Someone asked; how do you use technical analysis (charting) as an investment manager?

I’ll share a simple and succinct example.

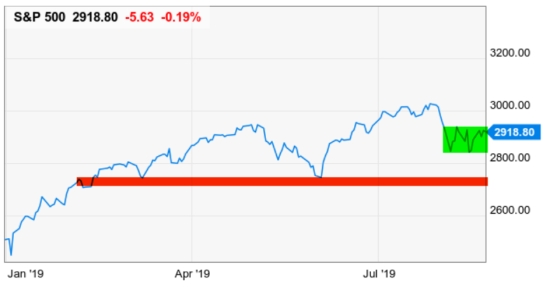

Below is a chart of a popular stock market index. What do you see when you look at it?

I see an overall uptrend based on this time frame, which is only year-to-date.

I see it’s experiencing a normal-looking interruption in the short term, so far.

As such, I’m looking for signs of which direction it’s going to move, by observing which direction it does move.

Without adding a single “technical indicator” for statistical or quantitative analysis, I see the stock market using this proxy has been drifting generally sideways since February.

However, it has made higher highs and higher lows, so it’s a confirmed uptrend.

Looking closer, are shorter term, I see the green highlighted area is also in a non-trending state, bound by a range. I’m looking for it to break out; up or down.

If it breaks down, I will look for it to pause around the red line I drew, because it’s the prior low as well as an area of trading before that. I would expect to see some support here, where buyer demand could overcome selling pressure.

If it doesn’t, I’d say:

Look out below!

Do I trade-off this? Nope.

Am I telling you to? Nope.

But, if I wanted to trade off it, I could. This is an index and the index is an unmanaged index and cannot be invested in directly. But, for educational purposes, assume I could enter here. Before I did, I would decide my exit would be at least a break below the red line. Using that area as an exit to say “the trend has changed from higher lows to lower lows, which is down, I’ll exit if it stays below the line.

Of course, the same strategy can be applied quantitatively into a computerized trading system. I could create an algorithm that defines the red line as an equation and create a computer program that would alert me to its penetration.

This is a succinct and simple glimpse into concepts of how I created my systems.

I hope you find it useful.

I developed skills at charting before I created quantitative systems. If someone doesn’t believe in either method, they probably lack the knowledge and skill to know better.

Let me know if we can help!

Mike Shell is the Founder and Chief Investment Officer of Shell Capital Management, LLC, and the portfolio manager of ASYMMETRY® Global Tactical.

Mike Shell and Shell Capital Management, LLC is a registered investment advisor and provides investment advice and portfolio management exclusively to clients with a signed and executed investment management agreement. The observations shared on this website are for general information only and should not be construed as advice to buy or sell any security. Securities reflected are not intended to represent any client holdings or any recommendations made by the firm. Investing involves risk, including the potential loss of principal an investor must be willing to bear. Past performance is no guarantee of future results. All information and data is deemed reliable, but is not guaranteed and should be independently verified. The presence of this website on the Internet shall in no direct or indirect way raise an implication that Shell Capital Management, LLC is offering to sell or soliciting to sell advisory services to residents of any state in which the firm is not registered as an investment advisor. Use of this website is subject to its terms and conditions.

You must be logged in to post a comment.