Author Archives: Mike Shell

Asymmetric Alpha? Completely Different Measures and Objectives

I was talking to an investment advisor about ASYMMETRY® Global Tactical and the objective of asymmetric returns when he mentioned “asymmetric alpha”. I explained the two words don’t go together.

Asymmetric is an imbalance, or unequal. Asymmetric returns. For example, is an asymmetric risk/reward profile: one that is imbalanced or skewed toward the upside than the downside. I believe that some investors prefer to capture more of the upside, less of the downside. Others seem to mistakenly prefer symmetry: to balance their risk and reward. When they balance their risk and reward it results to periods of gains followed by periods off losses that results in no real progress over time. If that has been your experience the past decade or so, you may consider what I mean by ASYMMETRY® .

Alpha is the excess return of the fund relative to the return of the benchmark index or an abnormal rate of return. The term alpha was derived by the academic theory “Capital Asset Pricing Model (CAPM). I believe CAPM has many flaws and is incapable of actively managing risk as necessary to produce asymmetric returns.

The two terms, asymmetric and alpha, are very different and probably should not be used together. The first is about absolute returns. The later is about relative returns. So, I believe we have to pick one of the other, rather than use them together. Asymmetric returns and alpha are completely different measures and objectives.

For information about the application of absolute and asymmetric returns visit http://www.asymmetrymanagedaccounts.com/

The State of the Union: What You Need to Read First

Image source: here

Before you listen to the State of the Union address tonight, consider reading this very closely:

“Happiness is not to be achieved at the command of emotional whims. Happiness is not the satisfaction of whatever irrational wishes you might blindly attempt to indulge. Happiness is a state of non-contradictory joy—a joy without penalty or guilt, a joy that does not clash with any of your values and does not work for your own destruction, not the joy of escaping from your mind, but of using your mind’s fullest power, not the joy of faking reality, but of achieving values that are real, not the joy of a drunkard, but of a producer. Happiness is possible only to a rational man, the man who desires nothing but rational goals, seeks nothing but rational values and finds his joy in nothing but rational actions.

Just as I support my life, neither by robbery nor alms, but by my own effort, so I do not seek to derive my happiness from the injury of the favor of others, but earn it by my own achievement. Just as I do not consider the pleasure of others as the goal of my life, so I do not consider my pleasure as the goal of the lives of others. Just as there are no contradictions in my values and no conflicts among my desires—so there are no victims and no conflicts of interest among rational men, men who do not desire the unearned and do not view one another with a cannibal’s lust, men who neither make sacrifices nor accept them.

The symbol of all relationships among such men, the moral symbol of respect for human beings, is the trader. We, who live by values, not by loot are traders, both in manner and spirit. A trader is a man who earns what he gets and does not give or take the undeserved. A trader does not ask to be paid for his failures, nor does he ask to be loved for his flaws. A trader does not squander his body as fodder, or his soul as alms. Just as he does not give his work except in trade for material values, so he does not give the values of his spirit—his love, his friendship, his esteem—except in payment and in trade for human virtue, in payment for his own selfish pleasure, which he receives from men he can respect. The mystic parasites who have, throughout the ages, reviled the trader and held him in contempt, while honoring the beggars and the looters, have known the secret motive of the sneers: a trader is the entity they dread—a man of justice.”

“This is John Galt Speaking”

Chapter VII

“There is always a disposition in people’s minds to think that existing conditions will be permanent …

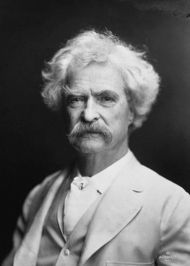

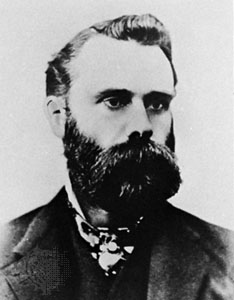

“There is always a disposition in people’s minds to think the existing conditions will be permanent,” Dow wrote, and went on to say: “When the market is down and dull, it is hard to make people believe that this is the prelude to a period of activity and advance. When the prices are up and the country is prosperous, it is always said that while preceding booms have not lasted, there are circumstances connected with this one, which make it unlike its predecessors and give assurance of permanency. The fact pertaining to all conditions is that they will change.” – Charles Dow, 1900

Source: Lo, Andrew W.; Hasanhodzic, Jasmina (2010-08-26). The Evolution of Technical Analysis: Financial Prediction from Babylonian Tablets to Bloomberg Terminals (Kindle Locations 1419-1423). Wiley. Kindle Edition.

You can probably see from Dow’s quote how trends do tend to continue, just because enough people think they will. However, price trends can continue into an extreme or a “bubble” just because people think they will continue forever. I like to ride a trend to the end when it bends and then be prepared to exit when it does finally reverse, or maybe reduce or hedge off some risk when the probability seems high of a change.

Image source: Wikipedia

Charles Henry Dow; November 6, 1851 – December 4, 1902) was an American journalist who co-founded Dow Jones & Company. Dow also founded The Wall Street Journal, which has become one of the most respected financial publications in the world. He also invented the Dow Jones Industrial Average as part of his research into market movements. He developed a series of principles for understanding and analyzing market behavior which later became known as Dow theory, the groundwork for technical analysis.

The One Thing: The Surprisingly Simple Truth Behind Extraordinary Results

I had a two-hour interview with someone yesterday (that will be available soon) about my firm and investment programs and found myself sharing a few of the same thoughts, over and over.

“Managing the ASYMMETRY® investment programs is all we do. I am fully committed and focused on this one thing: buying, selling, and managing risk in global markets to generate the positive asymmetry needed to compound capital positively within our risk tolerance”.

In a recent letter to our investors to reflect on the 10-year anniversary of my founding Shell Capital Management, LLC, I described the evolution of the firm, ASYMMETRY®, and myself over 10 pages. I called it “10 years of Shell Capital Management”; Christi called it “10 pages of 10 years of Shell Capital Management”! (When talking about these things, I have no short version!)

That’s because I’m fully committed and focused on this one thing we do. In that letter, I went so far as to say: it’s all I have, all I am, and all I ever will be. As I reflected on the past 10 years, it occurred to me that my whole life has revolved around this one thing. Without it, none of the other things, the lifestyle we enjoy, would exist. I believe my priorities are in line with reality. That has been a tremendous advantage for us.

Then this morning, I get an email from getAbstract: “Top 10 Summaries”, the 10 most downloaded getAbstract summaries in 2014.

The first on the list?

“Achieving great success in all aspects of your life calls for devotion to one single thing.”

The One Thing

The Surprisingly Simple Truth Behind Extraordinary Results

Gary Keller and Jay Papasan

Bard Press, 2013

getAbstract goes on to describe it: (I highlighted a key part in bold)

“Gary Keller, co-founder of Keller Williams Realty and a best-selling author, overcame his own issues about focus, which makes his claims about cultivating better habits even more compelling. Multitasking isn’t fruitful, he says, since success requires long periods of laser-like concentration, not scattershot swats. If you find your “ONE Thing,” Keller says, everything else will fall into place. Keller, writing with co-author Jay Papasan, breaks his approach down into manageable steps based on research and experience. With an engaging writing style and plenty of bullet points, this reads much faster than its 200-plus pages”

It says the ONE Thing will bring your life and your work into focus. I obviously don’t need a book to tell me that, but it may help me understand myself better. I’ll be reading the abstract, but also listening to the audiobook version on Audible during my long walks in sunny Florida.

“I hated every minute of training, but I said, ‘Don’t quit. Suffer now and live the rest of your life as a champion.”

The Holiday Party: Mindset of the Active Risk Manager

I keep hearing of symptoms of this awful virus going around. I’ll spare you of the details, but it involves both ends around the porcelain bowl. We’ve all been there, done that, and probably consider it a “bad outcome”.

Then, we have all these holiday party plans to spend time with friends and family, knowing this ‘bug’ is contagious and spreading. Hearing about it, the natural mindset of the active risk manager is to ask:

“Has anyone at the party had the flu recently?”

You wonder if you’re entering into a high risk of a bad outcome. Most people may not even consider it, and it’s those people who will probably be there spreading it around! I know people who never consider the possibility of a bad outcome; they tend to be the ones who have the worst outcomes, more often. Others may be overly afraid of things that may never happen, so they miss out on life. Some even worry about things they fear so much they experience those things, even when they don’t happen.

The active risk manager internally thinks of risk.

Let’s first use the dictionary to better understand the meaning of “active”:

1. engaged in action; characterized by energetic work, participation, etc.; busy: an active life.

2. being in a state of existence, progress, or motion:

3. involving physical effort and action :active sports.

4. having the power of quick motion; nimble: active as a gazelle.

5. characterized by action, motion, volume, use, participation, etc.

So, let’s say that to be active is to be engaged in action, participate, an active life, progress, nimble, motion, and even a state of existence.

Risk is exposure to the possibility of a bad outcome. When we are speaking of money, risk is the exposure to the possibility of loss. If we incur a loss, that isn’t a risk, that’s an actual loss. Some people believe that uncertainty is risk, but we always have uncertainty. So, risk is the exposure to a chance or possibility of loss. It’s the exposure that is the risk, the chance or possibility is always there. So, your risk of loss is your choice. We decide it in advance.

To manage is to take charge of, handle, direct, govern, or control through action.

A bad outcome in money management may be losing money, or in life it may be anything we perceive as unwanted. We can’t be certain about an outcome. Uncertainty is something we live with every day and in all things, so we may as well embrace it and enjoy not knowing the outcome of things in advance. So, risk is the exposure to a chance or possibility of loss. It’s the exposure that is the risk, the chance or possibility is always there. So, your risk of loss is your choice. We decide it in advance.

So, an active risk manager, like me, is someone who engages in the action of actively and intentionally directing and controlling the exposure to a bad outcome. Because I actively management my risks, I am able to trade and invest in things other people perceive as risky, but they aren’t to me because I define my risk exposure and control it. Because active risk management is not only a learned skill I have advanced for myself but also something that is a natural part of me and who I am, I am also able to live my life enjoying and even embracing change and uncertainty. Yet, I do that initially and naturally thinking of what my risk is. Once I understand my risk, I manage it, and then accept it for what I’ve decided it will be, and then I let it all unfold as it will. I control what I can and let the rest do what it’s going to do.

You see, it’s also a big risk to not experience life. Studies show that happiness is more driven by new experiences than any other thing. Hedonic Adaptation means that we tend to get used to things and adapt, good or bad. Broadening our horizons makes and keeps us happy, doing the same old things leads to a dull and less happy life. Much of our happiness comes from new experiences and change, because we get used to even the finest and fastest new car and eventually it becomes our new normal.

Although I feel a strong obligation to keep myself well, I’m not going to miss spending time with people I enjoy. Instead, I’ll take my chances and deal with, and actively manage, any bad outcome that arises from it. So, consider your risks, then get out there and enjoy yourself with new experiences. Even if you get sick for a few days, that too shall eventually pass.

Merry Christmas!

Tomorrow’s Newspaper: the Future, Part One

People often ask me questions of the future. I guess they figure I have such a strong track record, I must know something about the future.

I paused my time machine, the rest of the world stopped; I took one step forward to see what happens next.

Here is what I saw:

Source: The Future: a period that doesn’t yet exist.

If anyone sees anything different please take a picture, come back here, now, and post it in the comments for all of us to see.

What is the Alternative?

Anything beyond buying and holding stocks and bonds is called “alternative” investments, alternative investment strategies, or alternative trading strategies.

What is “alternative”?

- offering or expressing a choice

- not usual or traditional

- existing or functioning outside of the established society

- different from the usual or conventional

Source: http://www.merriam-webster.com/dictionary/alternative

I like it.

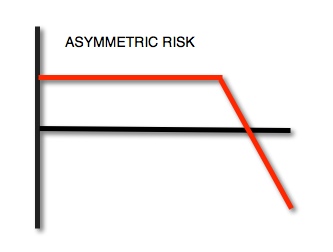

Tony Robbins on Asymmetrical Risk Reward

Just last week I posted my article Asymmetrical Risk Definition and Symmetry: Do you Really Want Balance? about asymmetric risk reward and how we want imbalance between profit and loss, not balance. That is, we want asymmetry, not symmetry. Tony Robbins has a new book out, mentioning the very concept of asymmetric risk and asymmetric payoffs. I’ve always been a big fan of Tony.

Richard Feloni interviews Tony Robbins about his first new book in over 20 years, “MONEY Master the Game: 7 Simple Steps to Financial Freedom,”. In an article in Business Insider titled “Tony Robbins Reveals What He’s Learned From Financial Power Players Like Carl Icahn And Ray Dalio”.

Below is a piece of the interview of Robbins explaining he learned about asymmetric risk reward, which used a link to ASYMMETRY® Observations for the definition of asymmetrical risk reward.

“You’ve gotta be obsessed because you know when you lose 50%, you have to make 100% to get even.

[Warren Buffett’s advice mentioned in the book] came from Ben [Graham], his teacher. It’s, “What’s rule number one in investing? Never lose money. What’s rule number two? Don’t forget rule number one.”

That would be boring if that was the only universal piece besides the other one, which I find fascinating, was that they’re not giant risk takers, most of them. They believe in asymmetrical risk reward. It simply means they take the smallest risk possible for the largest return possible.

The average person goes out and invests a dollar hoping to make 10% or 20%, if they’re lucky — so if they’re wrong they’re in the hole majorly. Paul Tudor Jones [had a principle he used to use] called 5:1. And 5:1 is this: If he invests a dollar, he doesn’t part with that dollar he’s investing unless he feels certain he’s going to make five. He knows — he’s not stupid — he knows he’s going to be wrong [sometimes] so if he loses a dollar and has to spend another dollar, spending two to make five, he’s still up $3. He can be wrong four out of five times and still be in great shape.

Most everybody thinks that if I want to get big rewards I need to take huge risks. But if you keep thinking that, you’re gonna be broke.”

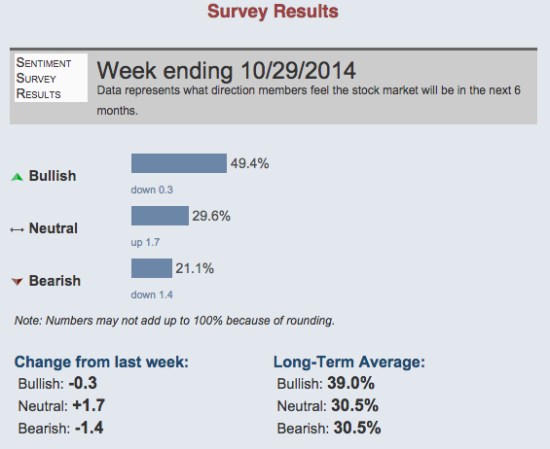

Stock Investors Even More Bullish While Japan Falls into Surprise Recession

Following up with Are investors getting overly optimistic again? I pointed out that investor sentiment as measured by the AAII Investor Sentiment Survey had shifted to a point of unusually high bullishness.

After prices trend up, investors get more optimistic as they extrapolate higher prices into the future, assuming that existing trends will continue. Interestingly, they get more bullish as prices are more “overvalued”. As more and more investors become optimistic about stocks in the months ahead, you have to wonder who will continue the buying needed to push stocks higher. A good trend follower knows that trends do indeed often continue, until the demand runs out. Since supply and demand is the driver of all things traded in an auction market, we can observe demand shifts and how it drives prices.

Since I wrote Are investors getting overly optimistic again? less than two weeks ago, the latest AAII Investor Sentiment Survey shows bullishness is even higher.

source: http://www.aaii.com/sentimentsurvey?adv=yes

In the mean time, Fox Business reports this morning “Japan’s economy unexpectedly slipped into recession in the third quarter”. That shouldn’t be a big surprise. If you take a look at the weekly chart of the Japan stock index (priced in Dollars) below, it’s been suggesting something for the past year. I am seeing similar trends (or choppy non-trends) in many global stock markets.

Courtesy of http://www.stockcharts.com

It will be interesting to watch how it all unfolds.

Asymmetrical Risk Definition and Symmetry: Do you Really Want Balance?

Asymmetric is imbalance, uneven, or not the same on both sides.

Risk is the possibility of losing something of value, or a bad outcome. The risk is the chance or potential for a loss, not the loss itself. Once we have a loss, the risk has shifted beyond a possibility to a real loss. The investment or position itself isn’t the risk either, risk is the possibility we may lose money in how we manage and deal with it.

Asymmetrical Risk, then, is the potential for gains and losses on an investment or trade are uneven.

When I speak of asymmetric risk, I may also refer to the probability for gains and losses that are imbalanced, for those of us who can determine probability. If the probability of losing something or a bad outcome is asymmetric, it means the risk isn’t the same as the reward.

Asymmetric risk can also refer to the outcome for profits and losses that are imbalanced, after we have sold a position, asset, or investment.

Some examples:

If we risk $10, but earn $10, the risk was symmetrical.

- We risked $10

- We earned $10 – we just broke even (symmetry).

Symmetry is the outcome when you balance risk and reward.

If we risk $10, but earn $20, the risk was positively asymmetric.

- We risked $10

- We earned $20

If we risk $10, but lose $10, the risk was symmetrical.

- We risked $10

- We lost $10 – we lost the same as we risked.

If we risk $10, but lose $20, the risk was an asymmetric risk.

- We risked $10

- We lost $20 – we lost even more than we though we risked.

Strangely, I often hear investment advisers say they want to balance risk and reward through their asset allocation.

Do you?

It was when I noticed my objective of imbalancing profit and loss, risk and reward, was so different from others that I knew I have a unique understanding and perception of the math and I could apply it to portfolio management.

You can probably see how some investors earn gains for years, then lose those gains in the following years, then earn gains again, then lose them again.

That’s a result of symmetry and its uncontrolled asymmetrical risk.

You can probably see why my focus is ASYMMETRY® so deeply that the word is my trademark.

The Mistake is Not Taking the Loss: Cut Your Losses and Move on

One of the keys to managing investment risk is cutting losers before they become large losses. Many people have difficulty selling at a loss because they believe it’s admitting a mistake. The mistake isn’t taking a loss, the mistake is to NOT take the loss. I cut losses short all the time, that’s why I don’t have large ones. I’ve never taken a loss that was a mistake. I predetermine my risk by determining before I even buy something at what point I’ll get out if I am wrong. If I enter at $50, my methods may determine if it falls to $45 that trend I wanted to get in is no longer in place and I should get out. So when I enter a position in any market, I know how I’ll cut my loss short before I even get in. It’s the exit, not the entry, that determines the outcome. I don’t know in advance which will be a winner or loser or how much it will gain or lose. For me, not taking the loss, would be the mistake.

I thought of this when a self-proclaimed old-timer admitted to me he still holds some of the popular stocks he bought the late 90’s. Many of those stocks are no longer in business, but below we revisit the price trend and total return of some of the largest and most popular stocks promoted in the late 90’s. The black line is Cisco Systems (CSC), Blue is AT&T (T), Red is Pfizer (PFE), and green is Microsoft (MSFT). AT&T’s roots stretch back to 1875, with founder Alexander Graham Bell’s invention of the telephone. Pfizer started in 1849 “With $2,500 borrowed from Charles Pfizer’s father, cousins Charles Pfizer and Charles Erhart, young entrepreneurs from Germany, opened Charles Pfizer & Company as a fine-chemicals business”. At one point during the late 90’s “tech bubble” Microsoft and Cisco Systems were valued more than many countries. But the chart below shows if you did buy and held these stocks nearly 20 years later you would have held losses for many years and many of them are just now showing a profit.

chart courtesy of http://www.stockcharts.com

The lesson to cut losses short rather than allow them to become large losses came from a book published in 1923.

“Money does not give a trader more comfort, because, rich or poor, he can make mistakes and it is never comfortable to be wrong. And when a millionaire is right his money is merely one of his several servants. Losing money is the least of my troubles. A loss never bothers me after I take it. I forget it overnight. But being wrong – not taking the loss – that is what does the damage to the pocketbook and to the soul.”

-Reminiscences of a Stock Operator (1923)

If you are unfamiliar with the classic, according to Amazon:

Reminiscences of a Stock Operator is a fictionalized account of the life of the securities trader Jesse Livermore. Despite the book’s age, it continues to offer insights into the art of trading and speculation. In Jack Schwagers Market Wizards, Reminiscences was quoted as a major source of stock trading learning material for experienced and new traders by many of the traders who Schwager interviewed. The book tells the story of Livermore’s progression from day trading in the then so-called “New England bucket shops,” to market speculator, market maker, and market manipulator, and finally to Wall Street where he made and lost his fortune several times over. Along the way, Livermore learns many lessons, which he happily shares with the reader.

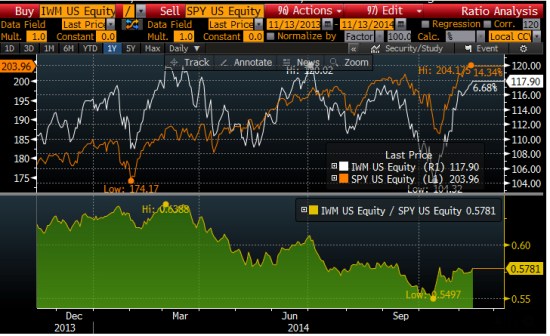

Small vs. Large Stocks: A Tale of Two Markets (Continued)

A quick follow up to my recent comments about the down trend in smaller company stocks in Playing with Relative Strength and Stock Market Peak? A Tale of Two Markets below is a chart and a few observations:

Source: Bloomberg/KCG

A few observations of the trend direction, momentum, and relative strength.

- The S&P 500 index (the orange line) of large company stocks has been in a rising trend of higher highs and higher lows (though that will not continue forever).

- The white line is the Russell 2000 small company index has been in a downtrend of lower highs and lower lows, though just recently you may observe in the price chart that it is at least slightly higher than its August high. But it remains below the prior two peaks over the past year. From the time frame in the chart, we could also consider it a “non-trending” and volatile period, but its the lower highs make it a downtrend.

- The green chart at the bottom shows the relative strength between S&P 500 index of large company stocks and the Russell 2000 small company index. Clearly, it hasn’t taken all year to figure out which was trending up and the stronger trend.

- Such periods take different tactical trading skills to be able to shift profitability. When markets get choppy, you find out who really knows what they’re doing and has an edge. I shared this changing trend back in May in Stock Market Peak? A Tale of Two Markets.

If you are unsure about the relevance of the big picture regarding these things, read Playing with Relative Strength and Stock Market Trend: reverse back down or continuation? and Stock Market Peak? A Tale of Two Markets.

Are investors getting overly optimistic again?

Just as I was observing U.S. stocks getting to a point that I would expect to see stock indexes pull back at least a little or drift sideways, I noticed that investor sentiment readings last week were unusually bullish. 49.4% of investors polled by AAII last week believe stocks will rise in the next 6 months. Only 21.1% were bearish, believing stocks would fall.

That’s an unusual asymmetry between the percent of individual investors believing stocks will rise over those who believe they will fall. You can see the historical averages below.

source: http://www.aaii.com/sentimentsurvey?adv=yes

Investors tend to get more bullish about stocks after they have risen recently (and they have). They tend to get more bearish after stocks have fallen and they are losing money – and fear losing more.

It isn’t a perfect indicator, but the majority tends to feel the wrong feelings at the wrong time. That presents an advantage for those of us who don’t, and are aware of how behavior signals trends, but a challenge for advisers and individual investors as they try to modify their behavior to avoid it.

We decide what we do, everyday

Stock Market Trend: reverse back down or continuation?

I normally don’t comment here on my daily observations of very short-term directional trends, though as a fund manager I’m monitoring them every day. The current bull market in stocks is aged, it’s lasted much longer than normal, and it’s been largely driven by actions of the Fed. I can say the same for the upward trend in bond prices. As the Fed has kept interest rates low, that’s kept bond prices higher.

Some day all of that will end.

But that’s the big picture. We may be witnessing the peaking process now, but it may take months for it all to play out. The only thing for certain is that we will only know after it has happened. Until then, we can only assess the probabilities. Some of us have been, and will be, much better at identifying the trend changes early than others.

With that said, I thought I would share my observations of the very short-term directional trends in the stock market since I’ve had several inquiring about it.

First, the large company stock index, the S&P 500, is now at a point where it likely stalls for maybe a few days before it either continues to trend up or it reverses back down. In “Today Was the Kind of Panic Selling I Was Looking For” I pointed out that the magnitude of selling that day may be enough panic selling to put in at least a short-term low. In other words, prices may have fallen down enough to bring in some buying interest. As we can see in the chart below, that was the case: the day I wrote that was the low point in October so far. We’ve since seen a few positive days in the stock index.

All charts in this article are courtesy of http://www.stockcharts.com and created by Mike Shell

Larger declines don’t trend straight down. Instead, large declines move down maybe -10%, then go up 5%, then they go down another -10%, and then back up 7%, etc. That’s what makes tactical trading very challenging and it’s what causes most tactical traders to create poor results. Only the most experienced and skilled tactical decision makers know this. Today there are many more people trying to make tactical decisions to manage risk and capture profits, so they’ll figure this out the hard way. There isn’t a perfect ON/OFF switch, it instead requires assessing the probabilities, trends, and controlling risk.

Right now, the index above is at the point, statistically, that it will either stall for maybe a few days before it either continues to trend up or it reverses back down. As it all unfolds over time, my observations and understanding of the “current trend” will evolve based on the price action. If it consolidates by moving up and down a little for a few days and then drifts back up sharply one day, it is likely to continue up and may eventually make a new high. If it reversed down sharply from here, it will likely decline to at least the price low of last week. If it does drift back to last weeks low, it will be at another big crossroads. It may reverse up again, or it may trend down. Either way, if it does decline below low of last week, I think we’ll probably see even lower prices in the weeks and months ahead.

Though I wouldn’t be surprised if the stock index does make a new high in the coming months, one of my empirical observations that I think is most concerning about the stage of the general direction of the stock market is that small company stocks are already in a downtrend. Below is a chart of the Russell 2000 Small Cap Stock Index over the same time frame as the S&P 500 Large Cap Stock Index above. Clearly, smaller companies have already made a lower low and lower highs. That’s a downtrend.

Smaller company stocks usually lead in the early stage of bear markets. There is a basic economic explanation for why that may be. In the early stage of an economic expansion when the economy is growing strong, it makes sense that smaller companies realize it first. The new business growth probably impacts them in a more quickly and noticeable way. When things slow down, they may also be the first to notice the decline in their earnings and income. I’m not saying that economic growth is the only direct driver of price trends, it isn’t, but price trends unfold the same way. As stocks become full valued at the end of a bull market, skilled investors begin to sell them or stop investing their cash in those same stocks. Smaller companies tend to be the first. That isn’t always the case, but you can see in the chart below, it was so during the early states of the stock market peak in 2007 as prices drifted down into mid 2008. Below is a comparison of the two indexes above. The blue line is the small stock index. In October 2007, it didn’t exceed its prior high in June. Instead, it started drifting down into a series of lower lows and lower highs. It did that as the S&P 500 stock index did make a prior high.

But as you see, both indexes eventually trended down together.

As a reminder to those who may have forgotten, I drew the chart below to show how both of these indexes eventually went on to lower lows and lower highs all the way down to losses greater than -50%. I’m not suggesting that will happen again (though it could) but instead I am pointing out how these things look in the early stages of their decline.

If you don’t have a real track record evidencing your own skill and experience dealing with these things, right now is a great time to get in touch. By “real”, I’m talking about an actual performance history, not a model, hypothetical, or backtest. I’m not going to be telling you how I’m trading on this website. The only people who will experience that are our investors.

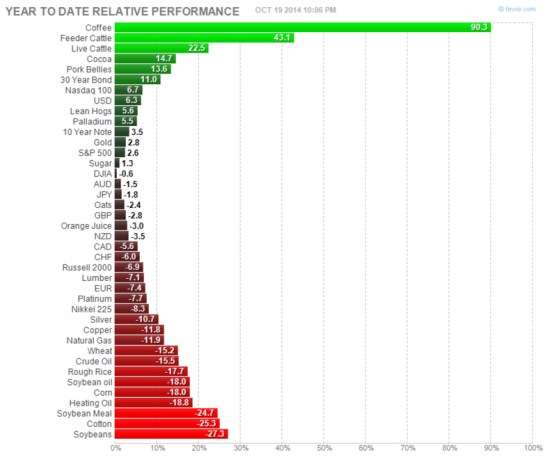

How is the market doing? Global Deflation

How are the markets doing this year?

Well, it depends on what market you mean. So far 2014 has had only a few gains in world markets: coffee, cattle, cocoa, pork bellies, 30 year treasury bond, the U.S. Dollar,. The Dow Jones Industrial average is flat.

Most commodities prices have fallen materially. It looks like “global deflation”, which means prices are falling. I bet it’s getting the Feds attention. Deflation isn’t a good thing.

Chart courtesy of FINVIZ

Markets don’t always react the way investors expect, so I focus on what is actually happening

I noted the below question and answer between Jack Schwager and Ray Dalio in Jack’s book “Hedge Fund Market Wizards: How Winning Traders Win” (2012). Ray Dalio is the founder of Bridgewater, the largest hedge fund in the world and one of the most successful. I saved it when I read the book as a fine example that markets don’t always react the way people expect, and that is why I focus instead on what is actually happening rather than what could or should happen – but may not. Everything is very transient, coming and going, and it’s funny how some of the same kinds of things happen over and over again. As you read comments below you’ll hear it’s always a similar story, different day. 1982 was the end of a 20 year secular bear market made up of huge swings similar to the past decade and the beginning of the largest bull market on record up to 2000.

Below is Jack Schwager asking a question to Ray Dalio:

Any other early experiences stand out where the market behaved very differently from what you expected?

In 1982, we had worse economic conditions than we do right now. The unemployment rate was over 11 percent. It also seemed clear to me that Latin America was going to default on its debt. Since I knew that the money center banks had large amounts of their capital in Latin American debt, I assumed that a default would be terrible for the stock market. Then boom—in August, Mexico defaulted. The market responded with a big rally. In fact, that was the exact bottom of the stock market and the beginning of an 18-year bull market. That is certainly not what I would have expected to happen. That rally occurred because the Fed eased massively. I learned not to fight the Fed unless I had very good reasons to believe that their moves wouldn’t work. The Fed and other central banks have tremendous power. In both the abandonment of the gold standard in 1971 and in the Mexico default in 1982, I learned that a crisis development that leads to central banks easing and coming to the rescue can swamp the impact of the crisis itself.

All of this, everything that is happening and expected to happen, will be reflected in the directional trend and volatility of price. The directional price and range of prices (volatility) will overreact at times and under-react at others, but it will reflect what is actually going on. Because the direction and volatility of price “is” what matters.

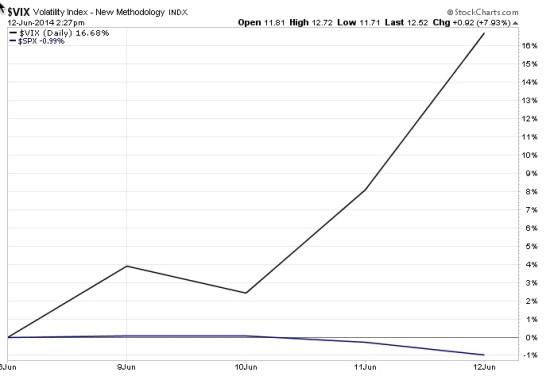

VIX® gained 140%: Investors were too complacent

Several months ago I started sharing some of my observations about the VIX ( CBOE Volatility Index). The VIX had gotten to a level I considered low, which implied to me that investors were too complacent, were expecting too low future volatility, and option premiums were generally cheap. After the VIX got down to levels around 11 and 12 and then started to move up, I pointed out the VIX seemed to be changing from a downward longer term trend to a rising trend.

As I was sharing my observations of the directional trend and volatility of VIX that I believed was more likely to eventually go up than down, it seemed that most others were writing just the opposite. I know that many volatility traders mostly sell volatility (options premium), so they prefer to see it fall.

As you can see in the chart below, The VIX has increased about 140% in just a few weeks.

Chart courtesy of http://www.stockcharts.com

For those who haven’t been following along, you may consider reading the previous observations:

A VIX Pop Then Back to Zzzzzzzz? We’ll see

VIX Shows Volatility Still Low, But Trending

The VIX is Asymmetric, making its derivatives an interesting hedge

Is the VIX an indication of fear and complacency?

What does a VIX below 11 mean?

What does the VIX really represent?

Declining (Low) Volatility = Rising (High) Complacency

Today Was the Kind of Panic Selling I Was Looking For

I mentioned in “Fear is Driving Stocks Down, or is Declining Stocks Driving Fear?” that falling prices could lead to panic selling and it may require some panic selling to push prices low enough to bring in new buying demand. Of course, to have cash to buy you had to have previously sold before the decline.

Today we’ve observed just that. The headlines today “Dow Plunging 460 points” is what I was talking about. Big down days rid weak holders of their positions they held too long, so they fear losing more money. Those of us who already sold early enough to have cash for new entries can wait for prices to get to a low enough point to make the risk/reward attractive enough to take a chance.

Although we could be observing the early stages of a much larger downside bear market that unfolds in the months ahead, they don’t drift straight down. Instead, they cycle down 10%, up 7%, down 10%, etc. When they’ve moved down, one potential sign of a reversal back up is when the worst performing areas of the markets reverse back up. I usually observe the things that were trending down the most get oversold and are the first to shift back up, at least temporarily.

The chart below is the past 2 days of the S&P 500 (SPY), Russell 2000 Small Company stocks (IWM), the Energy Sector (IYE), and Energy MLPs (AMJ). As I’ve pointed out lately, smaller companies and energy have declined the most and on today’s big down day for stocks, you can see below those weakest areas are drifting up. It’s a positive sign in the days ahead IF that continues…

Chart courtesy of http://www.stockcharts.com

The way directional trends unfold is they sometimes get to a point like they are now and reverse back up, if prices have gotten low enough to attract enough new buying, that buying ends to fall. But if that doesn’t happen, this is what the early stage of how even more panic selling begins. I believe everyone has an exit point. Even those who say they are passive and “buy and hold” eventually panic when their losses get too large. Stock indexes have only fallen about -9% from their peak a few weeks ago, so that probably isn’t yet enough to drive too many out who are 100% invested, but you can probably see how as their losses get larger and larger many of them do eventually exit.

I think everyone has an exit, an “uncle point”, it can either be an earlier predefined exit like mine are, or after their losses get so large they can’t take it anymore (-20% or 30%) or to the point it begins to change their life plans (like -40% or 50%).

Let’s see how it all unfolds…

If you are an investment adviser or individual investor and don’t have a strong track record of active risk management, now is a good time to get in touch.

Fear is Driving Stocks Down, or is Declining Stocks Driving Fear?

The last time I pointed out a short-term measure of extreme investor sentiment was August 4, see “Extreme Fear is Now the Return Driver“. At that time, popular stock indexes had declined -3% or more and as prices fell, investor fear measures increased.

As stocks rise, investors get complacent and brag about their profits. After prices fall, investor fear measures start to rise.

Since I pointed out “Extreme Fear is Now the Return Driver”, the Dow Jones Industrial Average went on to trend back up 5% by mid September. Below is a price chart for the Dow year to date. I marked August 4th with a red arrow. You can see how the price trend had declined sharply, driving fear of even lower prices, then it reversed back up. Fear increases after a decline and when fear gets high enough, stocks often reverse back up in the short term. They get complacent and greedy after prices rise to the point there are no buyers left to keep bidding prices up, then prices fall. Investors oscillate between the fear of missing out and the fear of losing money.

Source: http://www.stockcharts.com

Since mid September, the price trend has drifted back down over 4% from the peak. As you can see, the Dow has made no gain for the year 2014. It is no surprise that investor sentiment readings are now at “Extreme Fear” levels, as measured by the Fear & Greed Index below.

Source: Fear & Greed Index CNN Money

So, the last time investor fear levels got this high, stocks reversed back up in the weeks ahead. However, it doesn’t always work out that way. These indicators are best used with other indications of trend direction and strength to understand potential changes or a continuation. For example, we commonly observe 4% to 5% swings in stock prices a few times a year. That is a normal range and should be expected. However, eventually prices will decline and investors will continue to fear even more losses. As prices fall, investors sell just because they’re losing money. Some sell earlier in the decline, some much later. You may know people who sold after they were down -50% in 2008 or 2002. The trouble with selling out of fear is: when would they ever get back in? That’s why I manage risk with predefined exit points and I know at what point I would reenter.

My point is: fear always has the potential to become panic selling leading to waterfall declines. Panic selling can take weeks or months to drive prices low enough that those who sold earlier (and avoided the large losses and have cash available) are willing to step in to start buying again. Those who stay fully invested all the time don’t have the cash for new buying after prices fall. It’s those buy and hold (or re-balance) investors who also participate fully in the largest market losses. It’s those of us who exit our losers soon enough, before a large decline, that have the cash required to end the decline in prices.

Selling pressure starts declines, new buying ends them.

We’ll see in the weeks ahead if fear has driven prices to a low enough point that brings in new buying like it has before or if it continues into panic selling. There is a chance we are seeing the early stages of a bear market in global stocks, but they don’t fall straight down. Instead, declines of 20% or more are made up of many cycles of 5 – 10% up and down along the way. So, we shouldn’t be surprised to see stock prices drift up 5% again, maybe even before another -10% decline.

Declining stocks drive fear, but fear also drives stocks down.

Let’s see how it all unfolds…

Trend Change in Dollar, International Stocks, Gold?

Directional trends tend to persist. When a price is trending, it’s more likely to continue than to reverse. A directional trend is a drift up or down. For example, we can simply define a uptrend by observing a price chart of higher highs and higher lows. A downtrend is an observation of lower highs and lower lows. For a trading system, we need to be more precise in defining a direction with an algorithm (an equation that mathematically answers the question). The concept that directional trends tend to persist is called “momentum“. Momentum is the empirically observed tendency for rising prices to rise further. Momentum in price trends have been exploited for decades by trend following traders and its persistence is now even documented in hundreds of academic research papers. Momentum persists, until it doesn’t, so I can potentially create profits by going with the trend and then capturing a part of it.

But all trends eventually come to an end. We never know in advance when that will be, but we can determine the probability. Sometimes a trend reversal (up or down) is more likely than others. If you believe markets are efficient and instead follow a random walk, you won’t believe that. I believe trends move in one direction, then reverse, then trend again. When I look at the charts below, I see what I defined previously as “a trend”. I have developed equations and methods for defining the trend and also when they may bend at the end. More importantly, I observe them when they do bend. For example, to capture a big move in a trend, say 20% or more, we can’t get out every time it drops -2%, because it may do that many times on its way to that 20%. So, trend following means staying with the trend until it really bends. Counter-trend trading is trying to profit from the bends by identifying the change in the trend. Both are somewhat the opposite, but since my focus is these trends I observe them both.

Inertia is the resistance to change, including a resistance to change in direction. I could say then, that it takes inertia to keep a trend going. If there is enough inertia, the trend will continue. Trends will almost always be interrupted briefly by shorter term trends. For example, if you look at a monthly chart of a market first, then view a weekly chart, then a daily chart, you’ll see different dimensions of the trend and maybe left with a different observation than if you just look at one time frame.

Below I drew a monthly charge going back nearly 12 years. As you can see, the U.S. Dollar ($USD) has been “down” as much as -40% since 2002. It’s lowest point was 2008 and using my definition for trend, it’s been rising since 2008 though with a lot of volatility from 2008 to 2011. We could also say it’s been “non-trending” generally since 2005, since it has oscillated up and own since then without any meaning breakout.

All of charts are courtesy of http://www.stockcharts.com

Next we observe the weekly price trend. In a weekly chart we see the non-trending period, but ultimately over this time frame the Dollar gained 9%. The Dollar has been at a relatively low price range during this time. For those who want to understand why a trend occurs: A low currency is a reflection of the U.S. debt burden and lack of economic growth. We can only say that in hindsight. Most of the time we don’t actually know why a trend is a trend when it’s trending – and I don’t need to know.

You can probably begin to see how “the trend” is a function of “the time frame”. The most recent trend is observed in a daily chart going back less than a year. Here we see the U.S. Dollar is rising since July. I pointed out in “Interest Rates and Dollar Rising, Commodities Falling” how the Dollar is driving other markets.

The Dollar is now at a point that I mathematically expect to see it may reverse back down some. Though a trend is more likely to persist and resist change (inertia), trends don’t move straight up or down. Instead, they oscillate up and down within their larger trend. If you look at any of the price trend charts above, you’ll see smaller trends within them. It appears the Dollar is now likely to change direction at least briefly, though maybe not very much. As I mentioned in “Interest Rates and Dollar Rising, Commodities Falling”, it seems that rising interest rates are probably driving the Dollar higher. The market seems to be anticipating the Fed doing things to increase interest rates in the future. Let’s look at some other trends that seem to be interacting with the Dollar and interest rates.

The MSCI EAFE Index is an index of developed countries. You can observe the trend below. International stocks tend to decline when the Dollar rises, because this index is foreign country stocks priced in Dollars.

Below is the MSCI Emerging Markets index, which are smaller more emerging countries. MSCI includes countries like Russia, Brazil, and Mexico as “emerging”, but some may be surprised to hear they also consider China an emerging market. The recent rising Dollar (from rising rates) has been partly the driver of falling prices.

Another market that is directly impacted by the trend in the Dollar is commodities. Below we see the S&P/GSCI Commodity Index.

I am sharing observations about global macro trends and trend changes. We previously saw that the Dollar was generally in a downtrend and at a low level for years. When the Dollar is down, commodities priced in Dollars may be up. One commodity that became very popular when it was rising was Gold. When the Dollar was falling and depressed, Gold was rising. Below is a more recent price trend of gold.

I wouldn’t be surprised to see the Dollar trend to reverse back down some in the short-term and that could drive these other markets to reverse their downtrends at least briefly. Only time will tell if it does reverse in the near future and by how much.

In the meantime, let’s watch it all unfold.

Global Market Trends and Returns 3rd Quarter 2014

The end of a quarter is a popular time for investors to review what happened over the past three months. Below we review some three-month price trends to get an idea of the direction and magnitude of return streams for a wide range of world market indexes.

In the chart below, we see the U.S. Dollar ($USD) was in the strongest rising directional trend and increased smoothly. The second most increasing trend in magnitude was U.S. Long Term Treasury Bonds (TLT), though it made its move in just the past two weeks. The popular large company stock index, the Dow Jones Industrial Average ($INDU) and the broad-based bond index Barclay Aggregate Bond Index (AGG) lost a little during the quarter. Small company stocks, the Russell 2000 ($RUT), and the commodities indexes ($USD and GSG) lost over -9%. As I pointed out in “Interest Rates and Dollar Rising, Commodities Falling” interest rates started drifting up, driving up the U.S. Dollar, which then drove down many commodities. The decline in small company stocks is probably more a sign of an aging bull market in stocks.

Charts courtesy of: http://www.stockcharts.com ©StockCharts.com

Looking closer within the U.S. stock market at its individual sectors, the Healthcare and Technology sectors ended the quarter with the largest gains of around 3%. Energy was by far the largest losing sector over the past three-months with a decline of nearly -10%. Other weakness was Industrial and Utilities. That may be suggesting something about the markets anticipation of the economy.

I also include a bar chart below of the sectors for a different visual of the advance and decline within sectors. The trouble with only looking at the quarter end result is that it ignores what happened along the way. For example, in the line charts above we can see how the trends unfold.

I pointed out in “Interest Rates and Dollar Rising, Commodities Falling” that interest rates started drifting up, driving up the U.S. Dollar. When the Dollar and interest rates rise it can directly impact other markets like commodities, international stocks priced in Dollars, and interest rate sensitive markets like real estate and utilities. In the next chart I include the U.S. Dollar again to show its steady increase the past three months. Then we see that commodities like Gold (GLD), interest rate sensitive markets like Utilities (IDU), U.S. Real Estate REITs (IYR), and Mortgage REITs (REM) all declined materially. International stocks in Developed Countries (EFA) and Emerging Markets (EEM) also declined around 5 to 7%. None of these three-month price trends are permanent, but for those of us who tactically rotate between these world markets it is useful to understand how they all interact with each other.

You may notice when I speak of these trends I use past tense. The past tense is a grammatical tense whose principal function is to place an action or situation in past time. When I speak of trends, I’m always speaking of the past trend, never the future. These charts are created by looking back three months. It is not possible to draw a chart of realized trends looking forward three months. If we could do that, we would only need to do it once. If we could know for sure what just one of these trends would do in the future we could leverage a large bet, take the profit, pay the tax, and be done forever. Instead, we only have past price trends to study and draw inference from. Past data is all we have. As it turns out, that’s all I need.

Interest Rates and Dollar Rising, Commodities Falling

I believe an edge I have developed as a global tactical investment manager over the past two decades is a strong understanding how markets interact with each other and their return drivers, but most important is the directional trend. Below I show that interest rates are rising. $FVX is the 5 year Treasury Yield and $UST2Y is the 2 year yield. If we define an uptrend as higher highs and higher lows, both are trending up.

source: http://www.stockcharts.com

You can probably see how when interest rates rise on U.S. Dollar bonds, that may also increase the yield on the U.S. Dollar. For U.S. investors, the rising rates are eventually reflected in money markets, CDs, and new bond issues. Below is a chart of the U.S. Dollar so you can see how it is trending up sharply since July.

When the U.S. Dollar rises, that usually drives just the oppose in Gold. Below is the directional drift of gold.

A rising U.S. Dollar (from rising interest rates) also drives down the price of some commodities. Below we see the price trend a broad based commodity index that includes a basket of many different commodities.

Looking closer at commodities, below we see that wheat, sugar, corn, cotton, and agriculture are trending down. So much for inflation! Those who have believed the U.S. would see strong inflation have been wrong. These commodity trends suggest prices have been falling the past year, not rising.

Finally, I’ll add that the direction of the U.S. Dollar also drives foreign currency relative to the U.S. Dollar. For example, the British Pound and Euro and drifting down as the Dollar is rising. Investors around the world have choices about where to invest their cash. When one currency yields more than another, or is expected to, it could attract demand for that currency. Demand leads to rising price trends.

You can probably see how these global markets are interconnected and driven by the same things. A strong understanding of how global markets interact with each other is an edge in global tactical trading and allocation. Of course, something that may be of concern for traditional stock and bond investors may be how rising rates drive their positions. If rates continue to rise, bond prices will eventually fall.

What’s the Fed Going to Do Next?

The talk about what the Federal Reserve Open Market Committee (“the Fed”) will do next is a fascinating example of investor behavior. The days leading up the Fed meeting and decision announcement is filled with speculations about what’s going to happen next. The Fed has been so involved in driving capital markets these past several years that some of the talk about it is ridiculous. One Fed watcher at the Wall Street Journal says everyone is waiting to see if they continue to use the words “considerable time”, or not. Another article argued it’s not about “considerable time”, but something else.

None of it matters.

None of the people talking about what the Fed will do next know what they will do. They also don’t know how markets will respond to it.

That’s all that matters.

The only thing that matters is the directional trend. There are an infinite number of time frames for a trend. For example, I’ve drawn a chart below for the popular large company stock index, the S&P 500. Over this period, it’s trend is up. It has moved up and down over shorter time frames, but overall the recent trend is up. Stock investors should focus on the direction of the trend, and identify and react when it changes.

source: http://www.stockcharts.com

We can say the same for other markets. The Fed decisions drive certain interest rates that impact global markets. That necessarily means their actions may impact currency (the Dollar), bonds, commodities, and alternatives like volatility and real estate.

I focus on the directional trend. I’m never trying to figure out what’s going to happen next. Instead, I know exactly what I’ll do at certain prices. I’ll exit to cut a loss here, enter a new trend there, or take a profit.

I don’t need to know what they’ll do. I only need to know how the trend will respond to it and how I’ll respond to any change in that trend.

Trend Following Doesn’t Always Mean Crowd Following

“Trading has taught me not to take the conventional wisdom for granted. What money I made in trading is testimony to the fact that the majority is wrong a lot of the time. The vast majority is wrong even more of the time. I’ve learned that markets, which are often just mad crowds, are often irrational; when emotionally overwrought, they’re almost always wrong.”

– Richard Dennis (Famous Trend Follower)

Richard J. Dennis, a commodities speculator once known as the “Prince of the Pit,”. In the early 1970s, he borrowed $1,600 and reportedly made $200 million in about ten years.

Extreme Fear is Now the Return Driver

A professional investment adviser recently passed along some materials and asked for my opinion about a “tactical model” offered by another money manager. I was surprised that they expect great results from their model when it said something like:

“As investors become more risk-averse, the model becomes more defensive and vice versa.”

Let’s consider that for a moment.

As investors become more risk-averse, the model becomes more defensive. When investors become more risk-seeking, the model becomes more offensive.

That surprises me because investor sentiment is usually used as a countertrend indicator, not as a trend following indicator. Investors often get overly optimistic after prices have trended up and investors get more afraid after prices have trended down.

They went on to say they also use economic indicators as their signal to increase and decrease exposure. I am always concerned when I hear of someone using anything other that the direction of the price trend itself. Other indicators like credit spreads or perceived risk premiums are derivatives of price and it’s the directional movement of the price trend itself we really want. If the price gains 5%, we make money. If the price loses 5%, we lose money. If the price does nothing and the ratio or spread you rely on goes up or down, it did nothing for you. If you use something that is a derivative of the price itself, you have the potential to stray far from the price trend itself.

All blow-ups in history started that way.

Investor sentiment is usually wrong. It isn’t something I’d want to follow. If anything, I’d want to do the opposite of investor sentiment when it reaches an extreme. I occasionally point out my observations when investor sentiment reaches an extreme. When I do, I’ll highlight a simple sentiment gauge that is publicly available on the CNN Money website. Now, that gauge doesn’t actually have a signal that says when it has reached an extreme. It’s just a gauge to swings from one extreme to the other and spends a lot of time in between. It isn’t what is telling me to share my observations – it’s not my signal. I have other systems for actually doing that, but my systems often coincide with extreme readings in the Fear and Greed Index.

source: Fear and Greed Index

As of Friday, fear is driving stocks. A few weeks ago I pointed out “It’s official: extreme greed is driving the stock market”. Prices had been rising and investors became more and more optimistic. Stocks have now fallen about 3 – 4% and investor sentiment quickly shifted from “Extreme Greed” a few weeks ago to “Extreme Fear” now. The stock market had gone months without a 1% move, so a -2% down day got their attention.

source: http://www.stockcharts.com

Investor sentiment isn’t necessarily and indicator I use to increase and decrease exposure, but instead one that is useful to help investors understand problems in their behavior. If you find yourself getting more aggressive after prices have already made a big move, or scared after price declines, you may find it useful to monitor the Fear and Greed Index to help adjust your behavior. That money manager may be one of them.

If anything, you may find increasing and decreasing exposure to risk is best done opposite of sentiment extremes, not along with it. Investor sentiment is usually wrong, not right. Extreme fear occurs at lows, extreme greed at highs.

A VIX Pop Then Back to Zzzzzzzz? We’ll see

The chart and table below from Russell Rhoads at VIX Views shows an interesting visual of yesterdays increase in the VIX spot index and its futures. The chart is the VIX term structure for the VIX futures. The blue line is yesterdays term structure and the red line the day before. A term structure chart shows how the futures are priced over time. Notice the bottom goes from from left to right August 2014 to April 2015. That corresponds to the table below it, which shows the VIX (spot index) and then each months futures starting with August 2014 (the front month).

source: http://www.cboeoptionshub.com/wp-content/uploads/2014/07/VIX-Curve.jpg

A Few Observations

The term structure shows how the curve shifted up yesterday. That is, the VIX futures increased August 2014 through April 2015 expiration dates. Notice the VIX spot index gained 27% while the August month gained 12%. When we speak of the VIX, we speak of the CBOE Volatility Index. We can’t actually trade the index, so exposure is gained through futures and options. This is a good time to point out how much the VIX spot index gained and how much less the futures moved. In the table below the chart you can see the % gain. The front month (August) gained 12.18%. The nearer months gained more than the expiration months farther out. I think Rhoads correctly points out that the options market seems to be expecting a quick pop in the VIX and then back to Zzzz. I say that because the August front month contacts gained 12% the months farther out in time had a much smaller increase in expected volatility. It’s another example of complacency. Investors aren’t so concerned about risk enough to pay up to insure it beyond this month. In this low vol environment over the pas year, increases in volatility have been quick and sharp, then revert back to lower levels. So the market seems to be following the trend that way. That works, until it doesn’t.

Let’s see how it plays out this time.

Global Market Returns Year to Date 2014

After yesterday, stock indexes haven’t made much progress in the first seven months of 2014. At the beginning of the year everyone seemed to talk about how much the Dow Jones Industrial Average had gone up, almost as if they could buy it after the fact and get what it did. This year the Dow (DIA in the chart) has gained 1.06%. Interestingly, small company stocks as measured by the Russell 2000 Index (IWM) are down 3%. In Stock Market Peak? A Tale of Two Markets back in May I pointed out the divergence between large company stocks as measured by the Dow Jones Industrial Average and small company stocks. At this late stage of a bull market, the recent negative trend of small company stocks may be an early warning a major peak for stocks could be near. Many are probably surprised that bonds have gained the most so far this year.

source: http://www.stockcharts.com

In fact, U.S. Long Term Treasuries (TLT) have gained so much more than other global markets that I show it as a separate chart below. Here I drew the same chat as above, but added U.S. Long Term Treasuries (TLT).

Asymmetric VIX

In The VIX is Asymmetric, making its derivatives an interesting hedge I explained how the CBOE Volatility Index (VIX) tends to react with sharper and with greater magnitude than stock indexes. There is an asymmetric relationship between stock index returns and the VIX. Below includes yesterdays action when the S&P 500 stock index was down 2% and the CBOE Volatility Index (VIX) spot gained 27%. The chart is a good visual of how, when the stock index falls, implied volatility spikes up.

source: http://www.stockcharts.com

I have been sharing some observations about the VIX recently because it had gotten do a low level not seen in many years. It’s an indication that investors have become complacent about risk. When a trend gets to an extreme, it’s interesting to observe how it all plays out.

VIX Shows Volatility Still Low, But Trending

It seemed that many of the commentators who write and talk about the VIX started talking as though it would stay down a long time. Of course, that’s as much a signal as anything that the trend could instead change.

Below is a chart of the CBOE Volatility Index (VIX) since I observed “VIX Back to Low” on July 3. It says to me that volatility, is, well, volatile. It trended up as much as 34% and then retraced much of that.

source: http://www.stockcharts.com

Looking back the past several months, we can see since the beginning of July it has started to make higher highs and higher lows. Volatility (and therefore some options premiums) are still generally cheap by this measure, but from the eyes of a trend follower I wonder if this may be the very early stage of higher vol. We’ll see…

Either way, whether it stays low or trends back up, the monthly chart below shows the implied volatility in options is “cheaper” now than we’ve seen in 7 years, suggesting exposures with options strategies may be a “good deal”.

Volatility Risk Premium

Following up from “VIX Back to Low” I wrote last week, sure enough: the volatility index has gained 20%. Since last week it has been a good time to be long volatility and a bad time to be short volatility. Many professionals who trade volatility as their primary strategy mostly sell it to collect the Volatility Risk Premium. To do that, they have to be willing to experience gaps like this.

VIX Back to Low

It isn’t unusual for the CBOE Volatility Index (VIX) to drop before a weekend and then pop on Monday morning. That is especially true before a long weekend for those who are concerned with Theta (time decay). Since options are deteriorating assets, their value declines over time. As an option approaches its expiration date without being in the money, its time value declines because the probability of that option being in the money (profitable) is reduced. The more time to expiration, the more time it has to be profitable. With less time, the probably is lower it will ever swing high enough. Theta is a ratio of the change (relative strength) of an option price to the decrease in time to expiration.

With that said, the VIX reached its prior low today. Here is what it looks like on a daily chart:

Below we zoom in with an hourly chart for a closer view:

You may notice the last time it reached this level it gained nearly 20% quickly. The swings in implied volatility are very significant. We’ll see next week if it does it again. Or, if it is on its way to single digits.

Business Cycle: Mean Reversion and Trends

The National Bureau of Economic Research publishes U.S. Business Cycle Expansions and Contractions in the economy. During an expansion, economic growth is rising and during a contraction it is slowing or actually falling.

Below is a chart of their idealized expansion and contraction phases. During each phase, different sectors of the economy are expected to do well or poorly. And, you can see what is happening at a peak and what happens afterwards. At a peak, economic data is strongest and news is good. Then it reverses down eventually. At a trough economic data is at its worst and news is bad, then it turns around. You may think about it and consider where the U.S. economy is now if you have an interest in the stage of the business cycle.

Source: National Bureau of Economic Research

A few concepts to think about.

Does it trend? Yes, it does. A trend is a directional drift over a time frame. The business cycle typically sees drifts up for 4 or 5 years and drifts down for 1 or 2 years. The trends are asymmetric, as you can see in the chart, the upward drifts tend to last longer and progress at a lower rate of change than the faster declining trends down. It seems that economic data, like prices, do trend over time.

Does it mean revert? Yes, while over shorter time frames of 1 year to 5 years we observe trends in the business cycle, when we look over a full business cycle we see that it oscillates up and down. However, the actual meaning of “mean reversion” means that it oscillates around an average, not just oscillates. If the data above has an average, and it necessarily must, then it does oscillate around that average. It’s just that the range up and down may be far away from the average. That is, the peak and trough in the chart above may stray far away from the actual “average” of the data series. Said another way, the business cycle is really volatile when you consider it over its full cycle because of the magnitude in range from high and low.

For those of you following along, you may see how I’m going to tie this in to something else next week…

Global Market Trends Mid Year 2014

I’m not one to put much emphasis on judging trends across arbitrary time frames like “mid year” or a specific calendar year, but it’s still interesting to see how global trends are playing out relative to how people perceive they are. At the end of last year the Dow Jones Industrial Average (DIA) was all the talk since it was the biggest gainer. So far in 2014 that DIA has gained only 2.54%. So, we could say that, though its range of motion and swings (volatility) has calmed down lately. Over the past 6 months the Dow stocks have lost their momentum. Those who only listen to financial news about stocks may be surprised to hear the 30 year U.S. Treasuries as measured by TLT have been the biggest gainer this year at 12%. Gold (GLD) and Emerging Markets (EEM) have had the largest range of swings. The broad-based bond index (AGG), Commodities (GSG), and Developed Countries (EFA) have trended similar to the Dow. I included $VIX, the CBOE Volatility Index to point out several observations. Notice how it has generally trended down and is down -15% over the first half of the year, you may also notice how much more it spikes up and down. That is, volatility is volatile.

Source: http://www.stockcharts.com

It’s important to understand that no intelligent person investors all their capital in stocks or in U.S. Treasuries or in Gold. Instead, they either allocate to many markets or rotate between them. The trouble with allocation to markets is they sometimes all go down at the same time, so diversification through just allocation may fail when you want it the most. That is why we rotate, instead of allocate, hoping to capture some of the good, and avoid most of the bad. No market trends up all the time and no strategy trends perfectly all the time, but the overall risk / reward profile is what matters. If someone can handle 50% declines and willing to wait 5 or more years to reach prior values, maybe they could invest all their money in stocks. We could say the same for commodities, real estate, and bonds. That is why we rotate, instead of allocate.

Have a great 4th of July!

Playing with Relative Strength

I discussed in my interview with Investor’s Business Daily in 2011 titled “How Mike Shell Uses Relative Strength To Trade ETFs” some very basic concepts of how I apply proprietary relative strength systems to ETFs in a tactical ETF managed portfolio. Though we can develop all kinds of sophisticated algorithms to define relative strength, momentum, and directional price trends, at the end of the day the concept is very simple.

Up until now (a signal that something has changed) small company stocks where lagging large company stocks. To illustrate what that looked like, I stopped the relative chart below in Mid-May. You may observe that the blue line (the Russell 2000 index of small company stocks) was lagging and with a higher range of swings (more volatile). The black line is the S&P 500 stock index weighted toward larger stocks.

Source: http://www.stockcharts.com

Next we update the chart to today’s date. Over the past month, small companies caught up. However, they are now at the prior high, so we’ll find out in the weeks ahead if the relative out-performance continues, or if it finds some resistance and reverses back down.

Below I have zeroed out one side to express only the relative change of the small cap index while holding the large cap index steady. Here we see only the relative difference between small and large over the past year.

You can probably see how relative strength isn’t just about strength, there is also relative weakness. And, relative change oscillates over time.

Flaw of Averages

In Declining (Low) Volatility = Rising (High) Complacency I said:

“The VIX has a long-term average of about 20 since its inception. At this moment, it is 11.82. It’s important to realize the flaw of averages here, because the VIX doesn’t actually stay around 20 – it instead averages 20 as it swings higher and lower.”

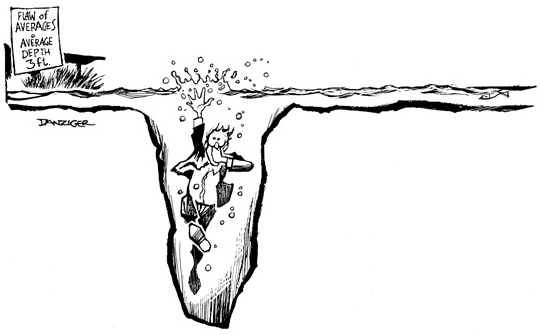

The flaw of averages is the term used by Sam L. Savage to describe the fallacies that arise when single numbers (usually averages) are used to represent uncertain outcomes.

A fine example of the flaw of averages involves a 6 ft. tall statistician who drowns while crossing a river that is 3 ft. deep on average.

Source: http://www.danzigercartoons.com/

You can probably see how assumptions using averages can get us in trouble. It only takes a little to be “too much”… and that is mostly likely a problem when we expect the average and the possible range is much wider.

Asymmetric Volatility

Asymmetric Volatility is an observed phenomenon that volatility is higher in declining markets than in rising markets.

You can probably see how we can relate this as asymmetric risk: the downside risk is higher than upside reward.

The VIX is Asymmetric, making its derivatives an interesting hedge

The VIX is asymmetric, its distribution is non-symmetrical, it is skewed because it has very wide swings. The volatility of volatility is very volatile. There is an asymmetric relationship between stock index returns and the VIX. This asymmetric relationship is what initially makes the VIX interesting for hedging against S&P 500 volatility and losses.

Since I started the series about the extremely low VIX level Monday, like The VIX, as I see it…, The VIX has gained 17% while the S&P 500 stock index has lost about 1%. The VIX is asymmetric. While the VIX isn’t always a perfect opposite movement to the stock indexes, it most often does correlate negatively to stocks. When stocks fall, the implied (expected) volatility increases, so the VIX increases. Asymmetry is imbalance: more of one thing, less of the other. For example, more profit potential, less loss or more upside, less downside.

An advantage of the VIX for hedging is that it is asymmetric: it increases more than stocks fall. For example, when we look at historical declines in the stock index we find the VIX normally gains much more than the stock index falls. For example, if the stock index declined 5% the VIX may have gained 30% over the same period. That ratio of asymmetry of 6 times more drift would allow us to tie up less cash for a hedge position. Of course, the ratio is different each time. Sometimes it moves less, sometimes more.

When the VIX is at a low enough level as it’s been recently, the asymmetric nature of the VIX makes it an interesting hedge for an equity portfolio. The best way to truly hedge a portfolio is to hedge its actual holdings. That’s the only true hedge. If we make a bet against an index and that index doesn’t move like our positions, we still have the risk our positions fall and our hedge does too or doesn’t rise to offset the loss. I always say: anything other than the price itself has the potential to stray far from the price. But the asymmetry of VIX, its potential asymmetric payoff, makes it another option if we are willing to accept it isn’t a direct hedge. And, that its derivatives don’t exactly track the VIX index, either. None of the things we deal with is a sure thing; it’s always probabilistic.

This week has been a fine example of VIX asymmetry. The chart below shows it well.

Note: The VIX is an unmanaged index, not a security so it cannot be invested in directly. We can gain exposure to the VIX through derivatives futures, options, or ETNs that invest in VIX futures or options. This is not a recommendation to buy or sell VIX derivatives. To determine whether or not to take a long or short position in the VIX requires significantly more analysis than just making observations about its current level and direction. For example, we would consider the term structure and implied volatility vs. historical volatility and the risk/reward of any options combinations.

It’s official: extreme greed is driving the stock market

In Is the VIX and indication of fear and complacency? I pointed out a few reasons I believe a low VIX level can indeed be a signal of greed and complacency and a high VIX level is a measure of fear. It’s very simple: fear and greed are reflected in the price of options. When there is a strong demand for protection, the prices goes up. When there is little demand for protection, the price goes down. The recent low levels of VIX suggest a lack of fear or desire for protection from falling prices or rising vol.