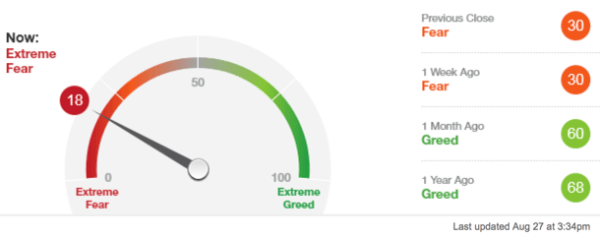

As I said in “Fear is the Current Return Driver“, investor sentiment has turned to “Fear” since the stock and bond markets have declined recently. Investors tend to get optimistic (and greedy) after prices have gone up and then fearful after prices go down. Now, I am not a contrarian investor. I want to be positioned in the direction of global markets and stay there until they change. My purpose of pointing out these EXTREMES in investor sentiment (fear and greed) is to illustrate how investors feelings oscillate between the fear of missing out (if global markets have gone up and they aren’t in them) and the fear of losing money (if they are in global markets and they are falling). Fear and greed is a significant driver of price trends and investment returns. When stock market investor sentiment readings get to an extreme it often reverses trend afterward. For example, as you can see in the Fear & Greed Index below, the dial is now at “Extreme Fear” as the return driver. When we see these extremes in fear it happens after prices have fallen. Prices can keep falling after it gets to such an extreme, but we often see the directional price trend reverse back up after an extreme fear measure. With that said, the purpose of this observation of extreme points of sentiment isn’t to be necessarily used as a timing indicator, but instead to recognize how extreme readings of investor sentiment are most often the wrong feeling at the wrong time. It isn’t the best timing indicator because, thought extreme readings often proceed a change in the price trend, these extreme readings can get a LOT more extreme and prices can keep moving far more than expected. So, all countertrend indicators have that risk. It’s like value investing: you think it’s oversold, or undervalued, but it gets a lot more oversold and a lot more undervalued. What I think is useful about observing extremes in sentiment are to understand how investors behave at certain points in a market cycle. If you find you have problems with this behavior, you may use to modify your behavior.

If you don’t understand this, or have question or comment, contact me directly or reply to this post if you don’t mind others to see your reply.

Pingback: Time for Investors to Hunker Down - Invest Offshore

Pingback: What emotion is driving the market now? Extreme Greed « Asymmetry Observations