I recently compared the climate differences between two places I call home: Knoxville, Tennessee and Tampa, Florida. They have very different climates, Knoxville is in the Tennessee mountains, the Tampa Bay/Clearwater/St. Pete area is home of the best beaches in America. Some of us consider the two the best of both worlds. What you believe depends on your own experience. Knoxville is one of the gateways to the Great Smoky Mountains National Park, the most visited national park in America. It had about 10 million visitors in 2013, which was double the Grand Canyon, the second most visited. The two cities have very different climates in the summer and winter months. We think of Tampa, Florida as hot and sunny. Knoxville is cooler in the summer, chilly in the winter. But that’s just my opinion and description. If we really want to understand the absolute level of temperature, humidity, and sunshine, and relative differences we can apply some quantitative methods and draw some visual graphs between them. Here you will see how I see and understand how I make decisions and draw distinctions. For those who otherwise have difficultly understanding data and graphs, you may find it more interesting to apply the same concepts to the weather. I’ll share with you my study of Knoxville vs. Tampa weather which I think is a good example of applying historical data to understand what to expect. To do this weather comparison, I used this tool with data from the NOAA Comparative Climate Data.

Summer in Knoxville, Winter in Tampa?

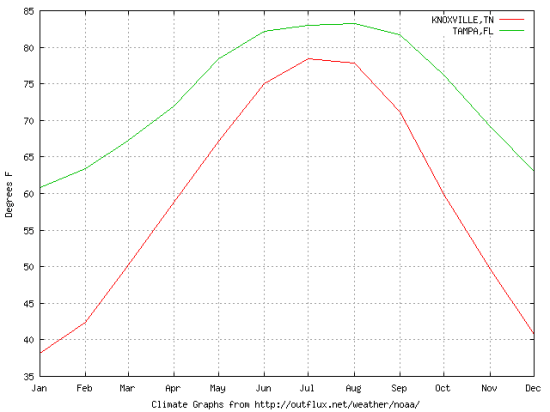

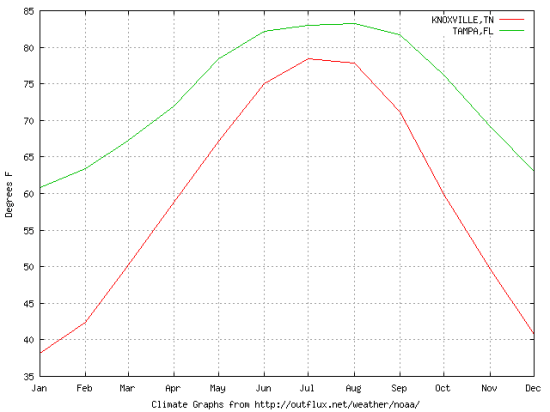

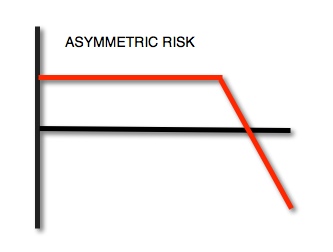

Initially, we can compare the average temperature between Knoxville and Tampa to get a quick visual. We can see some positive asymmetry between the winter and summer months. The average temperature in January is in the 60’s in Tampa and only the 30’s in Knoxville: a 30 degree spread. Yet, the average summer months is only a 10 degree spread. I call that positive asymmetry, because we don’t want it too hot in the summer and we don’t want it too cool in the winter. Tampa has the better tradeoff. But, the flaw of averages is that the actual high and low range can be much wider than we realize, so can gain a better understanding by looking specifically at the highs and lows.

AVERAGE TEMP

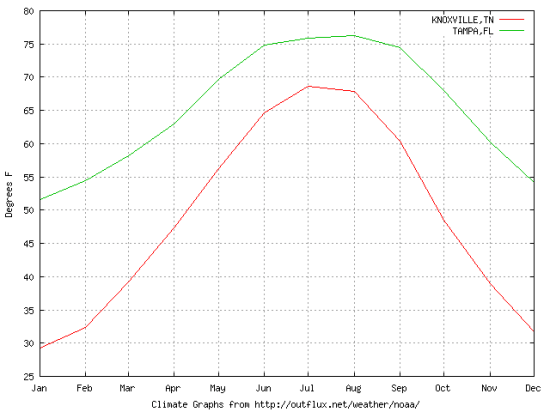

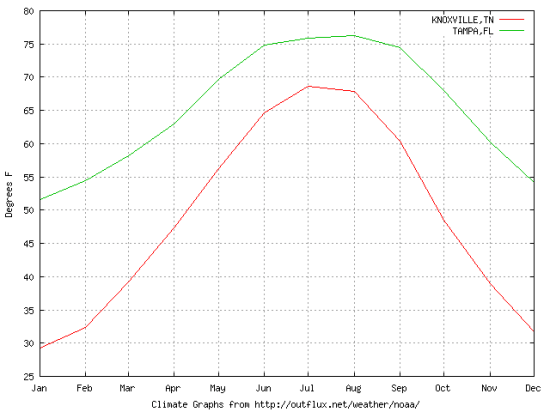

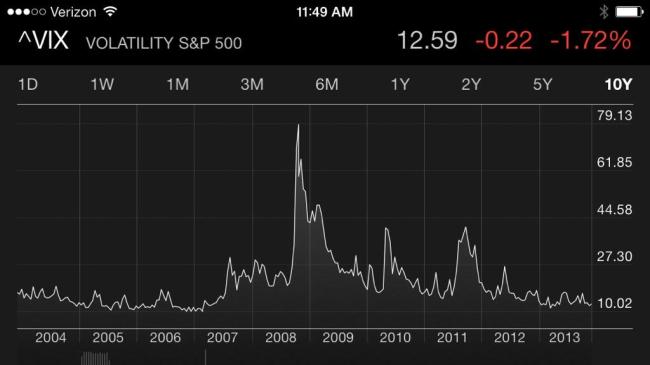

Although Knoxville is in the south, it still gets cold in the winter months. If we wanted a “winter home” to avoid those cold winter months, we would first focus on the average low temperature. That is, “how cold does it get”? Comparing the lows allows us to understand how cold it gets. As we see in the chart below, January and February are the coldest months in Knoxville when the low is around freezing. On the other hand, in Tampa the average low is above 50. 50 is chilly, not really cold. Notice the other extreme on the chart is the peak, when the average low in Tampa is over 70 during starting in June through September. We could say that that weather in Knoxville is more volatile throughout the year since it has a wider range of temperatures. We can see the visually by how quickly the data spreads out or how steep it is between the summer months and colder months. Clearly, the average lows of Tampa are more comfortable if you enjoy the outdoors.

AVERAGE LOW

What about summer?

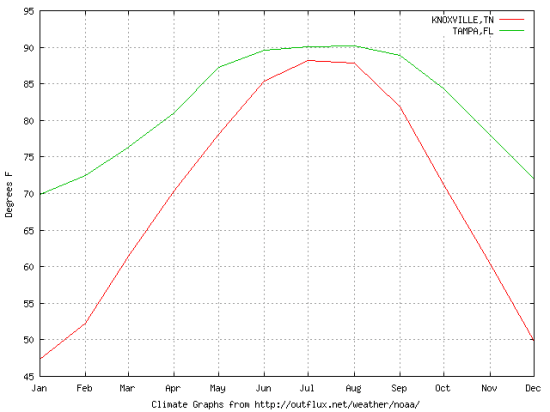

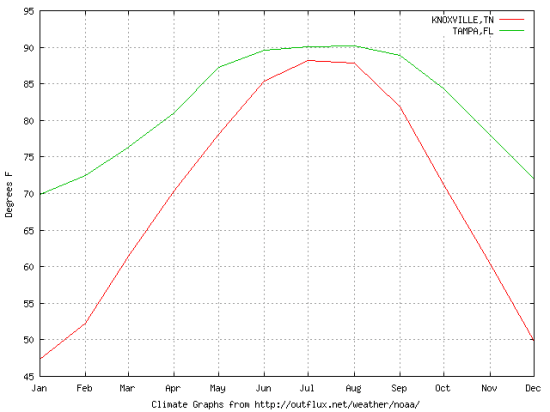

We know that the further south we go, the hotter the summers we can expect. To see that visually, we can graph the average high temperatures. In Tampa, the average high is above 70 year around. The cold months in Knoxville have an average high around or below 50. When we consider the average low in Knoxville is in the 30’s and average high is the 50’s, that’s a material difference from an average low in Tampa in the 50’s and average high in the comfortable 70’s. In fact, you may observe the average low in Tampa is the average high in Knoxville.

But what about too much heat? While the average high in Knoxville is in July and just short of 90, Tampa stays as hot as Knoxville hottest month from May up to October. For some, Tampa may be too hot in the summer. But humidity has a lot of do with how hot it feels, we’ll get to that.

AVERAGE HIGH

What about extreme cold?

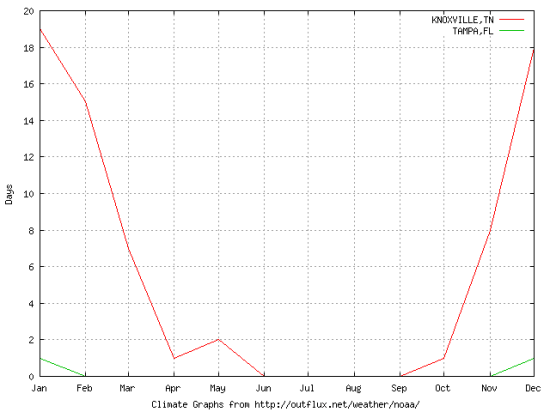

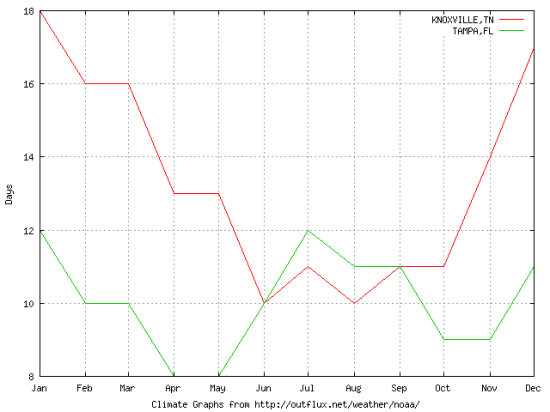

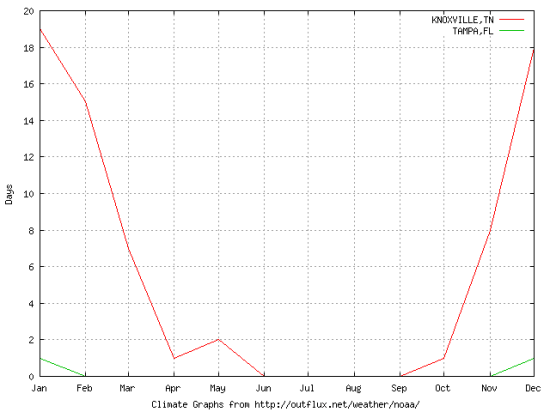

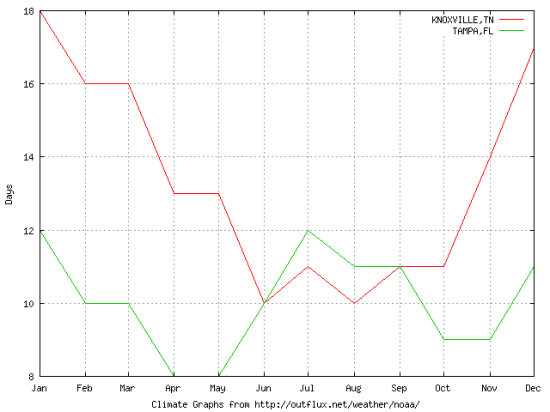

When we analyze data, we want to look at it in different ways to carve out the things we want (warm weather) and carve away the things we don’t (cold and hot weather). Below we graph for a visual to see the average days below freezing (32F). Clearly, Knoxville experiences some freezing days that are rare in Tampa, Florida. Some of you are probably laughing at my calling below 32F “extreme cold”, thinking it should be instead below zero. What you consider extreme depends on your own judgment and experience.

AVERAGE DAYS BELOW 32F

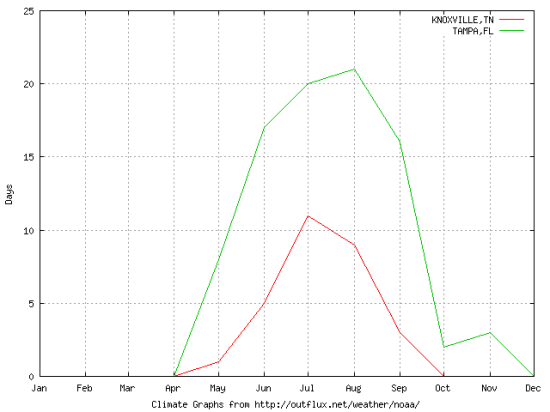

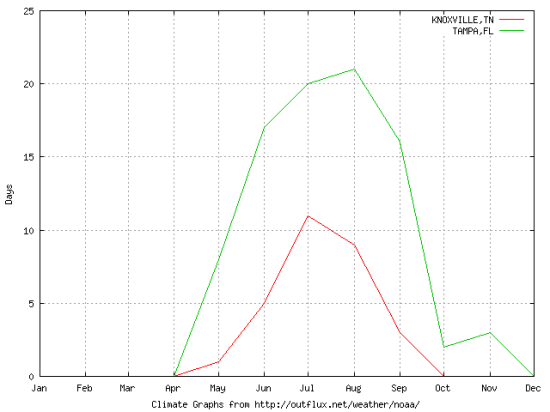

What about extreme heat?

When we state an extreme, we have to define what we mean by extreme quantitatively. I used 90F to define an extremely hot day. As we see below, while Knoxville has many more days below freezing in the winter, Tampa has many more days of extreme heat in the summer. We are starting to discover when we want to be in Knoxville, Tennessee and when we may want to be in Tampa, Florida. As with investment management, timing is everything.

AVERAGE DAYS ABOVE 90F

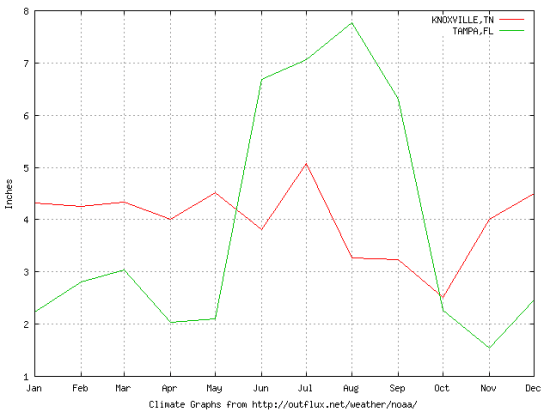

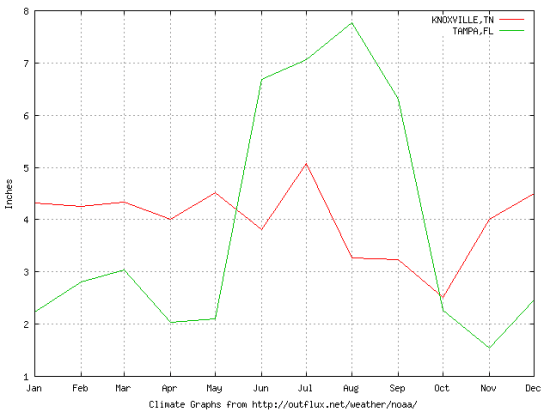

What about Precipitation?

It doesn’t matter if the weather feels great if it’s raining all the time. Tampa experiences a lot of rainfall in inches starting in May through September. Knoxville rainfall is actually a little less in the summer months. So, we could describe Tampa as hot wet summers and Knoxville as warm dry summers.

AVERAGE PRECIPITATION

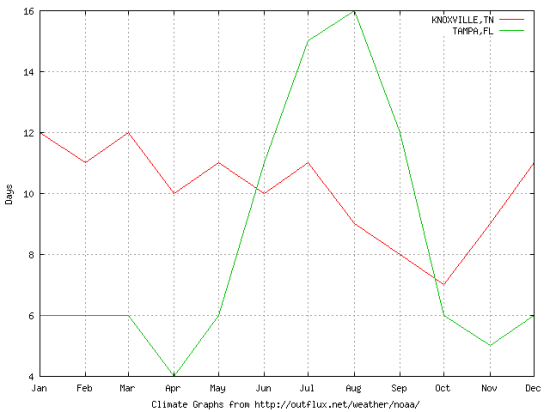

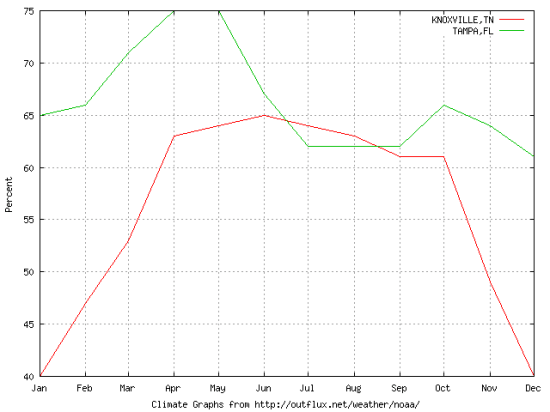

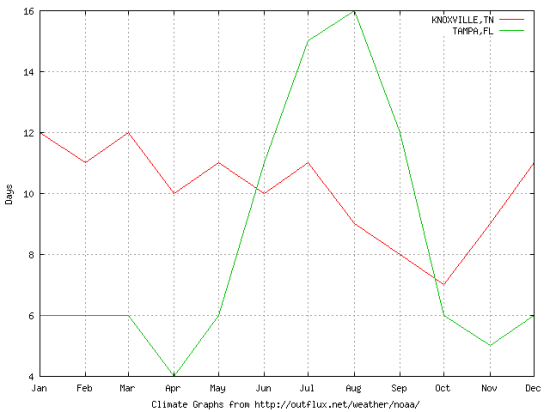

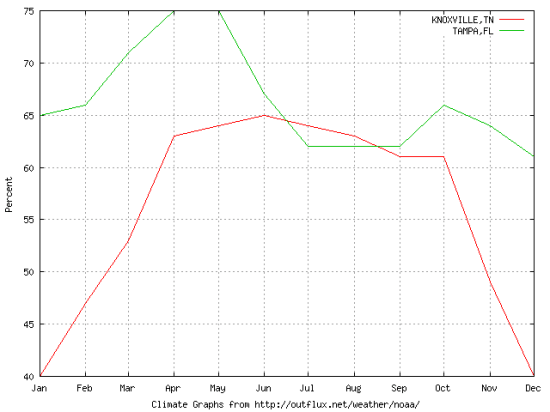

A little rain is one thing and may not be significant. What if we define a “significant rain” as greater than 0.10 inches? The stand out is that Tampa has “significant rain” in the summer months and little in the winter.

AVERAGE DAYS OF PRECIPITATION LESS GREATER THAN 0.10 INCHES

What about Humidity?

If you’ve ever experienced a place like Vail, Colorado in the winter were you can sit outside for lunch in the snow without a coat on when it’s 32F, you’ll have a unique understanding of humidity. We can say the same for south Florida in July. Humidity is the amount of water vapor in the air. Humidity may take more explanation to better understand. According to Wikipedia:

Higher humidity reduces the effectiveness of sweating in cooling the body by reducing the rate of evaporation of moisture from the skin. This effect is calculated in a heat index table or humidex, used during summer weather.

There are three main measurements of humidity: absolute, relative and specific. Absolute humidity is the water content of air. Relative humidity, expressed as a percent, measures the current absolute humidity relative to the maximum for that temperature. Specific humidity is a ratio of the water vapor content of the mixture to the total air content on a mass basis.

Relative humidity is an important metric used in weather forecasts and reports, as it is an indicator of the likelihood of precipitation, dew, or fog. In hot summer weather, a rise in relative humidity increases the apparent temperature to humans (and other animals) by hindering the evaporation of perspiration from the skin. For example, according to the Heat Index, a relative humidity of 75% at 80.0°F (26.7°C) would feel like 83.6°F ±1.3 °F (28.7°C ±0.7 °C) at ~44% relative humidity.

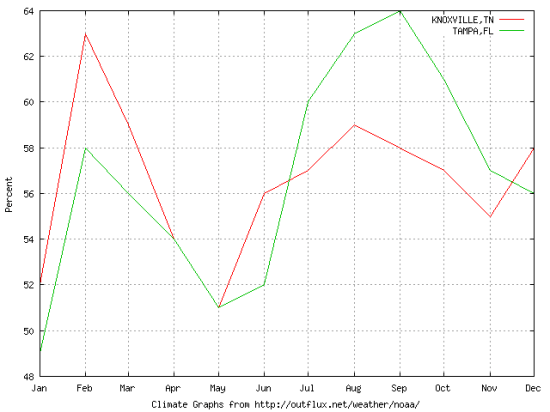

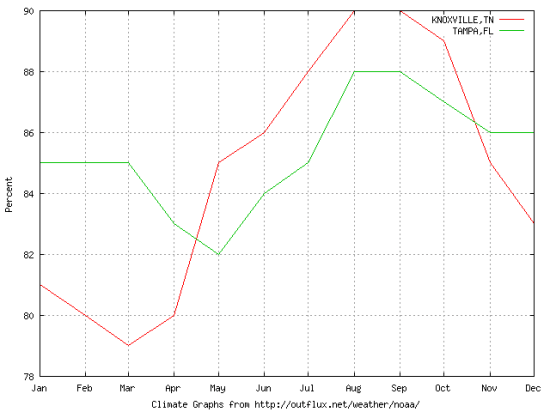

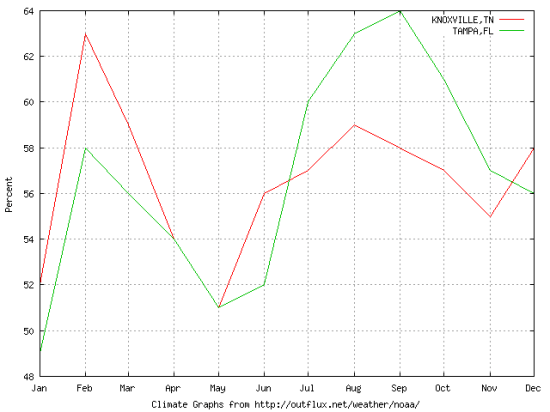

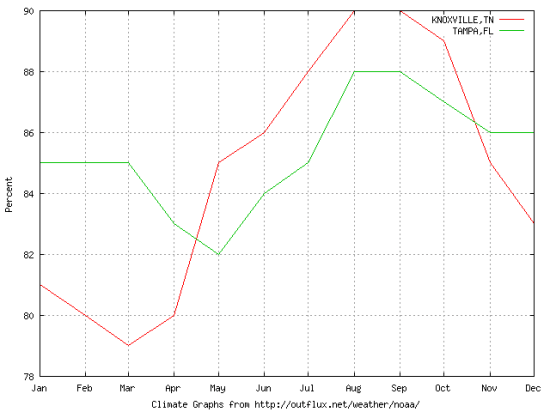

The temperature alone isn’t the full measure of how hot and uncomfortable the climate can be. We can break down humidity into morning and afternoon. Morning humidity in Knoxville is highest in the winter months, which leads to a cold, wet feeling winter. Morning humidity in Tampa is highest in the summer, making hot feel even hotter.

AVERAGE MORNING HUMIDITY

As we see below, afternoon humidity is much higher in Knoxville during the summer months.Tampa stays above 82% humidity on average. By now you have probably began to spot directional trends in the data as well as mean reversion. For example, in the chart below the red line (Knoxville) trends upward sharply from March to August. Then it reverses back down to retrace about half the prior gain. I see the same patterns and trends in global markets, though they are more difficult based more on social science than the science of climate and seasons. Yet, there are seasonal patters in global markets, too, such as “sell in May and go away” and “January Effect”. But unlike weather changes, they seasonal changes in the stock market aren’t as sure as the transition from summer to fall to winter to spring to summer again in Tennessee.

AVERAGE AFTERNOON HUMIDITY

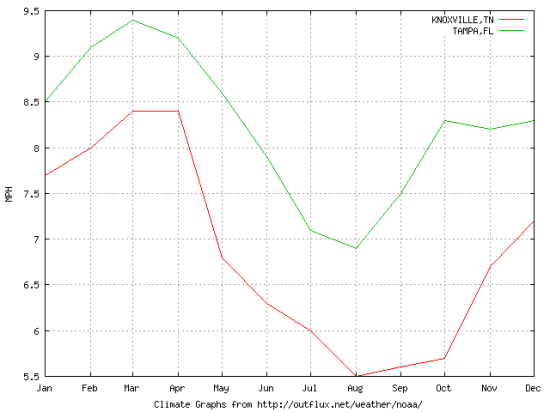

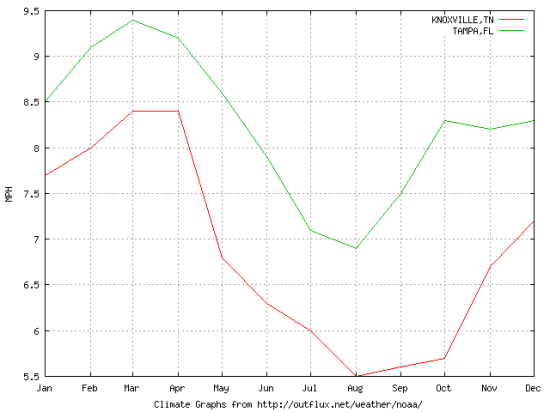

Tampa has a Breeze

Below we see the average wind speed. Tampa has a breeze to help cool us down compared to Knoxville.

What about Sunshine?

Warm dry weather is nice, but what about sunshine? Below we see why they say “Sunny Florida”. You may notice that Tampa is more sunny in the winter months then even the summer months. Knoxville has a greater possibility of sunshine March through October with a sharp downtrend on both ends.

AVERAGE SUNSHINE POSSIBLE

What about Cloudy Days?

If you live in the north, you are familiar not only with cold wet winters, but cloudy grey skies. The outliear that stands out on this graph is that Knoxville is cloudy half of the days of each month in the winter. Tampa, on the other hand, has few cloudy days throughout the year, but its highest is the July. You may have noticed some climate patterns between Tampa and Knoxville are negatively correlated. That is, Knoxville tends to be cloudy in January and least cloudy in July and Tampa is nearly the opposite.

AVERAGE DAYS CLOUDY

In the late 1990’s I remember listening to Steven Covey audiobook of “7 Habits of Highly Effective People” when he would say: “proactive people carry weather with them”. That is an example of Projection makes perception: seek not to change the weather, but to change your mind about the weather. That may work for some of us for many years, but eventually we may instead decide to “rotate instead of allocate”. That is, we may decide a warm sunny place like Tampa, Florida is a great place when its cold, wet, and cloudy in a place like Knoxville. Though, Knoxville may be better to spend the summer months with its more mild summer than the hot humid wet Tampa summer.

You can “carry weather with you” by perceiving it how you want, or you can carry (rotate) yourself to the weather you prefer. You can probably see how this quantitative data study helps visualize the absolute climate ranges and relative differences to make the decision with a greater understanding of what to expect.

You must be logged in to post a comment.