Category Archives: Asymmetric Sector Exposure

Are Growth Sectors Technology, Consumer Cyclicals, and Communication Services more Undervalued than Value?

Growth sectors like technology, consumer cyclical, and communications have seen the brunt of the selling this year, and growth is now more “undervalued” than value sectors per CFRA.

According to CFRA: Stocks are ranked in accordance with the following ranking methodologies. Qualitative STARS recommendations are determined and assigned by equity analysts, with 5 being the highest rating.

But as stated in Fundamental Valuation: Is the Stock Market Cheap or Expensive? undervalued stocks can get much more undervalued (prices fall more) in a recessionary bear market.

Risk management is essential in bear markets.

For example, the S&P 500 is down about -23% so far and needs a 30% gain to get back to the prior high.

Mike Shell is the Founder and Chief Investment Officer of Shell Capital Management, LLC, and the portfolio manager of ASYMMETRY® Managed Portfolios. Mike Shell and Shell Capital Management, LLC is a registered investment advisor focused on asymmetric risk-reward and absolute return strategies and provides investment advice and portfolio management only to clients with a signed and executed investment management agreement. The observations shared on this website are for general information only and should not be construed as investment advice to buy or sell any security. This information does not suggest in any way that any graph, chart, or formula offered can solely guide an investor as to which securities to buy or sell, or when to buy or sell them. Securities reflected are not intended to represent any client holdings or recommendations made by the firm. In the event any past specific recommendations are referred to inadvertently, a list of all recommendations made by the company within at least the prior one-year period may be furnished upon request. It should not be assumed that recommendations made in the future will be profitable or will equal the performance of the securities on the list. Any opinions expressed may change as subsequent conditions change. Please do not make any investment decisions based on such information, as it is not advice and is subject to change without notice. Investing involves risk, including the potential loss of principal an investor must be willing to bear. Past performance is no guarantee of future results. All information and data are deemed reliable but are not guaranteed and should be independently verified. The presence of this website on the Internet shall in no direct or indirect way raise an implication that Shell Capital Management, LLC is offering to sell or soliciting to sell advisory services to residents of any state in which the firm is not registered as an investment advisor. The views and opinions expressed in ASYMMETRY® Observations are those of the authors and do not necessarily reflect the position of Shell Capital Management, LLC. The use of this website is subject to its terms and conditions.

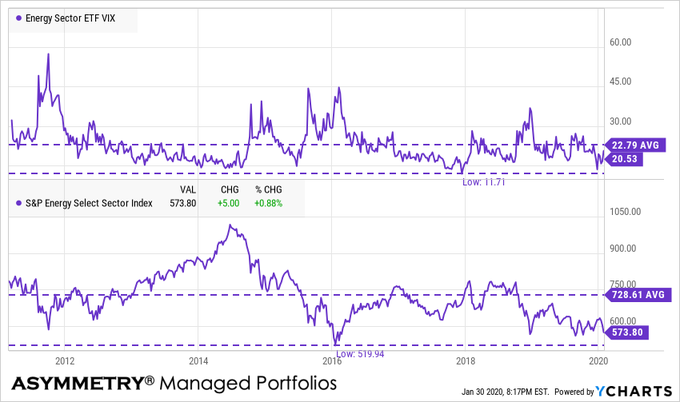

Energy and MLP’s are the most oversold sector

The energy sector is the most oversold so far.

By oversold, I mean a condition where there has been enough selling pressure to drive prices down to low enough levels which overextended or excessive on a short-term basis, suggesting the downtrend could be an overreaction. When price trends overreact in the short-term by moving potentially too far, too fast, the trend becomes likely to reverse back up, at least temporarily. Afterward a countertrend back up, however, a short-term oversold trend may later reverse down again in continuation of a downtrend. So, observing a short-term oversold condition may not result in a long-term trend reversal up, but instead, my increase the odds of a short-term retracement. In the chart below of the energy sector index, we see an overall downtrend since the price on the left side is higher than the right a year later, however, we also observe the price swings along the way, which are shorter-term overbought/oversold countertrends.

Energy sector is -43% from its early 2014 high.

Energy sector is almost near its 2016 low.

Energy implied volatility is relatively low and below average.

Alerian MLP energy index is at a new low

With the energy sector momentum signaling its price trend may have dropped too far, too fast, the dividend yield on the MLP index is at its high post-2016 at over 9%.

As the price falls, the dividend rises from that starting point, so it’s the one time we apply countertrend systems to capture future income from dividends. I wouldn’t be surprised to see the energy sector catch some buying enthusiasm soon if the overall stock market can hold up. Sometimes the weakest sectors show strength even as other sectors fall. Of course, the risk of a falling trend is it may keep falling and they can trend down far more than expected. The trouble is, when a trend does fall more than expected, it results in serial correlation; prices keep falling because, well, prices are falling! Waterfall declines are contagious, so you can probably see the ‘risk premium’ involved in this high dividend yield. There is no free lunch and nothing is without risks. I deal with risks by managing them through predefined exits, drawdown controls, and hedging.

So, I probably enter and exit a more global opportunity set of markets than most do since the risk for me is how I define it and how the position is structured, not the security itself.

I’m off to the Super Bowl in the morning! Unfortunately, my Tennessee Titans didn’t make it and my Tampa Bay Bucs didn’t come close, but I’ll be there anyway.

Mike Shell is the Founder and Chief Investment Officer of Shell Capital Management, LLC, and the portfolio manager of ASYMMETRY® Global Tactical. Mike Shell and Shell Capital Management, LLC is a registered investment advisor in Florida, Tennessee, and Texas focused on asymmetric risk-reward and absolute return strategies and provides investment advice and portfolio management only to clients with a signed and executed investment management agreement. The observations shared on this website are for general information only and should not be construed as advice to buy or sell any security. Securities reflected are not intended to represent any client holdings or any recommendations made by the firm. Any opinions expressed may change as subsequent conditions change. Do not make any investment decisions based on such information as it is subject to change. Investing involves risk, including the potential loss of principal an investor must be willing to bear. Past performance is no guarantee of future results. All information and data are deemed reliable but is not guaranteed and should be independently verified. The presence of this website on the Internet shall in no direct or indirect way raise an implication that Shell Capital Management, LLC is offering to sell or soliciting to sell advisory services to residents of any state in which the firm is not registered as an investment advisor. The views and opinions expressed in ASYMMETRY® Observations are those of the authors and do not necessarily reflect a position of Shell Capital Management, LLC. The use of this website is subject to its terms and conditions.

Divergence between Value, Growth, and Momentum.

There is an interesting divergence today between Momentum, Growth, and Value.

Up until now, Value has lagged Growth and Momentum, as seen in this 5-year chart.

The underperformance of Value has been a topic of conversation of hedge fund managers I know who are Value investors.

Three-month momentum shows Value is trending up.

I believe styles like Growth vs. Value are largely driven by sectors, which is why I tend to focus more on the more granular sectors rather than broader styles. Today we see the relative strength is in Energy and Financials, which have been the lagging sectors lately.

So, this may not be enough to say the trend is changing to a period where Value outperformance growth for years, but it’s at least enough to be aware.

At some point, Value will take over leadership and when it does, it may continue for years.

For now, exposure to Value, including high dividend-paying stocks like we have, is having a good day while other factors are not.

Mike Shell is the Founder and Chief Investment Officer of Shell Capital Management, LLC, and the portfolio manager of ASYMMETRY® Global Tactical.

Mike Shell and Shell Capital Management, LLC is a registered investment advisor focused on asymmetric risk-reward and absolute return strategies and provides investment advice and portfolio management only to clients with a signed and executed investment management agreement. The observations shared on this website are for general information only and should not be construed as advice to buy or sell any security. Securities reflected are not intended to represent any client holdings or any recommendations made by the firm. Any opinions expressed may change as subsequent conditions change. Do not make any investment decisions based on such information as it is subject to change. Investing involves risk, including the potential loss of principal an investor must be willing to bear. Past performance is no guarantee of future results. All information and data is deemed reliable, but is not guaranteed and should be independently verified. The presence of this website on the Internet shall in no direct or indirect way raise an implication that Shell Capital Management, LLC is offering to sell or soliciting to sell advisory services to residents of any state in which the firm is not registered as an investment advisor. Use of this website is subject to its terms and conditions.

Sector SPDRs are subject to risk similar to those of stocks including those regarding short selling and margin account maintenance. All ETFs are subject to risk, including possible loss of principal. Sector ETF products are also subject to sector risk and non-diversified risk, which will result in greater price fluctuations than the overall market.

An exhaustive stock market analysis… continued

I guess An exhaustive analysis of the U.S. stock market wasn’t exhaustive enough, because I now have a few things to add.

First, since the financial news media, as well as social media like Twitter, is so bearish with all kinds of narratives about why the stock market is falling, I’ll go ahead and discuss it here. This observation will not be complete without first reading An exhaustive analysis of the U.S. stock market so you know where I am coming from. If you haven’t read it already, I would before continuing so you understand the full context.

It is the financial news media’s business to report new information. We all know that if they want to get people to tune in, the fastest way is to provide provocative and alarming headlines and commentary. So, we shouldn’t be surprised to see distressing news.

There are always many reasons for the stock market to trend up or down. It isn’t hard to write some narrative attempting to explain it. The reality is, there are all kinds of causes that create an effect. None of them alone drive price trends. Ultimately, what drives price trends is behavior and sentiment which drives supply and demand. Behavior and investor sentiment may be impacted by the news and what people decide to believe.

I often say “what you believe is true, for you” even if it isn’t actually true. A person’s beliefs could be completely wrong and could be scientifically disproven, but if they still believe it, it’s their truth, so it’s true – for them. So, whatever you choose to believe is going to be your truth, so I suggest weighing the evidence to determine the truth if you want it to be more accurate. In science, we can’t prove the truth to be true, we can only disprove it as untrue.

Let’s look at some truths that I believe to be true based on empirical observation of facts.

The biggest news headline is probably the government shutdown. There have been twenty U.S. government shutdowns over the budget since 1976 by both political parties. Half of the time it was followed by stock gains and half the time declines. The average result is -0.40% and the median is 0%. So, historically a government shutdown hasn’t seemed to drive prices. Below is the table. It is what it is.

Yesterday evening Steven Mnuchin, the 77th Secretary of the Treasury, tweeted a note that he had called the nations six largest banks to confirm they have ample liquidy for consumer and business lending and other market operations. The words “Plunge Protection Team” started trending in social media. Much of the response has been negative, which seems odd to me.

Since when was doing “channel checks” not a good idea?

It seems not doing it would be imprudent…

There are many things going on all over the world all the time, so we can always find narratives to fit the price trend and believe it’s the driver. Narratives and news also seem to drive more emotional responses since people like to hear a story. I focus on the data, which is the price action. Whatever is driving the markets is reflected in the price trend. The price trend is the final arbiter. Nothing else matters.

The Morningstar table of index performance shows the 2018 total return of large, mid, small cap stocks along with growth, value, and blend.

The most popular broad-based indexes like the S&P 500 and Dow Jones Industrial Average show 2018 is ending just the opposite of the way it started.

Let’s look at some price trends.

Yesterday I shared the Bullish Percent measures on the broad stock market indexes and each individual sector. We observed the percent of stocks in all sectors except for the Utility sector was already at historical lows after previous market declines. After today’s price action, we have some updated observations to explore.

The S&P 500 is in a bear market, commonly defined as a -20% decline from a prior price peak. What is most interesting is how fast it reached -20%. In the chart below, I included the S&P 500 Total Return Index (including dividends), the S&P 500 Index price only, and the S&P 500 ETF (SPY). On a total return basis, the S&P 500 Total Return Index that includes no costs or fees didn’t quite close down -20% from its high, but the rest did. It’s close enough.

Though the stock indexes had declined -10% earlier this year, they had recovered to new highs by September and it appeared the primary uptrend would resume. Starting in October, the stock market declined again and attempted to recover twice in November. What came next was probably most shocking to those who follow market seasonality; the stock indexes are down over -15% in the month of December, which is historically one of the strongest months of the year. It seems this decline happening so fast and at the end of a calendar year is going to make it seem more significant. Because it’s at year end it results in a “down year” instead of having time to recover during the normally seasonally strong period after October. The period from November to April historically has stronger stock market gains on average than the other months. Not this year.

The Utility sector reverses down to participation in the market decline.

Yesterday I had highlighted the top range of the Bullish Percent chart in yellow to mark the high-risk zone above 70%. After today, the Utilities sector has declined below that range. Individual Utility stocks are now participating in the stock market decline.

The Utilities sector ETF declined over -4% today and is now slightly down for the year.

During significant market declines, diversification sometimes isn’t the crutch it is promoted to be by most of the investment industry. Broad asset allocation and diversification do not assure a profit or protect against a loss in a declining market. In declining markets, we often see price trends cluster more as serial correlation. That is, prices begin to fall more just because they are falling. Investors sell because prices are falling. So, stocks, sectors, and markets can all become highly correlated to the downside. By the end of a market decline, all stocks, sectors, and markets are often participating.

The upside is, this panic selling is capitulation as the final weak holders stop resisting and begin to “sell everything!” We eventually see the selling dry up and buyers step in with enthusiasm at lower prices.

In the big picture, as I said in An exhaustive analysis of the U.S. stock market I guess we shouldn’t be surprised to see prices falling with greater velocity since this is an aged bull market at high valuations and the same Fed actions that probably drove it up are probably going to reverse it in a similar fashion. I started this year warning of complacency from the 2017 low volatility uptrend and the potential for a volatility expansion. I also pointed out during the stock market peak in September that volatility had contracted to a historically very low level in VIX shows the market’s expectation of future volatility. Specifically, on September 25th I wrote,

“Looking at the current level of 12 compared to history going back to its inception in 1993, we observe its level is indeed near its lowest historical low.”

I ended it with;

“When the market expects volatility to be low in the next 30 days, I know it could be right for some time. But, when it gets to its historically lowest levels, it raises situational awareness that a countertrend could be near. It’s just a warning shot across the bow suggesting we hedge what we want to hedge and be sure our risk levels are appropriate.”

Well, that has turned out to be an understatement I guess.

What’s more important is what I actually did. On August 23th as the stock market began to appear overbought on a short-term basis, I took partial profits on our leading momentum stock positions. In hindsight, it would have been better to sell them all. By September 26th (when I wrote the above) I had reduced our exposure to only around 30% stocks and the rest in Treasury bonds. It still didn’t turn out perfectly as the stocks we did hold declined, too, and in many cases even more than the stock indexes. As we entered October, I shared a new observation “Here comes the volatility expansion” as stock prices fell and volatility increased. As prices fell to lower and lower levels, I started adding more exposure. At this point, prices have broadly become more and more extremely “oversold” and sentiment has become more negative. This has been a hostile period for every strategy, but I’ve been here before.

By the way, I have been a tactical portfolio manager for over twenty years now. The highlight of my performance history has been the bear markets. I executed especially well in the October 2007 to March 2009 period when the S&P fell -56%. My worst peak to trough drawdown during that period was only -14.3% and I recovered from it about six months or so later. That was compared to a -56% drop in the stock index that took several years to recover. In fact, I did so well at a time when very few did that it was almost unbelievable, so I had my performance verified by a third party accountant. I have considered writing about it and sharing the commentaries I wrote during the period and the tactical decisions I made. Make no mistake, it wasn’t easy nor was it pleasant. I didn’t lose the money others did, so I was in a position of strength, but it was still a challenging time. What I will tell you is I entered and exited various positions about seven or eight times over that two year period. We never know in advance when the low is in, or when a trend will reverse back down. Buy and hold investors just take the beating, I entered and exited hoping the average gain exceeds the average losses. The swings are the challenge. It takes great discipline to do what needs to be done. Most people had very poor results, for me to create good results, I necessarily had to feel and do the opposite of most people. The market analysis I’m sharing here as observations aren’t necessarily the exact signals I used to enter and exit, but they are part of the indicators I monitored during the crash. Every trend is unique. We have no assurance my methods will do as well as in the past. But, the one thing I feel confident in is I’ve been here before. This ain’t my first rodeo. I know what I’m doing and I’m disciplined in my execution. That’s all I can do. I’m dealing with the certainty of uncertainty, so I can’t guarantee I’ll do as well the next time around, but I am better prepared now than I was then.

So bring it. Get some. I’m ready.

Yesterday I shared the extreme levels of Bullish Percent indicators for the broad market and sectors as well as other indicators like the Put/Call Ratios. I want to add to these observations with more indicators reaching an extreme. I’ve not seen these extremes since 2008 and 2009.

The Nasdaq has declined the most which is no surprise since it’s mostly emerging companies and heavily weighted in Technology. Market conditions have pushed the number of Nasdaq stocks hitting new lows to over 1,100 as of last week. Since the total number of Nasdaq issues is about 3,200 that has caused the value, in percentage terms, to jump to over 30% of the total. As you can see, the last time this many Nasdaq stocks hit new lows was the October 2008 low and the March 2009 low. The current level has exceeded other corrections since then and even the “Tech Wreck” after 2000. At this point, it becomes a contrarian indicator.

To no surprise, the same trend is true for NYSE stocks. As of last week, the percent of stocks listed on the New York Stock Exchange at new lows has reached the levels of past correction lows, but not as high as the 2008 period.

From here, I’ll share my observations of the relative strength and momentum of the sectors and stocks within them so we can see how oversold they have become. We already looked at the Bullish Percent of each sector yesterday, this is just more weight of the evidence.

First, I applied the Relative Strength Index to the S&P 500 daily chart. This RSI is only 14 days, so it’s a short-term momentum indicator that measures the magnitude of recent price changes to estimate overbought or oversold conditions. RSI oscillates between zero and 100, so it’s range bound and I consider it overbought above 70 and oversold below 30. Below we see the current level of 19 is very low over the past twenty years and is at or below the low level reached during past shorter-term market bottoms. However, we also see during prolonged bear markets like 2000 to 2003 and 2007 to 2009 it reached oversold conditions two to three times as the market cycles up and down to a lower low.

Zooming out from the daily chart to the weekly chart, we see the extremes more clearly and this is one of them. On a weekly basis, this oversold indicator is as low as it’s been only at the low points of the last two major bear markets.

s

Zooming out one more time from the weekly to the monthly chart, we observe a monthly data point only highlights the most extreme lows. It’s the same data but ignores the intra-month data. On a monthly basis, the current measure isn’t as low as it reached at the bear market lows in March 2009 or October 2002. For it to reach that level, I expect the green area I highlighted in the price chart to be filled. In other words, this suggests to me if this is a big bear market, we could ultimately see the price trend decline to at least the 2015 high. It only takes about -10% to reach that level. However, as we saw in the shorter term readings, if history is a guide, it would most likely cycle back up before it would trend back down.

You can probably see why I stress that longer-term price trends swing up and down as they unfold. Within a big move of 50%, we see swings around 10 – 20% along the way.

Let’s continue with this same concept to see how each sector looks. The broader indexes are made of the sectors, so if we want an idea of the internal condition of the broader market it is useful to look at each sector as I did yesterday with the Bullish Percent indexes.

Since we just had a -15% correction in August 2015 and January 2016, we’ll just focus on the daily RSI looking back four years to cover that period. Keep in mind, none of this is advice to buy or sell any of these sectors or markets. We only provide advice and investment management to clients with an executed investment management agreement. This observation is for informational and educational purposes only.

The Consumer Discretionary sector is as oversold as it’s been at historically low price points. A trend can always continue down more and stay down longer than expected, but by this measure, it has reached a point I expect to see a reversal up.

The price trend of Consumer Staples that is considered to be a defensive sector initially held up, but then the selling pressure got to it. It’s oversold as it’s been at historical lows.

The Energy sector has declined the most in 2018 and is oversold similar to prior price trend lows. We can see the indicator isn’t perfect as a falling trend sometimes reverses up temporarily, then trends back down to a lower low only to get oversold again. We’ll observe this same behavior at different times in each sector or market.

The Financial sector is deeply oversold to the point it has reached at prior lows. Any market could always crash down more, but Financials have reached a point we should expect to see at least a temporary reversal up.

Healthcare is a sector that isn’t expected to be impacted by the economy, but it has participated in the downtrend. It’s also reached the oversold point today. You can see what happened historically after it reached this level. If history is a guide, we should watch for a reversal.

The Industrial sector is trending down but has now reached a point we could see a reversal back up.

Clearly, the market decline has been broad as every sector has participated. The Materials sector reached the oversold level today.

Real Estate has not been spared during the selloff. It has now reached an oversold level normally seen at lows, but historically it’s cycled up and down a few times before reversing up meaningfully. That can be the case for any of them.

The Technology sector had been one of the best-looking uptrends the past few years. It’s now oversold after today’s action.

Up until today, the Utility sector was the lone survivor, but it was one of todays biggest losers. It’s falling so sharply so fast it’s now oversold with the other sectors.

After prices have declined, I look for indications that selling pressure may be getting more exhausted and driving prices to a low enough point to attract buying demand. That’s what it takes to reverse the trend.

I’ve been here before. I’ve executed through these hostile conditions as a tactical operator. The more hostile it gets, the more focused in the zone I get. After the stock market has already declined, I start looking for this kind of panic selling and extreme levels for a countertrend. We’re seeing those levels now. Sure, it could get worse, but we have reached a point that lower prices are more and more likely to result in a reversal back up.

I’m just going to do what I do.

Have a Merry Christmas!

Mike Shell is the Founder and Chief Investment Officer of Shell Capital Management, LLC, and the portfolio manager of ASYMMETRY® Global Tactical.

The observations shared on this website are for general information only and are not specific advice, research, or buy or sell recommendations for any individual. Investing involves risk including the potential loss of principal an investor must be willing to bear. Past performance is no guarantee of future results. The presence of this website on the Internet shall in no direct or indirect way raise an implication that Shell Capital Management, LLC is offering to sell or soliciting to sell advisory services to residents of any state in which the firm is not registered as an investment advisor. Use of this website is subject to its terms and conditions.

An exhaustive analysis of the U.S. stock market

It’s a big task for me to use the word exhaustive when it comes to stock market analysis. Exhaustive is examining, including, or considering all elements or aspects; fully comprehensive. There is no way to consider all elements, but we can focus on how the price trends are actually trending and the behavior and sentiment that is driving the trend.

Many years ago a friend of mine once tried to debate me about what trend following is or is not. He argued that trend following is all lagging moving averages or breakouts. The more we discussed it, the more we both realized that isn’t true. What made us realize it was when I said:

A skillful trend follower wants to catch a trend early in its stage and capitalize on it until it ends.

That’s hard to argue against. Who would rather enter a trend later in its stage? Who wants to catch less of the trend? My point is: we should want to capture as much of a trend as possible and for me, that necessarily means I want to not only determine the direction of a trend but also observe when trends are likely to change direction.

I want to share this with you so you know where I’m coming from. My objective is all about ASYMMETRY®. For me, it’s all about asymmetric risk/reward. Asymmetric risk/reward is an expectation of average gains larger than average losses. It could be as simple as risking a loss of 10% for the potential to earn a gain of 20%. That’s an asymmetric payoff. If I did that with just a 50% probability, I would earn 5% on average. How much total return we would achieve over time would be controlled by how much capital I risk in each position. How much I risk in each position across the portfolio dictates my portfolio drawdown. The portfolio drawdowns relative to total return since inception creates an asymmetric risk/reward profile. So, everything I do involves ASYMMETRY® and that’s why it’s my trademark. As you read my observations you can probably see how I’m looking for exposure at lower risk levels and less exposure at higher risk levels and that can be counterintuitive. It can certainly go against investor sentiment and emotions at times.

Every decision we make is in the present moment. We can do nothing in the past. We can do nothing in the future. The only time we can do something is now, or not.

To get an understanding of an asymmetric risk/reward let’s look at an idealized situation. The chart below, unnamed because it doesn’t matter, is a price trend that gained over 100%. If your objective is an asymmetric payoff and you have perfect hindsight, what would be your best entry point?

Clearly, the price is trending from the lower left to the upper right, so the answer is the lowest price possible. As I said, in the real world we don’t know in advance the trend will continue, so we have to be willing to place our bet and let it unfold. When I enter a trend, I determine how much capital I’ll risk to see if it becomes an asymmetric payoff. If we were looking at the trend in 2016 with perfect hindsight, where would be the very best entry? Of course if would be the -15% dips in 2015 and 2016. The trouble is, as the price is falling sharply, it never seems there will be a catalyst to make the market trend back up. The news is always bad. Investor sentiment is very bearish. The sky is falling and all people want to do is duck for cover.

After trends have moved, I find it more productive to look for a change of trend.

After price trends up, I start looking for signs of a potential countertrend back down.

After prices have fallen, I start looking for signs of a potential countertrend back up.

What I do as a tactical portfolio manager is systematic rules-based. Although, it isn’t so mechanical that my computers are doing it all and executing trades. I am Man + Machine, not Machine – Man. I make no bones about it. I ultimately make tactical decisions that are informed by all of the proprietary systems I’ve developed over the past two decades. Some of my systems are more automated than others, but ultimately I am the portfolio manager.

So, when I share market analysis observations, this is something different than specific trading signals to enter and exit. Market analysis is something I do to gain insights from my observations.

Observations are the action or process of observing something carefully in order to gain information.

Insights are the capacity to gain an accurate and deep intuitive understanding of something.

Observations are “what is going on” and insights are “understanding what is going on.”

I can share my observations of what is going on, but I can’t necessarily give you the insight to understand it. Understanding is up to you. To gain an accurate and deep intuitive understanding of something you have to study it closely.

So, you can probably see why I believe it’s useful to do market analysis to get an understanding of the probabilities and possibilities. I do it by looking at the current price trend and where it’s been and more likely to go next.

Here we go.

I said this is going to be exhaustive, so I’m going to share my top down macro view of the U.S. stock market. I also do this for International stock markets, bonds, commodities, etc. but this is going to be focused on the U.S. stock market. However, I may throw in some relative comparisons of other markets to make a point. The top-down macro view is going to be in this order;

- Broad stock market index price trends and breadth

- Sectors within the stock market price trends and breadth

- Stocks within those sectors price trends and momentum

THE BIG PICTURE

The big picture is the overall long-term secular situation. In April I presented my big picture observations to a group of advisors. The two things I shared are:

- This is the longest bull market in history. At 9 years old, it’s very aged. The average length of a bull market is 4 to 5 years. Twice the average is aged by any measure.

- The Shiller PE Ratio was the second highest, ever. Only the 1999 bubble was higher. When the stock market is trading so expensive, we have to be prepared for the trend to reverse the other direction.

Below is a 20-year monthly chart of the S&P 500. I added the green highlight to show the current price is only -35% from the October 2007 high eleven years ago. Losses are asymmetric as they compound exponentially. Losses erode gains asymmetrically. For example, the price gain from the 2007 high to the current price is 56%, but it only takes -35% to decline back to that point. You may also consider the stock index is only 56% higher than its 2000 peak eighteen years ago.

In The REAL Length of the Average Bull Market I wrote: “Whether you believe the average bull market lasts 39 months, 50 months, or 68 months, it seems the current one is likely late in its stage at 54 months as of September 2013.” Yes, I was saying 5 years ago the trend seemed late stage – and it was. It just continued anyway, though was interrupted by two declines in the range of -15% in 2015 and 2016.

At the same time in late 2013, the Shiller PE Ratio was increasing to a very overvalued level. It only kept going higher. By January of this year, it reached 33x earnings, the second highest ever. In fact, the only two times it reached this extreme the stock market followed with the Great Depression crash and the -46% decline after 2000. After the current -18% decline in the S&P it is now down to 26.74. The median is around 15, secular bear markets often begin at 20 or higher, secular bull markets begin below 10.

The bottom line is:

I’m guessing the unprecedented Quantitative Easing of the Federal Reserve helped to push the valuations to an extreme. The Fed is now unwinding the QE and raising interest rates, which may be partly why we are seeing prices fall. So, we certainly can’t overlook the situational awareness that this could eventually become a much worse bear market to the -50% level. However, if it does, it will usually unfold with many swings up and down along the way. Falling prices are eventually followed by sharp countertrend moves up. It’s when we see lower highs and lower lows over time that it becomes more evident it’s a big bear market.

One thing that’s been talked about a lot lately is the risk of an inverted yield curve. An inverted yield curve is when the short-term 3-month interest rate is higher than the long-term 30-year interest rate. The yield curve hasn’t inverted like it did in December 2006 and August 2000. The yield curve doesn’t suggest a recession anytime soon.

How big are the stock market losses in 2018?

Starting with a top-down view. First, the broad asset classes and styles like large, mid, small and value, growth, and blend using Morningstar Small Value is down the most at -19% YTD. Small Cap stocks are down the most. Large Growth and Large Cap generally have declined the least. The average U.S. Market index is down -8.58%. Keep in mind that index performance does not include any costs or fees and may not be invested in directly.

The table above also includes sectors. Energy and Basic Materials are down over -20%, so any tactical system that avoided them had an advantage.

Most investors don’t necessarily invest all of their money in the stock market all the time. Many instead do global asset allocation like I wrote about in Global asset allocation takes a beating in 2018. Fewer have an objective like mine; a global tactical strategy that shifts between markets by increasing and decreasing exposure aiming for asymmetric risk/reward. Here are iShares asset allocation ETFs YTD as a proxy for low-cost exposure to a global asset allocation of stocks and bonds all the time with no active risk management or tactical decisions. Each “risk level” has a different exposure to stocks/bonds. Even the most conservative allocation which is mostly invested in bonds is down -4% in 2018.

I shared more detailed observations of global asset allocation Global asset allocation takes a beating in 2018.

For a more exhaustive observation of GAA trends, here I included some of the more popular active global allocation funds along with the iShares ETFs that track allocation indexes. Clearly, 2018 has been a hostile year for most every strategy; static, balanced, or tactical.

So, that’s the big picture. From there, let’s zoom in for a closer look for a shorter term observation.

The downside very quickly erodes the progress. However, the asymmetric nature of losses starts to really compound against capital after -20%. At this point, the S&P 500 is down -18%. It’s a little lower than 2016 and about the same as the decline in 2011.

Though this has been a very long bull market, it has been interrupted by deeper “corrections” of more than -10%.

In comparison, the 2003 to 2007 bull market corrections were less than -10%.

When does the bleeding stop?

After prices have already fallen, I start looking for signs of a potential countertrend and divergence.

The price trend itself is the final arbiter. It is what it is. A price that is trending down is going to continue to trend down until the desire to sell has been exhausted and drives prices low enough until the enthusiasm to buy takes over. After sharp selling pressure like we’ve seen since September, we’ll likely see some similarly sharp countertrend reversals up. Market trends don’t usually drift in a direction until it’s over, instead, we observe swings up and down as the price trend cycles. Short term cycles develop the longer term cycles.

Though the price trend itself is the final arbiter, the best way I have identified when trends are most likely to change direction at extremes is to observe extremes in investor sentiment and breadth. Ultimately, investor sentiment and the breadth is evident in the price, but at extremes, these measures can be a warning shot across the bow at high levels and indicate panic selling exhaustion at lows. From here, we’ll look at investor sentiment measures. We’ll also look at breadth indicators that quantitatively tell us the breadth of participation in the decline. The thinking is at some point these measures reach an extreme, suggesting the selling may be becoming exhausted and to prepare for a potential reversal. Since asymmetric risk/reward is my objective, I’m looking for lower-risk entries that have the potential for greater payoff than the amount I risk.

Investor Sentiment: Fear is Driving the Stock Market

A simple way to quickly observe overall investor sentiment is the Fear & Greed index, which tracks seven different indicators.

It’s the lowest level I’ve seen it, suggesting we’ve observed panic level selling. If you read my observations from the beginning of this year, you’ll see the opposite was true at the start of 2018.

It’s the lowest level I’ve seen it, suggesting we’ve observed panic level selling. If you read my observations from the beginning of this year, you’ll see the opposite was true at the start of 2018.

We’ve observed a round trip this year from Extreme Greed to Extreme Fear. Investor sentiment obviously swings up and down over time. As sentiment oscillates, it drives price tends to cycle, too. Even in bull markets, there are declines and in bear markets, we’ll see sharp upswings.

When investor sentiment is so bearish we see a spike in the words “bear market.” Google Trends shows the bear market talk on the Internet has spiked to the highest level in five years, even higher than 2015-16 and February this year.

I’m also hearing the typical talk about a 1987 type crash. The October 1987 -20% single day crash was 32 years ago but it’s still talked about today when prices fall. Markets are risky, so a crash is something we risk when we invest our money. The risk is partially why markets generate a return. We have to be willing to have exposure to risks that can come when no one expects it. Has modern market regulation and technology created any prevention of an ’87 type crash? Around 2012 circuit breakers were created to theoretically prevent a single day crash.

Circuit breaker thresholds: trading is halted market-wide for single-day declines in the S&P 500. Circuit breakers halt trading on the stock market during dramatic drops and are set at 7%, 13%, and 20% of the closing price for the previous day. There are also single stock limits and halts by the exchanges

Buy and hold, long-only asset allocation investors may take comfort in knowing there is some limit, but for those of us who actively manage our risk we prefer to deal with risk sooner if we can, but there is no assurance any strategy will always do as intended. You can read more about circuit breakers in Measures to Address Market Volatility. The bottom line is these circuit breakers are intended to limit a single day waterfall decline, they do not control overall drawdowns.

How many stocks are participating in the decline?

Another way to say it; How “washed out” is the stock market? To understand the internal condition, I look inside the indexes at the sectors and stocks. We’ll start with Breadth indicators, which quantitatively measure the percent of stocks in uptrends vs. downtrends.

- When 70% of stocks are already in uptrends it signals a strong market trend but also suggests as most stocks have caught up and participated, buying enthusiasm may be getting exhausted.

- When less than 30% of stocks are in uptrends, 70% of them are in downtrends, so the market trend is bearish. However, after most of the stocks have already fallen, at some point, it suggests we look for the exhaustion of selling pressure that could reverse the downtrend.

The percent of the S&P 500 stocks above their moving averages tells us how many of the 500 stocks are in an uptrend vs. a downtrend. When it’s declining, the market is bearish so we can see how many stocks are participating in the decline. When it reaches an extreme low, it may be an indication selling could be becoming exhausted. As we see, it has reached the low levels of past stock market lows with the exception of the low in March 2009.

Notice the low was reached October 2008 and stayed down until late March 2009. In the massive crash when stocks fell over -50%, it stayed “oversold” for over 6 months. It’s an example of the limitations of countertrend signals in outlier events.

For a view of the short-term trends, I do the same for the 50 day moving average. Only 6% of the S&P 500 stocks are in uptrends, so 94% are in short-term downtrends. That’s the bad news for stock investors. The good news is, it’s reached the low range where we have historically seen a reversal up. A reversal up from here would be bullish, at least temporarily.

The S&P 500 Bullish Percent Index is the number of stocks in the S&P that are trading on a Point & Figure buy signal. By this measure, only 17% of the 500 stocks are in uptrends. I highlighted the top are in red to note the contrary indicator of breadth and green on the bottom to mark the contrarian bullish zone where downtrends may reverse to uptrends when selling gets exhausted. The S&P 500 Bullish Percent Index is below 2011, 2015 and 2016 stock market correction lows. BPI is considered overbought when above 70% and oversold when below 30%. Once it reaches the green zone, I start looking for a reversal up from a low level, which is a bullish signal.

Notice the current level is below the 2011 and 2015-16 decline, but not as low as the 2008-09 bear market when the stock index fell -56%.

We see the same scenario in the NYSE Bullish Percent, which applies the same method to the stocks trading on the NYSE.

We’re not seeing any divergence in the breadth indicators, they are all down as most stocks have fallen. These are now at the level to look for countertrend signals.

The High-Low Index is a 10-day moving average of new highs vs. new lows. This breadth indicator shows when new highs outnumber new lows and when new highs are expanding. In general, new highs outnumber new lows when the indicator is above 50. New highs are expanding when the indicator is above 50 and rising. As with most range bound oscillator indicators, high is over 70 and low is below 30. Here we see it’s about as low as it has been. We also see how it can swing around for a year or two in a bear market. Since it can take time for prices to reach all-time highs and lows, the High-Low Index is more lagging than similar indicators.

Before we look inside the sectors, we’ll look at some other indicators of sentiment. This week, the CBOE Total Put/Call Ratio spiked to 1.82, which is its highest put volume over call volume ratio ever. We have data going back to 1995. As you can see in the chart, we normally see this ratio less than one as more calls trade than puts. A reading over 1 is usually a signal of pessimism as options traders appear to buy buying put options for protection or to speculate the stock market will fall. We’ve never seen put volume so high. Options traders appear to be very bearish, which has historically been a contrarian indicator at some point.

By the way, big bear markets unfold in cycles as the trend swings up and down. In the last bear market, the stock indexes fell -15%, then gained 10%, then fell 20%, then gained 15%, along the way you never know in advance which direction it is going to trend next. Many tactical traders had trouble with the 2007 to 2009 period because of whipsaws. By the time they exited, the market trended up without them, then they reentered just in time for the next fall. This is the risk of tactical trading, whether the method is breakouts, momentum, relative strength, or any other rotation style. I know this because I’ve known over 100 other tactical traders for over two decades. The price swings are the challenge. For example, below is the 2008 – 2009 -56% decline. As you can see, the Equity Put/Call Ratio is on top. I drew green lines at its peaks to show they typically indicate a short-term price low, but probably not as well as it would in a correction within a primary bull market. The point is, sometimes signals work out well, other times they don’t. They don’t have to be perfect and none are. The key is asymmetry: higher average profits than losses over full market cycles.

One indicator showing some divergence is the VIX CBOE Volatility Index. Although the S&P 500 is about -5% lower than its February low when the VIX spiked up to nearly 40, the VIX is only at 30 this time. However, I point out it did the same thing in the lower low in January 2016. The VIX initially spiked more in the first decline in August 2015 but remained less evaluated at the lower low in January 2016. It appears the options market expects elevated volatility, but not as much as an expansion as before. We’ll see.

Drilling down, what about sectors? Below are the individual sectors YTD. Energy and Materials are down the most. Ironically, they are tied to inflation. Where is the rising prices (inflation) the Fed is supposed to be fighting?

Sector Trends and Breadth

To get an underatnding of the individual stock trends within a sector, I look at the bullish percent of the sectors.

First, we’ll observe the bullish percent of the Energy sector. Energy is down the most and only 3% of stocks in the index is an uptrend as measured by a point & figure buy signal. It’s as low as its been in 20 years. Though it could stay at this low level in a bear market as it did around 2008, it still swings up and down for those willing to trade it.

The next biggest loser sector is Basic Materials, another commodity-related sector. I highlighted the current low level in green, which is nearly as low as it’s ever been in 20 years. These indicators are range bound, so they can only fall to 0% and as high as 100%.

The Financial sector is the third largest weight in the S&P 500 stock index at 13%. It’s down -18%, making it one of the biggest laggards. Banks, brokers, etc. are leading the market down and that isn’t a good sign for the economy of the market. Financials often lead in bear markets. However, as we see below, their participation in the fall is about as high as it’s ever been. On the other hand, we see how volatile and weak Financials were in 2007 to 2009. During that “Financial Crisis”, they were among the worst.

The industrials sector, down about -18%, continues the trend of broad participation in the sell-off. It’s also reached the lowest it did in 2008 and 2011.

Consumer Staples is a sector that is supposed to hold up in market declines, but the index is down -12% year to date, which is more than the S&P. Staples stocks have participated as much as they did in prior corrections in 2011 and 2016, but not as much as around 2008.

The Technology sector is a big one because at 20% it has the largest weighting in the S&P 500. The Technology sector is down about -7% YTD. The Technolgy sector bullish percent is down below its lows in prior corrections and nearing the 2008 and 2009 lows. Keep in mind, once prices have moved to a low point, they eventually attract buying demand and reverse the other direction. These indicators help us see the levels it is more likely to happen and a reversal in these indicators increases the potential even more.

Consumer Discretionary is 10% of the S&P and down -5% YTD. Its bullish percent is as about as low as it’s been.

Another major sector is Healthcare, it’s the second largest weighting at 16% of the S&P 500. It’s flat for the year, but its bullish percent is very washed out.

The Utility sector is the lone survivor so far in 2018. Like Consumer Staples, Utilities are considered “defensive.” That expectation hasn’t held true for Consumer Staples down -12% this year, but the Utility sector is up 2% YTD. The first half of the year, Utilities were laggard as they are sensitive to rising interest rates, but the last half they’ve found some buying interest. As we see, the Utility sector momentum has been strong enough to keep its stocks in uptrends and into the higher risk zone. However, notice they tend to stay at higher bullish percent levels over time. Utilities don’t usually have strong momentum against other sectors, but they do tend to have less volatility. Of course, in the last big bear market that wasn’t the case as everything fell.

The bottom line is the stock market could certainly be entering another big bear market. It’s long overdue as this bull is very aged and overvalued. Even if it is, it will include swings up and down along the way. That’s the challenge for all strategies that trade or invest in stocks. For buy and hold investors, it’s a challenge as stocks swing up and down and they have full exposure all the time and unlimited downside risk. For tactical traders, the swings are a challenge as we increase and decrease our exposure to risk and reward and none of our methods are perfect. The key, for me, in dealing with it is to hold the lowest risk, highest potential reward exposure. Barring we don’t see some waterfall decline, most of the market is at a point we should see a countertrend move up at least temporarily. If prices keep trending down, I’m guessing the upswing that does come will be just as sharp.

After prices have fallen, I start looking for signs of a potential countertrend and it could come at any time.

Someday in the future, stock investors will be giddy again and completely forget about how they feel right now. But for now, the trend is down, but the sentiment and breadth are at such extremes we should be alert to see at least a short-term reversal in the days ahead.

I hope you find this market analysis helpful. If you don’t believe it is exhaustive enough, I encourage you to read some of the other recent observations since they cover more detail on some of the topics above.

Have a Merry Christmas!

Mike Shell is the Founder and Chief Investment Officer of Shell Capital Management, LLC, and the portfolio manager of ASYMMETRY® Global Tactical.

The observations shared on this website are for general information only and are not specific advice, research, or buy or sell recommendations for any individual. Investing involves risk including the potential loss of principal an investor must be willing to bear. Past performance is no guarantee of future results. The presence of this website on the Internet shall in no direct or indirect way raise an implication that Shell Capital Management, LLC is offering to sell or soliciting to sell advisory services to residents of any state in which the firm is not registered as an investment advisor. Use of this website is subject to its terms and conditions.

U. S. Sector Trends

Yesterday I shared my observations of the overall stock market in The Stock Market Trend. Here are my observations of U. S. Sector trends to see which sectors are trending, which sectors have experienced declining momentum, and where they are year-to-date. Keep in mind, I use the actual index ETFs for observations since they represent real-world price trends including expenses, none of this is advice to buy or sell any of them for anyone.

Below are the sector trends year-to-date.

Ok, I know that looks like a hurricane spaghetti chart to show potential cyclone paths, so here is a table showing the year-to-date price trends using the Select Sector SPDRs. In 2018, Healthcare, Consumer Discretionary, and Technology are still the leading sectors. I’ll point out the divergence with sectors like Basic Materials and Consumer Staples lagging in relative momentum.

A more interesting view is a visual observation of drawdowns year to date and recently. Here, we see that Basic Materials, Communication Services, Financials, and Consumer Staples are down over -10% from their highs.

For a stock market decline to stop and reverse, it has to reach a low enough point to attract enough buying demand to support higher prices.

The good news is the stock indexes, and many of these sectors are testing their longer-term trend lines. At the same time, they are reaching a point we could see at least a short-term reversal up from here.

Only time will tell if the recent price declines are just a correction in an ongoing uptrend in the U. S. stock market or the beginning of a more significant downtrend.

As a portfolio manager, I am a risk manager and risk taker.

The only way to create gains is to take some risk. The way to manage risk is to predefine how much I’m willing to lose in advance. My focus is on asymmetric risk/return. So, my objective is to take a risk when it is more likely to result in positive asymmetry.

The essential parts necessary to create asymmetric risk/return are:

Risk manager: decide in advance at what price to exit as a declining trend to manage the size of the loss. Determine how much of our portfolio we are willing to lose to see if price trends will become profitable.

Risk taker: decide when to enter a position to take that predefined risk to see if the potentially profitable trend unfolds in our favor to become a profit.

You can probably see how these market cycles and trends create both the potential for risks and rewards and we can decide how to tactically operate with them.

Mike Shell is the Founder and Chief Investment Officer of Shell Capital Management, LLC, and the portfolio manager of ASYMMETRY® Global Tactical.

The observations shared on this website are for general information only and are not specific advice, research, or buy or sell recommendations for any individual. Investing involves risk including the potential loss of principal an investor must be willing to bear. Past performance is no guarantee of future results. The presence of this website on the Internet shall in no direct or indirect way raise an implication that Shell Capital Management, LLC is offering to sell or soliciting to sell advisory services to residents of any state in which the firm is not registered as an investment advisor. Use of this website is subject to its terms and conditions.

Rising Interest Rate Impact on Real Estate and Home Construction

The Federal Reserve raised interest rates today and raised expectations for a fourth rate hike in December. They unanimously agreed to raise the federal funds rate a quarter percentage point, to a range of 2% to 2.25%. The rate helps drive interest rates for mortgages, consumer loans, and credit cards. In 2019, the Fed expects at least three more rate hikes.

The rising trend in interest rates impacts many things beyond consumer credit. Ultimately, when the cost of borrowing increases it can impact real estate, homebuilders, and home construction.

The price trend of homebuilders and home construction stocks is down. The ETF of home builders and home construction stocks is down about -20% from their highs in January.

The price trends in Homebuilders stock ETF (XHB) and Home Construction ETF (ITB) show they really haven’t recovered from the fall that started in 2007.

Below we add the 10-year treasury rate. Rising interest rates may be having some impact on real estate home builders and construction.

Rising interest rates are supposed to boost the profit margins of financials like banks and insurance. However, so far we observe the bank stocks and insurance stocks ETFs are trending mostly sideways since interest rates moved higher.

Another real estate sector is represented by the Real Estate sector ETF (XLRE), which seeks to provide precise exposure to companies from real estate management and development and REITs, excluding mortgage REITs. I shared some observations about the overall real esate sector earlier this year in Interest Rate Trend and Rate Sensitive Sector Stocks. The impact of rising rates has continued.

A clearer observation is seen in the chart of homebuilders stocks along with the trend in the 15-year and 30-year mortgage rate.

Clearly, there seems to be some correlation between rising rates and falling real estate sector and industry groups like homebuilders and home construction stocks.

This is why I shift between markets and sectors based on their price trends instead of just allocating capital to them regardless of their directional trend. It’s also why we manage our risk in absolute terms with our intention of avoiding large losses created by significant down-trending price trends. I rotate between world markets rather than allocate to them.

Mike Shell is the Founder and Chief Investment Officer of Shell Capital Management, LLC, and the portfolio manager of ASYMMETRY® Global Tactical.

You can follow ASYMMETRY® Observations by click on on “Get Updates by Email” on the top right or follow us on Twitter.

The observations shared in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. Investing involves risk including the potential loss of principal an investor must be willing to bear. Past performance is no guarantee of future results.

Earnings season is tricky for momentum growth stocks

Momentum stocks are stocks that show high upside momentum in their price trend. Momentum stocks are trending not only regarding their absolute price gains but also relative strength vs. other stocks or the stock market index.

Momentum stocks are usually high growth stocks. Since momentum stocks are the strongest trending stocks, their trends are often driven by growth in sales and earnings. Growth stocks are companies that are growing earnings at a rate significantly above average. Growth stocks have high increases in earnings per share quarter over quarter, year over year, and may not pay dividends since these companies usually reinvest their strong earnings to accelerate growth.

Now that we have defined what I mean by “momentum stocks,” we can take a look at some examples of momentum stocks and their characteristics like how their prices trend.

Grubhub Inc. ($GRUB) is an online and mobile food-ordering company that connects diners with local restaurants. GrubHub is a great example today of a high momentum growth stock. GrubHub stock has gained 24% today after smashing Wall Street’s expectations. Earnings grew 92% to 50 cents a share, marking the fifth quarter in a row of accelerating EPS growth. Revenue soared 51% to $239.7 million, a quarterly best.

Before today, GrubHub stock was in a positive trend that developed a flat base since April (highlighted on the chart). GRUB had already gained 60% year to date, but after such as explosive uptrend in momentum, it trended sideways for a while.

It is earnings season, which can be tricky for the highest momentum stocks. Once a stock has already made a big move, it could already have a lot of good news expectations priced in. That concerns some momentum stock traders. In fact, I know some momentum stock traders who exit their stocks before their quarterly earnings announcements. If they had exited GrubHub, they would have missed today’s continuation of its momentum. However, they would avoid the downside of those that trend in the other direction.

I’ve been trading momentum stocks for over two decades. Over the years I’ve observed different regimes of how they act regarding trend strength and volatility. There are periods of volatility expansion and contraction and other periods when momentum is much stronger.

Volatility is how quickly and how far the price spreads out. When price trends are volatile, it’s harder to stick with them because they can move against us. We like upside volatility, but smart investors are loss averse enough to dislike downside volatility that leads to drawdowns. To understand why the smart money is loss averse, read: “Asymmetry of Loss: Why Manage Risk?“.

Strong upward trending stocks are sometimes accompanied by volatility. That’s to be expected because momentum is a kind of volatility expansion. Upward momentum, the kind we like, is an upward expansion in the range of the price – volatility.

That’s good vol.

But, strong trending momentum stocks necessarily may include some bad volatility, too. Bad volatility is the kind investors don’t like – it’s when the price drops, especially if it’s a sharp decline.

I mentioned GrubHub had gained 60% YTD. I like to point out, observe, and understand asymmetries. The asymmetry is the good and the bad, the positive and the negative, I prefer to skew them positively. What I call the Asymmetry® Ratio is a chart of the upside total return vs. the chart of the downside % off high. To achieve the gain for GrubHub, investors would have had to endure its price declines to get it. For GrubHub, the stock has declined -10% to -15% many times over the past year. It has spent much of the time off its high. To have realized all of the gains, investors had to be willing to experience the drawdowns.

I point this out because yesterday I wrote “Asymmetry of Loss: Why Manage Risk?” where I discussed the mathematical basis behind the need for me to actively manage the downside risk. To achieve the significant gain, we often have to endure at least some of the drawdowns along the way. The trick is how much, and for me, that depends on many system factors.

Earnings season, when companies are reporting their quarterly earnings, is especially tricky for high momentum stocks because stocks that may be “priced for perfection” may be even more volatile than normal. Accelerating profit growth is attractive to investment managers and institutional investors because increasing profit growth means a company is doing something right and delivering exceptional value to customers. I’m more focused on the direction of the price trend – I like positive momentum. But, earnings are a driver of the price trend for stocks.

Earnings can trend in the other direction, too, or things can happen to cause concern. This information is released in quarterly reports.

Another example of a momentum stock is NetFlix. By my measures, GrubHub is a leading stock in its sector and NetFlix (NFLX) is the leader in its industry group, too, based on its positive momentum and earnings growth. As we see in the chart below, NFLX has gained 88% year to date. That’s astonishing momentum considering the broad stock market measured by the S&P 500 has gained around 5%, and its Consumer Services Sector ETF has gained 11%.

However, NetFlix stock regularly declines as much as -15% as a regular part of its trend. It has fallen over -10% five times in the past year on its way to making huge gains. The latest reason for the decline was information that was released during its quarterly earnings announcement. The stock dropped sharply afterward.

But, as we see in the chart, it’s still within its normal decline that has happened five times the past year.

While some of my other momentum stock trader friends may exit their stocks during the earnings season, I instead focus more on the price trend itself. I predefine my risk in every position, so I determine how much I’ll allow a stock to trend to the downside before I exit. When a stock trends down too far, it’s no longer in a positive trend with the side of momentum we want. To cut losses short, I exit before the damage gets too large.

How much is too much?

A hint is in the above charts.

If we want to experience a positive trend of a momentum stock, we necessarily have to give it enough room to let it do what it does. When it trends beyond that, it’s time to exit and move on. We can always re-enter it again it if trends back to the right side.

Sure, earnings season can be tricky, but for me, it’s designed into my system. I’m looking for positive Asymmetry® – an asymmetric risk/reward. What we’ve seen above are stocks that may decline as much as -15% as a normal part of their trend when they fall, but have gained over 50% over the same period.

You can probably see how I may be able to create a potentially positive asymmetric risk/reward payoff from such a trend.

Mike Shell is the Founder, and Chief Investment Officer of Shell Capital Management, LLC, and the portfolio manager of ASYMMETRY® Managed Portfolios and ASYMMETRY® Global Tactical.

You can follow ASYMMETRY® Observations by click on on “Get Updates by Email” on the top right or follow us on Twitter.

The observations shared in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. Investing involves risk including the potential loss of principal an investor must be willing to bear. Past performance is no guarantee of future results.

Asymmetry of Loss: Why Manage Risk?

“The essence of portfolio management is the management of risks, not the management of returns.” —Benjamin Graham

Why actively manage investment risk?

Why not just buy and hold markets and ride through their large drawdowns?

Losses are asymmetric and loss compounds exponentially.

The larger the loss, the more gain is required to recover the loss to get back to breakeven.

The negative asymmetry of loss starts quickly, losses more than -20% decline start to compound against you exponentially and with a greater magnitude the larger the loss is allowed to grow.

If your investment portfolio experiences a -20% loss, it needs a 25% gain to get back the breakeven value it was before the loss.

At the -30% loss level, you need a 43% gain to get it back.

Diversification is often used as an attempt to manage risk by allocating capital across different markets and assets.

Diversification and asset allocation alone doesn’t achieve the kind of risk management needed to avoid these large declines in value. Global markets can fall together, providing no protection from loss.

For example, global markets all fell during the last two bear markets 2000-2003 and 2007-2009.

It didn’t matter if you had a global allocation portfolio diversified between U.S. stocks, international stocks, commodities, and real estate REITs.

Diversification can fail when you need it most, so there is a regulatory disclosure required: Diversification does not assure a profit or protect against loss.

This is why active risk management to limit downside loss is essential for investment management.

I actively manage loss by knowing the absolute point I’ll exit each individual position and managing my risk level at the portfolio level.

Active risk management, as I use it, applies tactics and systems to actively and dynamically decrease or increase exposure to the potential for loss.

My risk management systems are asymmetric risk management systems. Asymmetric risk management intends to manage risk with the objective of a positive asymmetric risk/reward.

My asymmetric risk management systems are designed to cut losses short, but also protects and manages positions with a profit.

After markets trend up for a while without any significant interruption, investors may become complacent and forget the large damage losses can cause to their capital and their confidence. When investors lose confidence in the markets, they tap-out when their losses are allowed to grow to large.

I prefer to stop the loss before it gets too large. How much is too large depends on the client, but also the math. As seen here, I have a mathematical basis for believing I should actively manage investment risk.

It’s why I’ve been doing it for two decades. Because I understood the math, I knew I had to do it over twenty years ago and developed the systems and tactics that proved to be robust in the devastating bear markets I’ve executed through since then.

Mike Shell is the Founder, and Chief Investment Officer of Shell Capital Management, LLC, and the portfolio manager of ASYMMETRY® Managed Portfolios and ASYMMETRY® Global Tactical.

You can follow ASYMMETRY® Observations by click on on “Get Updates by Email” on the top right or follow us on Twitter.

The observations shared in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. Investing involves risk including the potential loss of principal an investor must be willing to bear. Past performance is no guarantee of future results.

Global Stock and Bond Market Trends 2Q 2018

Yesterday we shared the 2nd Quarter 2018 Global Investment Markets Review, which used a broad range of indexes on performance tables to present the year-to-date progress of world markets. The issue with a table that simply shows a return number on it is it doesn’t properly present the path it took to get there. In the real world, investors and portfolio managers have to live with the path of the trend and we can see that only in the price trend itself. So, today we’ll look at the price trends of stocks, bonds, commodities, real estate, sectors, and other alternatives like volatility. I don’t just look for potentially profitable price trends in stocks and bonds, I scan the world.

How is the market doing this year? Which market?

First, a quick glance at global markets including commodities, stock indexes, volatility, ranked by year-to-date momentum. We wee the CBOE Volatility Index $VIX has gained the most. One clear theme about 2018 is that volatility has increased and this includes implied or expected volatility. Overall, we see some asymmetry since the markets in the green are more positive than the markets in the red. The popular S&P 500 stock index most investors point to is in the middle with only a 2% gain for the year. Commodities like Cocoa, Lumber, Orange Juice, and Crude Oil are leaders while sugar, live cattle, and soybeans are the laggards. Most investors probably don’t have exposure to these markets, unless they get it through a commodities ETF.

Most investors probably limit themselves to the broad asset classes, since that’s what most financial advisors do. So, we’ll start there. Below are the trends of broad market ETFs like the S&P 500, Aggregate Bond, Long-Term Treasury. For the year, Emerging Markets has the weakest trend – down nearly -6%. Developed Markets countries are the second weakest. The rising U.S. Dollar is helping to put pressure on International stocks. The leader this year is Commodities, as we also saw above. The Commodity index has gained 8% YTD.

What about alternative investments? We’ll use liquid alternative investments as an example since these are publicly available ETFs. I’ve included markets like Real Estate, Private Equity, Mortgage REITs, and the Energy MLP. Not a lot of progress from buying and holding these alternative investments. This is why I prefer to shift between markets trying to keep capital only in those markets trending up and out of those trending down.

The Volatility VXX ETF/ETN that is similar to the VIX index has gained so much early in the year I left it off the following chart because it distorted the trends of the other markets. It’s one of the most complex securities to trade, but we can see it spike up to 90% when global markets fell in February.

Looking at the price trend alone isn’t enough. It would be incomplete without also considering their drawdowns. That is, how much the market declined off its prior high over the period. Analyzing the drawdown is essential because investors have to live with the inevitable periods their holdings decline in value. It’s when we observe these decline we realize the need for actively managing risk. For me, actively managing risk means I have a predetermined exit point at all times in my positions. I know when I’ll exit a loser before it becomes a significant loss. Many say they do it, I’ve actually done it for two decades.

The alternative investments are in drawdowns YTD and Energy MLP, and Mortgage REIT is down over -10% from their prior highs. The Energy MLP is actually down -51% from its 2014 high, which I don’t show here.

Next, we go back to the global asset class ETFs to see their drawdowns year-to-date. We don’t just experience the gains, we also have to be willing to live with their declines along the way. It isn’t enough to provide an excellent investment management program, we also have to offer one that fits with investors objectives for risk and return. The most notable declines have been in Emerging Market and developed international countries. However, all of these assets are down off their prior highs.

Clearly, markets don’t always go up. The trends so far in the first six months of 2018 haven’t offered many opportunities for global asset allocation to make upward progress.

This is why I rotate, rather than allocate, to shift between markets rather than allocate to them. We also trade in more markets than we covered here, like leading individual stocks. The magnitude of these drawdowns also shows why I believe it is essential to direct and control risk and drawdown.

Mike Shell is the Founder and Chief Investment Officer of Shell Capital Management, LLC, and the portfolio manager of ASYMMETRY® Global Tactical.

You can follow ASYMMETRY® Observations by click on on “Get Updates by Email” on the top right or follow us on Twitter.

The observations shared in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. Investing involves risk including the potential loss of principal an investor must be willing to bear. Past performance is no guarantee of future results.

Is it a stock pickers market?

Sometimes the stock market is trending so strongly that the rising tide lifts all boats. No matter what stocks or stock fund you invest in, it goes up. That was the case much of 2017.

Then, there are periods when we see more divergence.

When we observe more divergence, it means stocks, sectors, size, or style has become uncorrelated and are trending apart from each other.

I pointed out in Sector Trends are Driving Equity Returns; there is a notable divergence in sector performance, and that is driving divergence in size and style. Growth stocks have been outperformance value, and it’s driven by strong momentum in Technology and Consumer Discretionary sectors.

When specific sectors are showing stronger relative momentum, we can either focus more on those sectors rather than broad stock index exposure. Or, we can look inside the industry to find the leading individual stocks.