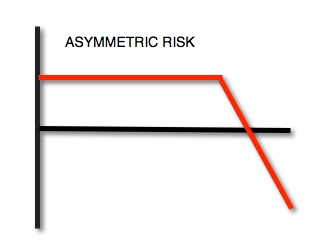

Asymmetric Risk

Asymmetric Risk is when the downside risk is unequal, or greater, than reward. Or, when a market price trend cascades down faster than the market trends up.

We observe declines in price trends expand faster than when prices trend up. Mike Shell believes the asymmetric risk of price trends in the stock market is driven by investor loss aversion. For example, Prospect Theory finds that investors feel the pain from a loss about twice as painful as they feel pleasure from gain.

For information about ASYMMETRY® visit Shell Capital Management, LLC

For more information, see:

You must be logged in to post a comment.