Unconstrained Investment Strategy

Unconstrained investment strategy is an investment strategy that doesn’t require the money/asset/portfolio manager to track/follow/beat/outperform an index or benchmark. Unconstrained investment management may allow the portfolio manager seek asymmetric risk/reward across any sector, market, or asset class.

Unconstrained may also go beyond what market the investment manager invests in to also include unconstrained strategy selection. To achieve unconstrained returns, multiple strategies may be employed. For example, an unconstrained investment manager may be discretionary or systematic, or both. Unconstrained investing/trading can include different trading styles of a trading system including trend following, countertrend, momentum, relative value, global macro, or tactical trading.

Unconstrained investment managers avoid benchmark tracking and shun being compared to an index. Unconstrained investment managers aim to create their own unique return stream through their investment/trading strategy rather than track an index or benchmark.

Unconstrained investment management is usually an absolute return objective. An absolute return objective aims for positive returns over a time frame instead of relative returns compared to a benchmark.

Unconstrained asset management may be unconstrained as to time frame. Rather than focusing on short-term performance relative to a benchmark like a relative return strategy, unconstrained managers may focus on longer-term capital gains and total return. For example, many unconstrained absolute return managers are more concerned about their performance over full market cycles that include both positive and negative trending periods.

Unconstrained investment universe: unconstrained investment management may include different securities and methods of portfolio construction to gain exposure. For example, the investment manager may have the ability to gain exposure to markets and strategies with individual stocks, bonds, options, derivatives, and other funds like ETFs.

Unconstrained investment manager risk? Some investment management consultants may believe unconstrained investing leads to more “portfolio manager risk”, since the portfolio manager may make tactical decisions that result in an undesired outcome. We could say the same for market indexes.

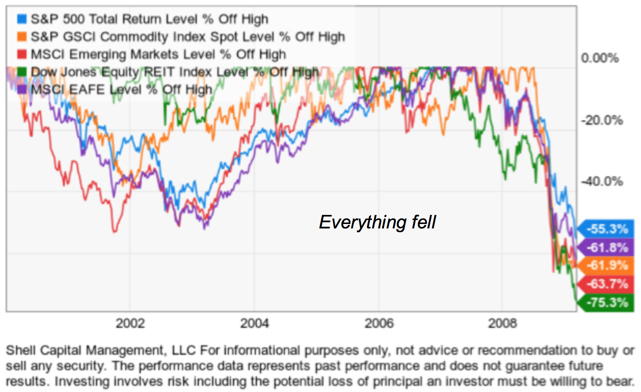

When and why did “unconstrained investing become popular? I first started hearing more about unconstrained investment management strategies after the crash of 2007 to 2009 often called the “2008 Financial Crisis”. It was a period when most global markets including stocks, bonds, and commodities declined. Diversification failed global asset allocation when it was needed most. It was a harsh reminder of the regulatory disclosure; “Diversification alone does not assure a profit or protect against loss.”. After so many markets crashed together, investors saw the potential for an investment manager that is unconstrained, able to be more flexible and go anywhere. Of course, not every portfolio manager will have the skills to be unconstrained and at the peak of the next bull market, we can expect more investors will desire stock market index benchmark hugging to be more popular, just in time for the next bear market.

After waterfall declines in markets, investors become more aware that indexes used as benchmarks don’t always meet their objectives. Yet, relative return investment managers are required to closely track performance against these benchmark indexes. Without any flexibility to adapt to changing conditions, constrained relative return investment managers were unable to avoid large declines or attempt to capitalize on the trend changes.

For more information about unconstrained investment strategies, contact Shell Capital Management, LLC.

You must be logged in to post a comment.