to its terms and conditions.

Inflation is Declining According to this Trend Analysis of Commodities

In economics, inflation is an increase in the prices of goods and services in an economy.

When the general price level rises, each unit of currency buys fewer goods and services; consequently, inflation corresponds to a reduction in the purchasing power of money.

You may not see the value of your money change online like you do with your investment fund values changing daily, but it’s changing.

Inflation is a real risk for everyone, but it’s worse for people who have their money earning a low rate of interest at a bank or another low-yield fixed asset.

If someone believes they are being a “conservative investor” by investing money in an interest-bearing bank account, it’s only because the bank statement doesn’t show the real value of money after inflation.

The latest inflation report shows U.S. Inflation is 9%, three times higher than the long-term average of 3.25%, so if someone is only earning 3% on a CD, the value of their money is 6% less than it was.

That is, they “lost” 6% of buying power.

But that’s not the main point of this observation, it’s just one of many reasons the trend in prices is important.

The US Inflation Rate is the percentage a chosen basket of goods and services purchased in the US increases in price over a year. Inflation is one of the metrics used by the US Federal Reserve to gauge the health of the economy. Since 2012, the Federal Reserve has targeted a 2% inflation rate for the US economy and may make changes to monetary policy if inflation is not within that range. A notable time for inflation was the early 1980’s during the recession. Inflation rates went as high as 14.93%, causing the Federal Reserve led by Paul Volcker to take dramatic actions.

As an investment manager applying trend systems to global markets, I see it much more granular. I’m applying computerized trend systems to a wide range of global currencies, commodities, stocks, and bond markets, so I see the directional trend changes and shifts in momentum. Although I’ve automated the process of monitoring all these global markets, I still like to review the pictures as charts to see what is going on.

I ranked the S&P GSCI Indices by short-term momentum to see which are trending up the most, so we’ll start there.

I think it’s well known that many commodities markets had been trending up this year, but as we’ll see, many of these markets are now in downtrends.

I’ll share these trends in a way that makes it obvious that commodities aren’t just tradable markets, but they impact all of us, and commodities are interconnected. For example, the price of soybeans impacts livestock.

The S&P GSCI Feeder Cattle Index provides investors with a reliable and publicly available benchmark for investment performance in the feeder cattle market. S&P GSCI Feeder Cattle Index is in an uptrend as defined by above the 50 and 200-day moving averages. In fact, in the lower two frames, I include the percent above or below the 50 and 200-day average, and Feeder Cattle is about 5% above its 50-day average and 8% above its 200-day average price.

Feeder Cattle is the strongest uptrend over the past three months. It only gets worse from here.

S&P GSCI All Cattle Index is a broader basket of cattle, and it too is in an uptrend after breaking out of a multi-month base.

Live Cattle represented by S&P GSCI Live Cattle Index looks very similar, and is an uptrend, but not an all-time new high as it’s still below the February high.

Here’s where the weakness in these commodities trends begins. The S&P GSCI Gas Oil Index is in an intermediate-term uptrend; It’s 20% above the 200-day average. But the recent decline pushed it 6% below the 50-day average. The Gas & Oil index is in a primary uptrend, but short-term pullback. Longer-term trends begin with a shorter-term trend, so we’ll see how it trends from here.

Heating oil is represented by the S&P GSCI Heating Oil Index. Like gas and oil, it’s in a primary uptrend, but a short-term downtrend.

Now we’re getting into commodities with a negative price momentum over the past 3 months.

S&P GSCI Sugar Index is in a non-trending, volatile period over the past year, and it’s right at the 50 and 200-day average.

The S&P GSCI Livestock Index, a sub-index of the S&P GSCI, provides investors with a reliable and publicly available benchmark for investment performance in the livestock commodity market. Livestock is another market that’s lost its upward momentum over the past three months, and one to watch for a breakout.

S&P GSCI Natural Gas Index is in a primary uptrend, but recent downtrend in the short term. It tapped its 200-day average and is trending back up, but nearly 7% below where it was three months ago.

I ranked these trends by three-month momentum, so all of the commodities up to this point were outperforming the broad commodity index we know as S&P GSCI Total Return Index. My three-month momentum ranking is completely arbitrary, but it signaled many of these trends had changed recently.

The S&P GSCI Total Return Index is in a primary uptrend as defined by a level above its 200-day average, but it’s in a downtrend since it peaked in June.

S&P GSCI Total Return Index is what many global macro asset managers managing global macro hedge funds use as a benchmark for commodities, so the rest of these trends are more granular looking inside this broader index made up of these other indices.

S&P GSCI Energy Index is in a primary uptrend but has declined materially over the past month.

S&P GSCI Unleaded Gasoline Index is a big one that impacts Americans and our personal economy. S&P GSCI Unleaded Gasoline Index is in a primary uptrend but has corrected a lot these past five weeks. Once again, we see a commodity trend tapping the 200-day moving average, so a breakout below it will signal a changing primary trend.

Coffee is in a downtrend. S&P GSCI Coffee Index is below the 50 and 200 average, signaling it’s in both a short-term and intermediate-term downtrend. This may help explain why Latin American countries like Brazil’s stock index is down, too. Latin America makes a lot of the world’s coffee.

Unless you’re a long/short commodity trader like a CTA trend follower who aims to capitalize on these downtrends as much as the uptrends, this is one of the rare times downtrends are something to cheer on.

S&P GSCI Crude Oil Index is in a short-term downtrend, but a primary uptrend.

Meanwhile, S&P GSCI Cocoa Index is in a downtrend across both time frames.

Hey Crude, as in Brent Crude. We have a downtrend in S&P GSCI Brent Crude Index over the short run after a volatile non-trending period.

An interesting Intermarket analysis this year has been the trend in Gold. Gold is seen by many market participants as a store of value and a safe haven, but S&P GSCI Gold Index is in a downtrend after a sharp uptrend around March. You can probably see how applying multiple time frames can be useful in observing these trends.

By and large, the metals like precision metals are in downtrends.

S&P GSCI Platinum Index is in a downtrend.

Soft commodities, or softs, are commodities such as coffee, cocoa, sugar, corn, wheat, soybean, fruit and livestock. The term generally refers to commodities that are grown, rather than mined. You can see how some of the commodity markets tracked by indices are very granular focused on one single market trend, and others are a basket of commodities within a sector.

S&P GSCI Softs Index has shifted from a quiet uptrend to a volatile downtrend.

A biofuel is any fuel that is derived from biomass, that is, plant or algae material or animal waste.

After an uptrend breakout around March, S&P GSCI Biofuel Index has trended back to the same level it started.

Some of the most common products produced with soybeans are tofu, soy milk, soy sauce, and soy flour. Approximately 85% of soybeans grown around the world are used to make vegetable oils that are either sold to consumers or used commercially according to The Spruce Eats. The USDA says “Just over 70 percent of the soybeans grown in the United States are used for animal feed, with poultry being the number one livestock sector consuming soybeans, followed by hogs, dairy, beef and aquaculture.”

You can probably see how interconnected all this stuff is.

S&P GSCI Soybeans Index is in a downtrend after an uptrend started at the beginning of this year. Hopefully, this lower animal feed cost will help lower the prices of the livestock that are in uptrends.

Lead is still widely used for car batteries, pigments, ammunition, cable sheathing, weights for lifting, weight belts for diving, lead crystal glass, radiation protection and in some solders, according to RSC.org.

S&P GSCI Lead Index is in a downtrend, so I guess we’ll eventually see the price of ammo and car batteries decline, too. Overall, lead has been a non-trending volatile market the past year, but it’s now more decisively in a dowtrend.

Lean Hog is a type of hog (pork) futures contract that can be used to hedge and to speculate on pork prices.

S&P GSCI Lean Hogs Index has trended into a downtrend, so your bacon price may improve.

Palladium is one of a number of metals starting to be used in the fuel cells to power things like cars and buses as well as in jewelry and in dental fillings and crowns.

S&P GSCI Palladium Index is in a downtrend.

Grains are used around the world and are also called cereals, and are the most important staple food. According to NatGeo, humans get an average of 48 percent of their calories, or food energy, from grains. Grains are also used to feed livestock and to manufacture some cooking oils, fuels, cosmetics, and alcohols.

S&P GSCI Grains Index is in a downtrend after it broke up with momentum going into this year. If you like to eat and drink alcohol, this is great news as it seems the prices should drift back to where they were.

Wheat is used for white bread, pastries, pasta, and pizza, so this downtrend in S&P GSCI Wheat Index is a welcome change.

Dr. Copper is market lingo for the base metal that is reputed to have a “Ph. D. in economics” because of its ability to predict turning points in the global economy.

S&P GSCI Copper Index is in a strong downtrend, so if its reputation holds true, the Ph. D. in economics suggests a global economic slowdown is ahead.

The Royal Society of Chemistry says aluminum is used in a huge variety of products including cans, foils, kitchen utensils, window frames, beer kegs and airplane parts.

If the trend in S&P GSCI Aluminum Index is a guide, the price of your next beer keg or airplane should drift lower. Aluminum is in a downtrend.

Industrial Metal alloys are known for their strength, durability, and corrosion resistance, so engineers, architects, and others in the industrial field use these alloys to construct buildings, wires, pipes, bridges, machines, and much more according to Wieland.

S&P GSCI Industrial Metals Index shows industrial metals are in a downtrend with great momentum.

Industrial metals are down so much I’ll show a two-year chart to see the price is back to 2020 levels.

Last but not least is cotton. I think we all know what cotton is used for. The price of clothes should see some decline with S&P GSCI Cotton Index in such a downtrend.

What we’ve observed is many commodity markets were in uptrends, but have more recently trended down. Not all of these necessarily impact the Consumer Price Index, but we certainly use most if not all of them one way or another.

Commodities are real “stuff”, and the prices of much of this stuff are no longer as elevated as it was. If this flows into lowering prices of the stuff we buy, then we’ll see inflation fall from here.

If inflation trends down from here, it’ll be positive for stocks and bonds and may result in the Federal Reserve pausing its aggressive interest rate hikes.

Now you know why we aren’t long commodities at this point.

Investor sentiment (about stocks) is so negative right now, that any slight improvement in inflation may spark an uptrend, then the extremely bearish positioning may drive short covering to keep the trend going a while.

Let’s see how it all unfolds.

Mike Shell is the Founder and Chief Investment Officer of Shell Capital Management, LLC, and the portfolio manager of ASYMMETRY® Managed Portfolios. Mike Shell and Shell Capital Management, LLC is a registered investment advisor focused on asymmetric risk-reward and absolute return strategies and provides investment advice and portfolio management only to clients with a signed and executed investment management agreement. The observations shared on this website are for general information only and should not be construed as investment advice to buy or sell any security. This information does not suggest in any way that any graph, chart, or formula offered can solely guide an investor as to which securities to buy or sell, or when to buy or sell them. Securities reflected are not intended to represent any client holdings or recommendations made by the firm. In the event any past specific recommendations are referred to inadvertently, a list of all recommendations made by the company within at least the prior one-year period may be furnished upon request. It should not be assumed that recommendations made in the future will be profitable or will equal the performance of the securities on the list. Any opinions expressed may change as subsequent conditions change. Please do not make any investment decisions based on such information, as it is not advice and is subject to change without notice. Investing involves risk, including the potential loss of principal an investor must be willing to bear. Past performance is no guarantee of future results. All information and data are deemed reliable but are not guaranteed and should be independently verified. The presence of this website on the Internet shall in no direct or indirect way raise an implication that Shell Capital Management, LLC is offering to sell or soliciting to sell advisory services to residents of any state in which the firm is not registered as an investment advisor. The views and opinions expressed in ASYMMETRY® Observations are those of the authors and do not necessarily reflect the position of Shell Capital Management, LLC. The use of this website is subject to its terms and conditions.

Fundamental Valuation: Is the Stock Market Cheap or Expensive?

For me, and everyone else even if they don’t realize it, the price trend is the final arbiter.

For more than two decades, I’ve focused my efforts on developing systems to identify trends early in their stage to capitalize on trends as they continue and exit a trend if it reverses.

It all started in business school, where I earned a Bachelor of Applied Science degree in advanced accounting. It was “advanced” because I took the extra advanced classes above a typical accounting major required to sit for the CPA exam in Tennessee. It basically results in a master’s in accounting, but not really, but it’s just the same 150 credit hours.

I rarely speak of my formal college simply because I haven’t considered it a source of edge for investment management.

But maybe it has.

In some conversations recently, people have asked about my background and how I got started as an investment manager and founder of an investment firm. After further review, I’ve come to realize the knowledge I have of financial statements, and the vast details and fundamental information that make them up, is what drove me to observe very little of it really drives the market price in an auction market.

That’s something I’ve always believed, but it occurred to me during business school.

To be succinct; I very quickly discovered undervalued stocks are trading at a cheap multiple of earnings for a reason, and that’s more likely to continue than to reverse.

I didn’t have a lot of capital to play with, and it was hard earned capital. I worked as a Sheriffs’ Officer full time through college fully time, so it took me a few extra years to complete. I wasn’t about to lose too much of what I had in the stock market, so I aimed to cut my losses short early on.

I’ve focused on cutting my losses short ever since, so now I have about 25 years experience as a tactical trader with an emphasis on the one thing I believe I can best limit or control; the downside of my losers.

When I focus on limiting the downside of loss, I am left to enjoy the upside of gains.

But we can’t do that with fundamentals and valuation. Risk can only be directed, limited, managed, and controlled, by focusing on the price trend.

The price trend is more likely to continue than to reverse, as evidenced even by vast academic studies of momentum.

Because a price trend is more likely to continue than to reverse, it’s essential to realize if you attempt to buy stocks that are in downtrends, you’ll likely experience more downtrend.

So, buying what you perceive are “undervalued” stocks is like catching a falling knife they say.

I’d rather wait for the knife to fall, stab the ground or someone’s foot, then pick it up safely.

Knives a dangerous, and up close, even more dangerous than a gun, so govern yourself accordingly.

Nevertheless, the valuation of stocks and overall valuation of the market by and large can be useful to observe at the extremes in valuation.

The chart below tells the story based on Morningstar’s fair value estimates for individual stocks.

The chart shows the ratio price to fair value for the median stock in Morningstar’s selected coverage universe over time.

- A ratio above 1.00 indicates that the stock’s price is higher than Morningstar’s estimate of its fair value.

- The further the price/fair value ratio rises above 1.00, the more the median stock is overvalued.

- A ratio below 1.00 indicates that the stock’s price is lower than our estimate of its fair value.

- The further it moves below 1.00, the more the median stock is undervalued.

It shows stocks are as undervalued as they were at the low in 2011, nearly as undervalued stocks were March 2020, but not as undervalued as stocks reached in the 2008 stock market crash when the S&P 500 lost -56% from October 2007 to March 2009.

If I were to overall a drawdown chart of the stock index it would mirror the undervalued readings in the chart.

As prices fall, stocks become more undervalued by this measure.

My observation is by and large stocks are relatively undervalued, but they can get much more undervalued if they haven’t yet reached a low enough point to attract institutional buying demand.

To be sure, in 2011 when stocks were as undervalued as Morningstar suggests they are now, the stock index had declined about -19%, similar to the current drawdown of -23%.

The waterfall decline in stock prices March 2020 was -34%, although it recovered quickly in a v-shaped reversal, so it didn’t get as much attention as the current bear market which is down 10% less, but has lasted for seven months without a quick recovery.

Time allows the losses to sink in for those who are holding their stocks.

This time the average stock is down much more than the stock indexes, too, so if you’re holding the weakest stocks your drawdown is worse than the index.

In that case, you’re probably wondering how low it can go.

If stock prices haven’t yet be driven down to a low enough level to attract big institutional capital to buy these lower prices, stocks can certainly trend down a lot lower from here.

For example, in the 2007 – 2009 bear market known as the 2008 Financial Crisis, one I successfully operated through as a tactical trader and risk manager, the stock index dropped -56% over 16 grueling months.

The infamous 2008 crash included many swings up and down on its way to printing a -56% decline from its high in October 2007.

That’s how bad it could get.

It’s also largely the cause of the situation the U.S. finds itself in today.

Since the 2008 Global Financial Crisis, the U.S. Treasury and Federal Reserve Open Market Committee have provided unprecedented support for the equity market and the bond market.

Passive investors and asset allocators have been provided a windfall from the Fed and Treasury, but it’s time to pay the debt.

For passive investors, they’ve been hammered with large losses this year and risk losing more if stock and bond prices keep trending down.

Stocks are already undervalued, but they can get much more undervalued.

Even worse, as my experience tactically operating through many declines like this since the 1990s reflects, are the paranna bites along with the shark bites.

The shark bite is from a passive asset allocator holding on through a prolonged deep bear market in stock prices as they fall -20%, -30%, -40%, -50% or more.

Because losses are so asymemtric and geometically compound aginast you, these capital losses become harder and harder to recover from.

If you lose -50%, it takes a 100% gain to get it back.

Stock market trends are asymmetric; they trend up much lower than they crash down, so that larger gain needed often takes longer, too.

So your emotional capital is at risk.

When you’re down a lot, you’re thinking and decision-making becomes cloudy and stressed because you[‘re under pressure like a pressure cooker.

You don’t know how low it can go.

If you are a buy and hold asset allocator, your loss is unlimited, as there is not point in which you would exit but zero.

Zero may be unlikely, but -50% or more isn’t, as evidenced by history.

And you’ve not been here before.

You’ve not seen this before.

The Fed has never stretched its open market operations this far before.

We just don’t know what’s going to happen next.

But, I’m prepared to tactically execute through whatever unfolds.

I’m having a great year relatively speaking. I’ve been positive most of the year and haven’t ventured far below our all-time new high.

Times like these are when my skillset is designed to show an edge.

Like many tactical investment managers like trend followers, hedge funds, global macro, I too had a period of relative underperformance of the long-only stock indexes. I held my ground but learned some new tricks during the many swings the past decade, and sharpened my countertrend axe to chip away some of the bad parts we don’t want.

But relative outperformance has never been my objective, especially not against a stock index for stock fund that’s fully invested in stocks all the time.

My objective has always been absolute return, not relative return.

My absolute return objective is what drives me to actively manage risk for drawdown control.

Like a good doctor, I aim to first do no harm… as best I can as a risk taker.

Looking at the Shiller PE ratio for the S&P 500, a long-term observation, the U.S. stock market is still grossly overvalued.

The S&P 500 was the second-highest most expensive valuation in 140 years, and even after the decline this year, the stock index is still twice the valuation of Black Monday in October 1987 and

only down to its extremely overvalued level it was on Black Monday Oct. 19, 1987, when the Dow Jones Industrial Average fell -22% in a single day and just now down to the valuation level the stock index was on Black Tuesday in the 1929 crash.

If you believe in fundamental valuation as a gauge and a guide, anything can happen, so please govern yourself accordingly.

If you need help or have questions, contact us here.

Mike Shell is the Founder and Chief Investment Officer of Shell Capital Management, LLC, and the portfolio manager of ASYMMETRY® Managed Portfolios. Mike Shell and Shell Capital Management, LLC is a registered investment advisor focused on asymmetric risk-reward and absolute return strategies and provides investment advice and portfolio management only to clients with a signed and executed investment management agreement. The observations shared on this website are for general information only and should not be construed as investment advice to buy or sell any security. This information does not suggest in any way that any graph, chart, or formula offered can solely guide an investor as to which securities to buy or sell, or when to buy or sell them. Securities reflected are not intended to represent any client holdings or recommendations made by the firm. In the event any past specific recommendations are referred to inadvertently, a list of all recommendations made by the company within at least the prior one-year period may be furnished upon request. It should not be assumed that recommendations made in the future will be profitable or will equal the performance of the securities on the list. Any opinions expressed may change as subsequent conditions change. Please do not make any investment decisions based on such information, as it is not advice and is subject to change without notice. Investing involves risk, including the potential loss of principal an investor must be willing to bear. Past performance is no guarantee of future results. All information and data are deemed reliable but are not guaranteed and should be independently verified. The presence of this website on the Internet shall in no direct or indirect way raise an implication that Shell Capital Management, LLC is offering to sell or soliciting to sell advisory services to residents of any state in which the firm is not registered as an investment advisor. The views and opinions expressed in ASYMMETRY® Observations are those of the authors and do not necessarily reflect the position of Shell Capital Management, LLC. The use of this website is subject to its terms and conditions.

Does Trend Following Work on Stocks?

Some recent conversations prompted me to revisit some of the return capture and loss avoidance conclusions from the 2005 paper, Does Trend Following Work on Stocks?

Conclusions:

The evidence suggests that trend following can work well on stocks. Buying stocks at new all time highs and exiting them after they’ve fallen below a 10 ATR trailing stop would have yielded a significant return on average. The evidence also suggests that such trading would not have resulted in significant tax burdens relative to buy & hold investing. Test results show the potential for diversification exceeding that of the typical mutual fund. The trade results distribution shows significant right skew, indicating that large outlier trades would have been concentrated among winning trades rather than losing trades. At this stage, we are comfortable answering the question “Does trend following work on stocks?” The evidence strongly suggests that it does.

Does Trend Following Work on Stocks?

Following the Trend of Inflation and Risk of Bonds

In How We’ll Know if a Recession is Imminent I said if the 10-2 Year Treasury Yield Spread crosses below zero, and the yield curve becomes inverted, that’s what will signal a recession is probably imminent, but a recession may not be identified until 6 – 24 months later.

We can’t wait until a recession is called to manage our investment risks; the stock market has historically been the leading indicator, declining well in advance.

After U. S. inflation was reported today that inflation accelerated last month to a 7.5% annual rate to a 40-year high, U.S. Treasury Yields trended up to 2%.

Since the 10-2 Year Treasury Yield Spread is the difference between the 2 year U. S. Treasury and the 10 year U. S. Treasury, the spread will tighten as the shorter-term interest rate converges with the longer-term rate.

Recently both yields have been increasing, but the 10-2 Year Treasury Yield Spread is still falling.

The U.S. inflation momentum is driven by rising price trends for autos, household furniture, appliances, as well as for other long-lasting goods we buy.

For example, here is the U. S. Consumer Price Index for used cars and trucks.

It is well known certain consumer prices have been trending up since the pandemic, so the question for the second-level thinker is whether or not these rising inflation trends are already reflected in the prices of stocks and bonds.

So far this year, 2022 has started off with stock markets trending down.

For example, the S&P 500 declined nearly -10% in the few weeks before retracing about half the loss over the past two weeks.

Longer downtrends often retrace about half of their decline before turning down again, so we’ll soon see if this is the early stage of a deeper decline for stocks or a continuation of the primary uptrend.

The Nasdaq 100, which is weighted heavier in large-cap growth stocks and the technology sector, has reacted to more selling pressure down -14% before retracing some of the decline.

Emerging country stocks as measured by the MSCI Emerging Markets Index have finally shown some relative strength against U. S. stocks.

The MSCI Emerging Markets Index trended up at first, then only declined about -3%, and is now positive YTD.

Rising interest rates have a direct negative impact on bond prices, and that is especially true for longer-term bonds.

For example, the ICE U.S. Treasury 20+ Year Bond Index shows the bond price is down over -6% already in 2022.

If you buy and hold bonds, you’re going to learn the risks of bonds and bond funds in a rising rate regime.

Many investors today haven’t invested long enough to have experienced the possible losses that can be driven by this kind of rising inflation, rising interest rates, regime.

Investing involves risks you must be willing to bear, and if you aren’t willing and able to take the risk, you may consider reducing or hedging your risks.

For information about our proactive investment management, active risk management, hedging your risks, and ASYMMETRY® Managed Portfolios, contact us.

Mike Shell is the Founder and Chief Investment Officer of Shell Capital Management, LLC, and the portfolio manager of ASYMMETRY® Managed Portfolios. Mike Shell and Shell Capital Management, LLC is a registered investment advisor focused on asymmetric risk-reward and absolute return strategies and provides investment advice and portfolio management only to clients with a signed and executed investment management agreement. The observations shared on this website are for general information only and should not be construed as advice to buy or sell any security. Securities reflected are not intended to represent any client holdings or any recommendations made by the firm. Any opinions expressed may change as subsequent conditions change. Please do not make any investment decisions based on such information, as it is subject to change. Investing involves risk, including the potential loss of principal an investor must be willing to bear. Past performance is no guarantee of future results. All information and data are deemed reliable but are not guaranteed and should be independently verified. The presence of this website on the Internet shall in no direct or indirect way raise an implication that Shell Capital Management, LLC is offering to sell or soliciting to sell advisory services to residents of any state in which the firm is not registered as an investment advisor. The views and opinions expressed in ASYMMETRY® Observations are those of the authors and do not necessarily reflect a position of Shell Capital Management, LLC. The use of this website is subject to its terms and conditions.

Nasdaq Resumes Downtrend

Breadth of the Stock Market Indicates Internal Weakness and a Stealth Bear Market

I focus most of my attention on my own positions or those on my lists for portfolio management.

Nothing is more telling than what the stocks on my lists that meet certain fundamental earnings growth and technical criteria are doing.

Nothing is more important than the trend, momentum, and volatility of our actual positions.

However, it doesn’t mean we don’t also observe all the other stocks, bonds, commodities, and currencies for signs of strength or weakness.

Even though it may not impact my exposures or drive any change in our positions, I still enjoy taking the time to see what “the market” is doing, overall, in the big picture. That’s what I mostly share here, for informational purposes only.

Below is a chart of the percent of U. S. stocks trending about the 50-day moving average, an intermediate-term trend signal.

A few observations of asymmetry are:

- Only 30% of stocks are trending above the 50 day moving average.

- As we can see in the charge giong back 20 years, its at the low end of its historical range.

- In signficant stock market declines, it gets much worse. For example, in March 2020, more than 90% of stocks were in downtrends, the worst in two decades, including 2008.

- About 8 times this Market Breadth indicator stopped at this level before trending back up, as stocks trended back up.

- About 13 times this Market Breadth indicator didn’t stop here at this level, but instead kept trending loweer as stocks trended lower.

Overall, my observation from this asymmetry (imbalance) is many stocks have already entered downtrends.

Overall, stock market participation started showing weakness after the May 2020 advance, then improved into late 2010 before reaching a peak, and it’s been trending down since.

We may start to hear some call it a “Stealth Bear Market,” a phrase used to describe stock market conditions when the overall indexes are by and large trending higher, but many stocks are trending lower.

A “Stealth Bear Market” may define a trend like this because the S&P 500 stock index has been trending up, as the percent of stocks participating in the uptrend has declined.

Regardless of what we call it, the bottom line is most stocks are already in downtrends, so we’ve been stalking to see when they start trending back up again.

I think it’s essential to actively manage risk and adapt to changing market trends. If you need help, contact us. We manage accounts titled in your own name at an independent custodian of Goldman Sachs.

Mike Shell is the Founder and Chief Investment Officer of Shell Capital Management, LLC, and the portfolio manager of ASYMMETRY® Global Tactical. Mike Shell and Shell Capital Management, LLC is a registered investment advisor focused on asymmetric risk-reward and absolute return strategies and provides investment advice and portfolio management only to clients with a signed and executed investment management agreement. The observations shared on this website are for general information only and should not be construed as advice to buy or sell any security. Securities reflected are not intended to represent any client holdings or any recommendations made by the firm. Any opinions expressed may change as subsequent conditions change. Do not make any investment decisions based on such information, as it is subject to change. Investing involves risk, including the potential loss of principal an investor must be willing to bear. Past performance is no guarantee of future results. All information and data are deemed reliable but are not guaranteed and should be independently verified. The presence of this website on the Internet shall in no direct or indirect way raise an implication that Shell Capital Management, LLC is offering to sell or soliciting to sell advisory services to residents of any state in which the firm is not registered as an investment advisor. The views and opinions expressed in ASYMMETRY® Observations are those of the authors and do not necessarily reflect a position of Shell Capital Management, LLC. The use of this website is subject to its terms and conditions.

Interesting convergence between small and large company stocks

Market cycles and trends are dynamic, ever evolving, so labels such as big and small are subjective, relative, and change over time. Everything is impermanent, so nothing lasts forever.

Investors expect smaller companies stocks to offer greater potential returns over the long-term, but they may come with greater risk compared to large-cap companies. Because smaller faster growing companies are considered more risky, they also require a higher expected return as the “risk premium.”

The Russell 2000® Index measures the performance of the small company stock segment of the US equity universe. The Russell 2000® Index is a subset of the Russell 3000® Index representing approximately 10% of the total market capitalization of that index. It includes approximately 2,000 of the smallest securities based on a combination of their market cap and current index membership.

According to the index provider, the Russell 2000® is constructed to provide a comprehensive and unbiased small-cap barometer and is completely reconstituted annually to ensure larger stocks do not distort the performance and characteristics of the true small-cap opportunity set.

| The Russell 2000 tracks the roughly 2000 securities that are considered to be US small cap companies. The Russell 2000 serves as an important benchmark when investors want to track their small cap performances versus other sized companies. The Russell 2000 tends to have a larger standard deviation in comparison to the S&P 500. However, it also is expected to yield larger returns in positive market environments. The reasoning is smaller companies are in a more aggressive growth phase of a business cycle and small companies are more nimble than large companies to take advantage of opportunities. It is also widely believed small-cap stocks have historically achieved better relative momentum early in a new cycle when liquidity is cheap and overall growth rates are faster. Small-cap companies may also be less affected by global trade conditions given their businesses are more domestically driven than large companies that do business globally. Indeed, up until March, the chart below comparing the relative strength of the price trend of the Russell 2000 small cap index relative to the S&P 500 weighted more toward large companies shows small companies outperformed larger companies significantly. |

However, that has not been the case since the small stock index peaked in March. As I highlighted in yellow, the Russell 2000 has been drifting sideways into a five month long base without a breakout.

In the meantime, the S&P 500 stock index has trended up with decreasing volatility.

What we observe now is a convergence between the two. The S&P 500 is catching up as the Russell 2000 drifts in a non-trending state.

If the market generally believes small company stocks will outperform in the early stage of a new economic expansion and business cycle because they may respond to new positive conditions faster and potentially grow quicker in young bull markets, then this recent relative underperformance the past five months may be bearish sentiment.

It’s going to be interesting to see how this unfolds. It may be a an early warning of a market top, at least temporarily. Then again, if the Russell 2000 can break out of this base to the upside (instead of the downside) it could eventually bring the large companies with it.

A rising tide lifts all boats, so the saying goes, and it sometimes applies to stocks participation in market trends.

We’ll see…

Mike Shell is the Founder and Chief Investment Officer of Shell Capital Management, LLC, and the portfolio manager of ASYMMETRY® Global Tactical. Mike Shell and Shell Capital Management, LLC is a registered investment advisor focused on asymmetric risk-reward and absolute return strategies and provides investment advice and portfolio management only to clients with a signed and executed investment management agreement. The observations shared on this website are for general information only and should not be construed as advice to buy or sell any security. Securities reflected are not intended to represent any client holdings or any recommendations made by the firm. Any opinions expressed may change as subsequent conditions change. Do not make any investment decisions based on such information as it is subject to change. Investing involves risk, including the potential loss of principal an investor must be willing to bear. Past performance is no guarantee of future results. All information and data are deemed reliable but is not guaranteed and should be independently verified. The presence of this website on the Internet shall in no direct or indirect way raise an implication that Shell Capital Management, LLC is offering to sell or soliciting to sell advisory services to residents of any state in which the firm is not registered as an investment advisor. The views and opinions expressed in ASYMMETRY® Observations are those of the authors and do not necessarily reflect a position of Shell Capital Management, LLC. The use of this website is subject to its terms and conditions.

The General Market Cycle Influences Almost Every Stock

“I found that the relationship between the Average and my individual stocks was confined within certain principles, but they could not be measured exactly. From then on I made up my mind to keep watching the Dow Jones Industrial Average, but only in order to determine whether I was in a strong or a weak market. This I did because I realized that a general market cycle influences almost every stock. The main cycles like a bear or bull market usual creep into the majority of them.”

-Nicolas Darvas, Nicolas . How I made 2,000,000 in the stock Market. Larchmont, NY: American Research Council, 1960.

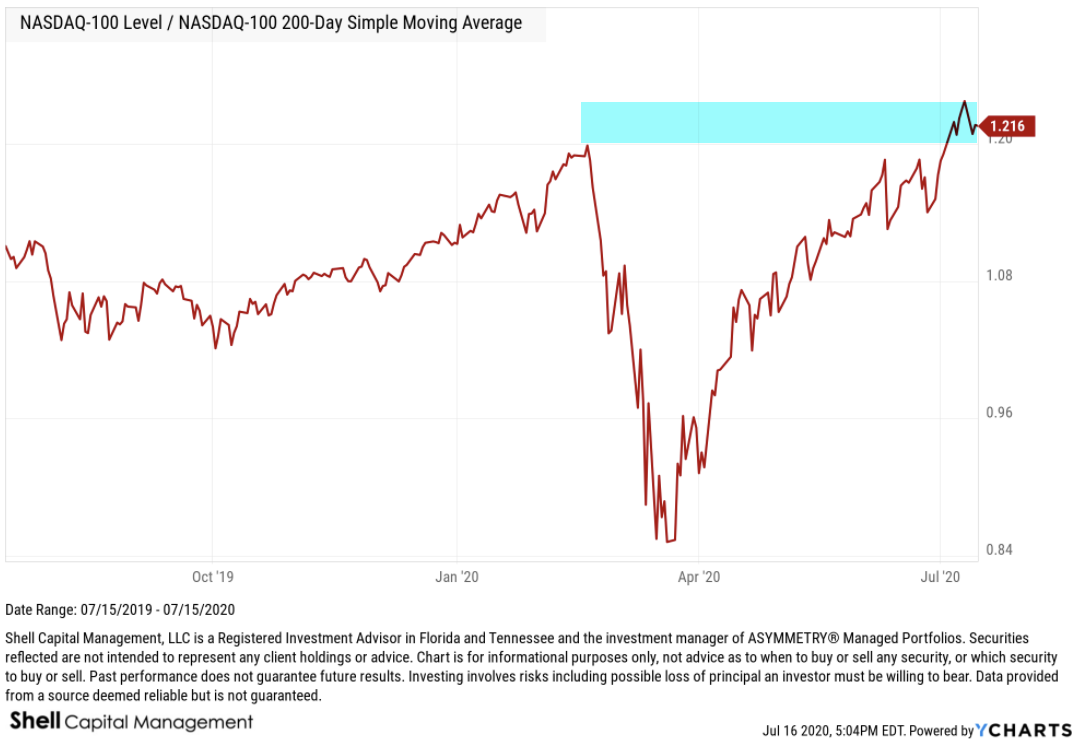

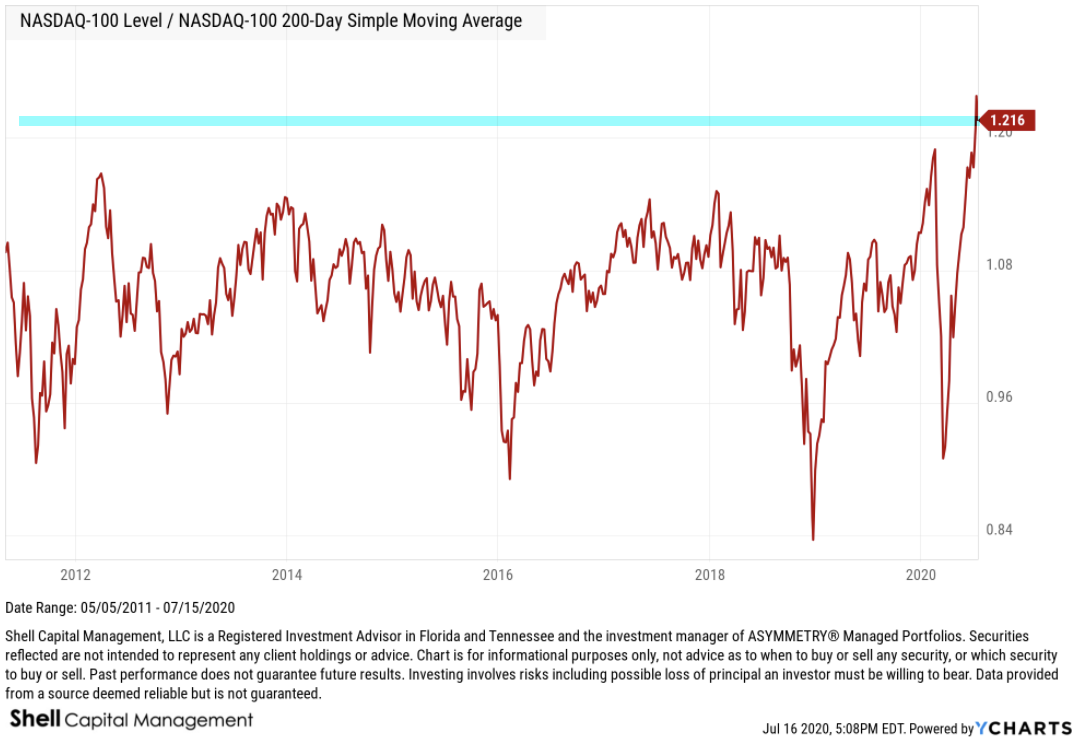

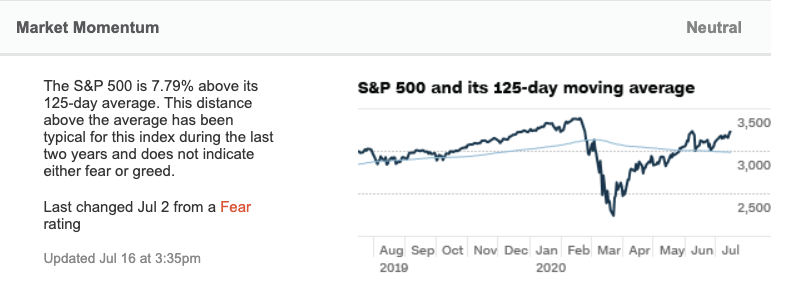

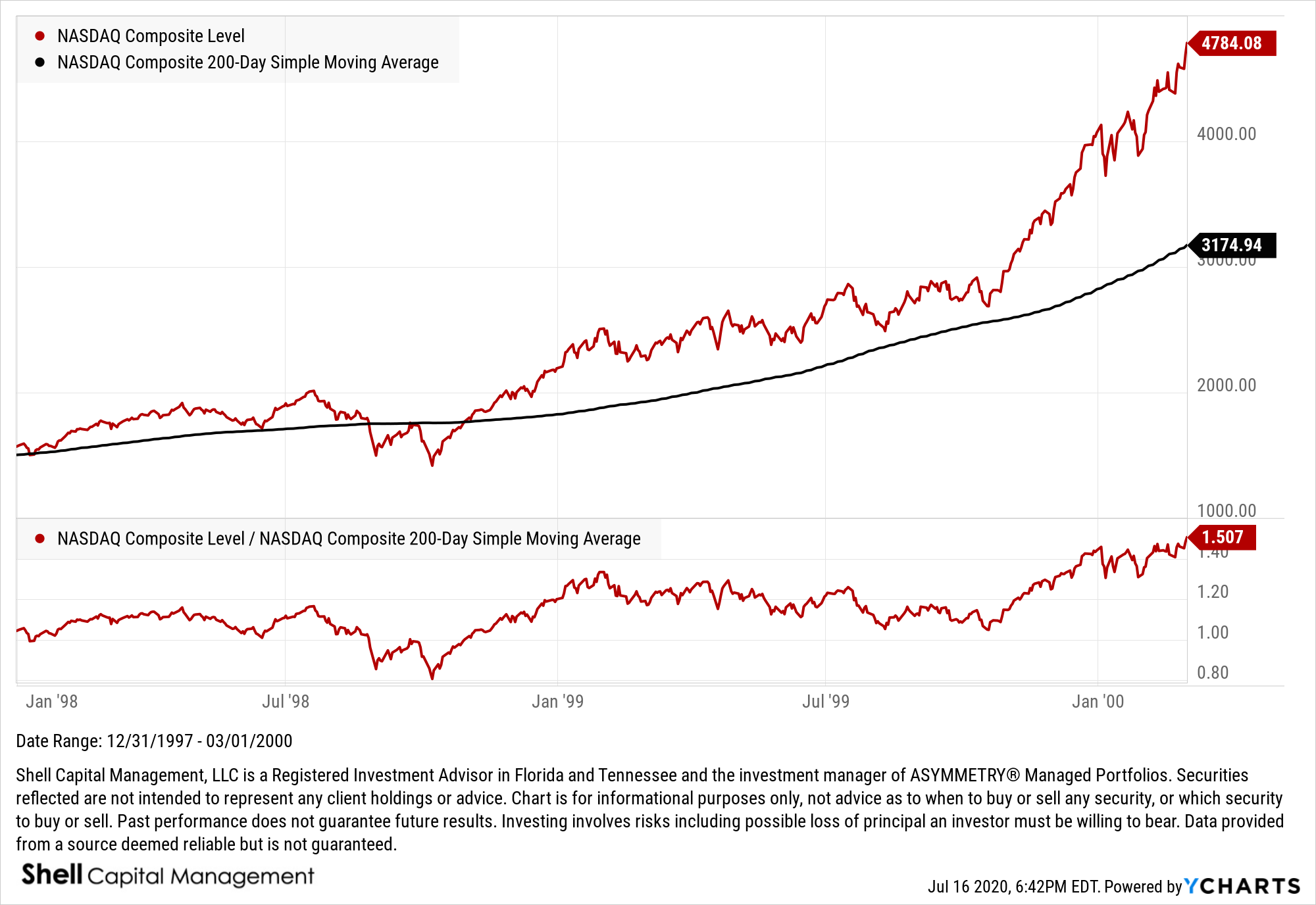

The stock market uptrend is strong, but it’s entering a higher risk level

The year 2020 has been quite a ride for most of us.

It started out with the stock indexes trending up, then collapsing over -30% in March. Now, the stock market proxies are reaching new highs.

Clearly, the trend is up recently, and we’re in this trend.

Overall, these volatile conditions has been hostile for both active and passive strategies.

I’m about as active, tactical, as it gets, and even I’m not thrilled with 2020.

I normally enjoy volatility expansions and such, but this one has presented unprecedented risks from the uncertainty of the global pandemic, but also the risk of price shocks as we saw in March.

Oh, and then there was a contentious Presidential Election.

The risk now is a price shock driven by the enormous stimulus because of the uncertainty of how it will all unfold.

It’s all part of it, and I do embrace uncertainty. I enjoy watching how a movie unfolds, and don’t like to know in advance, even if I could.

I just keep doing what I do; adapt, improvise, and overcome.

It is what it is.

Speaking of volatility: the CBOE S&P 500 Volatility Index (VIX) signals expected volatility is evaporating. The VIX has contracted back down to near 20 again, the same range it reached in August. So, the demand for the protection of options is declining. Sometimes it’s a good sign, and the volatility contraction could continue. Notice in January and February the VIX was at 12, today it’s nearly 22, so it’s elevated.

I’m on guard to protect my profits, so I actively monitor risk and sentiment indicators to see when the potential for a price trend reversal is more likely.

I think we’re starting to get there, but we’ve got aggressive stimulus acting as a put option.

It could keep going.

But, the percent of stocks in the S&P 500 above their 200 day moving averages measures the breadth of participation in the uptrend. Right now, 90% of the 500 or so stocks are in longer term uptrends. That means only 10% are not in uptrends. This strong breadth is a positive sign for momentum, but once it reaches such a high level I begin to wonder when the buying enthusiasm may dry up.

After most of the stocks have already been driven up, we have to wonder when the bullish sentiment reverses to selling pressure.

If you want to realize profits, we have to take them at some point.

Unrealized profits are just the markets money, and can fade away quickly, and even become a loss.

That’s all I’ll share for now. I’m just seeing some signs of what may be becoming an inflection point.

I’m usually more early than I am late, so we’ll see how it unfolds from here.

Investors who are inclined to actively manage risk may start considering reducing exposure or hedging off the risk of loss.

Have a Happy Thanksgiving!