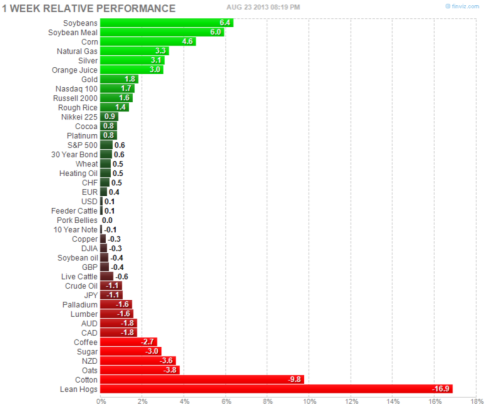

From 1928-2012 the S&P 500 was up 39 months and down 46 months. It’s down 55% of the time in September…

Dow Jones Industrial Average 1886-2004 (116 years) 49 years the Dow was down, in 67 years the Dow was up. It’s down 58% of the time in September…

Those are probability statements. First, let’s define probability.

Probability is likelihood. It is a measure or estimation of how likely it is that something will happen or that a statement is true. Probabilities are given a value between 0 (0% chance or will not happen) and 1 (100% chance or will happen). The higher the degree of probability, the more likely the event is to happen, or, in a longer series of samples, the greater the number of times such event is expected to happen.

But that says nothing about how to calculate probability and apply it. One thing to realize about probability it that is the math for dealing with uncertainty. When we don’t know an outcome, it is uncertain. It is probabilistic, not a sure thing.

As I see it, there are two ways to calculate probability: subjective and objective.

Subjective Probability: assigns a likelihood based on opinions and confidence (degree of belief) in those opinions. It may include “expert” knowledge as well as experimental data. For example, the majority of the research and news is based on “expert opinion”. They may state their belief and then assign a probability: “I believe the stock market has a X% chance of going down.” They may go on to add a good sounding story to support their hypothesis. You can probably see how that is subjective.

Objective Probability: assigns a likelihood based on numbers. Objective probability is data-driven. The popular method is frequentist probability: the probability of a random event means the relative frequency of occurrence of an experiment’s outcome when the experiment is repeated. This method believes probability is the relative frequency of outcomes over the long run. We can think of it as the tendency of the outcome. For example, if you flip a fair coin, its probability of landing on head is 50% and tail is 50%. If you flip it 10 times, it could land on head 7 and tail 3. That outcome implies 70%/30%. To prove the coin is “fair” (balanced on both sides), we would need to flip it more times. If we flip it 30 times or more it is likely to get closer and closer to 50%/50%. The more frequency, the closer it gets to its probability. You can probably see why I say this is more objective: it’s based on historical data.

If you are a math person and logical thinker, you probably get this. I have a hunch many people don’t like math, so they’d rather hear a good story. Rather than checking the stats on a game, they’d rather hear some guru opinion about who will win.

Which has more predictive power? An expert opinion or the fact that historically the month of September has been down more often than it’s up? Predictive ability needs to be quantified by math to determine if it exists and opinions are often far too subjective to do that. We can do the math based on historical data and determine if it is probable, or not.

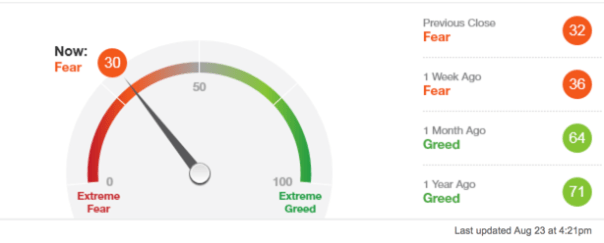

As I said in September is statistically the worst month for the stock market the data shows it is indeed statistically significant and does indeed have predictive ability, but not necessarily enough to act on it. Instead, I suggest it be used to set expectations: the month of September has historically been the worst performance month for the stock indexes. So, we shouldn’t be surprised if it ends in the red. It’s that simple.

Theory-driven researchers want a cause and effect story to go with their beliefs. If they can’t figure out a good reason behind the phenomenon, they may reject it even though the data is what it is. One person commented to me that he didn’t believe the September data has predictive value. But, it does.

I previously stated a few different probabilities about September: what percentage of time the month is down. In September is statistically the worst month for the stock market I didn’t mention the percent of time the month is negative, only that on average it’s down X% since Y. It occurred to me that most people don’t seem to understand probably and more importantly, the more complete equation of expectation.

Expectation

There are many different ways to define expectation. We probably think of it as “what we expect to happen”. In many ways, it’s best not to have expectations about the future. Our expectations may not play out as we’d hoped. If you base your investment decisions on opinion and expectations don’t pan out, you may stick with your opinion anyway and eventually lose money. The expectation I’m talking about is the kind I apply: mathematical expectation.

We have determined above the probability of September based on how many months it’s down or up. However, probability alone isn’t enough information to make a logical decision. First of all, going back to 1950 using the S&P 500 stock index, the month of September is down about 53% of the time and ends the month positive about 47% of the time. That alone isn’t a huge difference, but what makes it more significant is the expectation. When it’s down 53% of the time, it’s down -3.8% and when it’s up 47% of the time it’s up an average of 3.3%. That results in an expected value of -0.50% for the month of September. If we go back further to 1928, which includes the Great Depression, it’s about -1.12%.

The bottom line is the data says “based on historical data, September has been the worst month for the stock market”. We could then say “it can be expected to be”. But as I said before, it may not be! And, another point I have made is the use of multiple time frames for looking at the data, which is a reminder that by intention: probability is not exact. It can’t be, isn’t supposed to be, and doesn’t need to be. Probability and expectation are the maths of uncertainty. We don’t know in advance many outcomes in life, but we can estimate them mathematically and that provides a sound logic for believing.

We’ve made a whole lot of the month of September, but I think it made for a good opportunity to explain probability and expectation that are the essence of portfolio management. It doesn’t matter so much how often you are right or wrong, but instead the magnitude. Asymmetric returns are created by more profit, less loss. And that provides us a mathematical basis for believing a method works, or not. Not knowing the future; it’s the best we have.

Connect on Linkedin and Follow me on Twitter by clicking the buttons on the right.

You must be logged in to post a comment.