Technical indicators get a bad rap among some groups in the quantitative trading profession, but many of the most famous profitable investment managers apply technical indicators to global markets.

Category Archives: Quantitative Evidence-Based Rearch

Buying Climax Signals a Top in the Stock Market

There was enough buying climaxes in stocks this week to signal a short term top in the stock market.

This week 596 stocks printed a buying climax, which is the most since Feb 2018.

A buying climax is when a stock trends up to a 52 week high, then closes the week with a loss, which is a sign of distribution shifting from strong to weak hands.

A buying (or selling) climax is the result of surge in supply and demand.

The key theory of a buying climax is the exhaustion of demand as the last buyers enter the market.

The final surge of buying typically leads to p

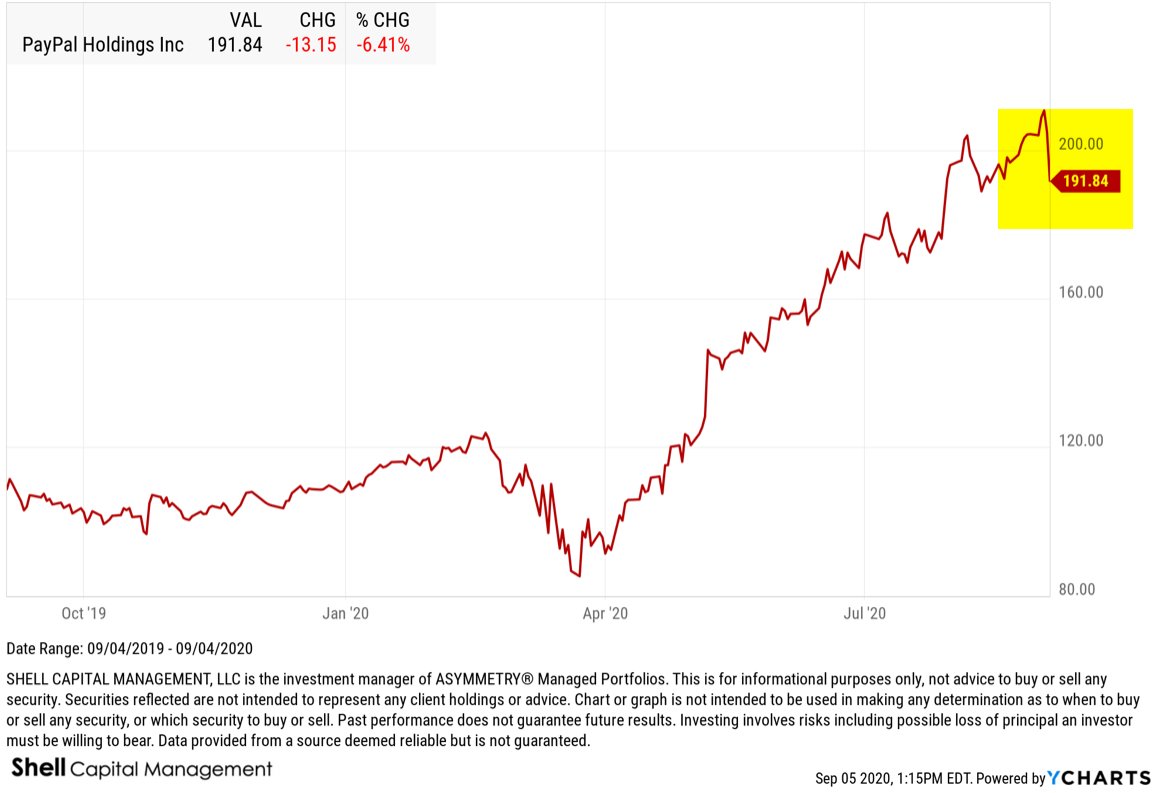

For example, PayPal printed a buying climax this week. Shares of PYPL trended up to a new 52 week high, then closed down on the week. It’s a sign of distribution, as shares of shifting from strong holders to weak. Stocks like PayPal have benefited from people staying at home and buying things online. It was a leading stock with strong relative strength, until now.

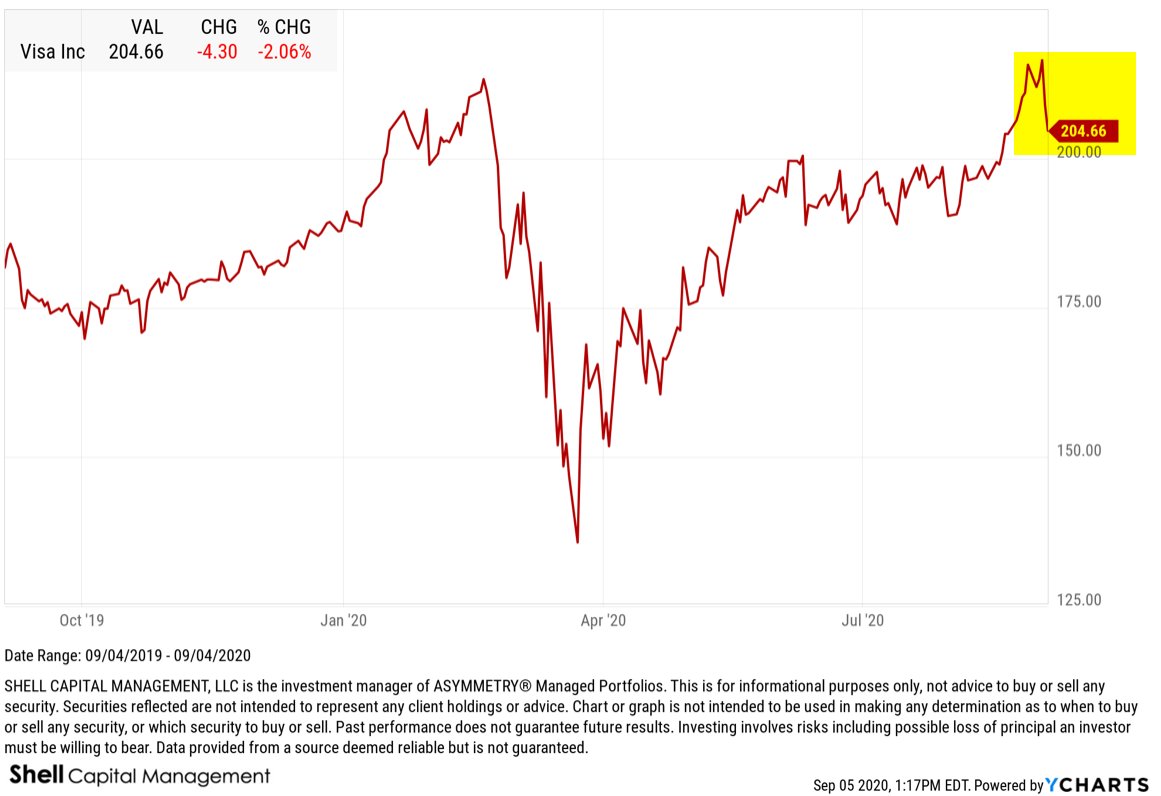

Visa (V) is another example of a BUYING CLIMAX. Visa has been a leading stock with strong momentum and earnings growth, but it trended to a new high, then closed down.

UPS is another example of a BUYING CLIMAX from a leading stock as it printed a new 52 week high, but closed down this week. Not as strong of an example as above, but a buying climax nonetheless.

As stocks like UPS have benefited from the stay at home climate of rising deliveries, it’s obviously driven by companies like Amazon (AMZN), which happens to be another BUYING CLIMAX example.

Amazon trended to a new high, then closed down this week.

Costco (COST) is another example of a big winning stock that printed a new high during the recent euphoria for stocks that closed down this weak to print a buying climax.

Nvidia has been one of the most explosive momentum stocks this year. NVDA printed a new high, then closed -12% off its high this week.

The list of 596 stocks that printed a Buying Climax includes most of the recent leading momentum technology stocks like Apple, Adobe, Microsoft, but also financials like asset manager BlackRock.

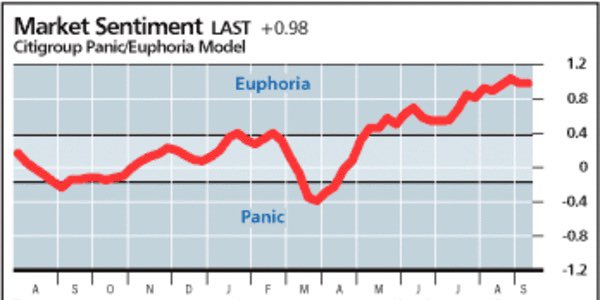

The bottom line is: we’ve seen a period of euphoria, as measured by investor sentiment indicators like the Citigroup Panic/Euphoria Model, and now we’re seeing some blow off tops shift to buying climaxes.

I shared my observations of investor sentiment getting silly the week before in “The weight of evidence is becoming increasingly bearish for the US stock market.”

These quantitative indicators have a long history of signaling a shift in supply and demand, which suggests the risk level is elevated for the stock market.

We typically see a buying climax at the end of a bull market cycle.

Investors confidence the trend will continue results in complacency as to market risk. Their confidence the uptrend will continue drives them to ignore the risk of loss, so they don’t manage their risk or hedge exposure to loss.

Complacent investors believe the current trend isn’t going to reverse anytime soon, so they get caught off guard when it does.

Once they start taking on heavy losses, they may panic sell, adding to the selling pressure that pushes prices down even lower.

Risk averse investors should prepare themselves for an increasing probably of a downtrend in stocks.

This may be just a warning shot across the bow of what may be more selling pressure to come.

Mike Shell is the Founder and Chief Investment Officer of Shell Capital Management, LLC, and the portfolio manager of ASYMMETRY® Global Tactical. Mike Shell and Shell Capital Management, LLC is a registered investment advisor focused on asymmetric risk-reward and absolute return strategies and provides investment advice and portfolio management only to clients with a signed and executed investment management agreement. The observations shared on this website are for general information only and should not be construed as advice to buy or sell any security. Securities reflected are not intended to represent any client holdings or any recommendations made by the firm. Any opinions expressed may change as subsequent conditions change. Do not make any investment decisions based on such information as it is subject to change. Investing involves risk, including the potential loss of principal an investor must be willing to bear. Past performance is no guarantee of future results. All information and data are deemed reliable but is not guaranteed and should be independently verified. The presence of this website on the Internet shall in no direct or indirect way raise an implication that Shell Capital Management, LLC is offering to sell or soliciting to sell advisory services to residents of any state in which the firm is not registered as an investment advisor. The views and opinions expressed in ASYMMETRY® Observations are those of the authors and do not necessarily reflect a position of Shell Capital Management, LLC. The use of this website is subject to its terms and conditions.

If we’re going to see selling pressure become resistance, this is where it starts

Technical analysis is the study of financial market price trends.

What’s funny is that technical analysis has evolved into now being called quantitative analysis.

Technical analysis has long been a method of much debate, until the academics determined that past price performance may have an impact on future performance.

I’ve been a chartist and technician for over twenty years now, and I make no bones about it.

I’m also called an independent thinker, because I don’t care what others think of it. I do me, and you do you.

Academics previously didn’t think the study and measurement of past price trends had any edge to be gained. It’s probably because Eugene Fama said “markets are efficient.” So, if it comes from the ivy tower of university, it must be true?

It isn’t.

The efficient-market hypothesis is a hypothesis in financial economics that states that asset prices reflect all available information.

If markets are efficient, then all known information is already factored into prices, and so there is no way to “beat” the market because there are no undervalued or overvalued securities available.

That’s far from reality.

If the markets reflect all known information, and are efficient, then how could we explain a -34% decline in the S&P 500? and a -37% decline in the Dow Jones Industrial Average in just three weeks?

No, that’s gotta be an under-reaction or an overreaction, or both at different times.

It’s the under-reaction and overreaction to new information that causes prices to drift, or trend, directionally over time rather than just always spiking up or down. It’s always what drives momentum, which is know even accepted by academics who didn’t want to believe that past performance had any impact on the current or future price.

I know, it was a silly proposition. Who wouldn’t look at the past price history for perspective of its historical direction, momentum, and volatility.

I was attracted to charting early on in my career. As I earned an advanced accounting degree, including all the advanced accounting courses on top of the standard ones, which would qualify me for the CPA exam in Tennessee. I don’t know about other states, but Tennessee required 150 credit hours and at least five advanced accounting classes on top of the core accounting degree. It is basically a Master’s degree, since I think a B.S. is about 124 hours.

Anyway, I did it, and the more I learned accounting, the more I realized it wasn’t of much use in an auction market.

In theory, the price of a stock trades at some multiple of earnings and such. If it were so simple, we could easily determine with high probability what a stock should trade at, and it would be accurate.

But it isn’t.

I say that anything other than the price trend itself has the potential to lead you astray from its reality.

That includes fundamental valuation measures.

I know accounting and finance about as well as anyone, and as a student who was trading stocks, it didn’t take long to realize the above statement. If a stock is undervalued, there’s a reason the market doesn’t like it. You may not know the reason yet, but some large institutional investors may.

I prefer to follow the big money that moves the price trend. They aren’t always right, either, but all the really matters is the direction they drive the price.

Does it really matter why?

or who?

So I’m a realist. I’ve got a lot of stereotypes I guess.

As I show you the following charts, I like to also include what may be wrong about them. For example, I’m about to show you the price trend of the S&P 500 index, which includes in it about 500 stocks. So, when we look at the index price trend, we have to realize what it represents. If we make a judgment based on the trend of an index, we’re doing it with an understanding there are about 500 different company stocks moving around inside it that have an impact on the outcome.

It isn’t perfect, but neither is fundamental analysis.

Here we go. What we have here is the popular stock index rubbing up on the top end of a range that represents the prior (February) high.

Technicians, or technical analysts, call this area “resistance”, but I disagree.

I call it potential resistance.

You see, it isn’t resistance until it is.

Resistance is an area on the chart where selling pressure overwhelms buying pressure enough to drive the price lower. A resistance level is identified by a previous price high or peak on price trend chart as I did above.

However, if resistance is where selling overwhelms buying, that hasn’t happened yet. So, it can’t yet be “resistance.”

All analysis requires some common sense and plain critical thinking.

Now, here is the problem. People always want to know of a catalyst that could cause a prevailing price trend to change.

People love a good story.

The reason I believe we’ll see some resistance here, if we’re going to, is because of my momentum measures are signaling the trend is entering the upper end of its range.

The last time the S&P 500 got into this zone was the first week of June.

The S&P 500 declined about -7% afterward.

So, if we’re going to see some pull back, I expect it will come soon.

Afterwards, we’ll then see if it eventually trends back up to a new all time high, or if it instead reverses down into more of a downtrend.

This is how it works. It’s a Bayesian probability, where we update the possibilities as we go.

At each new stage of a trend, the expected value changes.

Let’s see how it unfolds from here.

Mike Shell is the Founder and Chief Investment Officer of Shell Capital Management, LLC, and the portfolio manager of ASYMMETRY® Global Tactical. Mike Shell and Shell Capital Management, LLC is a registered investment advisor focused on asymmetric risk-reward and absolute return strategies and provides investment advice and portfolio management only to clients with a signed and executed investment management agreement. The observations shared on this website are for general information only and should not be construed as advice to buy or sell any security. Securities reflected are not intended to represent any client holdings or any recommendations made by the firm. Any opinions expressed may change as subsequent conditions change. Do not make any investment decisions based on such information as it is subject to change. Investing involves risk, including the potential loss of principal an investor must be willing to bear. Past performance is no guarantee of future results. All information and data are deemed reliable but is not guaranteed and should be independently verified. The presence of this website on the Internet shall in no direct or indirect way raise an implication that Shell Capital Management, LLC is offering to sell or soliciting to sell advisory services to residents of any state in which the firm is not registered as an investment advisor. The views and opinions expressed in ASYMMETRY® Observations are those of the authors and do not necessarily reflect a position of Shell Capital Management, LLC. The use of this website is subject to its terms and conditions.

Everything is Relative: Florida COVID – 19 Trend Update

“It doesn’t matter what we think about a trend, it matters what the crowd thinks about it, but more importantly, how they will respond to it.”

– Mike Shell

For a quick update on the Coronavirus COVID – 19 trend, I’ll use my home state of Florida as the example.

The first cases of Coronavirus (COVID-19) were confirmed on March 1st, 2020, which occurred in Manatee and Hillsborough County. During the initial outbreak of Coronavirus in the United States, Florida’s public beaches and theme parks were under scrutiny as being areas of large crowds. Some in the news media criticized Florida for being relatively late in issuing a “Shelter-At-Home” order, finally putting it in place beginning April 3rd, 2020. Cases ramped quickly from 2 on March 4th, to over 5000 by the end of the month. Since then, however, the number of cases in Florida has leveled off, slowing the rate of change.

I focus on the direction of the trend and its rate of change.

The COVID Tracking Project has now tracked 85,826 cumulative Florida Coronavirus cases , up from 82,719 Thursday. This is a change of 3.88%. Here, I show the standard arithmetic scale on the chart.

The concern I see in the above chart is it seems to be forming a rough S-shaped curve. That is, cases trended up though April and May around the same pace, but this month the rate of change is notably stronger in the linear price scale of an arithmetic chart. The arithmetic or linear chart doesn’t illustrate or scale movements in relation to their percent change, but instead, the linear price scale plots price level changes with each unit change according to a constant unit value. So, there is an equal distance between the data points as each unit of a change on the chart is represented by the same movement up the scale, vertical distance, regardless of what the level when the change happened. The arithmetic chart is the standard basic chart, especially over shorter time series, and it shows absolute trends.

To see how the time series unfolds with a focus on percentage of change, we changed the scale to logarithmic. The logarithmic chart is plotted so that two equal percent changes are plotted as the same vertical distance on the scale. Logarithmic scales are better than linear scales for normalizing less severe increases or decreases. Applying a logarithmic scale, the vertical distance between the data on the scale the percent change, so we can better identify changes in rates of change. Here, we see a strong uptrend in March, then the rate of change has since leveled off. The trouble, however, is it is still trending up and at its high.

Florida Coronavirus Tests Administered is at a current level of 1.5 million, which up from 1.486 million the day before, an increase of 1.72%.

COIVD – 19 Deaths have increased 1.4% since Thursday. Deaths are obviously an essential factor to track. Florida Coronavirus Deaths is at a current level of 3,154.00, up from 3,110.00 yesterday.

The steep uptrend in deaths is scary looking using the arithmetic scale showing the absolute trend in cumulative deaths. In the next chart, we observe the same trend as a log scale, which shows the rate of change is in an uptend, but has been slowing. I labeled the highest high (now) and the average over the period for reference.

Florida Coronavirus Hospitalizations is at 12,862, up from 12,673 the prior day, which is a change of 1.49%. To focus on the rate of change, here is the log scale chart.

Keep in mind, my objective here isn’t to rehash the research of others, but instead to share what I see in the trends and rates of change. As such, this isn’t a complete analysis of the virus. It’s my observations, as a quant and trend system developer and operator. The data source is The COVID Tracking Project which can only report the data as provided by the states.

ZOOMING IN TO PER DAY

The per day trends are important if we want to spot a change in trend quickly. As I warned in “In addition to the equity markets entering a higher risk level of a drawdown and volatility expansion, we now have a renewed risk of the scary COVID narrative driving more fear” a week ago, the uptrend got some attention last week. It doesn’t matter what we think about a trend, it matters what the crowd thinks about it, but more importantly, how they will respond to it.

The uptrend in Florida Coronavirus cases per day has indeed continued and with a notable new high.

I don’t like to see an uptrend like this because it’s a virus, and viruses are contagious, so they spread. In the case of Coronavirus, we can get an idea of the speed and rate of spread by the reproductive number (R0), or ‘R-naught’, represents the number of new infections estimated to stem from a single case. The reproductive number (R0) is relatively high, according to a research paper on the CDC: Assuming a serial interval of 6–9 days, we calculated a median R0 value of 5.7 (95% CI 3.8–8.9).

I’m not going into the details here, but, with a reproductive value of 5.7, an increase in new cases is material in my opinion. That is, once it trends up as we are seeing now, it seems more likely to continue.

Are new cases a function of increased testing?

Some say the increase in new cases per day is a result of more testing. That doesn’t seem to be the case. Below is a charge of cases per day with a time series of tests administered per day under it. Visually, we see no correlation. However, there are many caveats to the data. So, anyone who wants to make a cased leaning one way or another can find ways to skew it, but it is what it is. We have a material increase in cases in Florida.

QUANTIATIVE ANALYTICS

Now, we’ll take a deeper dive and apply some analytics to the trends by observing some ratios.

The Florida COVID – 19 Death Rate has been gradually trending down. Florida Coronavirus Death Rate is at 3.67%.

In the past two weeks of May, the death rate was 4.6%, so it is falling.

In our investment management, I’ve been drawing ratio charts for over two decades to determine which market or stocks has greater trend momentum than another. When the numerator (top) is trending stronger than the denominator (bottom value) we say it has stronger relative strength or momentum. In this case, I have used Florida Coronavirus Cases Per Day as the numerator (top value) and Florida Coronavirus Tests Per Day as the denominator (bottom value), which shows a clear uptrend in the cases per day relative to the tests per day. This concerns me because of the rate of spread. As you look at the ratio chart, consider that a value of 0 would mean new cases per day is the same as new tests per day. Instead, new cases is currently trending higher than testing.

Florida cumulative cases relative to tests administered is also showing some change in trend. the past few weeks. Again, not of the date collected is perfect, but it’s still representative of a statistically significant sample of the population.

My objective for trend following is to identify a trend early in its stage to capitalize on it until it changes.

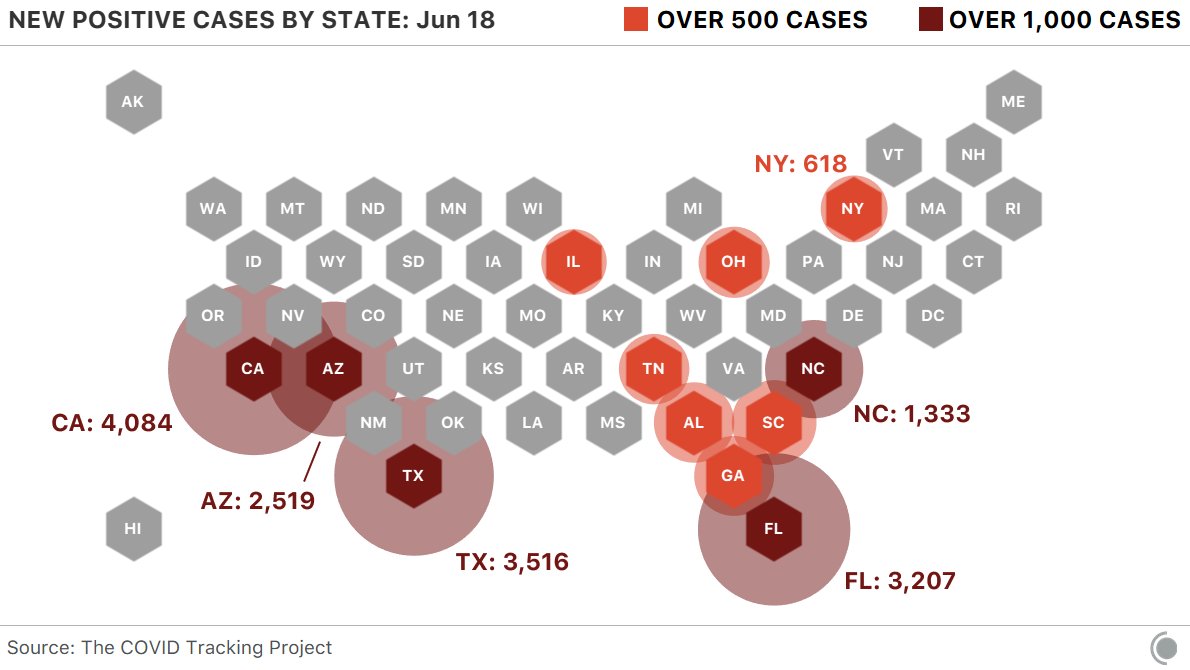

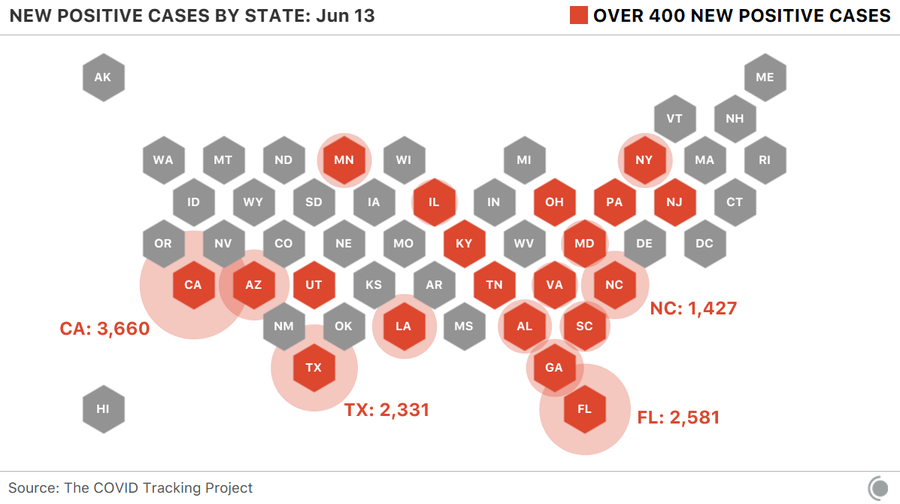

Comparing per day cases to other states doesn’t mean a lot, since the data needs to be normalized. For example, what President Trump said a few weeks ago is a true statement: the number of cases are a function of testing. If we didn’t test and didn’t categorize a case as COVID, there would be no “COVID cases.” Some people, politically motivated, seem to have difficult understanding that simple statement. I’m not politically motivated, so I just say it like it is. With that said, California is winning the match of the most cases per day followed by Texas. Florida is above Arizona.

Again, this doesn’t tell us anything aside from the absolute number. A relative comparison is often necessary and this is an example. For example, we could first calculate per day cases relative to tests or population, then compare them. That’s beyond the scope of my objective today.

Here are the states that reported over 500 new cases. We are seeing some large bubbles in the southwestern United States right now.

The bottom line is, we want to see these levels drifting down, not up. We want to see this trend down.

People who are at high risk should continue to operate according to the risks, but also keep it in perspective that at this point, it isn’t yet so wide spread.

In the big picture, the population in Florida is 22 million and about 86 thousand cases have been labeled COVID 19. 86,0000 out of 22 million is about 4 tenths of a percent, or 0.40%.

That’s 40 cents of $100.

Our changes of contracting COVID 19 in Florida, then, is less than half of 1% at this point.

Everything is relative.

Mike Shell is the Founder and Chief Investment Officer of Shell Capital Management, LLC, and the portfolio manager of ASYMMETRY® Global Tactical. Mike Shell and Shell Capital Management, LLC is a registered investment advisor focused on asymmetric risk-reward and absolute return strategies and provides investment advice and portfolio management only to clients with a signed and executed investment management agreement. The observations shared on this website are for general information only and should not be construed as advice to buy or sell any security. Securities reflected are not intended to represent any client holdings or any recommendations made by the firm. Any opinions expressed may change as subsequent conditions change. Do not make any investment decisions based on such information as it is subject to change. Investing involves risk, including the potential loss of principal an investor must be willing to bear. Past performance is no guarantee of future results. All information and data are deemed reliable but is not guaranteed and should be independently verified. The presence of this website on the Internet shall in no direct or indirect way raise an implication that Shell Capital Management, LLC is offering to sell or soliciting to sell advisory services to residents of any state in which the firm is not registered as an investment advisor. The views and opinions expressed in ASYMMETRY® Observations are those of the authors and do not necessarily reflect a position of Shell Capital Management, LLC. The use of this website is subject to its terms and conditions.

In addition to the equity markets entering a higher risk level of a drawdown and volatility expansion, we now have a renewed risk of the scary COVID narrative driving more fear

People tend to overreact and under-react to new information.

We observe it in the global capital markets more frequently than anywhere, and with immediate feedback.

So, those of us who are adept at identifying and monitoring directional trends in global markets have an advantage in researching trends of all kinds if our quantitative trend methods are robust, and our qualitative judgment and decision-making process is repeatable.

Intellectual skills that are associated with acquiring reliable information about nature are parts of the scientific process. Scientists of all kinds need skills like: communicating, observing, classifying, measuring, predicting, inferring, and researching.

Science isn’t just science, there’s also some art to it. I believe the first skills are more art, such as communicating, observing, classifying.

Many say investing and investment management is both art and a science. Some believe investment management is more art than science, others believe it’s more science than art. Quants try to make it more scientific than artistic.

I do a combination. I am Man + Machine.

The way I look at trends and how time series interact with each other is a robust process that may be applied to anything.

I don’t read articles in Bloomberg or The Wall Street Journal to hear the opinions of others to decide what I believe for myself. When I was a young rookie I did read a lot at first, as we all do, then learned the hard way to focus my efforts on my own original research and thinking.

I do best when I do my own work, as an independent thinker.

So, over the decades as a professional researcher, I first inspect the data to observe any trends and then make sense of it afterward. Sometimes my intention is for predictive analytics, other times it’s just prescriptive. predictive and prescriptive analytics. Predictive analytics provides us with the raw information for making informed decisions, while prescriptive analytics provides us with data-backed, evidence-based decision points that we can weigh against one another.

The scientific method is an empirical method of acquiring knowledge through careful observation, and applying rigorous skepticism about what is observed, realizing how cognitive assumptions and bias can distort how one interprets the observation.

- Descriptive Analytics, applying data aggregation and data mining to provide observations and insight into the past to answer:

- “What has happened?”

- Predictive Analytics, applying statistical models and probabilistic forecasting methods to understand the future and answer:

- “What could happen?”

- Prescriptive Analytics, applying simulation and testing algorithms to advise on possible outcomes and answer:

- “What should we do?”

The Scientific Method and experimenting is a systematic approach to problem-solving and decision-making.

An algorithm may look something like this:

Problem —> Hypothesis —-> Prediction —-> Test Predictions —> Evaluation

We all have biases. All industries have biases. Sometimes these biases gave blindspots. Our biases that can narrow our vision and influence behavior and beliefs. It’s why in asset management, we often consult with researchers outside the industry to help avoid blind spots from industry bias. For example, the personal financial planning profession has a tendency to blindly say “balance your risks and rewards” and “balance your portfolios”, which is about the silliest things I’ve ever heard.

If you balance your risk and reward, you get symmetry on your statement.

If we want asymmetry, we have to skew the risk and reward positively.

It’s essential to identify blind spots, own them without being defensive, and adjust our behavior to avoid it.

MY OBSERVATIONS OF COVID 19

I have an advantage, because I observe COVID 19 trends and rates of change as it is, without any bias as to beliefs about the disease and such. That is, I’m just purely looking at the data we collect and feed into our systems for observation.

It’s like this:

- I focus on; what has changed?

- I look for extremes in levels, like new high or low breakouts.

- I also monitor the rates of change. Fast breakouts are more likely to form an ongoing trend than slow.

FLORIDA COVID 19 UPDATE

As COVID 19 and the mass quarantine strategy for suppressing the spread has become a political debate lately, so some of you may perceive what you are about to read that way.

Don’t.

I have no political bias about this whatsoever. My personal preference is to get past this virus as quickly as possible with as little human suffering as possible. Ignoring the data and facts doesn’t get us there. Exaggerating the data and facts doesn’t either. So, I suggest you try to see the trends for what they are, as I am.

My home state of Florida is now, unfortunately, trending in the wrong direction. I pointed it out with some fellow money manager friends last week of a potential breakout in the trend and it has since trended higher for a meaningful and material breakout. No one wants businesses to open and get back to normal more than me, but what is, is. The cases per day is in a strong uptrend. The prior high was 1575 on April 3rd and 1601 on May 16th. Yesterday was 2581. I hope to see this trend down.

NEW UPTREND IN FLORIDA CASES NOT DRIVEN BY NEW TESTING

The first hypothesis we think of is, well, maybe the uptrend in driven by an increase in testing. Naturally, increasing the absolute testing also should increase the number of positive tests. That isn’t the case. The high in testing was May 20th in Florida. The testing per day remains materially below that level according to the most recent data.

Keep in mind, the lower line is tests administered per day, so there is a lag between testing and the classification of a positive case. In fact, there are natural lags in all of this data. For example, I don’t expect to see the results of the protests until a week or two afterward to account for the lag in showing symptoms, going to get tested, and getting the test results. If there is any increase in the protesting areas, we’ll hear about it next week or later.

FLORIDA COVID 19 HOSPITALIZATIONS AT AN ALL TIME HIGH

Not much to add here. It is what it is.

I can try to make it seem better with a logarithmic based chart, which draws the chart in a way that two equal percent changes are plotted as the same vertical distance on the scale. It visually normalizes the rate of change. The good news is the rate of change overall is slowing. The bad news is this could look like an S-curve later, which would be typical of a spread.

By the way, here is the log chart of the new cases per day. We normally use a logarithmic chart scale for long term charts to normalize the data especially if I’m comparing it to something else where relative strength (rate of change) is measured. But here, we still see a breakout in rate of change. So, it’s a material breakout in my opinion, but I hope it breaks down.

Unfortunately, three of the new uptrends are in states were we have clients; Florida, California, and Texas. Next up is Texas.

TEXAS COVID 19 UPTREND

New cases in Texas is trending up to all time highs. I think Houston, Texas is now at risk of another stay-at-home order.

CALIFORNIA COVID 19 TREND

California new cases per day has trended up to the all time high again. It doesn’t seem to be in direct result of more testing per day, either.

ARIZONA COVID 19 CASES AT NEW HIGH

Arizona is at a high in new daily cases reported, but also in tests per day. The trouble in Arizona is the material new uptrend in hospitalizations.

The momentum in hospitalizations in Arizona is a real problem, and I’m using a logarithmic scale below, but it doesn’t help.

So, we are seeing new hospitalization highs in Texas, Arizona, and North Carolina. We’re showing Louisiana here as well for context, since it had an early COVID-19 outbreak.

We saw 3 states report more than 2,000 cases yesterday: California, Florida, and Texas. A picture speaks a thousand words.

COVID HAS HIT THE NORTH MUCH HARDER THAN THE SOUTH

But the South is now seeing a surge in cases…

And it doesn’t seem to be an increase in testing.

Can hospitalizations keep falling if cases are rising?

Because hospitalizations are rising rapidly in some Southern states.

I expect we’ll be hearing a lot about these new high breakouts in Arizona, Florida, Texas, and California. All of which, by the way, are the hottest and most humid states in the U.S., so much for the heat and humidity killing the virus.

What we have here is, a a notable uptrend across the South. I hope to see it fade, but based on what I’m seeing, it’s more likely to continue. Only time will tell.

If you are at risk, I recommend remaining cautious, wearing the dang mask, and treating this virus with respect.

Speaking of the scientific method used for decision-making.

If you want to get as technical as possible, here’s some homework for the wannabe scientists and armchair mathematicians who really want to get into the maths of the matter. The virus has sparked a lot of important debates around the globe among though leaders. As researchers, we argue and debate our beliefs in hopes to gain new knowledge. One of the most heated public debates has been Taleb and Ioannidis.

The International Journal of Forecasting (IJF) is organizing a special section devoted to “Epidemics and forecasting with focus on COVID-19”. Based on their blog posts, John P. Ioannidis and Nassim N. Taleb will be given the opportunity to think of each other’s arguments about the COVID data and how to use it. Consequently, they will both be invited to write a full paper to better detail their views and why they think the opposite side’s views may not be adequate under the current circumstances. These opinion papers will then appear in the IJF, after scientific review by their peers. IJF should reserve the right to publish a closure based on this debate. This debate will not only allow us to better understand the points of view of the two great scientists but be also left as a guide for how to deal with future pandemics.

Nassim N. Taleb believes that all efforts and resources should be directed to halt its spread and reduce the number of infected and deaths without any concern about forecasting its future course as the uncertainty of doing so cannot be measured and the risks involved are highly asymmetric. See “On single point forecasts for fat tailed variable by Nassim Nicholas Taleb.”

John P. Ioannidis, on the other hand, claims that more reliable information is needed to make multiple billion-dollar decisions and that forecasting has failed us by being too pessimistic about the future growth of the pandemic and by exaggerating its negative effects. See “Forecasting for COVID-19 has failed”

Both of their observations are well worth a read.

In addition to the equity markets entering a higher risk level of a drawdown and volatility expansion, we now have a renewed risk of the scary COVID narrative driving more fear.

Mike Shell is the Founder and Chief Investment Officer of Shell Capital Management, LLC, and the portfolio manager of ASYMMETRY® Global Tactical. Mike Shell and Shell Capital Management, LLC is a registered investment advisor focused on asymmetric risk-reward and absolute return strategies and provides investment advice and portfolio management only to clients with a signed and executed investment management agreement. The observations shared on this website are for general information only and should not be construed as advice to buy or sell any security. Securities reflected are not intended to represent any client holdings or any recommendations made by the firm. Any opinions expressed may change as subsequent conditions change. Do not make any investment decisions based on such information as it is subject to change. Investing involves risk, including the potential loss of principal an investor must be willing to bear. Past performance is no guarantee of future results. All information and data are deemed reliable but is not guaranteed and should be independently verified. The presence of this website on the Internet shall in no direct or indirect way raise an implication that Shell Capital Management, LLC is offering to sell or soliciting to sell advisory services to residents of any state in which the firm is not registered as an investment advisor. The views and opinions expressed in ASYMMETRY® Observations are those of the authors and do not necessarily reflect a position of Shell Capital Management, LLC. The use of this website is subject to its terms and conditions.

Investor sentiment and feelings can be data-driven, quantitative, applying the scientific method, supported by a mathematical basis for feeling and believing

Individual investors are notably less bearish now, according to the AAII Sentiment Survey.

US Investor Sentiment, % Bearish is an indicator that is a part of the AAII Sentiment Survey. It indicates the percentage of investors surveyed that had a bearish outlook on the market. An investor that is bearish, will primarily believe the US stock market will trend lower in the next six months.

Bearish US Investor Sentiment dropped 25%, so only 26.4% of the investors surveyed expect the stock market to fall in the next 6 months. Bearish sentiment is now below its average over the past year, but far from an extreme reading. I marked the high, low, and average on the chart.

The most extreme level of bearish sentiment historically going back to 1989 is all the way down to only 6% Bearish, which we haven’t seen since 2003.

If you notice, the Bearish level has held a higher low the past decade. That is, recent stock market peaks haven’t resulted in those extreme lows since the investor survey started 22 years ago. So, behavior and sentiment surveys aren’t an exact science, nor are they intended to be. Below we see a Bearish level of 20% has been the common low in Bearish sentiment.

I could put the data into a table format and show a mode analysis, which is a study that shows when Bearish sentiment spikes or falls, what happens to the stock market. Since I apply the scientific approach to trends and cycles, I have certainly tested the indicators I observe scientific for quantitative analysis. I require a mathematical basis behind believing what I believe. If it doesn’t test out mathematically using the scientific approach, it would be of little use. To know what is of use, or not, requires quantitative testing. I don’t share my quant work, but instead, prefer to show observations of the trends in the data. When presenting my research, I do so visually.

In the chart below I overlay the % Bearish sentiment in orange over the S&P 500 % off high (the drawdown) in purple. We can visually see how they interact with each other. As the stock market falls, Bearish investor sentiment % spikes up. I highlighted these times.

Investors become more afraid of falling prices after they fall. Investors also extrapolate the recent past into the future, so they expect falling prices to beget further falling prices. We can hypothesize this because investors are more Bearish at lower prices, less so at higher prices.

Okay, so far I’ve only shown the Bearish sentiment.

What about Bullish investor sentiment?

US Investor Sentiment, % Bullish is a gauge of the AAII Sentiment Survey. It registers the percentage of investors surveyed that had a bullish outlook on the market the past week. An investor that is bullish, will primarily believe the market will trend higher in the next six months.

US Investor Sentiment, % Bullish increased 41.33% the week of February 13, 2020. The % Bullish investor sentiment was the most notable change over the last week. Individual investors are notably more Bullish. However, although the Bullish sentiment is well above the average of the past year, individual investor enthusiasm isn’t yet at the highest level reached over the past year, which I marked in the chart.

Meanwhile, the Fear & Greed Index, driven by 7 market sentiment indicators, is Neutral.

So, while individual investors are becoming more bullish about the stock market trend for the next 6 months, they haven’t quite yet reached an extreme level that often signals buying enthusiasm is becoming exhausted. But, the rate of change in Bullish investor sentiment is worth making note of for situational awareness as investors usually believe and do the wrong things and the wrong time at extremes.

So far, the US stock market has been resilient, especially considering the headlines have been dominated by the virus updates and images of people around the globe bearing masks.

“When the facts change, I change my mind. What do you do, sir?”

I’ve kept more of my market risk hedged-off than I’d like (in hindsight) if market prices don’t fall to a lower-risk point, but we’ll see how it unfolds from here.

My edge is discipline and my tactical decisions are completely intentional and come from a fully committed state, so I don’t fear losing money or missing out. I tend to feel the right feeling at the right time, as my feelings are data-driven, quantitative, applying the scientific method, supported by maths for a mathematical basis for feeling and believing. Oh, and a heavy dose of stoicism.

I also change as the facts do, and the only facts that ultimately matter are price trends.

Have a Happy Valentines Day and weekend, friends!

Mike Shell is the Founder and Chief Investment Officer of Shell Capital Management, LLC, and the portfolio manager of ASYMMETRY® Global Tactical. Mike Shell and Shell Capital Management, LLC is a registered investment advisor in Florida, Tennessee, and Texas focused on asymmetric risk-reward and absolute return strategies and provides investment advice and portfolio management only to clients with a signed and executed investment management agreement. The observations shared on this website are for general information only and should not be construed as advice to buy or sell any security. Securities reflected are not intended to represent any client holdings or any recommendations made by the firm. Any opinions expressed may change as subsequent conditions change. Do not make any investment decisions based on such information as it is subject to change. Investing involves risk, including the potential loss of principal an investor must be willing to bear. Past performance is no guarantee of future results. All information and data are deemed reliable but is not guaranteed and should be independently verified. The presence of this website on the Internet shall in no direct or indirect way raise an implication that Shell Capital Management, LLC is offering to sell or soliciting to sell advisory services to residents of any state in which the firm is not registered as an investment advisor. The views and opinions expressed in ASYMMETRY® Observations are those of the authors and do not necessarily reflect a position of Shell Capital Management, LLC. The use of this website is subject to its terms and conditions.

The flaw of average in stock market returns

We apply a lot of probability and statistical analysis for investment management and also our wealth management and strategy.

However, I do it with a complete system and framework that includes a heavy dose of skepticism and acceptance of reality.

There are many things we just can’t know and many other things people believe they know that just ain’t true.

Then, there are many flaws in the perception and how investors and wealth management clients use data.

Like a financial engineer, I focus on what may be wrong, what may go wrong, and how our thinking could be flawed. To achieve this level of reality, we necessary think deeply about it and share our independent thinking with other believable people who may disagree.

One of the flaws I see most often in investment management, retirement planning, and retirement income management is the flaw of averages.

The flaw of averages is the term used by Sam L. Savage to describe the fallacies that arise when single numbers (like averages and average returns for stock and bond markets) are used to represent uncertain outcomes.

A great example of the flaw of averages is a 6 ft. tall statistician can drown while crossing a river that is 3 ft. deep on average.

Too often we see the reliance on historical “average returns”.

Yet, almost 80% of rolling decades since 1900 have delivered returns 20% above or below the historical average

So, there is an 80% chance that the total nominal return for the next decade will be either above 12% or below 8%.

And, then, there could also be underwater periods that are much longer and deeper than the average portrays. These periods may cause investors to tap out when the water gets too deep, or the deep water lasts too long.

You can probably see why I think it’s essential to tactically manage risk to actively direct and control the possibility of loss and control drawdowns.

Knowing what I know, I don’t offer investment management any other way.

It’s why we describe it on the front page of our website at Shell Capital.

Mike Shell is the Founder and Chief Investment Officer of Shell Capital Management, LLC, and the portfolio manager of ASYMMETRY® Global Tactical.

Mike Shell and Shell Capital Management, LLC is a registered investment advisor focused on asymmetric risk-reward and absolute return strategies and provides investment advice and portfolio management only to clients with a signed and executed investment management agreement. The observations shared on this website are for general information only and should not be construed as advice to buy or sell any security. Securities reflected are not intended to represent any client holdings or any recommendations made by the firm. Any opinions expressed may change as subsequent conditions change. Do not make any investment decisions based on such information as it is subject to change. Investing involves risk, including the potential loss of principal an investor must be willing to bear. Past performance is no guarantee of future results. All information and data is deemed reliable, but is not guaranteed and should be independently verified. The presence of this website on the Internet shall in no direct or indirect way raise an implication that Shell Capital Management, LLC is offering to sell or soliciting to sell advisory services to residents of any state in which the firm is not registered as an investment advisor. Use of this website is subject to its terms and conditions.

Your technical analysis is no match for Trump Tweets!

Someone texted me this image this morning.

Now that’s funny right there; I don’t care who you are!

But seriously though, many people like to blame others for their reality. Most of the time, the market does what it does, and something or someone always gets the blame for it – besides them.

It’s an easy way for them to be right. It wasn’t them and their risk exposure that was wrong, it was someone else like the President, or the Fed, or the machines.

I ignore the nonsense and focus on price trends. I focus on the facts.

Yes, I call it technical analysis of price trends, as it has been called for decades.

But, just like we are now seeing trading firms call computerized quantitative trading systems more trendy names like “artificial intelligence” and “machine learning” or “pattern recognition”, others have renamed technical analysis “quantitative analysis”

The trend seems to be driven by those who write research papers, books, and such.

To be sure, an example is a disclosure I saw in an SEC Form ADV registration document. In Methods of Analysis, Investment Strategies, and Risk of Investment Loss, the first lists: Quantitative analysis and Fundamental analysis, but not Technical analysis. I’m going to fictitiously call this firm “QUANT”.

QUANT will primarily utilize Quantitative analysis but may also use other analysis methods, including Fundamental analysis as needed.

Quantitative analysis involves the analysis of past market data; primarily price and volume.

Fundamental analysis involves the analysis of financial statements, the general financial health of companies, and/or the analysis of management or competitive advantages.

Investment Strategies QUANT will utilize long term trading and short term trading strategies.

Under Material Risks Involved, it goes on to say:

Methods of Analysis

Quantitative analysis attempts to predict a future stock price or direction based on market trends. The assumption is that the market follows discernible patterns and if these patterns can be identified then a prediction can be made. The risk is that markets do not always follow patterns and relying solely on this method may not work long term.

Fundamental analysis (I’m skipping this irrelevant part for brevity)

Investment Strategies

Long term trading is designed to capture market rates of both return and risk. Frequent trading, when done, can affect investment performance, particularly through increased brokerage and other transaction costs and taxes.

Short term trading generally holds greater risk and clients should be aware that there is a material risk of loss using any of those strategies.

Investing in securities involves a risk of loss clients should be prepared to bear.

What’s the big deal?

It isn’t a big deal, but, let’s change a single word to see what happens.

Let’s replace “Quantitative” with “Technical” and see if it fits the same.

Technical analysis attempts to predict a future stock price or direction based on market trends. The assumption is that the market follows discernible patterns and if these patterns can be identified then a prediction can be made. The risk is that markets do not always follow patterns and relying solely on this method may not work long term.

Yes, that’s the definition used for Technical analysis.

The point is, they just didn’t want to call it “Technical analysis” because “Quantitative analysis is more trendy in modern times.

But, it’s the same.

I don’t debate others hoping to change their minds, but instead, I do mull over what others believe to see how it may be in conflict with what I believe. By doing that, it allows me to question my own beliefs to see if there is enough evidence to change what I believe. I do that to combat what we are all more prone to do, which is seek out information that confirms what we already believe and ignore information that says it isn’t true. Humans have the tendency to interpret new evidence as confirmation of one’s existing beliefs or theories. If we want to gain new knowledge, we have to consider we may be wrong and apply a scientific approach to discover new knowledge.

Confirmation bias is the tendency to search for, interpret, favor, and recall information in a way that affirms one’s prior beliefs or hypotheses. It is a type of cognitive bias and a systematic error of inductive reasoning.

We have to be careful of looking for information that reinforces what we already believe, without considering what could be wrong about our beliefs.

It’s reverse-engineering.

I try to break it to see if it will break and what makes it break.

…and speaking of Technical Analysis, Long Term U.S. Treasury Bond ETF TLT has been in a volatility expansion, on the upside. Demand has driven its price momentum up to levels historically seen during larger stock market declines. The price is now outside the upper price channel. You can probably observe what it typically does afterward.

Technical Analysis of the S&P 500 index price trend: it looks to me like we’re about to observe a breakout in one direction or the other. The last time, in May, the breakout was to the downside. This time may be different. See the first image above for risk disclosure of what may go wrong — or at least who may be blamed for it 🙂

Technical Analysis of VIX: the volatility expansion has now contracted from 25 to 15. So, the options market now expects the range to be within 15% instead of 25%.

We’ll see if vol expectations continue to drift down, or spike back up.

Ps. I didn’t provide any evidence of my political beliefs. If anyone took anything from the above as a sway one way of the other, they are joking themselves as I am joking with them. I focus on the facts. We can’t blame any single thing or any one person on the direction of stock market trends and if anyone does so, they are joking themselves.

We can say the same for calling Technical analysis Quantitative analysis, believing by changing the word, it means something different.

It doesn’t.

I say believe and do whatever creates asymmetric investment returns for you.

But as Larry the Cable Guy says:

Now that’s funny right there; I don’t care who you are!

Mike Shell is the Founder and Chief Investment Officer of Shell Capital Management, LLC, and the portfolio manager of ASYMMETRY® Global Tactical.

Mike Shell and Shell Capital Management, LLC is a registered investment advisor and provides investment advice and portfolio management exclusively to clients with a signed and executed investment management agreement. The observations shared on this website are for general information only and should not be construed as advice to buy or sell any security. Securities reflected are not intended to represent any client holdings or any recommendations made by the firm. Investing involves risk, including the potential loss of principal an investor must be willing to bear. Past performance is no guarantee of future results. All information and data is deemed reliable, but is not guaranteed and should be independently verified. The presence of this website on the Internet shall in no direct or indirect way raise an implication that Shell Capital Management, LLC is offering to sell or soliciting to sell advisory services to residents of any state in which the firm is not registered as an investment advisor. Use of this website is subject to its terms and conditions.

Front-running S&P 500 Resistance

The S&P 500 stock index closed just -1% from its all-time high it reached on January 26, 2018, and hasn’t been that high since. It’s been in a drawdown that was as much as -10% and it has taken six months to get back near its high point to break even.

Before the madness begins saying “The S&P 500 is at resistance,” I want to point out an observation of the truth. It is one thing to draw a trend line on an index to indicate its direction, quite another to speak of “support” and “resistance” at those levels.

Is the S&P 500 at resistance?

Depending on which stock charting service or data provider you use, it may appear the S&P 500 ETF (SPY) closed at its prior high. Many market technicians would draw a line like I did below in green and say “the S&P 500 is at resistance.”

In technical analysis applied to stock market trends, support and resistance is a concept that the movement of the price of a security will tend to stop and reverse at certain predetermined price levels.

Support is when a price trends down and stalls at a prior low. The reasoning is that investors and traders who didn’t buy the low before (or wish they’d bought more) may have buying interest at that prior low price if it reaches it again.

Resistance is when a price trends up and stalls at a prior high. The reasoning is that investors and traders who didn’t sell the high before (or wish they’d sold short to profit from a price decline) may have the desire to sell at that prior high price if it reaches it again.

Whether everyone trades this way or not, enough may that it becomes a self-fulling prophecy. I believe it works this way on stocks and other securities or markets driven by supply and demand, but an index of stocks?

To assume a market or stock will have support or resistance at some price level (or a derivative of price like a moving average) that hasn’t been reached yet is just a predictive assumption. Support and resistance don’t exist unless it is, which is only known after the fact.

One of the most fascinating logical inconsistencies I see by some technical analysts is the assumption that “support” from buying interest and “resistance” from selling pressure “is” there, already exists, before a price is even reached. Like “SPY will have resistance at $292.” We simply don’t know until the price does indeed reverse after that point is reached.

But, it gets worse.

To believe an index of 500 stocks is hindered by selling pressure at a certain price requires one to believe the price trend is controlled by the index instead of the 500 stocks in it.

Think about that for a moment. Let it sink in.

- Do you believe trading the stock index drives the 500 stocks inside the index?

or

- Do you believe the 500 stocks in the index drive the price of the index?

What you believe is true for you. But, to believe an index of 500 stocks is hindered by selling pressure or buying interest at a certain price requires you believe the price trend is controlled by the index instead of the 500 stocks in it. That’s a significant belief.

To complicate it more. If we want to know the truth, we have to look a little closer.

Is the S&P 500 at resistance?

As I said, it depends on which stock charting service or data provider we use and how we calculate the data to draw the chart. Recall in the prior chart, I used the SPDRs S&P 500 ETF (SPY) which shows the ETF closed near its prior high. I used Stockcharts.com as the data provider to draw the chart. I’ve been a subscriber of their charting program for 14 years so I can tell you the chart is based on Total Return as the default. That means it includes dividends. But, when we draw the same chart using the S&P 500 index ($SPX) it’s based on the price trend. Below is what a difference that makes. The index isn’t yet at the prior high, the SPY ETF is because the charting service includes dividends.

Here is another charting service where I’m showing the S&P 500 ETF (SPY) price return, total return, and the S&P 500 stock index. Only one is at the January high.

So, we don’t know if the S&P 500 is at resistance and we won’t know if there exists any “resistance” there at all unless the price does pause and reverse down. It so happens, it just may pause and reverse at this point. Not because more tactical traders are looking at the total return chart of SPY or because the index or ETF drives the 500 stocks in it, but because momentum measures indicate its potentially reaching an “overbought” level. So, a pause or reversal, at least some, temporarily, would be reasonable.

Some may call this charting, others call it technical analysis, statistical analysis, or quantitative analysis. We could even say there is some behavioral finance included since it involves investor behavior and biases like anchoring. Whatever we choose to call it, it’s a visual representation of supply and demand and like most things, it’s based on what we believe to be true.

I’ve been applying charting, pattern recognition, technical analysis, statistical analysis, and quantitative analysis for over twenty years. Before I started developing computerized programs based on quantitative trend systems that apply evidence-based scientific methods, I was able to trade successfully using visual charts. I believe all of it has its usefulness. I’m neither anti-quant or anti-charting. I use both, but for different reasons. I can argue for and against both because neither is perfect. But, combining the skills together has made all the difference for me.

Is the S&P 500 at resistance?

We’ll see…

Mike Shell is the Founder and Chief Investment Officer of Shell Capital Management, LLC, and the portfolio manager of ASYMMETRY® Global Tactical.

You can follow ASYMMETRY® Observations by click on on “Get Updates by Email” on the top right or follow us on Twitter.

The observations shared in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. Investing involves risk including the potential loss of principal an investor must be willing to bear. Past performance is no guarantee of future results.

Investment management can take many years of cycles and regimes to understand an edge.

It takes at minimum a full market cycle including both bull/bear markets to declare an edge in an investment management track record.

But we also have different regimes. For example, each bull market can be different as they are driven by unique return drivers. Some are more inflationary from real economic expansion driving up prices. Others are driven by external manipulation, like the Fed intervention.

I’ve been managing ASYMMETRY® Global Tactical for fourteen years. It’s an unconstrained, flexible, adaptable, go-anywhere global tactical program without the limitations of a fixed benchmark. I pursue absolute returns applying dynamic risk management and unconstrained tactical trading decisions across a broad universe of global currency, bonds, stocks, and commodities.

So, I can tell you the bull market 2003-07 was a regime of rising commodities, foreign currency, and international producers of commodities. In this bull market, U.S. equities have dominated. We can see that in the chart below. If your exposure up until 2008 was only U.S. stocks, you would be disappointed as Emerging Markets countries like China and Brazil were much stronger as was commodities. We can also see how those markets have lagged since the low in 2009.

Everything is impermanent, nothing lasts forever, so this too shall change eventually. Those who believe the next decade will be like the past do not understand the starting point matters, the return drivers, and how markets interact with each other. Past performance is never a guarantee of future results.

Mike Shell is the Founder and Chief Investment Officer of Shell Capital Management, LLC, and the portfolio manager of ASYMMETRY® Global Tactical.

You can follow ASYMMETRY® Observations by click on on “Get Updates by Email” on the top right or follow us on Twitter.

Investment results are probabilistic, never a sure thing. Past performance is no guarantee of future results.

Is this the Inflection Point for Stocks?

As if the election result wasn’t enough, the U.S. stock market has surprised most people by trending up since last November.

But, it has been stalling since March. The S&P 500 drifted down about -3% into March and April.

The stock market seems to be at an inflection point now.

Understanding the market state is an examination of the weight of the evidence.

The weight of the evidence seems to suggest defense.

My first indicator is always the actual price trend itself. If we want to know what is going on, there is no better observation than the actual price trend. The price action tells us what force is in control: supply or demand. And, we can see the potential for the inflection point – when the direction is changing. In the chart below, I highlight a recent point of “resistance”. I call it resistance because the stock index hasn’t broken above the March high and is instead drifting sideways.

Investors sometime assume a prior price high will automatically become “resistance” just because it’s the price range they expect to see the price trend stall. Resistance is the price level where selling is expected to be strong enough to prevent the price from rising further. We can see that recently in the chart. As the price advances towards the prior peak, supply may overcome demand and prevent the price from rising above resistance. For example, it may be driven by investors who wished they had sold near the prior peak and had to wait as the price recovered again. They anchor to that prior high. Once it gets back to the prior peak, they exit. Prior highs don’t always become “resistance” as expected. Sometimes demand is strong enough to break through and keep trending up. At this point, we see there has been some resistance at the prior high. I highlighted it in yellow in the chart above. So, we shouldn’t be surprised to see the price decline if this resistance holds for a while. Or, it could be an inflection point.

The S&P 500 stock index is mainly large companies. Smaller companies tend to lead larger companies. Their price trends move in a wider range and they sometimes move faster, so they get to a point sooner. That’s why we say small company stocks “lead” large company stocks. In that case, I highlight below that the small company stock index, the S&P 600 Small Cap ETF, reached its prior, but found resistance and reversed down. The soldiers may lead the way for the Generals.

It seems that the stock index is stalling at a time when investors are complacent. When investors are complacent or overly optimistic an inflection point is more likely. The CBOE Volatility Index® (VIX® Index) is very low. The CBOE Volatility Index® (VIX® Index®) is a key measure of market expectations of near-term volatility conveyed by S&P 500 stock index option prices. The VIX® historically trends between a long-term range. When the VIX® gets to an extreme, it becomes more likely to eventually reverse. In the chart below I show the price level of the VIX® since its inception in 1993. We can see its long-term average is around 20. I highlighted in red its low range is around 12 and it has historically spiked as high as 25 or 60. This means the traders of options are expecting lower volatility in the weeks ahead at a time when other things seem to suggest otherwise.

As I continue sharing some observations, I’m going to get farther away from my main decision maker which is the directional price trend, but you’ll see how these indicators help to quantify the state of the trend and the potential for an inflection point. As we keep going, keep in mind that indicators are a derivative of the price at best or a derivate of something unrelated to the directional price trend. In the case of the VIX® Index index above, it’s a measure of options (a derivative) on the stocks in the S&P 500. When we start looking at things like economic growth and valuations we are necessarily looking at things that are a derivative of price, but not as absolute as the price trend itself. The direction of the price trend is the arbiter.

Another signal of an inflection point is breadth. That is, what percent of stocks are rising or falling. Since I have mentioned the S&P 500 stock index, I’ll show the S&P 500 Bullish Percent Index below. The Bullish Percent is a breadth indicator based on the number of stocks on Point & Figure buy signals. Developed by Abe Cohen in the mid-1950s, the Bullish Percent Index was originally applied to NYSE stocks. Cohen was the first editor of ChartCraft, which later became Investors Intelligence. BP signals were further refined by Earl Blumenthal in the mid 70’s and Mike Burke in the early 80’s. The S&P 500 Bullish Percent shows a composite of the 500 stocks in the S&P 500 index that are in a positive trend. The S&P 500 Bullish Percent recently reversed to a column of O’s from a high point of 80, which means about 80% of the S&P 500 stocks were in a positive trend and about 8% of them are now in a negative trend. In addition to the direction, the level is important because we consider the level above 70% or 80% to be a higher risk (red zone) and the levels below 30% to be lower risk (green zone). So, more and more stocks within the index are starting to decline. This weak “breadth” or participation could be a signal of a change in trend.

I’m not necessarily a big user of economic indicators. I believe the stock indexes are the leading indicator for the economy, so that’s my guide. However, I have a strong sense of situational awareness so I like to understand what in the world is going on. The total return of stocks is a function of three things: earnings growth + dividend yield + P/E ratio expansion or contraction. Since earnings growth has made up nearly 5% of the historical total return of the S&P 500 since 1926, it does matter in the big picture in regard to expected return. Today, we observe the headline in the Wall Street Journal:

GDP Slows to Weakest Growth in Three Years

The U.S. economy’s output grew at the slowest pace in three years during the first quarter, underscoring the challenges facing the Trump administration as it seeks to rev up growth.

The New York Times says:

G.D.P. Report Shows U.S. Economy Off to Slow Start in 2017

■ The economy barely grew, expanding at an annual rate of only 0.7 percent.

■ The growth was a sharp decline from the 2.1 percent annual rate recorded in the final quarter of last year. It was the weakest quarterly showing in three years.

■ Consumption, the component reflecting individual spending, rose by only 0.3 percent, well below the 3.5 percent rate in the previous quarter.

The Takeaway

The first-quarter performance upset expectations for a Trump bump at the start of 2017.

If you want an economic catalyst for why prices could stall or reverse down, there you go. You see, earnings growth of stocks is part of GDP. GDP is the sales of all U.S. companies, private and public. The earnings growth of the S&P 500 is the earnings of those 500 companies. In other words, GDP of the economy is highly connected to EPS of an index of 500 stocks.

This recent stall in the price trend and economic growth along with a dash of complacency comes at a time when stocks are “significantly overvalued”, according to my friend Ed Easterling at Crestmont Research:

“In the first quarter the stock market surged 5.5%, well more than underlying economic growth. As a result, normalized P/E increased to 29.4—significantly above the level justified by low inflation and low interest rates. The current status remains “significantly overvalued.” The level of volatility plunged over the past quarter and is now in the lowest 4% of all periods since 1950. The trend in reported earnings for the S&P 500 Index reflects a repeating pattern of overly-optimistic analysts’ forecasts. Earnings and volatility should be watched closely and investors should heighten their sensitivity to the risks confronting an increasingly vulnerable market.”

Oh, and one more thing: Monday will be May. I’m not a huge fan of using seasonality as an indicator to enter or exit the stock market, but there is some tendency for certain periods to gain or lose value historically. For example, a common seasonality is “Sell in May and go away”. Depending on the historical time frame you look and which index, some periods show a “summer slump”. One theory is many investors and traders go on vacation in the summer, so volume is light. They return after the summer and take more action.

So, maybe this will be a good time to sell in May and go away. Not because it’s May, but instead because the weight of the evidence suggests this could be an inflection point.

We’ll see.

Systems trading is ultimately discretionary. The manager still has to decide how much risk to accept, which markets to play, and how aggressively to increase and decrease the trading base as a function of equity change. These decisions are quite important – often more important than trade timing.”

Stock Market Decline is Broad

We typically expect to see small company stocks decline first and decline the most. The theory is that smaller companies, especially micro companies, are more risky so their value may disappear faster. Below, we view the recent price trends of four market capitalization indexes: micro, small, mid, and mega. We’ll use the following index ETFs.

Since we are focused on the downside move, we’ll only observe the % off high chart. This shows what percentage the index ETF had declined off its recent highest price (the drawdown). We’ll also observe different look-back periods.

We first look back 3 months, which captures the full extent of the biggest loser: as expected, the micro cap index. The iShares Micro-Cap ETF (IWC: Green Line) seeks to track the investment results of an index composed of micro-capitalization U.S. equities. Over the past 3 months (or anytime frame we look) it is -13% below its prior high. The second largest decline is indeed the small cap index. The Vanguard Small-Cap ETF (VB: Orange Line) seeks to track the performance of the CRSP US Small Cap Index, which measures the investment return of small-capitalization stocks. The small cap index has declined -11.5%. The Vanguard Mega Cap ETF (MGC) seeks to track the performance of a benchmark index that measures the investment return of the largest-capitalization stocks in the United States and has declined -9.65%. The Vanguard Mid-Cap ETF (VO) seeks to track the performance of a benchmark index that measures the investment return of mid-capitalization stocks and has declined -9.41%. So, the smaller stocks have declined a little more than larger stocks.

Source: Shell Capital Management, LLC created with http://www.ycharts.com

Many active or tactical strategies may shift from smaller to large company stocks, hoping they don’t fall as much. For example, in a declining market relative strength strategies would rotate from those that declined the most to those that didn’t. The trouble with that is they may still end up losing capital and may end up positioned in the laggards long after a low is reached. They do that even though we may often observe the smallest company stocks rebound the most off a low. Such a strategy is focused on “relative returns” rather than “absolute returns“. An absolute return strategy will instead exit falling trends early in the decline with the intention of avoiding more loss. We call that “trend following” which has the objective of “cutting your losses short”. Some trend followers may allow more losses than others. You can probably see how there is a big difference between relative strength (focusing on relative trends and relative returns) and trend following (focusing on actual price trends and absolute returns).

So, what if we look at the these stock market indexes over just the past month instead of the three months above? The losses are the same and they are very correlated. So much for diversification. Diversification across many different stocks, even difference sizes, doesn’t seem to help in declining markets on a short-term basis. These indexes combined represent thousands of stocks; micro, small, medium, and large. All of them declined over -11%, rebounded together, and are trending down together again.

Source: Shell Capital Management, LLC created with http://www.ycharts.com

If a portfolio manager is trying to “beat the market” index, he or she may focus on relative strength or even relative value (buy the largest loser) as they are hoping for relative returns compared to an index. But a portfolio manager who is focused on absolute returns may pay more attention to the actual downside loss and therefore focuses on the actual direction of the price trend itself. And, a key part is predefining risk with exits.

You can probably see how different investment managers do different things based on our objectives. We have to decide what we want, and focus on tactics for getting that.

Low Volatility Downside was the Same

In Low Volatility and Managed Volatility Smart Beta is Really Just a Shift in Sector Allocation I ended with:

“Though the widening range of prices up and down gets our attention, it isn’t really volatility that investors want to manage so much as it is the downside loss of capital.“

As a follow-up, below we observe the PowerShares S&P 500® Low Volatility Portfolio declined in value about -12% from its high just as the SPDRs S&P 500® did. So, the lower volatility weighting didn’t help this time as the “downside loss of capital ” was the same.

Source: http://www.ycharts.com

Why Index ETFs Over Individual Stocks?

A fellow portfolio manager I know was telling me about a sharp price drop in one of his positions that was enough to wipe out the 40% gain he had in the stock. Of course, he had previously told me he had a quick 40% gain in the stock, too. That may have been his signal to sell. Biogen, Inc (BIIB) recently declined about -30% in about three days. Easy come, easy go. Below is a price chart over the past year.

Source: Shell Capital Management, LLC created with http://www.stockcharts.com

Occasionally investors or advisors will ask: “Why trade index ETFs instead of individual stocks?“. An exchange-traded fund (ETF) is an investment fund traded on stock exchanges, much like stocks. Until ETFs came along the past decade or so, gaining exposure to sectors, countries, bond markets, commodities, and currencies wasn’t so easy. It has taken some time for portfolio managers to adapt to using them, but ETFs are easily tradable on an exchange like stocks. Prior to ETFs, those few of us who applied “Sector Rotation” or “Asset Class Rotation” or any kind of tactical shifts between markets did so with much more expensive mutual funds. ETFs have provided us with low cost, transparent, and tax efficient exposure to a very global universe of stocks, bonds, commodities, currencies, and even alternatives like REITs, private equity, MLP’s, volatility, or inverse (short). Prior to ETFs we would have had to get these exposures with futures or options. I saw the potential of ETFs early, so I developed risk management and trend systems that I’ve applied to ETFs that I would have previously applied to futures.

On the one hand, someone who thinks they are a good stock picker are enticed to want to get more granular into a sector and find what they believe is the “best” stock. In some ways, that seems to make sense if we can weed out the bad ones and only hold the good ones. It really isn’t so simple. I view everything a reward/risk ratio, which I call asymmetric payoffs. There is a tradeoff between the reward/risk of getting more detailed and focused in the exposure vs. having at least some diversification, such as exposure to the whole sector instead of just the stock.

Market Risk, Sector Risk, and Stock Risk

In the big picture, we can break exposures into three simple risks (and those risks can be explored with even more detail). We’ll start with the broad risk and get more detailed. Academic theories break down the risk between “market risk” that can’t be diversified away and “single stock” and sector risk that may be diversified away.

Market Risk: In finance and economics, systematic risk (in economics often called aggregate risk or undiversifiable risk) is vulnerable to events which affect aggregate outcomes such as broad market declines, total economy-wide resource holdings, or aggregate income. Market risk is the risk that comes from the whole market itself. For example, when the stock market index falls -10% most stocks have declined more or less.

Stock and Sector Risk: Unsystematic risk, also known as “specific risk,” “diversifiable risk“, is the type of uncertainty that comes with the company or industry itself. Unsystematic risk can be reduced through diversification. If we hold an index of 50 Biotech stocks in an index ETF its potential and magnitude of a large gap down in price is less than an individual stock.