There is an interesting divergence today between Momentum, Growth, and Value.

Up until now, Value has lagged Growth and Momentum, as seen in this 5-year chart.

The underperformance of Value has been a topic of conversation of hedge fund managers I know who are Value investors.

Three-month momentum shows Value is trending up.

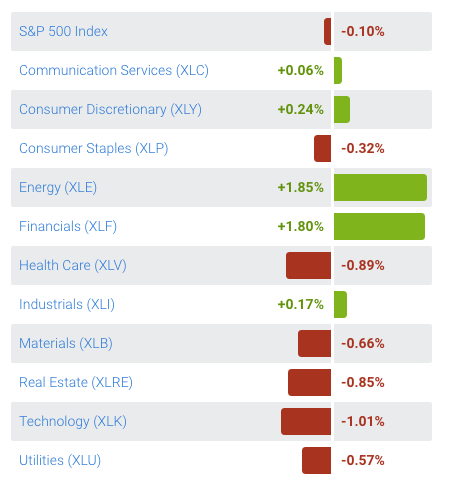

I believe styles like Growth vs. Value are largely driven by sectors, which is why I tend to focus more on the more granular sectors rather than broader styles. Today we see the relative strength is in Energy and Financials, which have been the lagging sectors lately.

So, this may not be enough to say the trend is changing to a period where Value outperformance growth for years, but it’s at least enough to be aware.

At some point, Value will take over leadership and when it does, it may continue for years.

For now, exposure to Value, including high dividend-paying stocks like we have, is having a good day while other factors are not.

Mike Shell is the Founder and Chief Investment Officer of Shell Capital Management, LLC, and the portfolio manager of ASYMMETRY® Global Tactical.

Mike Shell and Shell Capital Management, LLC is a registered investment advisor focused on asymmetric risk-reward and absolute return strategies and provides investment advice and portfolio management only to clients with a signed and executed investment management agreement. The observations shared on this website are for general information only and should not be construed as advice to buy or sell any security. Securities reflected are not intended to represent any client holdings or any recommendations made by the firm. Any opinions expressed may change as subsequent conditions change. Do not make any investment decisions based on such information as it is subject to change. Investing involves risk, including the potential loss of principal an investor must be willing to bear. Past performance is no guarantee of future results. All information and data is deemed reliable, but is not guaranteed and should be independently verified. The presence of this website on the Internet shall in no direct or indirect way raise an implication that Shell Capital Management, LLC is offering to sell or soliciting to sell advisory services to residents of any state in which the firm is not registered as an investment advisor. Use of this website is subject to its terms and conditions.

Sector SPDRs are subject to risk similar to those of stocks including those regarding short selling and margin account maintenance. All ETFs are subject to risk, including possible loss of principal. Sector ETF products are also subject to sector risk and non-diversified risk, which will result in greater price fluctuations than the overall market.

You must be logged in to post a comment.